Motor Insurance Canada

Motor insurance, or more commonly known as auto insurance, is an essential aspect of vehicle ownership in Canada. With its vast landscapes and diverse driving conditions, ensuring the safety and protection of drivers and their vehicles is of utmost importance. In this comprehensive guide, we will delve into the world of motor insurance in Canada, exploring the various aspects, coverage options, and factors that influence insurance rates.

Understanding Motor Insurance in Canada

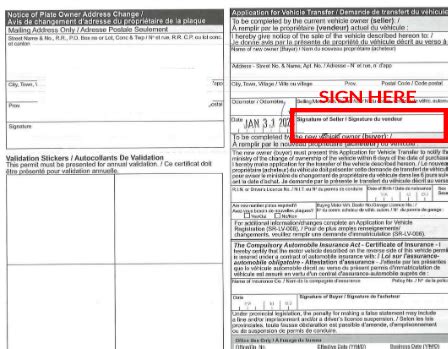

Motor insurance in Canada provides financial protection to vehicle owners and drivers in the event of accidents, theft, or other unforeseen circumstances. It is a legal requirement in all provinces and territories, ensuring that drivers can cover the costs of potential damages and liabilities. The insurance system in Canada is regulated by each provincial government, resulting in slight variations in coverage and pricing across the country.

The primary purpose of motor insurance is to safeguard policyholders against financial losses and provide peace of mind while navigating the roads. It covers a wide range of scenarios, including collisions, vandalism, natural disasters, and even medical expenses resulting from accidents. Additionally, insurance companies offer various add-on coverage options to tailor policies to individual needs.

Mandatory Coverage Requirements

Each province in Canada has its own set of mandatory insurance coverage requirements. These typically include liability coverage, which protects policyholders against claims for bodily injury or property damage caused to others. The minimum liability limits vary across provinces, ranging from 200,000 to 2 million. Some provinces also require additional coverage, such as accident benefits, uninsured motorist protection, and direct compensation for property damage.

| Province | Minimum Liability Coverage |

|---|---|

| Alberta | $200,000 |

| British Columbia | $200,000 |

| Manitoba | Basic coverage with public auto insurance |

| Ontario | $200,000 |

| Quebec | $50,000 for bodily injury and $25,000 for property damage |

| Saskatchewan | $200,000 |

| New Brunswick | $50,000 |

| Nova Scotia | $500,000 |

| Prince Edward Island | $500,000 |

| Newfoundland and Labrador | $500,000 |

| Northwest Territories | $200,000 |

| Yukon | $200,000 |

Optional Coverage and Add-ons

While the mandatory coverage requirements provide a basic level of protection, many drivers opt for additional coverage to enhance their insurance policies. Some common optional coverages include:

- Collision Coverage: Pays for damages to the insured vehicle in the event of a collision, regardless of fault.

- Comprehensive Coverage: Covers damages caused by non-collision incidents, such as theft, vandalism, fire, or natural disasters.

- Rental Car Coverage: Provides reimbursement for rental car expenses when the insured vehicle is undergoing repairs.

- Enhanced Accident Benefits: Offers higher limits for medical expenses, income replacement, and other benefits in the event of an accident.

- Roadside Assistance: Includes emergency services like towing, battery jump-starts, and tire changes.

Factors Influencing Motor Insurance Rates

Insurance rates in Canada can vary significantly based on several factors. Understanding these factors can help drivers make informed decisions when choosing their insurance policies.

Vehicle Type and Usage

The type of vehicle and its intended usage play a crucial role in determining insurance rates. Sports cars, luxury vehicles, and high-performance SUVs often attract higher premiums due to their increased risk of accidents and higher repair costs. Additionally, vehicles used for personal pleasure may have different rates compared to those used for business or commercial purposes.

Driver’s Profile

The driver’s age, gender, driving history, and location are key factors considered by insurance companies. Young drivers, particularly those under the age of 25, are often charged higher premiums due to their lack of driving experience and higher accident rates. Gender-based pricing has been largely phased out, but some insurance companies still consider it as a factor. Driving history, including at-fault accidents and traffic violations, can significantly impact insurance rates.

Location and Usage

The geographic location of the driver and the vehicle’s primary usage area can influence insurance rates. Urban areas generally have higher premiums due to increased traffic congestion, higher accident rates, and a greater risk of theft or vandalism. Additionally, the frequency and distance of driving can impact rates, with higher premiums for those who commute long distances or drive frequently.

Claims History

A driver’s claims history is a critical factor in determining insurance rates. Insurance companies closely monitor claims made by policyholders, and a history of frequent or costly claims can lead to increased premiums or even non-renewal of policies. It is important for drivers to carefully consider their driving habits and take steps to minimize the risk of accidents and claims.

Tips for Finding the Best Motor Insurance in Canada

Navigating the complex world of motor insurance can be daunting, but with the right approach, drivers can find the best coverage at competitive rates. Here are some tips to help you secure the ideal motor insurance policy:

- Compare Multiple Quotes: Obtain quotes from various insurance providers to compare coverage and prices. Online comparison tools can be particularly useful for this purpose.

- Understand Your Needs: Assess your specific requirements and prioritize the coverage options that matter most to you. Consider factors like the value of your vehicle, your driving habits, and any additional coverages you may need.

- Review Your Policy Regularly: Insurance needs can change over time, so it's important to review your policy annually. Update your information, assess your coverage, and make adjustments as necessary.

- Consider Bundling Policies: Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance. This can be a cost-effective way to save on your insurance premiums.

- Maintain a Good Driving Record: A clean driving record can significantly impact your insurance rates. Avoid traffic violations and at-fault accidents to keep your premiums low.

Future of Motor Insurance in Canada

The motor insurance landscape in Canada is evolving, driven by technological advancements and changing consumer expectations. Here’s a glimpse into the future of motor insurance:

Telematics and Usage-Based Insurance

Telematics technology, which uses data-gathering devices to monitor driving behavior, is gaining traction in the insurance industry. Usage-based insurance (UBI) policies offer personalized rates based on real-time driving data, rewarding safe drivers with lower premiums. This technology is expected to become more prevalent, providing drivers with greater control over their insurance costs.

Digital Transformation

The insurance industry is undergoing a digital transformation, with insurance companies embracing online platforms and mobile apps. This shift allows for more efficient and convenient policy management, claims processing, and customer service. Drivers can expect a more seamless and user-friendly experience when interacting with their insurance providers.

Enhanced Data Analytics

Advanced data analytics and machine learning algorithms are being utilized by insurance companies to make more accurate risk assessments. By analyzing vast amounts of data, insurers can identify patterns and trends, leading to more precise pricing and coverage recommendations. This technology will continue to improve the accuracy and fairness of motor insurance policies.

Collaborative Insurance Models

The rise of collaborative consumption and shared mobility services is influencing the insurance industry. Insurers are exploring partnerships with ride-sharing companies and car-sharing platforms to offer tailored insurance solutions. This trend is expected to grow, providing drivers with flexible and affordable insurance options for their diverse transportation needs.

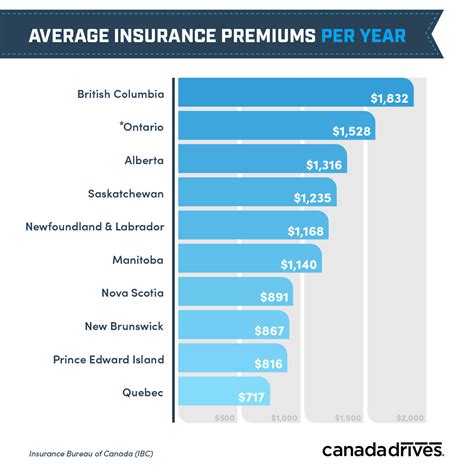

What is the average cost of motor insurance in Canada?

+The average cost of motor insurance in Canada varies depending on factors such as location, vehicle type, and driving history. According to recent statistics, the average annual premium ranges from 1,500 to 2,000. However, it’s important to note that rates can significantly differ based on individual circumstances.

Can I get insurance for a classic car in Canada?

+Absolutely! Many insurance companies offer specialized coverage for classic and vintage vehicles. These policies often provide enhanced protection and unique benefits tailored to the needs of classic car owners. It’s recommended to consult with an insurance broker who specializes in classic car insurance to ensure you get the right coverage.

Are there any discounts available for motor insurance in Canada?

+Yes, insurance companies in Canada offer a variety of discounts to policyholders. These may include discounts for safe driving records, loyalty rewards, multi-policy bundling, and even educational qualifications. It’s worthwhile to inquire about available discounts when obtaining insurance quotes.