Rating Homeowners Insurance

Homeowners insurance is an essential aspect of protecting one's most valuable asset, their home. It provides financial security and peace of mind, covering a range of potential risks and liabilities. Rating homeowners insurance is a critical process that helps policyholders understand the value and coverage of their policies. In this comprehensive guide, we will delve into the world of homeowners insurance ratings, exploring the factors that influence them, the rating process, and how to navigate this often complex yet crucial system.

Understanding Homeowners Insurance Ratings

Homeowners insurance ratings are a tool used by insurance companies to assess the level of risk associated with insuring a particular property. These ratings are based on a combination of factors, each playing a role in determining the overall risk profile and, consequently, the insurance premium. Understanding these ratings is key to making informed decisions about your insurance coverage.

Factors Influencing Homeowners Insurance Ratings

A multitude of factors contribute to the rating of homeowners insurance policies. These factors can be broadly categorized into three main groups: the property itself, the location, and the policyholder’s personal characteristics.

Property-Related Factors

The condition and characteristics of the home itself are significant determinants of insurance ratings. Age of the Property: Older homes may require more extensive coverage due to potential aging issues like roof damage or plumbing problems. Construction Materials: Homes built with fire-resistant materials or reinforced against natural disasters might receive more favorable ratings. Square Footage and Design: Larger homes or those with complex architectural designs can present unique risks and may influence insurance costs.

| Property Factor | Rating Impact |

|---|---|

| Age of the Property | Increased risk for older homes |

| Construction Materials | Resilient materials may lower risk |

| Square Footage and Design | Complex designs can increase costs |

Location-Based Factors

The geographical location of a home plays a significant role in insurance ratings. Natural Disaster Risk: Areas prone to hurricanes, earthquakes, or floods often carry higher insurance costs. Crime Rates: Regions with higher crime rates may see increased insurance premiums to cover potential theft or vandalism risks. Proximity to Fire Stations: Homes farther from fire stations might face higher premiums due to potential response delays.

Policyholder Factors

The personal characteristics and history of the policyholder also impact insurance ratings. Credit Score: In many states, insurance companies consider credit scores when determining premiums, with higher scores often resulting in lower rates. Claims History: A history of frequent claims can lead to increased premiums or even policy cancellations. Occupation: Certain high-risk occupations might be associated with increased liability risks.

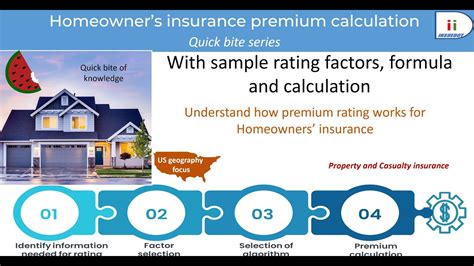

The Rating Process: A Step-by-Step Guide

The process of rating homeowners insurance is a comprehensive evaluation that considers all the aforementioned factors. Insurance companies employ sophisticated algorithms and risk assessment models to calculate ratings and, subsequently, insurance premiums.

- Property Inspection: Before issuing a policy, many insurance companies conduct a thorough inspection of the property. This involves assessing the home's condition, identifying potential risks, and determining the appropriate coverage levels.

- Risk Assessment: Based on the property inspection and other relevant data, insurance companies assign a risk score to the property. This score takes into account the property's location, construction, and the policyholder's personal factors.

- Coverage Determination: With the risk assessment complete, insurance companies can tailor the policy to the specific needs of the property. This includes selecting the appropriate coverage limits and deductibles.

- Premium Calculation: Finally, the insurance company calculates the premium based on the assessed risk and the chosen coverage. This premium is what the policyholder will pay for the insurance coverage.

Tips for Navigating Homeowners Insurance Ratings

Understanding homeowners insurance ratings is one thing, but knowing how to navigate them effectively is another. Here are some tips to help you get the best value for your insurance coverage.

Improving Your Insurance Rating

While many factors that influence insurance ratings are beyond your control, there are steps you can take to potentially improve your rating and lower your insurance costs.

- Home Maintenance: Regularly maintaining your home can help reduce the risk of issues like roof leaks or plumbing failures. This, in turn, can lead to more favorable insurance ratings.

- Improve Security: Investing in home security systems or making your home more resistant to break-ins can lower the risk of theft or vandalism, potentially reducing your insurance premiums.

- Bundle Policies: Many insurance companies offer discounts when you bundle multiple policies, such as homeowners and auto insurance, with them. This can be an effective way to save on insurance costs.

Shopping Around for the Best Rates

Don’t settle for the first insurance quote you receive. It’s important to shop around and compare rates from multiple insurance companies. This ensures you’re getting the best value for your insurance coverage.

- Compare Quotes: Obtain quotes from at least three different insurance companies. Compare not only the premiums but also the coverage limits and deductibles to ensure you're getting the right balance of cost and coverage.

- Use Insurance Comparison Websites: These websites can provide a quick and easy way to compare insurance rates and coverage from multiple providers. However, be sure to read reviews and understand the reputation of the insurance companies before making a decision.

- Understand Your Coverage Needs: Before shopping for insurance, understand your specific coverage needs. This will help you evaluate quotes more effectively and ensure you're not overpaying for coverage you don't require.

Understanding Policy Exclusions and Deductibles

Homeowners insurance policies often come with exclusions and deductibles, which can significantly impact your coverage and out-of-pocket costs. It’s crucial to understand these aspects of your policy.

Exclusions refer to the specific events or damages that are not covered by your insurance policy. These can vary widely between policies and insurance companies. Common exclusions include damage caused by floods, earthquakes, or poor home maintenance. Understanding these exclusions can help you make informed decisions about additional coverage you may need.

Deductibles are the amount you agree to pay out of pocket before your insurance coverage kicks in. For instance, if your policy has a $1,000 deductible and you suffer $5,000 in damage, you'll pay the first $1,000, and your insurance company will cover the remaining $4,000. Higher deductibles often result in lower premiums, so it's a trade-off to consider carefully.

The Future of Homeowners Insurance Ratings

The world of homeowners insurance is continually evolving, with advancements in technology and changing consumer needs. As we move forward, several trends and developments are shaping the future of homeowners insurance ratings.

Advancements in Risk Assessment Technology

Insurance companies are leveraging advanced technologies to improve the accuracy and efficiency of risk assessment. This includes the use of artificial intelligence (AI) and machine learning algorithms to analyze vast amounts of data, including satellite imagery and weather patterns, to better predict and assess risk.

Personalized Insurance Policies

The concept of one-size-fits-all insurance policies is gradually shifting. Insurance companies are moving towards offering more personalized policies that cater to the unique needs and circumstances of individual policyholders. This could involve tailoring coverage limits, deductibles, and even premium structures based on an individual’s risk profile and preferences.

The Impact of Climate Change

Climate change is an increasingly significant factor in homeowners insurance ratings. As extreme weather events become more frequent and severe, insurance companies are adjusting their risk assessments and coverage offerings. This could mean higher premiums in high-risk areas or the introduction of specialized coverage for climate-related risks.

Conclusion: Empowering Homeowners with Knowledge

Rating homeowners insurance is a complex process, but with the right knowledge and tools, policyholders can navigate this landscape with confidence. By understanding the factors that influence insurance ratings and the rating process itself, homeowners can make informed decisions about their coverage and potentially save on insurance costs. As the industry continues to evolve, staying informed about the latest trends and developments will be key to ensuring you have the right coverage for your needs.

How often should I review my homeowners insurance policy and ratings?

+It’s a good practice to review your homeowners insurance policy and ratings annually. This allows you to ensure your coverage is up-to-date and reflects any changes in your home or personal circumstances. Additionally, reviewing your policy annually provides an opportunity to shop around for better rates or negotiate with your current insurer for a more competitive premium.

Can I negotiate my homeowners insurance premium?

+Yes, you can negotiate your homeowners insurance premium. Insurance companies understand that policyholders are often looking for the best value, and they may be open to discussions about premium adjustments. You can negotiate by providing additional information that might lower your risk profile, such as recent home improvements or a spotless claims history. It’s also worth inquiring about discounts for bundling policies or for being a long-term customer.

What are some common mistakes to avoid when shopping for homeowners insurance?

+When shopping for homeowners insurance, it’s important to avoid rushing into a decision. Take the time to compare multiple quotes and understand the coverage and exclusions in each policy. Avoid the temptation to choose the cheapest option without considering the coverage limits and potential gaps in protection. Additionally, be cautious of insurance companies that offer extremely low rates without providing clear explanations of their coverage and claims process.