Short Term Travel Insurance

Traveling is an exciting and enriching experience, but it also comes with its fair share of uncertainties and unexpected situations. Whether you're planning a weekend getaway or an extended international trip, having the right travel insurance coverage is crucial to protect yourself and your travel plans. Short-term travel insurance, designed for brief adventures, offers a range of benefits and peace of mind, ensuring your journey is as smooth and worry-free as possible.

Understanding Short-Term Travel Insurance

Short-term travel insurance, often referred to as “single trip” insurance, provides coverage for a specific, limited period. It is tailored for individuals or groups embarking on a single trip, typically lasting from a few days to a few months. Unlike annual travel insurance policies, which cover multiple trips over a year, short-term plans are ideal for those who travel occasionally or for specific events, such as vacations, business trips, or study abroad programs.

This type of insurance policy offers comprehensive protection, covering a wide range of potential travel mishaps. From medical emergencies and trip cancellations to lost luggage and personal liability, short-term travel insurance ensures you're prepared for the unexpected. By purchasing this insurance, travelers can focus on enjoying their adventures without worrying about financial repercussions if things go awry.

Key Benefits of Short-Term Travel Insurance

Medical and Emergency Assistance: One of the primary advantages of short-term travel insurance is the coverage it provides for medical emergencies. In a foreign country, unexpected illnesses or accidents can be costly, and finding appropriate medical care can be challenging. Short-term insurance plans often cover medical expenses, including doctor visits, hospital stays, prescription medications, and even emergency medical evacuations.

Trip Cancellation and Delay Protection: Travel plans can be disrupted for various reasons, from unforeseen illnesses to natural disasters or airline issues. Short-term insurance policies typically offer coverage for trip cancellations and delays, reimbursing non-refundable expenses such as flight tickets, accommodations, and tour packages. This protection ensures that travelers don't suffer financial losses due to unforeseen circumstances.

Baggage and Personal Belongings: Losing or having your luggage delayed or stolen can be a significant inconvenience and expense. Short-term travel insurance often includes coverage for these situations, reimbursing the cost of essential items or providing emergency funds to replace lost belongings. This benefit is especially valuable when traveling with valuable items or specialized equipment.

Personal Liability and Legal Expenses: While on your travels, accidents or incidents can occur that may lead to legal liabilities. Short-term insurance plans provide coverage for legal expenses and personal liability, offering financial protection if you're involved in an incident that results in property damage or bodily harm to others.

How to Choose the Right Short-Term Travel Insurance

When selecting a short-term travel insurance plan, it’s essential to consider your specific travel needs and destinations. Here are some factors to keep in mind:

- Destination and Activities: Research the unique risks associated with your destination and planned activities. Some countries may have higher medical costs or specific health risks, while adventure activities like skiing or hiking might require additional coverage.

- Trip Duration: Ensure the policy covers the entire duration of your trip, including any stopovers or layovers. Short-term policies typically offer flexibility, but it's crucial to confirm the exact coverage period.

- Coverage Limits: Check the policy's coverage limits for medical expenses, trip cancellation, and other benefits. Ensure these limits align with your potential needs and the cost of travel in your destination country.

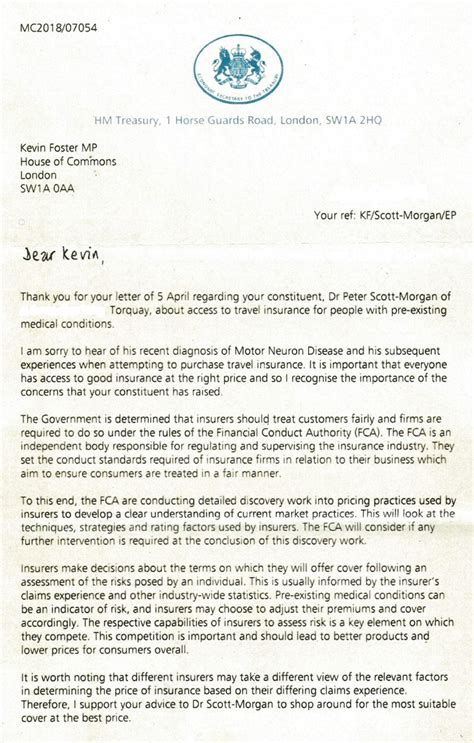

- Exclusions and Conditions: Carefully review the policy's exclusions and conditions. Some common exclusions include pre-existing medical conditions, high-risk activities, and certain types of injuries or illnesses. Understand these exclusions to avoid any surprises.

- Emergency Assistance: Opt for a policy that provides 24/7 emergency assistance and support services. This ensures you have access to help and guidance in case of an emergency, no matter where you are.

Case Study: The Benefits of Short-Term Travel Insurance in Action

To illustrate the real-world impact of short-term travel insurance, let’s consider the experience of Emma, a young professional planning a two-week vacation to Europe. Emma purchases a short-term travel insurance policy to protect her trip.

During her trip, Emma encounters several unforeseen situations:

- She twists her ankle while hiking in the Swiss Alps and requires medical attention. Her insurance policy covers the cost of her treatment and even provides emergency transportation to a nearby hospital.

- Emma's flight home is canceled due to a strike, causing a delay of several days. Her insurance policy reimburses her for additional accommodation and meal expenses during the delay.

- Unfortunately, Emma's checked luggage is lost during her return journey. The insurance company provides an emergency advance to purchase essential items and covers the cost of replacing her lost belongings once she returns home.

Without short-term travel insurance, Emma would have faced significant financial burdens and stress. However, with her policy, she received prompt assistance and reimbursement, allowing her to focus on recovering from her injury and enjoying the remainder of her trip without worrying about the financial implications.

Performance Analysis and Industry Trends

The travel insurance industry has witnessed significant growth in recent years, with a rising awareness of the importance of travel protection. Short-term travel insurance policies have become increasingly popular, especially among millennials and Gen Z travelers who tend to embark on more frequent, shorter trips.

According to a recent report by Travel Insurance Insights, the global travel insurance market is expected to reach $35 billion by 2025, with short-term policies contributing a significant portion of this growth. This surge in demand is attributed to factors such as the rise of digital nomads, increased international travel, and a greater emphasis on travel safety and security.

| Year | Short-Term Travel Insurance Market Size (USD Billion) |

|---|---|

| 2020 | 18.5 |

| 2021 | 21.7 |

| 2022 | 25.2 |

| 2023 | 28.6 |

| 2024 | 32.1 |

| 2025 | 35.0 |

Future Implications and Industry Insights

The future of short-term travel insurance looks promising, with several key trends shaping the industry:

- Digital Transformation: Travel insurance providers are increasingly leveraging digital technologies to enhance the customer experience. This includes online policy purchases, mobile apps for emergency assistance, and digital claim processes, making insurance more accessible and convenient for travelers.

- Personalized Coverage: Insurers are developing more flexible and customizable policies to meet the diverse needs of travelers. From adventure-specific coverage to tailored plans for business trips or student exchanges, personalized insurance options are becoming more prevalent.

- Health and Wellness Focus: With a growing emphasis on health and wellness, travel insurance policies are expanding their medical coverage. This includes coverage for mental health issues, pre-existing conditions, and even wellness treatments, ensuring travelers can access the care they need while away from home.

- Global Partnerships: To provide comprehensive coverage, travel insurance companies are forming partnerships with global healthcare providers, travel agencies, and assistance companies. These collaborations enhance the network of medical facilities and support services available to insured travelers worldwide.

Conclusion

Short-term travel insurance is an essential tool for anyone embarking on a journey, offering peace of mind and financial protection. By understanding the benefits and selecting the right policy, travelers can ensure they’re prepared for any unexpected challenges that may arise during their adventures. As the travel insurance industry continues to innovate and adapt, travelers can look forward to even more comprehensive and tailored coverage options to enhance their travel experiences.

What is the average cost of short-term travel insurance per day?

+The cost of short-term travel insurance can vary depending on factors such as your age, destination, trip duration, and the level of coverage you choose. On average, you can expect to pay around 1 to 5 per day for a basic policy, with premium plans costing up to $10 or more per day. It’s important to compare quotes from different insurers to find the best value for your specific needs.

Can I purchase short-term travel insurance after my trip has started?

+In most cases, short-term travel insurance policies must be purchased before your trip begins. However, some insurers offer emergency travel insurance plans that can be purchased while you’re already traveling. These policies typically provide limited coverage and are intended for unforeseen situations that arise during your journey.

What happens if I need to extend my trip beyond the coverage period of my short-term policy?

+If you decide to extend your trip beyond the coverage period of your short-term travel insurance policy, you will need to purchase a new policy or upgrade your existing policy to cover the extended period. It’s important to contact your insurance provider as soon as you know your plans have changed to ensure uninterrupted coverage.

Does short-term travel insurance cover COVID-19 related issues?

+The coverage for COVID-19 related issues varies among short-term travel insurance policies. Some policies specifically exclude COVID-19 related claims, while others may provide coverage for medical expenses, trip cancellations, or interruptions due to COVID-19. It’s crucial to carefully review the policy’s terms and conditions and understand the specific coverage for COVID-19 before purchasing.