Llc Business Insurance

Starting a business is an exciting venture, but it also comes with various risks and responsibilities. One crucial aspect of safeguarding your new venture is understanding the world of LLC business insurance. This comprehensive guide aims to delve into the intricacies of insuring your limited liability company (LLC), offering valuable insights and practical advice to ensure you make informed decisions about protecting your business.

The Significance of LLC Business Insurance

When you embark on the journey of establishing an LLC, you are not only launching a business but also assuming various risks. From unexpected accidents to legal liabilities, the business landscape can be unpredictable. This is where LLC business insurance steps in as a critical safeguard.

LLC business insurance serves as a protective shield, providing financial coverage for a wide range of potential risks. These risks can include property damage, liability claims, and even cyber attacks. By investing in the right insurance policies, you not only protect your business assets but also ensure the long-term viability and stability of your venture.

Key Benefits of LLC Business Insurance

- Risk Mitigation: Business insurance helps mitigate financial risks, ensuring that you are prepared for unforeseen events.

- Legal Protection: It provides crucial legal coverage, protecting your LLC from potential lawsuits and claims.

- Asset Security: Insurance policies safeguard your business assets, from physical property to intellectual property.

- Peace of Mind: With comprehensive insurance, you can focus on growing your business without constant worry.

Understanding the Insurance Landscape for LLCs

The insurance market for LLCs is diverse and tailored to meet the unique needs of different industries and business sizes. It's essential to grasp the variety of insurance options available to make informed choices that align with your specific business requirements.

Common Insurance Policies for LLCs

Here's an overview of some of the most prevalent insurance policies that LLCs often consider:

- General Liability Insurance: This is a fundamental policy that covers a broad range of liability risks, including bodily injury, property damage, and advertising injuries. It's an essential safeguard for any LLC, offering protection against common legal claims.

- Professional Liability Insurance (Errors and Omissions): Specifically designed for businesses that provide professional services, this policy covers claims arising from negligence, errors, or omissions in the course of providing those services. It's particularly crucial for industries like consulting, IT services, and legal practices.

- Product Liability Insurance: If your LLC manufactures, distributes, or sells physical products, this insurance is a must-have. It provides coverage for claims arising from product defects or failures, protecting your business from potential lawsuits.

- Commercial Property Insurance: This policy protects your business property, including buildings, equipment, and inventory, against damage or loss due to events like fires, storms, or theft. It's vital for LLCs that own or lease physical business premises.

- Business Interruption Insurance: In the event of a covered loss that disrupts your business operations, this insurance steps in to cover your lost income and ongoing expenses. It ensures your business can weather temporary shutdowns and maintain financial stability.

- Workers' Compensation Insurance: Required by law in most states, this insurance provides coverage for employees who suffer work-related injuries or illnesses. It pays for medical expenses and replaces a portion of lost wages, protecting both your employees and your business.

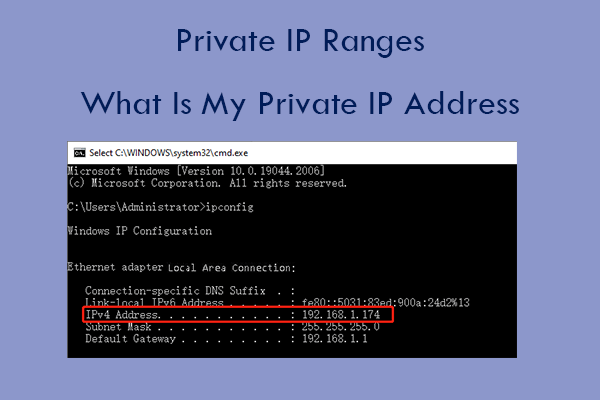

- Cyber Liability Insurance: With the increasing prevalence of cyber threats, this policy has become essential for LLCs. It provides coverage for data breaches, cyber attacks, and other online risks, helping to mitigate the financial impact of such incidents.

Tailoring Insurance Coverage to Your LLC's Needs

Every LLC is unique, and so are its insurance needs. The key to effective insurance coverage is customization. Here's how you can tailor your insurance portfolio to match your LLC's specific requirements:

Assessing Risks and Priorities

Start by conducting a thorough risk assessment of your LLC. Identify the potential hazards and vulnerabilities specific to your industry, location, and business operations. Consider factors like the nature of your products or services, the number of employees, and the value of your business assets.

Prioritize the risks that are most likely to occur and have the potential to cause significant financial harm. This risk assessment will guide you in determining the types and levels of insurance coverage that are essential for your LLC.

Industry-Specific Insurance Considerations

Different industries come with their own set of risks and insurance needs. For instance, a manufacturing LLC may require extensive property and product liability insurance, while a software development firm might prioritize cyber liability coverage.

Understand the unique challenges and risks associated with your industry. Research industry-specific insurance policies and consult with insurance experts who have experience working with businesses in your sector. This specialized knowledge can help you tailor your insurance portfolio effectively.

Bundling Policies for Cost-Effectiveness

Bundling multiple insurance policies together can often result in cost savings. Many insurance providers offer package deals or business owner's policies (BOPs) that combine essential coverage options, such as general liability, property insurance, and business interruption insurance, into a single, more affordable package.

Evaluate the potential cost savings of bundling policies while ensuring that you're not compromising on the necessary coverage. A balanced approach is key to optimizing your insurance portfolio.

Regular Policy Reviews and Adjustments

Insurance needs are not static; they evolve as your LLC grows and changes. Regularly review your insurance policies to ensure they remain aligned with your current business realities.

Consider factors like changes in your business operations, expansion into new markets, or the introduction of new products or services. These changes may necessitate adjustments to your insurance coverage. Stay proactive and consult with your insurance provider to ensure your policies remain up-to-date and comprehensive.

The Role of Insurance Brokers and Advisors

Navigating the complex world of business insurance can be challenging, especially for LLC owners who are new to the process. This is where insurance brokers and advisors can be invaluable assets.

Benefits of Working with Insurance Experts

- Expertise and Guidance: Insurance brokers and advisors bring a wealth of knowledge and experience to the table. They can provide valuable insights into the insurance market, helping you understand the nuances of different policies and coverage options.

- Tailored Solutions: These professionals can assess your LLC's unique needs and tailor insurance solutions specifically for your business. They consider factors like industry, size, and specific risks to create a comprehensive insurance portfolio.

- Cost-Effective Options: Insurance brokers often have access to a wide range of insurance providers and can negotiate better rates on your behalf. They can help you find the most cost-effective coverage options without compromising on quality.

- Claims Assistance: In the event of a claim, insurance advisors can guide you through the process, ensuring that you receive the full benefits of your policy. They can also help with policy adjustments to reflect any changes in your business.

Finding the Right Insurance Advisor

When searching for an insurance broker or advisor, consider the following:

- Experience: Look for professionals with a proven track record in working with LLCs and businesses in your industry.

- Specialization: Some advisors specialize in specific industries or types of insurance. Choose one who understands the unique risks and challenges of your business.

- Reputation: Research online reviews and seek recommendations from other business owners to find a reputable and trusted advisor.

- Communication: Effective communication is key. Choose an advisor who is responsive, transparent, and willing to explain complex insurance concepts in simple terms.

The Future of LLC Business Insurance

The insurance landscape for LLCs is continually evolving, driven by technological advancements, changing regulatory environments, and emerging risks. Keeping abreast of these developments is crucial for LLC owners to ensure their insurance coverage remains relevant and effective.

Emerging Trends and Technologies

The integration of technology in the insurance industry is transforming the way policies are designed and delivered. Insurtech, or insurance technology, is gaining momentum, offering innovative solutions like digital claims processing, risk assessment tools, and personalized insurance products.

As an LLC owner, embracing these technological advancements can streamline your insurance processes and potentially reduce costs. Stay informed about new insurance technologies and consider how they can benefit your business.

Regulatory Changes and Compliance

Insurance regulations are subject to change, and staying compliant with these evolving standards is essential. LLC owners should keep a close eye on legislative and regulatory updates that may impact their insurance requirements.

For instance, changes in data privacy laws may affect your cyber liability insurance coverage. Stay informed about these developments and consult with your insurance advisor to ensure your policies remain compliant.

Emerging Risks and New Coverage Options

The business world is dynamic, and new risks emerge regularly. LLC owners should be vigilant about identifying these emerging risks and considering whether their current insurance coverage addresses them.

For example, with the rise of remote work, LLCs may face new cybersecurity threats. Insurance providers are responding by offering expanded cyber liability coverage to address these evolving risks. Stay informed about these new coverage options to ensure your LLC remains protected.

Frequently Asked Questions (FAQ)

How much does LLC business insurance typically cost?

+The cost of LLC business insurance can vary significantly based on factors such as the size of your business, the industry you operate in, and the specific coverage options you choose. On average, small businesses can expect to pay anywhere from 500 to 2,000 per year for a basic general liability policy. However, the cost can quickly increase when you add other essential coverages like professional liability, product liability, or property insurance. It’s important to get quotes from multiple insurers to find the best coverage at a competitive price.

Do I need to purchase all the insurance policies mentioned in this guide?

+Not necessarily. The insurance policies outlined in this guide cover a wide range of potential risks, but not all of them may be relevant to your specific LLC. It’s crucial to assess your business’s unique needs and vulnerabilities. For instance, if your LLC provides professional services, professional liability insurance is a must-have. On the other hand, if you don’t manufacture or sell physical products, product liability insurance may not be necessary. Consult with an insurance advisor to determine the policies that are essential for your business.

Can I get discounts on my LLC business insurance premiums?

+Absolutely! Insurance providers often offer discounts for various reasons. You may qualify for discounts if you bundle multiple policies with the same insurer, have a good credit score, or maintain a strong safety record. Some insurers also provide discounts for businesses that implement risk management strategies or invest in security measures to reduce potential losses. It’s worth discussing these options with your insurance broker to see if you can lower your premiums.

How often should I review and update my LLC’s insurance coverage?

+Regularly reviewing and updating your insurance coverage is essential to ensure it remains adequate and up-to-date. As your business grows, expands into new markets, or introduces new products or services, your insurance needs may change. It’s generally recommended to review your coverage annually, or whenever there are significant changes in your business operations. This way, you can make sure your LLC is always protected against the risks it faces.