Emergency Insurance Health

In a world where unexpected health emergencies can strike at any moment, having adequate insurance coverage is not just a wise decision but a necessary one. This comprehensive guide aims to shed light on the significance of emergency health insurance, exploring its various facets and providing invaluable insights for individuals seeking peace of mind and financial protection during medical crises.

Understanding Emergency Health Insurance

Emergency health insurance is a specialized form of coverage designed to address the unique challenges and costs associated with sudden and unexpected medical situations. Unlike traditional health insurance plans, which often focus on routine care and preventive measures, emergency insurance steps in when time is of the essence and medical expenses can quickly escalate.

Considered a vital component of a robust financial safety net, emergency health insurance offers a range of benefits tailored to meet the urgent needs of policyholders. These benefits can include coverage for emergency room visits, ambulance services, critical illness treatments, and even overseas medical evacuations in extreme cases.

The Need for Emergency Coverage

The necessity of emergency health insurance becomes apparent when we delve into real-world scenarios. Take, for instance, the story of John, a young professional who sustained severe injuries in a car accident. Without emergency insurance, John faced not only the physical trauma but also the daunting prospect of covering substantial medical bills, including ambulance transportation, emergency surgeries, and extended hospital stays.

Similarly, imagine a family's ordeal when a child suddenly falls ill with a rare and life-threatening condition. In such situations, the emotional toll is compounded by the financial strain of specialized treatments, medications, and potential travel expenses for accessing advanced medical facilities.

These narratives highlight the stark reality: medical emergencies can happen to anyone, regardless of age, health status, or socioeconomic background. The absence of adequate emergency insurance coverage can lead to significant financial burdens, often forcing individuals and families to make difficult choices between their health and their financial well-being.

Key Features and Benefits

Emergency health insurance policies typically offer a comprehensive suite of features and benefits, ensuring that policyholders receive the necessary support during times of crisis. Here are some of the critical aspects to consider:

Prompt Coverage for Emergency Situations

One of the cornerstone benefits of emergency health insurance is its ability to provide immediate coverage when seconds can make a difference. Policyholders can access emergency medical services without the hassle of prior approval, allowing for swift action during critical moments.

Ambulance and Emergency Transportation

In emergency situations, the swiftness and safety of transportation to medical facilities are paramount. Emergency insurance often covers the cost of ambulance services, ensuring that individuals receive the necessary care without incurring additional financial stress.

Hospitalization and Intensive Care

Once admitted to a hospital, the costs associated with intensive care, specialized procedures, and extended stays can quickly accumulate. Emergency insurance plans typically include coverage for these expenses, providing a vital safety net for policyholders and their families.

Critical Illness and Surgery

Some emergency health insurance policies extend their coverage to include specific critical illnesses and surgeries. This ensures that individuals receive financial support for the treatment of life-threatening conditions, giving them one less worry during their recovery journey.

Overseas Medical Evacuation

For those who frequently travel abroad or reside in remote areas, emergency insurance policies may include provisions for overseas medical evacuation. This benefit can be a lifesaver, ensuring access to advanced medical facilities and specialized care when local options are limited.

Flexible Payment Options

To cater to a diverse range of financial circumstances, emergency health insurance providers often offer flexible payment plans. This flexibility allows policyholders to choose a premium structure that aligns with their budget, ensuring accessibility for all.

| Emergency Health Insurance Benefits | Description |

|---|---|

| Immediate Coverage | Swift activation of benefits without prior approval. |

| Ambulance Services | Coverage for emergency transportation to medical facilities. |

| Hospitalization | Financial support for hospital stays and intensive care. |

| Critical Illness | Coverage for specific life-threatening conditions. |

| Overseas Evacuation | Assistance for medical emergencies while traveling abroad. |

Choosing the Right Emergency Health Insurance

When navigating the complex landscape of emergency health insurance, several key considerations come into play. Here are some factors to keep in mind as you embark on your search for the ideal policy:

Coverage Limits and Deductibles

Understanding the coverage limits and deductibles of an emergency insurance plan is essential. While higher coverage limits offer more extensive protection, they often come with higher premiums. Evaluate your financial capacity and the likelihood of facing significant medical expenses to strike a balance between coverage and affordability.

Network of Healthcare Providers

Emergency insurance plans typically have networks of preferred healthcare providers. Ensure that the plan’s network includes reputable hospitals, clinics, and specialists in your area. This ensures that you have access to quality medical care without incurring additional out-of-network expenses.

Pre-existing Condition Coverage

If you have pre-existing medical conditions, it’s crucial to choose a plan that provides coverage for these conditions. While some emergency insurance policies may exclude pre-existing conditions, others offer specialized coverage. Disclose your medical history honestly to ensure you receive the appropriate coverage.

Renewability and Lifetime Limits

Consider the renewability terms of the policy. Some plans may have age limits or specific conditions for renewal, while others offer lifetime coverage. Additionally, be mindful of any lifetime maximum benefit limits, as exceeding these limits could leave you financially vulnerable in the future.

Additional Benefits and Riders

Emergency health insurance policies often come with optional riders or additional benefits. These can include coverage for dental emergencies, mental health services, or alternative therapies. Assess your personal needs and preferences to determine which optional benefits align with your health priorities.

Reputation and Customer Service

Research the reputation of the insurance provider and their track record in handling emergency claims. A reliable provider should have a strong customer service team, offering prompt assistance and guidance throughout the claims process. Read reviews and seek recommendations to make an informed decision.

The Impact of Emergency Insurance on Financial Security

The value of emergency health insurance extends far beyond the immediate medical crisis. By providing a financial safety net, emergency insurance policies contribute significantly to an individual’s long-term financial stability and peace of mind. Here’s how:

Reduced Financial Strain

The primary benefit of emergency insurance is the reduction of financial burden during medical emergencies. By covering a significant portion of the costs associated with emergency care, policyholders can focus on their recovery without worrying about mounting bills.

Prevention of Medical Debt

Without emergency insurance, unexpected medical expenses can lead to substantial debt. This debt can have a lasting impact on an individual’s credit score and overall financial health. Emergency insurance acts as a preventive measure, ensuring that medical emergencies do not derail one’s financial future.

Preservation of Savings

For many individuals, emergency funds and savings are vital for financial stability. Emergency health insurance helps preserve these savings by providing an alternative source of funding for medical expenses. This ensures that individuals can maintain their emergency reserves for other unforeseen circumstances.

Peace of Mind for Families

The emotional and financial stress of a medical emergency can be overwhelming for families. Emergency insurance provides a sense of security, knowing that the financial aspect of the crisis is covered. This peace of mind allows families to focus on providing support and care during challenging times.

Real-Life Success Stories

The impact of emergency health insurance is best illustrated through the stories of those who have benefited from it. Here are a few real-life accounts showcasing the life-changing impact of this vital coverage:

Case Study: Sarah’s Story

Sarah, a young mother, experienced a severe allergic reaction that required immediate hospitalization. Without emergency insurance, the cost of her treatment and medication would have been a significant financial burden. However, with her emergency health insurance plan, Sarah received the necessary care without financial strain, allowing her to focus on her recovery and her family.

Case Study: David’s Journey

David, an adventurous traveler, faced a medical emergency while hiking in a remote area. His emergency health insurance policy covered the cost of airlifting him to the nearest hospital and provided him with the specialized care he needed. Without this coverage, David’s journey could have taken a tragic turn, leaving him with overwhelming medical bills.

Case Study: The Smith Family

When the Smith family’s youngest child was diagnosed with a rare genetic disorder, the emotional toll was immense. However, their emergency health insurance policy provided coverage for the specialized treatments and therapies their child required. This financial support allowed the family to dedicate their time and energy to their child’s care without the added stress of managing medical expenses.

The Future of Emergency Health Insurance

As medical technologies advance and healthcare systems evolve, emergency health insurance is poised to play an even more critical role in safeguarding individuals and communities. Here’s a glimpse into the potential future developments:

Integration with Telehealth Services

With the increasing popularity of telehealth services, emergency health insurance may integrate these digital healthcare solutions into their coverage. This integration could provide policyholders with remote access to medical advice and emergency consultations, enhancing the efficiency and convenience of care.

Advanced Risk Assessment and Prevention

As data analytics and artificial intelligence continue to advance, emergency health insurance providers may leverage these technologies to assess and mitigate risks more effectively. By analyzing individual health data, insurers could offer personalized coverage and preventive measures, reducing the likelihood of emergencies and their associated costs.

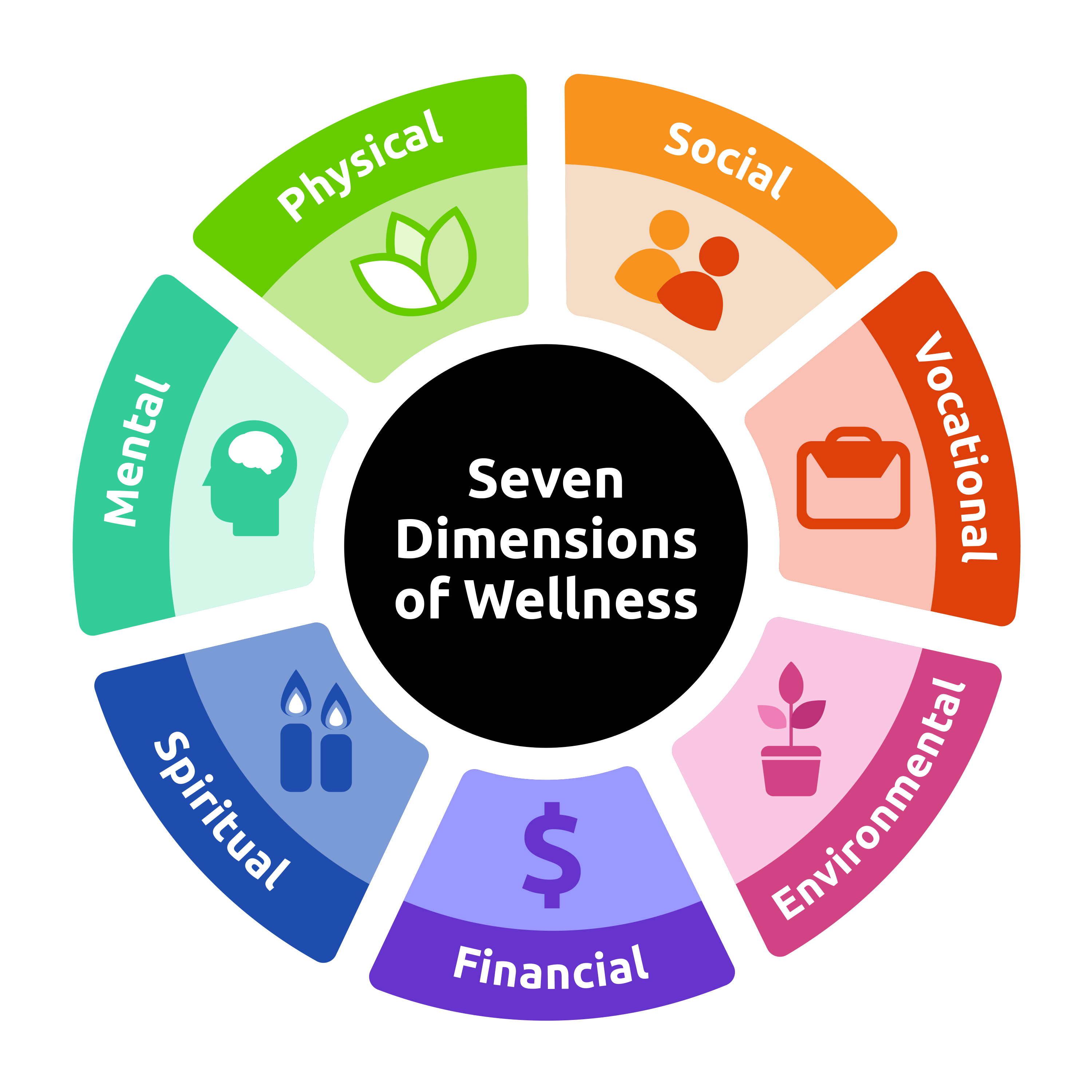

Focus on Wellness and Prevention

In the future, emergency health insurance may place a stronger emphasis on wellness and preventive care. This shift could involve incentives for policyholders to adopt healthy lifestyles and engage in regular preventive check-ups, ultimately reducing the incidence of medical emergencies and improving overall health outcomes.

Conclusion: Empowering Individuals for a Healthier Future

Emergency health insurance stands as a beacon of financial security and peace of mind in an uncertain world. By understanding the value and intricacies of this specialized coverage, individuals can make informed decisions to protect themselves and their loved ones during times of medical crisis. As we navigate the complexities of modern healthcare, emergency health insurance remains a crucial tool for empowering individuals to face the future with resilience and confidence.

How does emergency health insurance differ from traditional health insurance plans?

+Emergency health insurance is designed to address sudden and unexpected medical situations, offering immediate coverage and benefits tailored to urgent needs. In contrast, traditional health insurance plans typically focus on routine care, preventive measures, and long-term medical management.

What are some common exclusions in emergency health insurance policies?

+Common exclusions may include pre-existing conditions, elective procedures, cosmetic surgeries, and certain mental health disorders. It’s important to review the policy documents carefully to understand the specific exclusions applicable to your plan.

Can emergency health insurance be combined with other types of insurance coverage?

+Yes, emergency health insurance can be a valuable addition to other types of insurance, such as life insurance, disability insurance, or critical illness insurance. Combining these policies can provide a comprehensive financial safety net, ensuring that individuals and their families are protected from various potential risks.