Cheap Driving Insurance

Finding affordable car insurance can be a daunting task, especially with the multitude of options and factors to consider. The cost of driving insurance can vary significantly depending on various personal circumstances and the coverage you require. In this comprehensive guide, we will delve into the world of cheap driving insurance, exploring strategies, industry insights, and real-world examples to help you secure the best value for your money.

Understanding the Factors Affecting Insurance Costs

The price of car insurance is influenced by a range of variables, each playing a unique role in determining the overall cost. Let’s break down these factors to gain a clearer understanding:

Demographics and Location

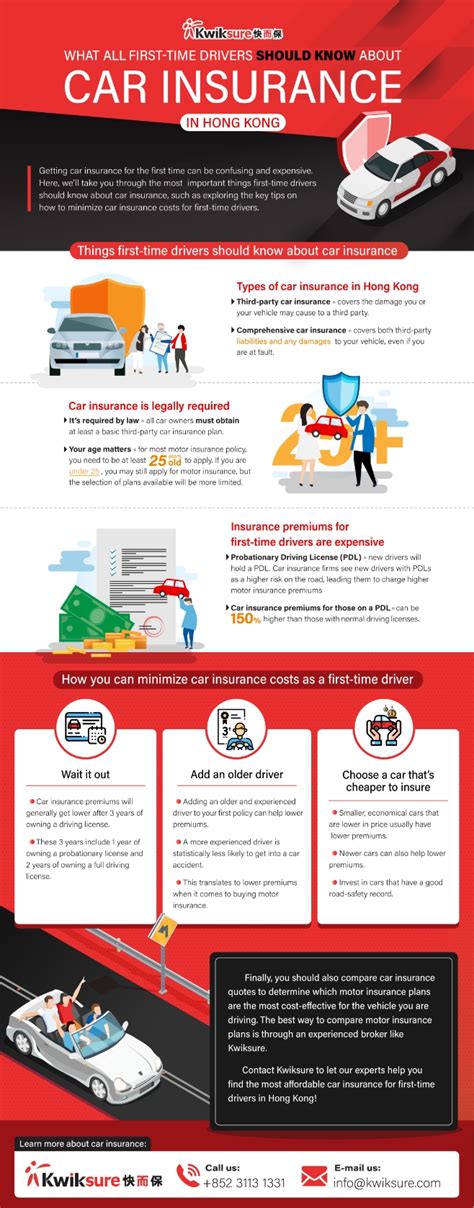

Your age, gender, and the area where you reside are significant determinants of your insurance premium. Statistics show that younger drivers, particularly males, tend to be involved in more accidents, leading to higher insurance rates. Additionally, the crime rate and accident frequency in your locality can impact the overall cost.

Driving Record

A clean driving record is a key factor in keeping insurance costs down. If you have a history of accidents or traffic violations, insurance companies may view you as a higher risk, resulting in increased premiums. Maintaining a safe and responsible driving behavior is crucial for affordable coverage.

Vehicle Type and Usage

The make, model, and age of your vehicle can greatly influence your insurance rates. Sports cars and luxury vehicles, for instance, often attract higher premiums due to their increased repair costs. Furthermore, the purpose of your vehicle usage, such as for personal or commercial use, can also affect your insurance costs.

Coverage and Deductibles

The level of coverage you choose will directly impact your insurance costs. Comprehensive and collision coverage, while offering more protection, can be more expensive. Adjusting your deductibles can be a strategic way to lower your premiums. A higher deductible means you pay more out-of-pocket in the event of a claim, but it can significantly reduce your monthly insurance payments.

Discounts and Bundling

Insurance companies often provide discounts for various reasons. These can include safe driving records, multiple policy bundles (such as combining car and home insurance), and even certain professional affiliations. Exploring these discounts can lead to substantial savings on your insurance premiums.

Strategies for Finding Affordable Insurance

Now that we’ve understood the key factors, let’s explore some effective strategies to secure cheap driving insurance:

Shop Around and Compare

One of the most effective ways to find affordable insurance is by comparing quotes from multiple providers. Each insurance company uses its own formula to calculate premiums, so rates can vary significantly. Online comparison tools can be a great starting point, allowing you to quickly assess various options and find the best deals.

Understand Your Coverage Needs

Assessing your specific coverage needs is crucial. While it’s tempting to opt for the cheapest option, ensure you have the necessary coverage to protect yourself and your vehicle. Consider your vehicle’s value, your financial situation, and any legal requirements in your state when determining the right level of coverage.

Improve Your Driving Record

A safe driving record is a powerful tool in reducing insurance costs. Avoid traffic violations and accidents to maintain a positive record. Some insurance companies offer discounts for defensive driving courses, so consider taking one to improve your skills and potentially lower your premiums.

Consider Telematics Insurance

Telematics insurance, also known as usage-based insurance, uses a device or smartphone app to monitor your driving behavior. It considers factors like mileage, driving speed, and braking habits to determine your premium. If you are a safe and cautious driver, telematics insurance can offer significant savings.

Explore Payment Options

Some insurance companies offer discounts for paying your premium in full or for using automated payment methods. Additionally, consider the impact of payment frequency. While monthly payments might be more convenient, they can incur additional fees, so explore annual or semi-annual payment options to potentially save money.

Build a Relationship with Your Insurer

Establishing a long-term relationship with your insurance provider can lead to loyalty discounts and better rates over time. Insurers often offer discounts for customers who have been with them for several years. Additionally, consider bundling multiple policies with the same insurer to take advantage of multi-policy discounts.

Case Study: John’s Journey to Affordable Insurance

Let’s illustrate these strategies with a real-world example. John, a 28-year-old male living in a suburban area, was looking to reduce his insurance costs. Here’s how he went about it:

- Comparison Shopping: John started by using online comparison tools to assess quotes from various insurers. He found that rates varied significantly, with some companies offering much lower premiums for his specific circumstances.

- Bundling Policies: John already had home insurance with a reputable company. By bundling his car and home insurance together, he was able to secure a substantial multi-policy discount, reducing his overall insurance costs.

- Telematics Insurance: After researching, John decided to try telematics insurance. By driving safely and responsibly, he was able to lower his premiums significantly over the course of a year.

- Safe Driving: John made a conscious effort to maintain a safe driving record. He avoided speeding tickets and accidents, which not only kept his insurance rates low but also improved his overall safety on the road.

- Exploring Payment Options: John opted to pay his premium annually, which reduced his overall costs by eliminating additional fees associated with monthly payments.

By implementing these strategies, John was able to save a significant amount on his driving insurance, demonstrating the effectiveness of a comprehensive approach to finding affordable coverage.

The Future of Affordable Driving Insurance

The insurance industry is continuously evolving, with technological advancements and changing consumer trends shaping the future of car insurance. Here’s a glimpse into what we can expect:

Increased Use of Telematics

Telematics insurance is expected to become more prevalent, with insurers relying on real-time driving data to assess risk and set premiums. This shift could lead to more personalized insurance plans, rewarding safe drivers with lower rates.

Focus on Prevention

Insurance companies are increasingly investing in technologies and programs that promote safe driving and accident prevention. This includes offering incentives for using advanced driver-assistance systems and providing resources for defensive driving education.

Blockchain and Smart Contracts

The integration of blockchain technology and smart contracts could revolutionize the insurance industry. These innovations could streamline claims processes, reduce fraud, and provide greater transparency, potentially leading to lower insurance costs for consumers.

AI and Data Analytics

Artificial intelligence and advanced data analytics will continue to play a significant role in insurance. By analyzing vast amounts of data, insurers can more accurately assess risk and offer personalized coverage options, ultimately benefiting consumers with more affordable and tailored insurance plans.

| Factor | Impact on Insurance Costs |

|---|---|

| Demographics and Location | Higher rates for younger drivers and areas with high crime/accident rates |

| Driving Record | Clean records lead to lower premiums; violations and accidents increase costs |

| Vehicle Type and Usage | Sports cars and luxury vehicles often attract higher premiums; personal vs. commercial usage impacts costs |

| Coverage and Deductibles | Higher coverage and lower deductibles result in higher premiums |

| Discounts and Bundling | Safe driving discounts, multi-policy bundles, and professional affiliations can reduce costs |

Frequently Asked Questions

How do I know if I’m getting a good insurance deal?

+

A good insurance deal offers a balance between affordable premiums and adequate coverage. Compare quotes from multiple providers, assess your specific coverage needs, and ensure you understand the terms and conditions of the policy.

Can I get cheap insurance if I have a poor driving record?

+

While a poor driving record can lead to higher premiums, it’s not impossible to find affordable insurance. Shop around, consider high-risk insurance providers, and explore options like usage-based insurance or taking defensive driving courses to improve your record.

What are some common discounts I should look for when shopping for insurance?

+

Common discounts include safe driver discounts, multi-policy bundles, loyalty discounts for long-term customers, and discounts for certain professions or affiliations. Some insurers also offer discounts for students with good grades or for vehicles equipped with advanced safety features.

Is it worth paying for comprehensive and collision coverage?

+

Comprehensive and collision coverage provide protection for situations like theft, vandalism, and accidents. While they can be more expensive, they offer valuable peace of mind and financial protection. Assess your vehicle’s value and your financial situation to determine if the added coverage is worth the cost.