Specialized Car Insurance For Collectors

For avid collectors and enthusiasts of classic cars, rare sports vehicles, or luxurious automobiles, ensuring the proper protection and coverage of their prized possessions is paramount. Standard auto insurance policies often fall short when it comes to providing the comprehensive coverage these unique vehicles demand. That's where specialized car insurance for collectors steps in, offering tailored solutions to safeguard these automotive treasures.

Understanding the Need for Specialized Coverage

The world of classic and collector cars is vastly different from that of everyday vehicles. These vehicles are often cherished for their historical significance, unique design, or the sheer thrill of owning a rare piece of automotive engineering. However, their value and significance extend beyond the mere purchase price.

Classic cars, in particular, may appreciate in value over time, becoming valuable assets that can be passed down through generations. Sports cars, on the other hand, are renowned for their powerful engines and thrilling performance, making them a target for theft and vandalism. Meanwhile, luxury vehicles are known for their opulent features and meticulous craftsmanship, which can be expensive to repair or replace.

Standard auto insurance policies are designed to cover everyday vehicles used for regular commuting or personal use. They typically offer coverage for collision, liability, comprehensive, and medical expenses. However, these policies often come with limitations and exclusions that may not adequately protect collector vehicles.

Limitations of Standard Auto Insurance

One of the primary limitations of standard auto insurance is the restriction on mileage. Most policies limit the number of miles a vehicle can be driven annually, which can be a significant constraint for collector cars that are often taken out for special occasions or events. This limited mileage can result in reduced coverage or increased premiums.

Additionally, standard policies often have a cap on the total value of the vehicle they cover. This can be problematic for collector cars, as their value can far exceed the limits set by standard policies. In the event of a total loss, the owner may be left with a significant financial gap to cover.

Another concern is the depreciation factor. Standard policies often apply depreciation to the value of the vehicle over time, which can significantly reduce the payout in the event of a claim. For collector cars, which may appreciate in value, this depreciation can result in an unfair settlement.

Lastly, standard policies may not adequately cover the unique risks associated with collector vehicles. These risks include theft, vandalism, and damage due to non-collision events such as fire, flood, or natural disasters. Without specialized coverage, collectors may find themselves underinsured and facing substantial out-of-pocket expenses.

The Benefits of Specialized Car Insurance for Collectors

Specialized car insurance for collectors is designed to address the unique needs and risks associated with these vehicles. It offers a range of benefits that standard policies simply cannot match, ensuring that collector cars receive the protection they deserve.

Agree-Value Coverage

One of the key advantages of specialized collector car insurance is the agreement value coverage. This type of coverage guarantees that in the event of a total loss, the owner will receive the agreed-upon value of the vehicle, regardless of its depreciated market value. This ensures that collectors are fully compensated for their loss, without the added stress of negotiating with insurance adjusters.

The agreed-value coverage is particularly beneficial for classic cars, as their value can be difficult to determine due to their rarity and historical significance. With this coverage, collectors can rest assured that their vehicles are adequately insured, even if their value appreciates over time.

Comprehensive Coverage for Unique Risks

Specialized collector car insurance provides comprehensive coverage for a wide range of risks. This includes protection against theft, vandalism, and damage due to non-collision events. Additionally, it covers liability for any accidents or incidents involving the collector vehicle.

Furthermore, these policies often include coverage for specialized transportation and storage needs. For instance, they may cover the cost of transporting the vehicle to and from events, as well as provide coverage for any damage that may occur during transit. Additionally, they may offer coverage for specialized storage facilities, ensuring that the vehicle is protected even when it's not in use.

Flexible Mileage Options

Unlike standard auto insurance policies, specialized collector car insurance offers flexible mileage options. This means that collectors can choose a mileage limit that suits their needs, without the fear of being penalized for exceeding the limit. This flexibility is particularly beneficial for collectors who take their vehicles out for frequent events or shows.

Additionally, some specialized policies offer mileage incentives. For instance, they may reward collectors for keeping their vehicles in storage for extended periods, offering reduced premiums as an incentive to minimize mileage.

Personalized Service and Expertise

Specialized collector car insurance is often provided by companies that have a deep understanding of the collector car market. These insurers have a team of experts who can provide personalized service and guidance to collectors. They can offer advice on the best coverage options, help collectors understand the unique risks associated with their vehicles, and assist in the event of a claim.

Furthermore, these insurers often have a network of trusted repair shops and restoration experts who can provide high-quality repairs or restorations in the event of damage. This ensures that the collector's vehicle is restored to its original condition, maintaining its value and integrity.

Selecting the Right Specialized Car Insurance Provider

When it comes to selecting a specialized car insurance provider for collectors, it’s essential to choose a company that understands the unique needs and risks associated with these vehicles. Here are some key factors to consider when making your decision:

Expertise and Reputation

Look for an insurer that has a proven track record in the collector car insurance market. Choose a company that has a team of experts who understand the value and significance of collector vehicles, as well as the unique risks they face. A reputable insurer will have a strong reputation for providing fair and timely claims settlements, ensuring that collectors are adequately compensated for their losses.

Tailored Coverage Options

Each collector’s needs are unique, so it’s essential to choose an insurer that offers a range of tailored coverage options. Look for a company that can customize their policies to suit the specific needs of your collection. This may include coverage for multiple vehicles, flexible mileage options, and specialized coverage for unique risks such as theft or vandalism.

Network of Repair and Restoration Experts

In the event of a claim, you’ll want to ensure that your collector car is repaired or restored by trusted professionals. Choose an insurer that has a network of reputable repair shops and restoration experts who are experienced in working with collector vehicles. This will ensure that your vehicle is returned to its original condition, maintaining its value and integrity.

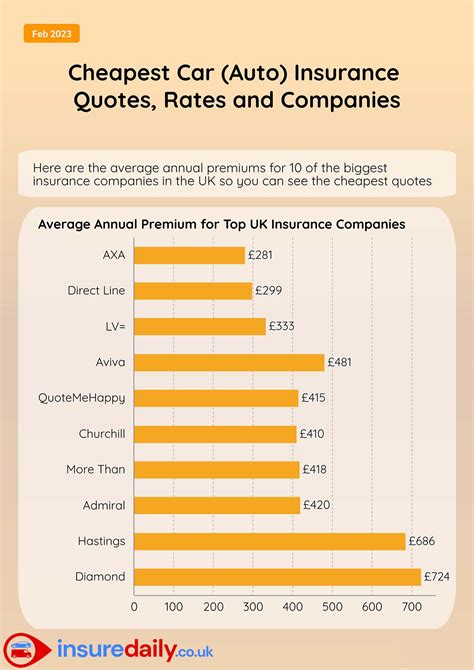

Competitive Pricing and Flexible Payment Options

While cost should not be the only factor in your decision, it’s still an important consideration. Compare quotes from different specialized car insurance providers to ensure you’re getting a competitive rate. Additionally, look for insurers that offer flexible payment options, such as monthly or quarterly payments, to suit your financial needs.

Excellent Customer Service

Choose an insurer that prioritizes excellent customer service. Look for a company that has a dedicated team of specialists who are readily available to answer your questions and provide guidance. A responsive and helpful customer service team can make a significant difference, especially in the event of a claim.

The Future of Specialized Car Insurance for Collectors

The collector car insurance market is constantly evolving, driven by advancements in technology and changing consumer needs. Here are some trends and developments that are shaping the future of specialized car insurance for collectors:

Digital Transformation

The insurance industry is undergoing a digital transformation, and specialized car insurance for collectors is no exception. Insurers are increasingly leveraging technology to enhance the customer experience, improve efficiency, and reduce costs. This includes the use of digital platforms for policy management, claims processing, and customer service.

Additionally, insurers are exploring the use of telematics and other data-driven technologies to better understand the risks associated with collector vehicles. This data can be used to personalize coverage options and provide more accurate pricing, ensuring that collectors receive the most suitable and cost-effective insurance solutions.

Enhanced Risk Assessment

Specialized car insurance providers are continuously refining their risk assessment processes to better understand the unique risks associated with collector vehicles. This includes developing more sophisticated models that take into account factors such as vehicle age, condition, and usage patterns.

By improving risk assessment, insurers can offer more accurate pricing and tailored coverage options. This ensures that collectors receive the right level of protection for their vehicles, without paying for unnecessary coverage.

Expanded Coverage Options

As the collector car market evolves, so too do the coverage options offered by specialized insurers. Insurers are expanding their product offerings to cater to the diverse needs of collectors. This includes coverage for emerging risks such as cyber threats, as well as specialized coverage for unique vehicle types such as vintage motorcycles or classic trucks.

Additionally, insurers are exploring the potential of offering coverage for collector car events and shows. This could include coverage for liability, property damage, and personal injury, providing collectors with peace of mind when participating in these events.

Partnerships and Collaborations

Specialized car insurance providers are increasingly forming partnerships and collaborations to enhance their service offerings. This includes partnerships with automotive clubs, restoration experts, and even technology companies. These collaborations can provide insurers with access to valuable data and expertise, helping them to better understand the collector car market and offer more innovative solutions.

Additionally, partnerships can lead to exclusive benefits for collectors. For instance, insurers may offer discounted rates or additional coverage options for members of specific automotive clubs, providing added value to collectors who are passionate about their vehicles.

| Key Takeaways | Details |

|---|---|

| Specialized Car Insurance for Collectors | Offers tailored coverage to protect classic, rare, and luxurious vehicles, addressing limitations of standard policies. |

| Benefits | Agreed-value coverage, comprehensive risk protection, flexible mileage options, personalized service, and expert guidance. |

| Choosing a Provider | Consider expertise, tailored coverage options, network of repair experts, competitive pricing, and excellent customer service. |

| Future Trends | Digital transformation, enhanced risk assessment, expanded coverage options, and partnerships to enhance services and benefits for collectors. |

What is the average cost of specialized car insurance for collectors?

+The cost of specialized car insurance for collectors can vary widely depending on factors such as the value of the vehicle, its age and condition, the level of coverage desired, and the insurer. On average, collector car insurance can range from a few hundred to a few thousand dollars per year. However, it’s important to note that cost should not be the sole factor in your decision. It’s essential to choose an insurer that offers the right level of coverage and provides excellent customer service.

Can I insure multiple collector vehicles under one policy?

+Yes, many specialized car insurance providers offer the option to insure multiple collector vehicles under a single policy. This can be a cost-effective solution for collectors who own multiple vehicles, as it often results in discounted rates. Additionally, having a single policy can provide convenience and ease of management, as all your vehicles are covered under one contract.

What should I do if my collector car is involved in an accident or suffers damage?

+If your collector car is involved in an accident or suffers damage, it’s important to follow these steps: First, ensure your safety and the safety of others involved. Then, contact your insurance provider as soon as possible to report the incident. They will guide you through the claims process, which may involve providing documentation, photographs, and other details. It’s essential to cooperate with your insurer and provide accurate information to ensure a timely and fair settlement.

How can I get a quote for specialized car insurance for my collector vehicle?

+To get a quote for specialized car insurance for your collector vehicle, you can contact several reputable insurers who offer collector car insurance. Provide them with details about your vehicle, including its make, model, year, and value. They will assess your needs and provide you with a quote based on their coverage options and pricing. It’s recommended to compare quotes from multiple insurers to find the best fit for your specific requirements.