Home Car Insurance Comparison

When it comes to safeguarding your home and vehicle, finding the right insurance coverage is crucial. The world of insurance can be complex and often confusing, especially when you're faced with numerous options and providers. This comprehensive guide aims to simplify the process of comparing home and car insurance, helping you make informed decisions to protect your most valuable assets.

Understanding Home Insurance: The Essentials

Home insurance, also known as homeowner’s insurance, is a policy that provides financial protection for one of the most significant investments you’ll ever make - your home. It offers coverage for a variety of risks, including damage to your property, theft, and liability claims. Understanding the different components of home insurance is essential to ensure you have adequate coverage.

Coverage Types for Your Home

Home insurance typically consists of several coverage types, each designed to address specific risks. These include:

- Dwelling Coverage: This covers the physical structure of your home, including the walls, roof, and permanent fixtures. It’s essential to ensure this coverage is adequate to rebuild your home in the event of a total loss.

- Personal Property Coverage: This type of insurance protects your personal belongings, such as furniture, electronics, and clothing. It’s important to assess the value of your possessions to ensure you have sufficient coverage.

- Liability Coverage: This provides protection if someone is injured on your property or if you’re found legally responsible for causing property damage or bodily harm to others. It’s a crucial aspect of home insurance, offering financial security in case of lawsuits.

- Additional Living Expenses: In the event your home becomes uninhabitable due to a covered loss, this coverage helps with temporary living expenses, such as hotel stays or rental costs.

Customizing Your Home Insurance

Home insurance policies can be tailored to your specific needs. Some common endorsements (or add-ons) include:

- Water Backup Coverage: This provides protection against damage caused by water backing up through drains or sewers.

- Identity Theft Coverage: In today’s digital age, this coverage offers assistance and financial protection if you become a victim of identity theft.

- Jewelry and Fine Arts Coverage: If you have valuable jewelry or artwork, this endorsement can provide additional protection beyond the standard personal property coverage.

Navigating Car Insurance: A Comprehensive Overview

Car insurance is a legal requirement in most states, and it plays a vital role in protecting you financially in the event of an accident or other vehicle-related incidents. Understanding the different aspects of car insurance is key to making informed decisions.

Key Components of Car Insurance

Car insurance policies are typically made up of several key components, including:

- Liability Coverage: Similar to home insurance, this provides protection if you’re found at fault for an accident, covering the cost of injuries or damage to others’ property.

- Comprehensive Coverage: This covers damage to your vehicle caused by events other than collisions, such as theft, vandalism, weather-related incidents, or collisions with animals.

- Collision Coverage: This type of insurance covers damage to your vehicle in the event of a collision, regardless of who is at fault. It’s an essential component for comprehensive protection.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage helps pay for medical expenses for you and your passengers, regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: This provides protection if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have sufficient coverage to cover the damages.

Choosing the Right Coverage Limits

When selecting car insurance, it’s crucial to choose appropriate coverage limits. Here’s a breakdown of the different limits and their significance:

| Coverage Type | Limit | Explanation |

|---|---|---|

| Bodily Injury Liability | 25,000 / 50,000 / 100,000</td> <td>These limits represent the maximum amount your insurance will pay for injuries to one person, for all injuries in an accident, and for property damage, respectively.</td> </tr> <tr> <td>Property Damage Liability</td> <td>25,000 | This limit covers the cost of repairing or replacing damaged property (usually another vehicle) caused by you. |

| Collision Coverage | Varies | This limit is the maximum amount your insurance will pay for damage to your vehicle in a collision. |

| Comprehensive Coverage | Varies | This limit covers non-collision related incidents, and the amount is typically the same as your collision coverage. |

Comparing Home and Car Insurance: A Comprehensive Analysis

Comparing home and car insurance policies can be a complex task, but it’s essential to ensure you’re getting the best value for your money. Here’s a breakdown of the key factors to consider when making your comparison.

Assessing Your Needs

Before comparing policies, it’s crucial to assess your specific needs. Consider the following:

- The value of your home and its contents.

- The make, model, and value of your vehicle(s).

- Your personal risk tolerance and budget.

- Any specific coverage needs, such as additional endorsements for valuables or water damage.

Understanding Provider Reputation

Researching the reputation of insurance providers is crucial. Look for providers with a strong financial rating, indicating their ability to pay claims, and consider customer reviews to gauge their level of service and claim handling.

Comparing Policy Features

When comparing policies, pay close attention to the following features:

- Coverage Limits: Ensure the limits offered are adequate for your needs. For home insurance, consider the replacement cost of your home and the value of your possessions.

- Deductibles: Higher deductibles can lower your premium, but ensure they’re affordable in case of a claim.

- Discounts: Many providers offer discounts for bundling home and car insurance, having safety features in your home or vehicle, or being a loyal customer.

- Exclusions: Understand what’s not covered in each policy to avoid surprises.

- Claim Process: Research how each provider handles claims, including their response time and customer satisfaction.

The Impact of Location

Your location plays a significant role in determining insurance rates. Factors such as crime rates, weather conditions, and traffic density can influence the cost of insurance. It’s essential to consider these factors when comparing quotes.

Expert Tips for Optimizing Your Insurance Coverage

As an industry expert, I’ve compiled a list of tips to help you get the most out of your home and car insurance:

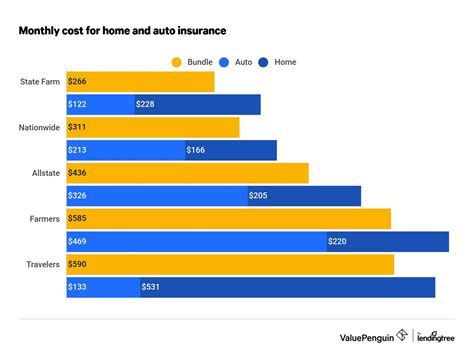

Bundling Your Policies

Many insurance providers offer discounts when you bundle your home and car insurance policies. This can result in significant savings, making it a cost-effective option.

Reviewing Your Policies Regularly

Life circumstances can change, and so can your insurance needs. Regularly review your policies to ensure they still meet your requirements. This is especially important if you’ve made significant home improvements or acquired new vehicles.

Understanding Deductibles

While higher deductibles can lower your premium, they also mean you’ll pay more out of pocket in the event of a claim. Weigh the cost-benefit and choose a deductible that aligns with your financial situation and risk tolerance.

Exploring Discounts

Insurance providers often offer a variety of discounts, including safe driver discounts, loyalty discounts, and discounts for certain professions or affiliations. Be sure to ask about all available discounts when obtaining quotes.

The Future of Home and Car Insurance

The insurance industry is evolving, and with advancements in technology, we can expect to see significant changes in the way home and car insurance is provided and utilized. Here’s a glimpse into the future of insurance.

The Rise of Telematics and Usage-Based Insurance

Telematics refers to the use of technology to monitor and analyze data from vehicles. Usage-based insurance, also known as pay-as-you-drive insurance, is a type of car insurance that uses telematics to assess driving behavior and set insurance rates accordingly. This technology is expected to become more prevalent, offering personalized insurance rates based on actual driving habits.

Home Insurance and Smart Home Technology

The integration of smart home technology, such as security systems and smart sensors, is expected to play a significant role in home insurance. These technologies can provide real-time data on home conditions, helping to prevent and mitigate risks. Insurers may offer discounts for homes equipped with such technology, recognizing the reduced risk.

The Role of Artificial Intelligence

Artificial Intelligence (AI) is already being used in the insurance industry to streamline processes and improve accuracy. In the future, AI is expected to play an even greater role, from automating claim processes to providing personalized insurance recommendations based on individual risk profiles.

The Impact of Climate Change

Climate change is expected to have a significant impact on insurance, particularly in the area of home insurance. With increasing extreme weather events, insurers may adjust their policies and rates to reflect the changing risk landscape. It’s crucial for homeowners to understand these changes and ensure they have adequate coverage.

Conclusion

Comparing home and car insurance is a critical step in ensuring you have the right protection for your assets and peace of mind. By understanding the key components of each type of insurance, assessing your needs, and staying informed about industry trends, you can make informed decisions and secure the best coverage for your situation.

How often should I review my home and car insurance policies?

+

It’s recommended to review your policies annually, or whenever your life circumstances change significantly. This ensures your coverage remains adequate and aligned with your needs.

What are some common exclusions in home insurance policies?

+

Common exclusions in home insurance policies include damage caused by earthquakes, floods, and poor maintenance. It’s important to understand these exclusions to avoid surprises in the event of a claim.

How do I choose the right coverage limits for my car insurance?

+

When choosing car insurance coverage limits, consider your financial situation and the value of your vehicle. It’s recommended to opt for higher liability limits to provide adequate protection in case of an accident.