Cheapest Homeowners Insurance Florida

When it comes to finding the cheapest homeowners insurance in Florida, you'll want to consider various factors that influence the cost of your policy. The Sunshine State is known for its unique climate and potential natural disasters, which can impact insurance rates. In this article, we'll delve into the specifics of what makes homeowners insurance in Florida different and explore strategies to secure the most affordable coverage for your home.

Understanding the Florida Insurance Market

Florida’s insurance landscape is distinct due to the state’s vulnerability to hurricanes and tropical storms. These natural phenomena often result in costly damages, leading to higher insurance premiums. Additionally, Florida’s insurance market is highly regulated, with specific laws and guidelines that affect coverage options and costs.

One key factor is the Hurricane Deductible, a unique feature of Florida insurance policies. This deductible applies only to damage caused by hurricanes and can be a significant percentage of your home's insured value. Understanding and comparing hurricane deductibles is crucial when seeking the cheapest rates.

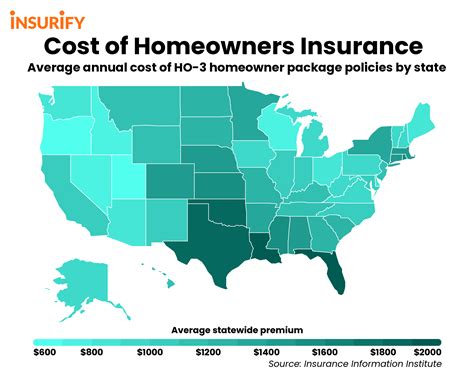

Average Costs and Regional Differences

The average cost of homeowners insurance in Florida varies greatly depending on your location. Coastal regions, especially those prone to hurricanes, typically have higher premiums. For instance, in 2022, the average annual premium for a 300,000 home in Miami-Dade County was approximately <strong>5,500, while in more inland areas like Orlando, it was around $2,000 for the same coverage.

| County | Average Annual Premium (2022) |

|---|---|

| Miami-Dade | $5,500 |

| Palm Beach | $4,800 |

| Broward | $4,600 |

| Orlando | $2,000 |

These regional variations highlight the impact of natural disaster risk on insurance costs. Inland areas, while not immune to storms, generally experience lower premiums due to reduced exposure to hurricanes.

Strategies to Find the Cheapest Homeowners Insurance

Securing the cheapest homeowners insurance in Florida requires a strategic approach. Here are some steps to help you find the most affordable coverage:

Shop Around and Compare

The Florida insurance market is competitive, with numerous insurers offering unique policies. By comparing quotes from at least three to five providers, you can identify the best rates for your needs. Online quote tools can be a convenient way to start this process.

Understand Your Coverage Needs

Determining the right level of coverage is crucial. Consider your home’s replacement cost, the value of your belongings, and any specific risks in your area. Overinsuring can lead to unnecessary expenses, while underinsuring may leave you vulnerable to financial losses. Work with an insurance professional to assess your needs accurately.

Explore Discounts and Savings

Many insurers offer discounts to encourage safer behaviors and reduce their risk exposure. Common discounts include:

- Multi-Policy Discounts: Bundling your homeowners and auto insurance policies with the same insurer can lead to significant savings.

- Safety Features: Installing security systems, fire alarms, and storm shutters may qualify you for discounts.

- Loyalty Rewards: Some insurers offer reduced rates for long-term customers.

- New Homeowner Discounts: If you're a first-time homeowner, certain insurers may provide introductory discounts.

Consider High Deductibles

Opting for a higher deductible can lower your insurance premiums. However, it’s essential to ensure you can afford the deductible in the event of a claim. Weigh the potential savings against your financial comfort level.

Review Your Policy Annually

Insurance rates and your personal circumstances can change over time. Review your policy annually to ensure you’re still getting the best deal. This practice also allows you to adjust your coverage as your needs evolve.

Factors Influencing Homeowners Insurance Costs in Florida

Several factors contribute to the cost of homeowners insurance in Florida. Understanding these factors can help you make informed decisions about your coverage.

Location and Natural Disasters

As mentioned earlier, your location plays a significant role in determining your insurance rates. Coastal areas and regions prone to hurricanes and storms typically have higher premiums. Consider the historical data of natural disasters in your area when evaluating coverage.

Home’s Age and Construction

Older homes may require more extensive coverage due to potential issues with outdated plumbing, electrical systems, or roofing. Newer homes, especially those built with hurricane-resistant features, often qualify for lower premiums.

Claim History

Your insurance claim history is a crucial factor. A clean claim record can lead to lower premiums, while multiple claims may result in higher rates or even policy non-renewal. Maintain a safe and secure home to minimize the need for claims.

Credit Score

In many cases, your credit score can impact your insurance rates. Insurers often use credit-based insurance scores to assess risk, with higher scores potentially leading to lower premiums.

The Future of Homeowners Insurance in Florida

The Florida insurance market is evolving, with insurers adapting to changing risk landscapes and consumer needs. Here’s a glimpse into the future of homeowners insurance in the state:

Increasing Use of Technology

Insurers are leveraging technology to offer more personalized and efficient services. This includes the use of digital platforms for quoting, claims management, and policy adjustments. Telematics and smart home devices may also play a role in risk assessment and premium determination.

Focus on Resilience and Prevention

With the increasing frequency and intensity of natural disasters, insurers are placing more emphasis on resilience and prevention. This shift may lead to incentives for homeowners to adopt hurricane-resistant features and improved building practices.

Collaborative Efforts for Disaster Resilience

Insurers, government agencies, and community organizations are working together to enhance disaster resilience. These efforts may include initiatives to strengthen building codes, improve emergency response, and educate homeowners on risk mitigation strategies.

Conclusion: Securing Affordable Coverage

Finding the cheapest homeowners insurance in Florida requires a comprehensive understanding of the unique insurance landscape in the state. By comparing quotes, understanding your coverage needs, and exploring discounts, you can secure the most affordable policy for your home. Remember, the key to saving money is a combination of knowledge, preparation, and regular review of your insurance options.

How can I lower my hurricane deductible in Florida?

+Lowering your hurricane deductible can be challenging, but you may qualify for a reduced deductible by installing hurricane-resistant features like impact-resistant windows and doors. Some insurers also offer incentives for homes built to modern hurricane standards.

What is the average increase in insurance rates after a hurricane claim?

+Insurance rates can increase significantly after a hurricane claim, with some insurers applying a surcharge or even non-renewing policies. The exact increase depends on various factors, including the severity of the claim and your insurance provider’s policies.

Are there any government programs to assist with homeowners insurance costs in Florida?

+Yes, Florida offers the Florida Homeowner’s Insurance Consumer Advocate Program, which provides resources and assistance to homeowners facing insurance challenges. The program can help with issues like claim disputes, policy cancellations, and more.