Njm Insurance Group New Jersey

The New Jersey Manufacturers Insurance Company, more commonly known as NJM Insurance Group, is a prominent insurance provider with a rich history and a strong presence in the Garden State. With a focus on delivering exceptional service and value to its policyholders, NJM has become a trusted name in the insurance industry, particularly in the state of New Jersey.

In this article, we will delve into the world of NJM Insurance Group, exploring its origins, its unique approach to insurance, the services it offers, and its impact on the community. By understanding the key aspects of NJM's operations, we can gain insights into why this insurance group has earned a reputation for excellence and how it continues to thrive in a competitive market.

A Legacy of Excellence: The History of NJM Insurance Group

The story of NJM Insurance Group began over a century ago, in the early 1900s. It was founded as the New Jersey Manufacturers Casualty Insurance Company, a mutual insurance company specifically catering to the needs of manufacturers and their employees in the state of New Jersey.

The company's founding principles were rooted in the belief that insurance should be accessible, affordable, and tailored to the unique risks faced by businesses. This focus on customization and customer-centricity has remained a cornerstone of NJM's philosophy throughout its history.

Over the years, NJM expanded its services beyond manufacturers, offering a comprehensive range of insurance products to individuals and businesses across various industries. This expansion allowed NJM to solidify its position as a leading provider of insurance solutions in New Jersey.

One of NJM's notable achievements was its ability to weather the Great Depression, a time when many insurance companies struggled to stay afloat. NJM's financial stability and commitment to its policyholders during this challenging period further solidified its reputation for reliability and trustworthiness.

Services and Products: Meeting the Diverse Needs of New Jersey Residents

NJM Insurance Group offers a comprehensive suite of insurance products designed to meet the diverse needs of New Jersey residents. Here’s an overview of their key offerings:

Auto Insurance

NJM provides auto insurance policies that offer comprehensive coverage, including liability, collision, and comprehensive protection. Their policies are tailored to meet the specific requirements of New Jersey drivers, ensuring they are adequately protected on the road.

NJM's auto insurance plans often include additional benefits such as rental car coverage, emergency road service, and accident forgiveness, providing added peace of mind to policyholders.

Home Insurance

For homeowners in New Jersey, NJM offers a range of home insurance options. These policies provide coverage for the structure of the home, personal belongings, and liability protection. NJM’s home insurance plans can be customized to suit the unique needs of each homeowner, whether they own a single-family home, a condominium, or a rental property.

Additional coverages, such as flood insurance and earthquake insurance, are also available to protect against specific risks prevalent in the region.

Business Insurance

NJM understands the importance of protecting businesses, and their business insurance offerings are tailored to meet the diverse needs of commercial enterprises. From small businesses to large corporations, NJM provides coverage for property, liability, workers’ compensation, and more.

Their business insurance policies are designed to protect against a wide range of risks, including property damage, liability claims, and employee injuries. NJM's experienced underwriters work closely with businesses to ensure their insurance needs are met effectively.

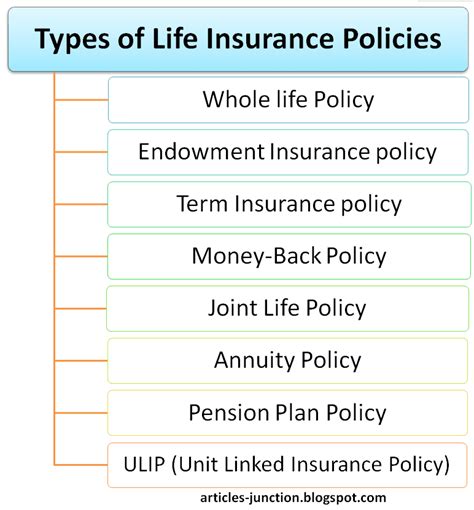

Life and Health Insurance

NJM also offers life and health insurance products to protect individuals and their families. Their life insurance policies provide financial security in the event of an untimely death, ensuring loved ones are taken care of.

In addition, NJM offers health insurance plans that provide comprehensive coverage for medical expenses, including doctor visits, hospital stays, and prescription medications. These plans are designed to meet the unique healthcare needs of New Jersey residents.

Community Engagement and Corporate Social Responsibility

Beyond its insurance offerings, NJM Insurance Group is deeply committed to the communities it serves. The company actively engages in various initiatives to give back and make a positive impact on society.

Philanthropic Initiatives

NJM has a long-standing tradition of supporting charitable causes and organizations that align with its values. The company’s philanthropic efforts focus on areas such as education, community development, and disaster relief.

Through partnerships with local non-profit organizations and community groups, NJM provides financial support, volunteer hours, and resources to address critical issues facing New Jersey residents.

Environmental Sustainability

NJM is dedicated to environmental sustainability and has implemented several initiatives to reduce its environmental footprint. The company has embraced green practices in its operations, including the use of renewable energy sources and the promotion of energy efficiency.

NJM's commitment to sustainability extends beyond its own operations. The company actively promotes eco-friendly practices among its policyholders and encourages businesses to adopt more sustainable business models.

Employee Engagement and Support

NJM recognizes the importance of its employees and strives to create a positive and supportive work environment. The company offers a range of employee benefits, including competitive salaries, comprehensive health insurance, and retirement plans.

NJM also encourages employee engagement through various initiatives, such as volunteer programs, wellness initiatives, and professional development opportunities. By investing in its employees, NJM fosters a culture of loyalty and excellence.

Customer Satisfaction and Industry Recognition

NJM Insurance Group’s commitment to customer satisfaction and excellence has not gone unnoticed. The company consistently receives high ratings and accolades for its exceptional service and products.

NJM has been recognized by numerous industry publications and rating agencies for its outstanding performance. These accolades include awards for customer service, financial stability, and overall excellence in the insurance industry.

Moreover, NJM's customers frequently share positive reviews and testimonials, highlighting their satisfaction with the company's products, claims handling, and overall customer experience.

| Rating Agency | Rating |

|---|---|

| A.M. Best | A (Excellent) Financial Strength Rating |

| J.D. Power | Top rankings in customer satisfaction for auto insurance |

| National Association of Mutual Insurance Companies | Recognition for outstanding performance and financial strength |

Conclusion: A Trusted Partner for New Jersey Residents

NJM Insurance Group has established itself as a leading insurance provider in New Jersey, offering a comprehensive range of insurance products and exceptional service. With a rich history, a customer-centric philosophy, and a commitment to community engagement, NJM has become a trusted partner for individuals and businesses in the Garden State.

As NJM continues to innovate and adapt to the evolving needs of its policyholders, it remains a reliable and forward-thinking insurance company. Whether it's protecting New Jersey drivers on the road, safeguarding homes and businesses, or providing financial security through life and health insurance, NJM is dedicated to delivering peace of mind and outstanding value to its customers.

How can I obtain a quote for NJM Insurance Group’s services?

+To obtain a quote from NJM Insurance Group, you can visit their official website and use their online quote tool. Alternatively, you can contact their customer service team via phone or email to discuss your insurance needs and receive a personalized quote.

What sets NJM Insurance Group apart from other insurance providers in New Jersey?

+NJM Insurance Group stands out for its commitment to customer satisfaction, financial stability, and its customer-centric approach. They offer competitive rates, comprehensive coverage, and exceptional service, making them a trusted choice for many New Jersey residents.

Does NJM Insurance Group provide insurance coverage outside of New Jersey?

+NJM Insurance Group primarily serves the state of New Jersey. While they have a strong presence in the Garden State, their insurance offerings are primarily tailored to meet the specific needs and regulations of New Jersey residents and businesses.