Private Health Insurance Quotes

In the ever-evolving landscape of healthcare, having access to quality medical services is paramount. Private health insurance plays a crucial role in providing individuals and families with the financial protection and peace of mind they need. Obtaining accurate and tailored quotes for private health insurance is an essential step towards securing comprehensive coverage that suits your unique needs. In this comprehensive guide, we will delve into the world of private health insurance quotes, exploring the factors that influence them, the steps to obtaining personalized estimates, and the key considerations to make an informed decision.

Understanding the Fundamentals of Private Health Insurance Quotes

Private health insurance quotes serve as a snapshot of the potential costs and coverage options available to individuals seeking medical insurance plans. These quotes are influenced by a myriad of factors, each contributing to the overall cost and benefits outlined in the policy. By understanding these fundamentals, you can navigate the quote process with confidence and make choices that align with your healthcare priorities.

Factors Influencing Private Health Insurance Quotes

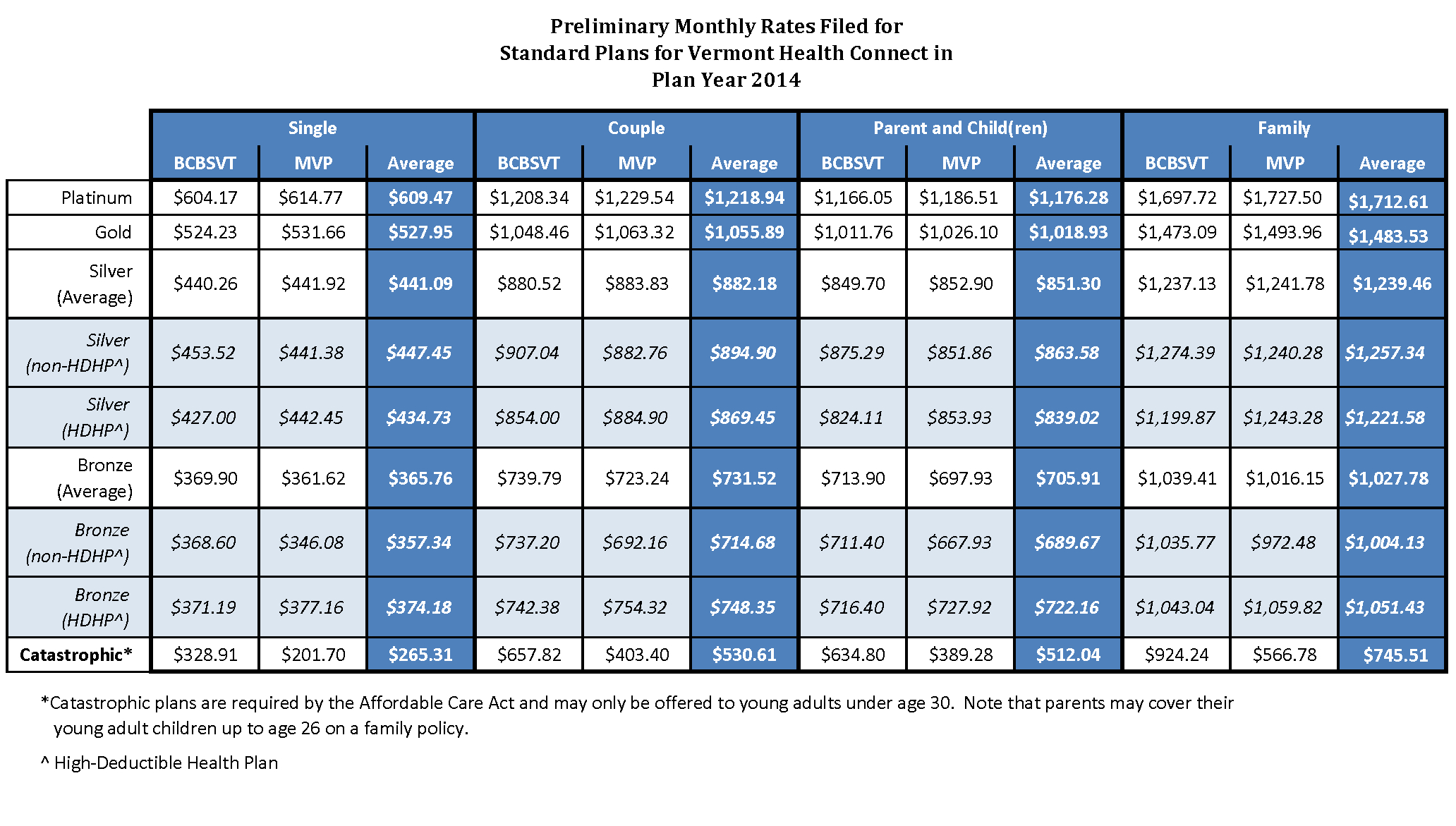

Several key elements come into play when determining private health insurance quotes. Age is a significant factor, as older individuals typically face higher premiums due to increased healthcare needs. The type of coverage desired, whether basic or comprehensive, also impacts the quote. Pre-existing medical conditions can affect both the availability of coverage and the associated costs. Geographic location is another consideration, as healthcare costs vary across different regions.

Lifestyle factors, such as smoking or engaging in high-risk activities, can influence the quote as well. Additionally, the chosen healthcare provider network, whether narrow or broad, affects the flexibility and potential out-of-pocket expenses. Family size and the number of dependents are crucial factors, as policies often offer family discounts or specific coverage options for children.

Lastly, the chosen insurance company and its financial stability are essential. Reputable insurers with strong financial ratings offer more security and reliability, which can impact the overall quote and policy experience.

| Factor | Influence on Quote |

|---|---|

| Age | Higher premiums for older individuals |

| Coverage Type | Basic vs. comprehensive plans affect cost |

| Pre-existing Conditions | May impact coverage availability and cost |

| Geographic Location | Healthcare costs vary by region |

| Lifestyle Factors | Smoking, high-risk activities influence quote |

| Provider Network | Narrow vs. broad networks affect flexibility and expenses |

| Family Size | Family discounts or specific coverage for children |

| Insurance Company | Reputable insurers with strong financial ratings offer security |

Navigating the Private Health Insurance Quote Process

Obtaining private health insurance quotes is a straightforward process that can be completed online or through insurance brokers. Here’s a step-by-step guide to help you navigate the quote process effectively.

Step 1: Determine Your Coverage Needs

Before seeking quotes, it’s essential to assess your healthcare needs and preferences. Consider factors such as your age, any pre-existing conditions, and the type of medical services you anticipate requiring. Determine whether you prioritize comprehensive coverage or are seeking a more budget-friendly option.

Evaluate your current health status and any specific medical concerns you have. This self-assessment will guide you in selecting the appropriate level of coverage and help you understand the potential costs associated with your unique situation.

Step 2: Compare Insurance Providers

Research and compare different insurance providers to understand their reputation, financial stability, and the range of plans they offer. Look for providers with a strong track record and positive customer reviews. Consider the availability of specific coverage options that align with your needs, such as maternity care, mental health services, or prescription drug coverage.

Utilize online comparison tools and resources to evaluate various providers simultaneously. These tools often provide detailed information about coverage, premiums, and customer experiences, enabling you to make informed comparisons.

Step 3: Request Quotes

Once you have a shortlist of insurance providers, request quotes from each. You can do this online through their websites or by contacting them directly. Provide accurate and detailed information about yourself, your family, and your healthcare needs to ensure the quotes are as precise as possible.

When requesting quotes, pay attention to the level of detail provided. Some providers offer basic quotes, while others provide comprehensive estimates that include coverage details, exclusions, and potential out-of-pocket expenses. Opt for detailed quotes to gain a clearer understanding of the policy's benefits and costs.

Step 4: Evaluate and Analyze the Quotes

After receiving the quotes, take the time to carefully evaluate and analyze them. Compare the premiums, coverage limits, deductibles, and any additional benefits or exclusions. Consider your budget and the potential impact of the out-of-pocket expenses outlined in each quote.

Assess the provider's financial stability and reputation. Look for reviews and ratings to ensure the insurer has a positive track record and is likely to fulfill their obligations. Consider the provider's customer service and claims process to ensure a smooth and stress-free experience if you need to make a claim.

Step 5: Make an Informed Decision

Based on your analysis and research, choose the private health insurance plan that best aligns with your needs, budget, and preferences. Consider not only the premium but also the coverage, exclusions, and potential out-of-pocket expenses. Ensure that the chosen plan provides adequate protection for your healthcare needs and offers the level of flexibility and benefits you require.

If you have any doubts or questions, don't hesitate to reach out to the insurance provider's customer support or consult an insurance broker for expert advice. Making an informed decision ensures you have the right coverage to protect your health and financial well-being.

Key Considerations for Private Health Insurance

When evaluating private health insurance quotes, it’s essential to consider several critical factors that can impact your overall experience and satisfaction with the chosen plan.

Understanding Coverage Limits and Exclusions

Review the coverage limits and exclusions outlined in the policy carefully. Understand what is covered and the specific limits or restrictions applied to each benefit. Some policies may have limitations on certain treatments or procedures, so ensure that your expected healthcare needs align with the coverage provided.

Assessing Out-of-Pocket Expenses

Out-of-pocket expenses, such as deductibles, co-payments, and co-insurance, can significantly impact your overall healthcare costs. Evaluate the potential out-of-pocket expenses for the chosen plan and consider how they align with your budget and financial capabilities. Understand the scenarios in which you may incur these expenses and plan accordingly.

Network of Healthcare Providers

The network of healthcare providers associated with the insurance plan is crucial. Ensure that your preferred doctors, specialists, and hospitals are included in the network. If you have a specific healthcare provider you wish to continue seeing, verify their participation in the plan’s network to avoid unexpected costs or limited access to care.

Understanding Waiting Periods

Private health insurance plans often have waiting periods for certain benefits or treatments. These waiting periods can vary depending on the type of coverage and the specific condition or procedure. Understand the waiting periods applicable to your chosen plan and ensure they align with your healthcare needs. If you anticipate requiring immediate access to certain services, choose a plan with shorter or no waiting periods.

Additional Benefits and Flexibility

Look beyond the basic coverage and consider additional benefits and flexibility options offered by the insurance plan. Some plans provide wellness programs, preventative care incentives, or discounts on certain services. Evaluate these added benefits and determine if they enhance the overall value of the plan for your specific healthcare needs.

The Future of Private Health Insurance: Trends and Innovations

The private health insurance industry is evolving rapidly, driven by technological advancements, changing consumer preferences, and the need for more efficient and personalized healthcare solutions. Here are some key trends and innovations shaping the future of private health insurance.

Telehealth and Digital Health Solutions

Telehealth services have gained significant traction, offering convenient and accessible healthcare options. Private health insurance providers are integrating telehealth into their plans, allowing policyholders to consult with healthcare professionals remotely. This innovation enhances accessibility, particularly for individuals in remote areas or with limited mobility, and provides a cost-effective solution for routine consultations and minor ailments.

Personalized Medicine and Genetic Testing

The field of personalized medicine is revolutionizing healthcare by tailoring treatment plans to an individual’s unique genetic makeup. Private health insurance companies are exploring ways to incorporate genetic testing and personalized treatment approaches into their coverage. This innovative approach holds the potential to improve patient outcomes, reduce healthcare costs, and provide more precise and effective care.

Value-Based Care Models

Value-based care models are gaining popularity, focusing on delivering high-quality healthcare while reducing costs. These models reward healthcare providers for achieving positive health outcomes rather than solely basing compensation on the volume of services rendered. Private health insurance companies are partnering with healthcare providers to implement value-based care, ensuring better patient experiences and more efficient healthcare delivery.

Artificial Intelligence and Predictive Analytics

Artificial intelligence (AI) and predictive analytics are transforming the healthcare industry. Private health insurance providers are leveraging these technologies to analyze large datasets and identify patterns that can improve risk assessment, predict healthcare needs, and enhance overall efficiency. AI-powered tools can assist in early disease detection, personalized treatment recommendations, and more accurate claims processing.

Consumer-Centric Approaches

The future of private health insurance is increasingly consumer-centric, with a focus on empowering individuals to make informed healthcare decisions. Insurance providers are adopting user-friendly interfaces, mobile apps, and online platforms to simplify policy management, claim submissions, and benefit access. By putting consumers at the center, private health insurance companies aim to enhance the overall customer experience and engagement.

Conclusion

Obtaining private health insurance quotes is a critical step towards securing comprehensive healthcare coverage that meets your unique needs. By understanding the factors influencing quotes, navigating the quote process effectively, and considering key aspects such as coverage limits, out-of-pocket expenses, and additional benefits, you can make informed decisions about your healthcare protection. The future of private health insurance is promising, with innovative trends and technologies shaping a more efficient, personalized, and accessible healthcare landscape.

How do I know if a private health insurance quote is accurate and reliable?

+

Accurate and reliable quotes depend on the information provided during the quote process. Ensure you provide accurate details about your age, health status, and coverage needs. Additionally, compare quotes from multiple providers to gain a comprehensive understanding of the market. Look for reputable insurance companies with strong financial ratings and positive customer reviews.

Can I customize my private health insurance plan to suit my specific needs?

+

Yes, many private health insurance providers offer customizable plans that allow you to tailor the coverage to your specific needs. You can choose the level of coverage, add optional benefits, and select the network of healthcare providers that best suits your preferences. Customization ensures you have a plan that aligns with your healthcare requirements and budget.

What happens if I need to make a claim under my private health insurance policy?

+

Making a claim under your private health insurance policy involves following the specified claim process outlined by your insurance provider. Typically, you will need to provide documentation such as medical bills, prescriptions, or treatment records to support your claim. The insurance company will then review the claim and, if approved, reimburse you for the covered expenses.

Are there any tax benefits associated with private health insurance?

+

Tax benefits for private health insurance vary by region and country. In some jurisdictions, you may be eligible for tax deductions or credits for certain types of private health insurance plans. It’s essential to consult with a tax professional or review the applicable tax regulations in your area to understand the potential tax advantages associated with your private health insurance coverage.