What Is Dwelling Insurance

Understanding dwelling insurance, also known as home insurance or homeowner's insurance, is crucial for anyone who owns a home. It is a type of property insurance that provides financial protection against damages to one's residence, its contents, and any additional living expenses incurred during the repair or rebuilding process. This comprehensive coverage ensures homeowners are safeguarded from a wide range of potential risks and unforeseen circumstances.

The Importance of Dwelling Insurance

Dwelling insurance serves as a vital safety net for homeowners, offering peace of mind and financial security. In the event of unexpected disasters or damages, such as fires, storms, or vandalism, this insurance steps in to cover the costs of repairs or even complete rebuilding. It also extends protection to personal belongings within the home, ensuring that valuable items are not left uninsured.

Furthermore, dwelling insurance often includes liability coverage, which safeguards homeowners against legal claims and lawsuits resulting from accidents or injuries that occur on their property. This comprehensive protection is designed to mitigate the financial risks associated with homeownership, making it an essential consideration for anyone with a residential property.

What Does Dwelling Insurance Cover?

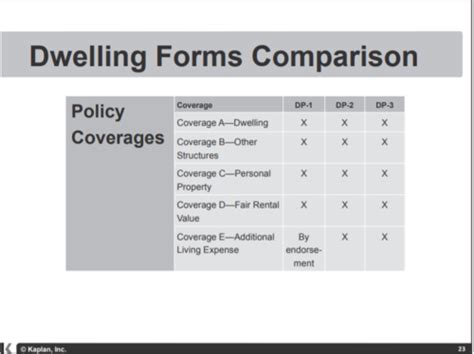

The coverage provided by dwelling insurance policies can vary significantly depending on the provider and the specific policy chosen. However, there are several key components that are typically included in most dwelling insurance plans.

Dwelling Coverage

The primary coverage offered by dwelling insurance is for the physical structure of the home itself. This includes protection against damages caused by various perils, such as fires, storms, lightning strikes, vandalism, and more. The policy will typically cover the cost of repairs or rebuilding up to the policy limit, ensuring that the homeowner can restore their residence to its pre-damage state.

In some cases, dwelling insurance may also cover additional structures on the property, such as detached garages, sheds, or guest houses. It's important to review the policy details to understand the extent of this coverage and any potential limitations or exclusions.

Personal Property Coverage

Dwelling insurance policies also provide coverage for the personal belongings and items within the home. This can include furniture, appliances, electronics, clothing, and other valuable possessions. In the event of a covered loss, the policy will reimburse the homeowner for the cost of repairing or replacing these items, up to the policy limits.

It's essential to note that the level of coverage for personal property can vary. Some policies offer actual cash value coverage, which considers depreciation, while others provide replacement cost coverage, ensuring the homeowner receives the full cost of replacing the items without deduction for depreciation.

Liability Coverage

A critical aspect of dwelling insurance is liability coverage, which protects homeowners from financial losses resulting from accidents or injuries that occur on their property. This coverage can be especially important if a visitor is injured while on the premises, as it provides protection against potential legal claims and lawsuits.

Liability coverage typically includes medical payments for injuries sustained by others on the property, as well as legal defense costs if a lawsuit is filed. It's important to ensure that the liability limits provided by the dwelling insurance policy are sufficient to cover potential risks, as these limits can vary widely.

Additional Living Expenses

In the event that a homeowner’s residence becomes uninhabitable due to a covered loss, dwelling insurance policies often include coverage for additional living expenses. This coverage reimburses the homeowner for the cost of temporary housing, meals, and other necessary expenses incurred while their home is being repaired or rebuilt.

The coverage limits and duration of additional living expenses can vary, so it's crucial to review the policy details to understand the specific terms and conditions.

Factors Influencing Dwelling Insurance Premiums

The cost of dwelling insurance, known as the premium, can vary significantly depending on several factors. Understanding these factors can help homeowners make informed decisions when choosing an insurance policy and managing their insurance costs.

Location

The geographical location of the home plays a significant role in determining dwelling insurance premiums. Areas that are prone to natural disasters, such as hurricanes, floods, or wildfires, often carry higher insurance costs due to the increased risk of damage.

Additionally, the crime rate in a particular area can also impact insurance premiums. Homes located in neighborhoods with higher crime rates may face higher insurance costs to account for the increased risk of vandalism, theft, or other criminal activities.

Home Value and Size

The value and size of the home are key factors in determining dwelling insurance premiums. Homes with higher replacement costs, due to their size, architectural features, or valuable materials, will generally have higher insurance premiums.

It's important for homeowners to accurately assess the replacement cost of their home when obtaining dwelling insurance. Underestimating the replacement cost can lead to insufficient coverage, while overestimating may result in unnecessary expenses.

Deductibles

The deductible is the amount the homeowner must pay out of pocket before the insurance coverage kicks in. Choosing a higher deductible can lead to lower insurance premiums, as it reduces the financial risk borne by the insurance company. However, it’s important to consider the potential financial impact of a higher deductible in the event of a claim.

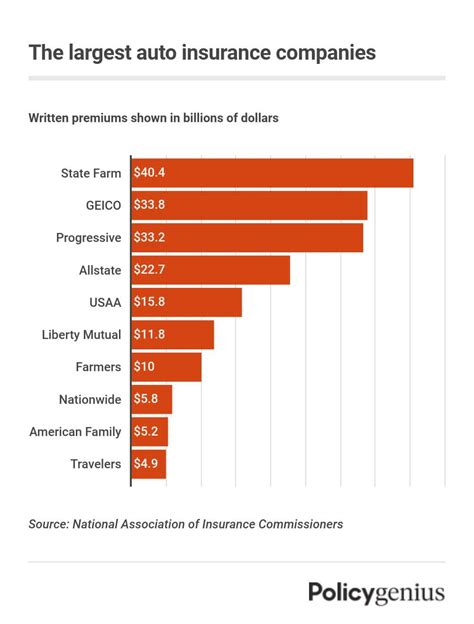

Insurance Company and Policy Features

Different insurance companies offer a wide range of policy features and pricing structures. It’s essential for homeowners to shop around and compare policies to find the best fit for their needs and budget. Factors such as the company’s financial stability, customer service reputation, and the specific coverage options and discounts available can all impact the overall cost of dwelling insurance.

Filing a Dwelling Insurance Claim

In the event of a covered loss, it’s important for homeowners to understand the process of filing a dwelling insurance claim. Here’s a step-by-step guide to help navigate this process effectively.

Assess the Damage

The first step is to thoroughly assess the damage to the home and personal property. Take photographs or videos of the damage, as these will serve as valuable evidence when filing the claim. It’s important to document the extent of the damage accurately and thoroughly.

Contact the Insurance Company

Once the damage has been assessed, the homeowner should contact their insurance company to report the claim. Provide as much detail as possible about the incident and the resulting damage. The insurance company will then assign an adjuster to evaluate the claim and determine the extent of coverage.

Work with the Insurance Adjuster

The insurance adjuster will review the claim and conduct an inspection of the damaged property. It’s important to cooperate fully with the adjuster and provide any additional information or documentation they may request. The adjuster will assess the damage, determine the cause, and evaluate whether the loss is covered under the policy.

Receive the Claim Settlement

Once the insurance adjuster has completed their evaluation, the homeowner will receive a settlement offer. This offer will outline the amount the insurance company is willing to pay for the covered loss. If the homeowner agrees with the settlement, they can proceed with the repairs or rebuilding process, using the funds provided by the insurance company.

Choosing the Right Dwelling Insurance Policy

Selecting the right dwelling insurance policy is a critical decision that requires careful consideration. Here are some key factors to keep in mind when choosing a policy that best suits your needs and provides adequate protection.

Coverage Limits

Review the coverage limits of the policy to ensure they align with the value of your home and personal belongings. Consider the cost of rebuilding your home and replacing your possessions, and choose a policy with limits that provide sufficient coverage.

Perils Covered

Different dwelling insurance policies offer varying levels of coverage for different perils. Some policies may provide comprehensive coverage for a wide range of risks, while others may have more limited coverage. Understand the specific perils covered by the policy and ensure they align with the potential risks you face in your area.

Additional Coverages

In addition to the standard coverage, many dwelling insurance policies offer optional additional coverages. These can include coverage for specific items of high value, such as jewelry or artwork, or coverage for additional living expenses in the event of a covered loss. Consider your specific needs and choose a policy that provides the necessary additional coverages.

Discounts and Bundling Options

Insurance companies often offer discounts and bundling options that can help reduce the cost of dwelling insurance. Look for discounts for factors such as having a security system installed, being a loyal customer, or bundling your dwelling insurance with other types of insurance, such as auto insurance.

Claims Process and Customer Service

The claims process and the quality of customer service provided by the insurance company are crucial considerations. Research the reputation of the insurance company and read reviews from existing customers to understand their experiences with filing claims and receiving assistance.

Dwelling Insurance and Natural Disasters

Natural disasters, such as hurricanes, floods, earthquakes, and wildfires, can cause significant damage to homes and properties. Understanding how dwelling insurance policies handle these events is essential for homeowners living in high-risk areas.

Hurricane and Windstorm Coverage

Many dwelling insurance policies provide coverage for damages caused by hurricanes and windstorms. However, it’s important to note that the level of coverage can vary widely. Some policies may offer comprehensive coverage, while others may have specific limitations or exclusions. It’s crucial to review the policy details and understand the extent of coverage for these types of events.

Flood Insurance

Standard dwelling insurance policies typically do not cover flood damage. Flood insurance is often provided through separate policies, such as those offered by the National Flood Insurance Program (NFIP) in the United States. Homeowners in flood-prone areas should consider obtaining flood insurance to ensure they have adequate protection against this specific peril.

Earthquake Insurance

Earthquake insurance is typically not included in standard dwelling insurance policies. However, it can be purchased as an additional coverage option or as a separate policy. The cost of earthquake insurance can vary significantly depending on the location and the level of coverage desired. Homeowners in earthquake-prone areas should carefully consider the potential risks and obtain appropriate coverage.

Wildfire Insurance

Wildfires can pose a significant threat to homes and properties, especially in certain regions. While dwelling insurance policies often provide coverage for fire damage, it’s important to understand the specific terms and conditions of the policy. Some policies may have limitations or exclusions related to wildfires, so it’s crucial to review the policy details thoroughly.

The Future of Dwelling Insurance

The dwelling insurance industry is continuously evolving to adapt to changing risks and technological advancements. Here are some insights into the future of dwelling insurance and how it may impact homeowners.

Advancements in Risk Assessment

Advancements in technology and data analysis are enabling insurance companies to more accurately assess risks and personalize insurance policies. This includes the use of advanced analytics, remote sensing technologies, and even artificial intelligence to better understand the potential risks associated with individual properties.

Personalized Insurance Policies

With improved risk assessment capabilities, insurance companies are moving towards offering more personalized insurance policies. These policies can be tailored to the specific needs and risks of individual homeowners, providing more accurate coverage and potentially reducing costs for those with lower risk profiles.

Incorporating Smart Home Technologies

The integration of smart home technologies, such as smart sensors, security systems, and automated devices, is expected to play a significant role in the future of dwelling insurance. These technologies can help reduce the risk of losses and provide valuable data for insurance companies to assess risks more accurately. Homeowners who embrace smart home technologies may benefit from reduced insurance premiums and enhanced protection.

Increased Focus on Prevention

As the dwelling insurance industry evolves, there is likely to be a greater emphasis on risk prevention and mitigation. Insurance companies may offer incentives or discounts to homeowners who take proactive measures to reduce the risk of losses, such as installing fire-resistant materials, reinforcing structures against earthquakes, or implementing water conservation measures to reduce the risk of floods.

What is the difference between dwelling insurance and homeowner’s insurance?

+Dwelling insurance and homeowner’s insurance are often used interchangeably, as they both refer to insurance policies that provide coverage for a homeowner’s residence and personal property. However, the term “dwelling insurance” specifically emphasizes the coverage for the physical structure of the home, while “homeowner’s insurance” encompasses a broader range of coverages, including liability and additional living expenses.

How much does dwelling insurance typically cost?

+The cost of dwelling insurance, or homeowner’s insurance, can vary significantly depending on factors such as the location, size, and value of the home, as well as the coverage limits and deductibles chosen. On average, the annual premium for dwelling insurance in the United States ranges from 1,000 to 2,000, but it can be higher or lower depending on individual circumstances.

Is dwelling insurance mandatory for homeowners?

+While dwelling insurance is not legally required for homeowners in most areas, it is highly recommended. Many mortgage lenders require homeowners to have dwelling insurance as a condition of the loan, as it provides financial protection for both the homeowner and the lender in the event of a covered loss. Additionally, having dwelling insurance can provide peace of mind and ensure that homeowners are prepared for unexpected disasters.