Homesite Insurance Progressive

In the ever-evolving landscape of the insurance industry, two prominent names that often come to the forefront are Homesite Insurance and Progressive. These companies have established themselves as key players in the market, offering a range of insurance solutions to meet the diverse needs of consumers. This article delves into the intricacies of these two entities, exploring their histories, product offerings, and the unique value propositions they bring to the table. By understanding the nuances of Homesite Insurance and Progressive, readers can make more informed decisions when it comes to safeguarding their assets and securing their financial future.

Homesite Insurance: A Comprehensive Provider

Homesite Insurance is a leading provider of property and casualty insurance, with a strong focus on delivering specialized coverage options. Founded in 1997, the company has since established a solid reputation for its expertise in the field of homeowners’ insurance. With a rich history spanning over two decades, Homesite has honed its skills in understanding the unique risks and challenges faced by homeowners, and has developed a range of tailored insurance solutions to address these concerns.

One of the key strengths of Homesite Insurance lies in its specialization. The company has carved out a niche for itself by offering renters' insurance, condo insurance, and landlord insurance, in addition to its comprehensive homeowners' insurance policies. This specialization allows Homesite to provide highly customized coverage, ensuring that its clients receive the exact protection they need, without paying for unnecessary add-ons.

Product Offerings and Benefits

Homesite Insurance’s product portfolio is extensive and tailored to meet the diverse needs of its clients. Here’s a glimpse into some of its key offerings:

- Homeowners' Insurance: Homesite offers customizable coverage for homeowners, including protection for the structure, personal belongings, and liability. They also provide options for additional coverage, such as identity theft protection and water backup.

- Renters' Insurance: Tailored specifically for tenants, this policy covers personal belongings, liability, and additional living expenses in case of a covered loss. It's an essential safeguard for those who rent their residences.

- Condo Insurance: Designed for condo owners, this policy covers the interior of the unit, personal belongings, and liability. It also includes coverage for improvements and upgrades made by the owner, providing peace of mind for those who own a piece of a larger property.

- Landlord Insurance: Homesite's landlord insurance policy protects the investment of property owners who rent out their homes. It covers the structure, loss of rental income, and liability, ensuring that landlords are protected against various risks associated with rental properties.

In addition to these core offerings, Homesite Insurance also provides coverage for mobile homes, secondary homes, and personal articles, such as jewelry or fine art. This breadth of coverage options allows Homesite to cater to a wide range of clients, ensuring that their insurance needs are met with precision and expertise.

| Coverage Type | Coverage Highlights |

|---|---|

| Homeowners' Insurance | Customizable coverage, including structure, belongings, and liability protection; optional add-ons like identity theft protection |

| Renters' Insurance | Covers personal belongings, liability, and additional living expenses; essential for tenants |

| Condo Insurance | Protects the interior, belongings, and liability for condo owners; includes coverage for improvements |

| Landlord Insurance | Covers the structure, loss of rental income, and liability for rental properties; safeguards the investment of landlords |

Progressive: Innovation and Digital Experience

Progressive, a name synonymous with innovation in the insurance industry, has revolutionized the way consumers interact with their insurance providers. Founded in 1937, Progressive has established itself as a pioneer, leveraging technology to enhance the customer experience and streamline the insurance process.

One of Progressive's standout features is its emphasis on digital transformation. The company has embraced a customer-centric approach, utilizing technology to create a seamless and intuitive user experience. From online quoting to policy management, Progressive has made it easier than ever for consumers to obtain and manage their insurance policies.

Product Offerings and Digital Innovations

Progressive offers a comprehensive range of insurance products, catering to various needs. Here’s an overview of their key offerings:

- Auto Insurance: Progressive's flagship product, auto insurance, provides coverage for a wide range of vehicles, including cars, motorcycles, and recreational vehicles. They offer customizable policies with various coverage options, ensuring clients can choose the protection that suits their needs.

- Homeowners' Insurance: Progressive's homeowners' insurance policies offer protection for the structure, personal belongings, and liability. They also provide additional coverage options, such as identity theft protection and water damage coverage.

- Renters' Insurance: Tailored for tenants, Progressive's renters' insurance covers personal belongings, liability, and additional living expenses. This policy is an essential safeguard for those who rent their homes.

- Commercial Insurance: Progressive's commercial insurance division offers coverage for small businesses, including general liability, property, and business auto insurance. They provide tailored solutions to meet the unique needs of businesses, ensuring they are protected against various risks.

In addition to these core offerings, Progressive also provides insurance for boats, motorcycles, RV's, and personal watercraft. Their comprehensive suite of products, coupled with their digital-first approach, positions Progressive as a leading choice for consumers seeking convenience, flexibility, and personalized insurance solutions.

| Coverage Type | Coverage Highlights |

|---|---|

| Auto Insurance | Customizable policies for cars, motorcycles, and recreational vehicles; various coverage options available |

| Homeowners' Insurance | Protects the structure, belongings, and liability; includes optional add-ons like identity theft protection |

| Renters' Insurance | Covers personal belongings, liability, and additional living expenses; essential coverage for tenants |

| Commercial Insurance | Tailored solutions for small businesses, including general liability, property, and business auto insurance |

Comparative Analysis: Homesite vs. Progressive

When comparing Homesite Insurance and Progressive, several key factors come into play. Both companies have established themselves as leaders in their respective niches, offering a range of insurance solutions to meet diverse consumer needs. However, there are subtle differences that set them apart and may influence a consumer’s choice.

Specialization vs. Broad Spectrum

Homesite Insurance’s strength lies in its specialization. The company has focused its efforts on delivering highly tailored coverage options for homeowners, renters, condo owners, and landlords. This specialization allows Homesite to provide customized solutions that address the unique needs of each client segment. On the other hand, Progressive takes a more comprehensive approach, offering a broad spectrum of insurance products, including auto, homeowners’, renters’, and commercial insurance. Progressive’s strategy caters to a wider audience, providing a one-stop shop for consumers seeking multiple insurance solutions.

Digital Experience

In terms of the digital experience, Progressive takes the lead. The company has invested heavily in digital transformation, leveraging technology to enhance the customer journey. From online quoting to policy management, Progressive has streamlined the insurance process, making it more efficient and accessible. Homesite, while offering online services, may not match Progressive’s level of digital innovation. For consumers who value convenience and a seamless digital experience, Progressive could be the preferred choice.

Coverage Customization

Both Homesite and Progressive offer customizable coverage options, allowing clients to tailor their policies to their specific needs. However, Homesite’s specialization in property and casualty insurance means they may have a more nuanced understanding of the unique risks faced by homeowners and renters. This expertise can result in more precise coverage recommendations, ensuring clients receive the protection they require without unnecessary add-ons. Progressive, while offering customization, may not have the same level of specialization in this niche.

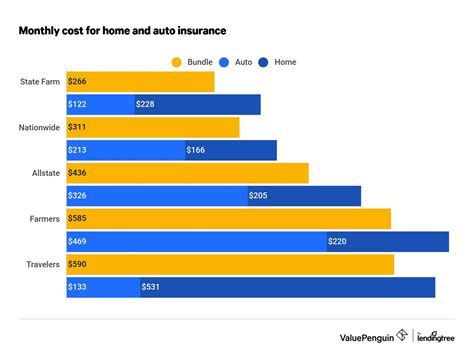

Pricing and Discounts

Pricing and discounts can be a decisive factor for many consumers. Progressive is known for its competitive pricing and a range of discounts, making it an attractive option for budget-conscious consumers. Homesite, while offering competitive rates, may not match Progressive’s extensive discount offerings. Consumers should carefully evaluate their specific needs and budget to determine which company provides the best value for their insurance requirements.

Customer Service and Claims

Customer service and claims handling are critical aspects of the insurance experience. Both Homesite and Progressive have invested in robust customer support systems, ensuring clients receive timely assistance when needed. However, given Progressive’s larger scale and digital focus, they may have a more extensive support network, providing quicker response times and a broader range of self-service options. Homesite, with its specialization, may offer more personalized customer service, but the scale of Progressive’s operations could provide additional benefits in terms of claims processing and support.

Conclusion: Making an Informed Choice

When choosing between Homesite Insurance and Progressive, consumers should carefully consider their specific insurance needs, budget, and preferences. Homesite’s specialization in property and casualty insurance makes it an excellent choice for those seeking highly tailored coverage options. Progressive, with its comprehensive product offerings and digital innovations, is an attractive option for consumers who value convenience and a seamless experience. Ultimately, the decision should be based on a thorough evaluation of the consumer’s unique circumstances and priorities.

In a rapidly evolving insurance landscape, companies like Homesite and Progressive continue to shape the industry, offering innovative solutions and enhancing the customer experience. As consumers, staying informed and making educated choices is key to ensuring our assets and livelihoods are protected effectively.

How do I choose between Homesite Insurance and Progressive for my insurance needs?

+The choice between Homesite and Progressive depends on your specific insurance needs and preferences. Homesite specializes in property and casualty insurance, offering highly tailored coverage for homeowners, renters, and landlords. Progressive, on the other hand, provides a broad spectrum of insurance products, including auto, homeowners’, and commercial insurance. Evaluate your needs, budget, and desired level of customization to make an informed decision.

What sets Homesite Insurance apart from other providers in the market?

+Homesite Insurance’s specialization in property and casualty insurance sets it apart. They offer customized coverage options for homeowners, renters, condo owners, and landlords, ensuring clients receive tailored protection that fits their unique circumstances. This level of specialization can provide a more precise fit for your insurance needs.

How does Progressive’s digital innovation enhance the insurance experience?

+Progressive has embraced digital transformation, leveraging technology to enhance the customer journey. From online quoting to policy management, Progressive has streamlined the insurance process, making it more efficient and accessible. This digital-first approach provides a seamless and intuitive experience, especially for those who value convenience and ease of use.

What are some key factors to consider when comparing Homesite and Progressive?

+When comparing Homesite and Progressive, consider factors such as specialization, digital experience, coverage customization, pricing and discounts, and customer service. Homesite’s specialization may offer more tailored coverage, while Progressive’s digital innovation and broad product offerings provide convenience and a one-stop shop experience. Evaluate these aspects based on your specific needs and priorities.