Housing Insurance Quote

Unveiling the Costs: Your Guide to Housing Insurance Quotes

Securing your home with the right insurance coverage is a vital step in safeguarding your investment and peace of mind. However, navigating the world of housing insurance quotes can be complex, with various factors influencing the final cost. This comprehensive guide aims to demystify the process, shedding light on the essential aspects that contribute to your housing insurance quote.

Whether you're a homeowner seeking comprehensive protection or a renter wanting to cover your belongings, understanding the intricacies of housing insurance is crucial. From the fundamental principles to the fine details, we'll explore the factors that insurance providers consider when determining your quote. By the end of this article, you'll have a clearer picture of what impacts your insurance costs and how to make informed decisions about your coverage.

The Fundamentals of Housing Insurance

Housing insurance, often referred to as home insurance, is a vital financial safety net designed to protect homeowners and renters from unexpected events that can cause damage or loss. These events could range from natural disasters like hurricanes and floods to unforeseen incidents such as fire or burglary. Understanding the basics of housing insurance is the first step toward securing your home effectively.

Types of Housing Insurance Policies

The world of housing insurance offers a variety of policy types, each tailored to meet specific needs. For homeowners, Homeowners Insurance is the most common choice, providing coverage for the structure of the home, personal belongings, and liability protection. On the other hand, Renters Insurance is ideal for tenants, focusing on their personal property and offering liability coverage, excluding the structure itself.

Additionally, there are specialized policies like Landlord Insurance, which covers the building structure and provides liability protection for the owner, and Condo Insurance, a hybrid policy that covers the interior of a condo unit while the condo association's master policy covers the exterior and common areas.

Coverage Options and Limitations

Housing insurance policies offer a range of coverage options, allowing policyholders to tailor their protection based on their needs and budget. These options typically include:

- Dwelling Coverage: Protects the physical structure of your home, including walls, roofs, and permanent fixtures.

- Personal Property Coverage: Covers the loss or damage of personal belongings like furniture, electronics, and clothing.

- Liability Coverage: Provides financial protection if someone is injured on your property or if you are found legally responsible for causing property damage or bodily injury to others.

- Additional Living Expenses: Covers the costs of temporary housing and other necessary expenses if your home becomes uninhabitable due to a covered event.

- Medical Payments: Covers the medical expenses of visitors who are injured on your property, regardless of liability.

However, it's important to note that housing insurance policies typically have limitations and exclusions. For instance, most standard policies do not cover damage caused by earthquakes, floods, or poor maintenance. Understanding these limitations is crucial to ensure you have adequate coverage for your specific risks.

Factors Influencing Housing Insurance Quotes

The cost of your housing insurance quote is influenced by a myriad of factors, each playing a role in determining the level of risk associated with insuring your home. Insurance providers carefully assess these factors to arrive at a quote that reflects the likelihood and potential cost of claims. Here's an in-depth look at the key factors that impact your housing insurance quote.

Location and Geographical Risks

Your home's location is a significant factor in determining your insurance quote. Insurance providers consider the geographical risks associated with your area, such as the likelihood of natural disasters like hurricanes, tornadoes, or earthquakes. Regions prone to these events often have higher insurance premiums to account for the increased risk of claims.

For instance, coastal areas are at a higher risk of hurricanes and flooding, leading to higher insurance costs. Similarly, regions with a history of wildfires or severe weather conditions may also face higher insurance rates. It's important to be aware of the natural risks in your area and how they can impact your insurance costs.

Home Value and Replacement Cost

The value of your home, along with the cost to rebuild or replace it, is a crucial factor in determining your insurance quote. Insurance providers assess the replacement cost, which is the amount it would take to rebuild your home from the ground up using similar materials and construction techniques. This cost is often higher than the market value of your home, as it doesn't account for factors like the age of the home or any depreciation.

For example, if your home is located in an area with a high cost of living and construction, the replacement cost will be higher, leading to a higher insurance premium. It's important to ensure that your home is adequately insured, as underinsurance can leave you vulnerable in the event of a claim.

Home Age and Construction

The age and construction of your home can also impact your insurance quote. Older homes may have outdated wiring, plumbing, or roofing, which can increase the risk of issues like electrical fires or water damage. Similarly, homes with unique or specialized construction materials may require additional coverage or have higher replacement costs.

For instance, homes with slate roofs, while durable, can be more expensive to repair or replace than homes with asphalt shingles. Additionally, older homes may require additional coverage for issues like mold or structural damage that can arise over time.

Claim History and Credit Score

Your insurance claim history and credit score are two personal factors that can influence your insurance quote. Insurance providers consider your claim history to assess your risk profile. A history of frequent claims, even for minor incidents, can indicate a higher likelihood of future claims and may lead to increased premiums.

Additionally, your credit score can play a role in determining your insurance costs. Studies have shown a correlation between credit scores and the likelihood of filing insurance claims. As a result, insurance providers may use credit-based insurance scores to assess your risk, with lower credit scores often resulting in higher insurance premiums.

Comparing Quotes and Making Informed Decisions

When it comes to housing insurance, comparing quotes from multiple providers is essential to ensure you're getting the best coverage at the most competitive price. While the factors mentioned above play a significant role in determining your insurance quote, the final cost can vary significantly between providers.

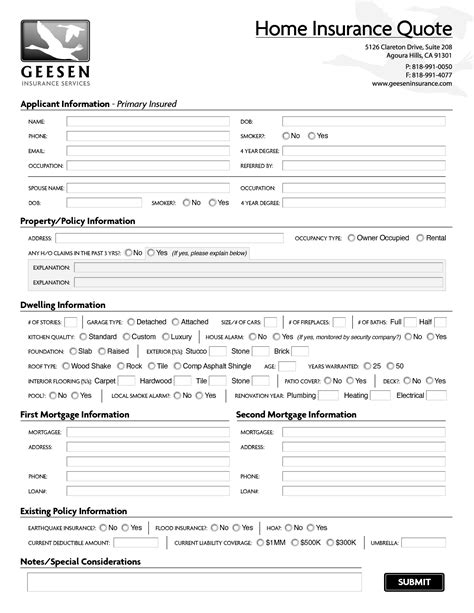

Obtaining Multiple Quotes

The first step in comparing quotes is to obtain multiple estimates from different insurance providers. This process can be done online through insurance comparison websites or by directly contacting insurance agents or brokers. By gathering several quotes, you can gain a better understanding of the range of prices and coverage options available in the market.

Understanding Policy Details

When comparing quotes, it's crucial to look beyond the price and delve into the policy details. Different providers may offer varying levels of coverage for similar prices. Make sure to compare the limits and deductibles of each policy, as well as the specific exclusions and endorsements. Understanding these details will help you choose a policy that provides the right balance of coverage and cost for your needs.

Bundling Policies for Discounts

Another strategy to consider when comparing quotes is bundling your insurance policies. Many insurance providers offer discounts when you purchase multiple policies, such as housing insurance and auto insurance, from the same company. This can be a cost-effective way to secure comprehensive coverage for your home and vehicles. However, it's important to ensure that the bundled policies meet your specific needs and provide adequate coverage.

Reviewing Your Policy Annually

Housing insurance is not a one-time purchase; it's an ongoing commitment. It's essential to review your policy annually to ensure that your coverage remains up-to-date and aligned with your changing needs. Life events like renovations, additions to your home, or changes in personal belongings can impact your insurance requirements. Regularly reviewing your policy allows you to make necessary adjustments and maintain adequate coverage.

The Future of Housing Insurance

As technology advances and our understanding of risk evolves, the housing insurance industry is also undergoing transformations. These changes are aimed at enhancing the accuracy of risk assessment, improving customer experience, and offering more tailored coverage options.

Data-Driven Risk Assessment

Insurance providers are increasingly leveraging data analytics and advanced technologies to refine their risk assessment processes. By analyzing vast datasets and employing predictive modeling, insurers can more accurately identify and assess risks associated with specific properties. This data-driven approach allows for more precise pricing and coverage, benefiting both insurers and policyholders.

Personalized Coverage Options

The traditional one-size-fits-all approach to housing insurance is giving way to more personalized coverage options. Insurance providers are now offering customized policies that take into account individual circumstances and needs. From tailored deductibles and coverage limits to specialized endorsements, policyholders can select the coverage that best suits their specific risks and preferences.

Digital Transformation

The digital revolution is transforming the way housing insurance is purchased and managed. Online platforms and mobile apps are making it easier for policyholders to compare quotes, purchase coverage, and manage their policies. Additionally, digital tools are enhancing the claims process, providing faster and more efficient resolution of claims through automated systems and streamlined documentation.

Sustainability and Resilience

The housing insurance industry is also increasingly focused on sustainability and resilience. As the impacts of climate change become more evident, insurers are developing strategies to address the growing risks associated with natural disasters. This includes investing in research and development to better understand and manage these risks, as well as offering incentives for policyholders to adopt sustainable practices and strengthen their homes against potential hazards.

What is the average cost of housing insurance?

+The average cost of housing insurance can vary widely depending on several factors, including location, home value, and coverage limits. On average, homeowners can expect to pay between 1,000 and 2,000 annually for basic coverage. However, this range can go significantly higher or lower depending on individual circumstances.

Can I reduce my housing insurance costs?

+Yes, there are several strategies to reduce your housing insurance costs. These include increasing your deductible, reviewing and adjusting your coverage limits, and taking advantage of discounts for safety features or policy bundling. Additionally, maintaining a good credit score and a clean claim history can also lead to lower premiums.

What happens if I don’t have housing insurance and my home is damaged?

+If you don’t have housing insurance and your home is damaged, you’ll likely have to pay for the repairs or replacement out of pocket. This can be financially devastating, especially if the damage is extensive. Housing insurance provides a crucial safety net to protect your investment and ensure you have the financial means to rebuild or repair your home.

How often should I review my housing insurance policy?

+It’s recommended to review your housing insurance policy annually. Life changes, such as home renovations, additions, or changes in personal belongings, can impact your insurance needs. Regular reviews allow you to ensure your coverage remains up-to-date and provides adequate protection for your current circumstances.

What should I do if I need to file a housing insurance claim?

+If you need to file a housing insurance claim, it’s important to act promptly. Contact your insurance provider as soon as possible to report the claim and initiate the process. Gather any necessary documentation, such as photos or videos of the damage, and be prepared to provide detailed information about the incident. Your insurance provider will guide you through the claims process and help you navigate any challenges that may arise.