Puppy Insurance Compare

When it comes to taking care of our furry friends, responsible pet owners know that unexpected veterinary costs can quickly add up, especially during their early years. This is where puppy insurance steps in as a crucial tool to safeguard both your pet's health and your financial well-being. In this comprehensive guide, we'll delve into the world of puppy insurance, exploring its benefits, the coverage it provides, and how to choose the right policy for your beloved four-legged companion.

Understanding Puppy Insurance: A Necessity for New Pet Parents

Puppy insurance, often referred to as pet insurance, is a vital aspect of pet ownership, offering financial protection and peace of mind to new dog owners. It’s an essential tool to ensure that your puppy receives the best possible care throughout its life, covering a range of medical conditions and unexpected emergencies.

The Importance of Early Coverage

Opting for puppy insurance is particularly beneficial as it allows you to establish a comprehensive health plan for your pet from a young age. Puppies, like human infants, are prone to a variety of health issues, from digestive troubles to more serious genetic conditions. Early detection and treatment are crucial for their long-term health and can be made more accessible with the right insurance plan.

Key Benefits of Puppy Insurance

- Financial Protection: Puppy insurance provides financial security, ensuring you can afford the best veterinary care without breaking the bank.

- Comprehensive Coverage: From routine check-ups to major surgeries, puppy insurance covers a wide range of medical procedures and treatments.

- Peace of Mind: Knowing your pet is insured allows you to focus on their well-being, not worry about the cost of care.

- Access to Quality Care: With insurance, you can choose the best veterinarians and specialists, offering your puppy the highest standard of healthcare.

The Ins and Outs of Puppy Insurance Policies

Puppy insurance policies vary greatly, and it’s essential to understand the nuances of each to make an informed decision. Here’s a breakdown of the key components to consider when comparing puppy insurance options.

Coverage Types

Puppy insurance policies typically offer two main types of coverage: Accident-Only and Accident and Illness.

- Accident-Only: As the name suggests, this type of policy covers injuries and accidents, such as broken bones or burns. It’s a more affordable option but provides limited coverage.

- Accident and Illness: This comprehensive policy covers accidents as well as a wide range of illnesses, including genetic conditions and chronic diseases. It offers the highest level of protection but comes at a higher cost.

Reimbursement Methods

Puppy insurance policies often use one of two reimbursement methods: Direct Billing or Reimbursement.

- Direct Billing: In this scenario, the insurance company pays the veterinarian directly, reducing your out-of-pocket expenses.

- Reimbursement: You pay the veterinarian upfront and then submit a claim to the insurance company for reimbursement.

Coverage Limits and Deductibles

Each puppy insurance policy will have specific limits and deductibles. These factors can significantly impact the overall cost and benefits of the policy.

| Coverage Limit | The maximum amount the insurance company will pay for a specific condition or over a given period. |

|---|---|

| Deductible | The amount you must pay out of pocket before the insurance coverage kicks in. |

Exclusions and Waiting Periods

It’s crucial to review the exclusions and waiting periods of each policy. Exclusions are specific conditions or treatments that are not covered by the policy, while waiting periods are the time frames during which certain conditions or illnesses are not covered.

Additional Benefits and Features

Some puppy insurance policies offer additional benefits, such as:

- Wellness or Preventative Care Coverage: This includes routine check-ups, vaccinations, and parasite control.

- Alternative Therapies: Coverage for treatments like acupuncture or chiropractic care.

- Behavioral Therapy: Assistance for behavioral issues such as anxiety or aggression.

- Travel Assistance: Coverage for emergencies that occur during travel.

Choosing the Right Puppy Insurance: A Step-by-Step Guide

Selecting the best puppy insurance policy for your needs involves a careful evaluation of your budget, your puppy’s breed and potential health risks, and the level of coverage you desire. Here’s a step-by-step guide to help you make an informed decision.

Step 1: Evaluate Your Budget

Begin by assessing your financial situation and determining how much you can afford to spend on insurance premiums and potential out-of-pocket expenses. Remember, the cost of insurance can vary significantly based on the coverage you choose.

Step 2: Understand Your Puppy’s Health Risks

Research common health issues associated with your puppy’s breed. Certain breeds are predisposed to specific conditions, so understanding these risks can help you choose a policy that provides adequate coverage.

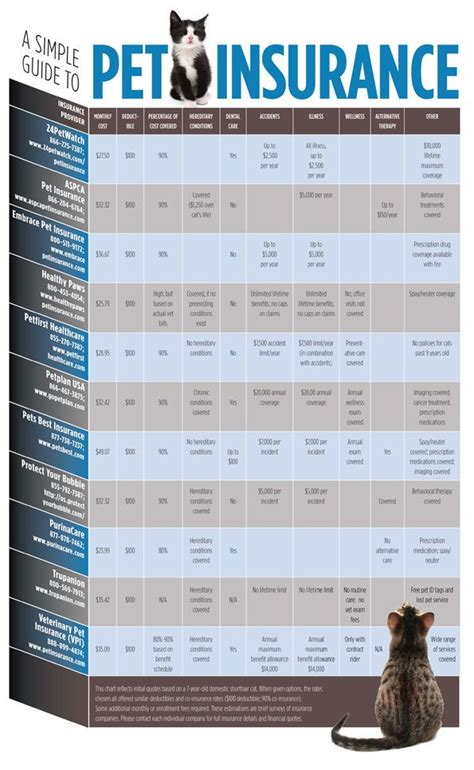

Step 3: Compare Policies

Use online resources and insurance comparison websites to explore a range of puppy insurance policies. Compare the coverage, deductibles, and premiums to find the best fit for your needs.

Step 4: Read the Fine Print

Don’t skip the policy’s terms and conditions. Understand the exclusions, waiting periods, and any other fine print that could impact your coverage.

Step 5: Consider Long-Term Costs

Puppy insurance is an ongoing expense, so ensure the policy you choose is sustainable for the long term. Consider the potential for rate increases over time and how that might impact your budget.

Step 6: Seek Professional Advice

Consult with your veterinarian or an insurance professional to get expert advice on the best policy for your puppy’s unique needs.

Real-Life Examples: How Puppy Insurance Has Helped Pet Owners

Understanding the impact of puppy insurance in real-life scenarios can provide valuable insight into its benefits. Here are a few stories that highlight how puppy insurance has made a difference:

Story 1: Jake’s Journey to Health

Jake, a lively Labrador Retriever, developed a severe ear infection shortly after joining his new family. The treatment required multiple vet visits, medication, and even surgery. With his puppy insurance policy, his family was able to focus on Jake’s recovery without worrying about the mounting vet bills.

Story 2: Bella’s Unexpected Emergency

Bella, a curious Cocker Spaniel, ingested a foreign object, leading to an emergency surgery. The procedure and follow-up care were covered by her insurance, providing her owners with the financial support they needed during a stressful time.

Story 3: Max’s Chronic Condition

Max, a loving Golden Retriever, was diagnosed with a chronic digestive condition. His insurance policy, which included coverage for chronic illnesses, helped his owners manage the ongoing treatment and medications, ensuring Max received the best care possible.

The Future of Puppy Insurance: Trends and Innovations

The pet insurance industry is evolving, and several trends and innovations are shaping the future of puppy insurance. Here’s a glimpse into what’s on the horizon:

Telemedicine and Online Services

With the rise of telemedicine, pet owners can now access veterinary care and advice remotely. Some insurance companies are integrating these services into their policies, offering convenience and expanded access to care.

Personalized Policies

Insurance providers are increasingly offering personalized policies that cater to the unique needs of each pet. These policies can be tailored to specific breeds, ages, and health conditions, providing a more customized level of coverage.

Wearable Technology Integration

Wearable devices for pets, such as fitness trackers and GPS collars, are gaining popularity. Some insurance companies are exploring partnerships with these technology providers, offering discounts or incentives for policyholders who utilize these devices to monitor their pet’s health and well-being.

Wellness and Preventative Care Focus

There’s a growing emphasis on preventative care and wellness within the pet insurance industry. Many companies are expanding their coverage to include routine check-ups, vaccinations, and even behavioral training, encouraging pet owners to be proactive about their pet’s health.

Conclusion: Securing Your Puppy’s Future with Insurance

Puppy insurance is a valuable tool for pet owners, offering financial protection and peace of mind. By understanding the different types of policies, their coverage, and the real-life impact they can have, you can make an informed decision to secure your puppy’s health and your financial future. Remember, the right puppy insurance policy can be a lifelong investment in your pet’s well-being.

What is the average cost of puppy insurance per month?

+The average cost of puppy insurance can vary significantly based on factors like breed, age, and the level of coverage chosen. Typically, accident-only policies range from 10 to 20 per month, while accident and illness policies can cost anywhere from 25 to 50 per month or more. It’s essential to shop around and compare policies to find the best value for your specific needs.

Can I get puppy insurance for pre-existing conditions?

+Most puppy insurance policies do not cover pre-existing conditions. However, there are some specialized policies that offer coverage for specific pre-existing conditions, often at a higher premium. It’s crucial to review the policy’s terms carefully to understand what is and isn’t covered.

Is puppy insurance worth it?

+The value of puppy insurance depends on your individual circumstances and the level of financial risk you’re comfortable with. For many pet owners, the peace of mind and financial protection that insurance provides is invaluable. However, it’s a personal decision, and you should carefully consider your budget and your puppy’s potential health risks before committing to a policy.