American National Insurance

American National Insurance, a prominent player in the insurance industry, has a rich history and a diverse range of offerings that have contributed to its success and reputation. Founded with a vision to provide financial security and peace of mind, this company has evolved into a trusted name, offering a comprehensive suite of insurance products and services. This article aims to delve deep into the world of American National Insurance, exploring its origins, key products, impact, and future prospects, providing an insightful journey through the insurance landscape.

The Evolution of American National Insurance: A Historic Overview

American National Insurance Company (ANICO) traces its roots back to the late 19th century, specifically to the year 1905, when it was established in Galveston, Texas. The company’s founding principles centered around offering comprehensive insurance solutions to individuals and businesses, a mission that has remained at the heart of its operations over the decades.

ANICO's journey has been one of resilience and innovation. The company weathered the challenges of the Great Depression and World War II, solidifying its position as a reliable provider of insurance services. This historical resilience has been a cornerstone of its brand, reinforcing the trust and confidence of its customers.

Over the years, American National Insurance has expanded its reach and diversified its product offerings. From its initial focus on life insurance, the company has grown to encompass a wide array of insurance products, including health, property, casualty, and even specialty lines of insurance. This strategic expansion has positioned ANICO as a full-service insurance provider, catering to the diverse needs of its clientele.

American National Insurance: The Comprehensive Suite of Insurance Products

American National Insurance’s product portfolio is extensive and tailored to meet the diverse needs of its customers. The company offers a range of insurance products designed to provide financial protection and security across various aspects of life and business.

Life Insurance

Life insurance is the cornerstone of American National’s offerings. The company provides a variety of life insurance policies, including term life, whole life, and universal life insurance. These policies are designed to cater to different needs and financial situations, offering flexible coverage options and premium payment structures.

One of the key strengths of American National's life insurance products is their adaptability. Policyholders can customize their coverage, adding riders for additional benefits such as accidental death or critical illness coverage. This level of customization ensures that policyholders receive a tailored plan that aligns with their unique needs and preferences.

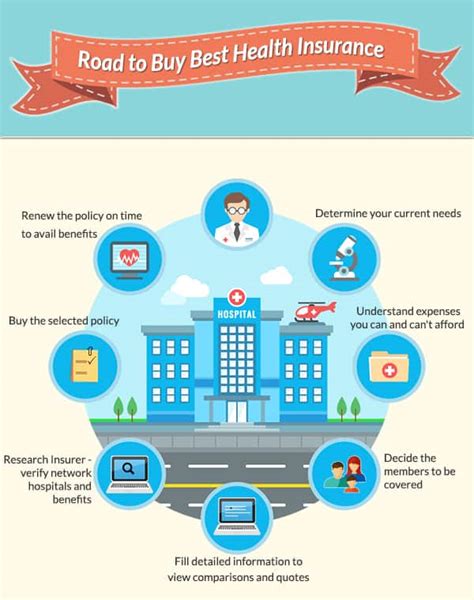

Health Insurance

American National Insurance recognizes the importance of health coverage in modern life. Their health insurance plans encompass a range of options, including individual and family plans, as well as group health insurance for businesses. These plans offer comprehensive coverage for medical expenses, hospitalization, and preventative care, providing individuals and families with the security of affordable and accessible healthcare.

In addition to traditional health insurance, American National also offers supplemental health insurance products. These plans provide additional financial protection in the event of critical illnesses, accidents, or long-term care needs, offering peace of mind and financial stability during times of medical uncertainty.

Property and Casualty Insurance

The company’s property and casualty insurance offerings are comprehensive, providing protection for a wide range of assets and liabilities. This includes homeowners’ insurance, renters’ insurance, auto insurance, and business insurance. American National’s policies are designed to offer robust coverage, ensuring that policyholders are protected against potential losses and liabilities.

For businesses, American National provides commercial insurance solutions tailored to the unique risks and exposures of different industries. This includes liability insurance, workers' compensation, and property insurance, among other specialized coverages. By offering a comprehensive suite of business insurance products, American National helps businesses mitigate risks and ensure their long-term viability.

Specialty Insurance

American National’s commitment to meeting diverse insurance needs extends to its specialty insurance offerings. These products are designed to provide coverage for unique situations and exposures that may not be addressed by traditional insurance policies. Specialty insurance products offered by American National include travel insurance, pet insurance, and even insurance for specific recreational activities or collections.

By offering a range of specialty insurance products, American National demonstrates its understanding of the diverse needs of its customers. This approach allows the company to cater to a wider market, providing tailored solutions that address specific risks and exposures, thus enhancing the overall customer experience.

Impact and Reach: American National Insurance’s Global Presence

American National Insurance’s influence extends far beyond its home state of Texas. The company has established a significant presence across the United States, with a network of agents and offices spanning the nation. This extensive reach ensures that American National’s insurance products and services are accessible to a wide range of individuals and businesses, regardless of their location.

Moreover, American National's international operations have further solidified its global presence. The company has expanded its operations into select international markets, offering its insurance expertise and products to customers abroad. This international expansion demonstrates American National's commitment to providing global solutions, catering to the needs of an increasingly interconnected world.

Industry Recognition and Partnerships

American National Insurance’s success and reputation are underscored by the numerous accolades and industry recognitions it has received. The company has been consistently recognized for its financial strength, customer satisfaction, and innovative insurance solutions. This recognition serves as a testament to the quality and reliability of American National’s products and services.

Additionally, American National has forged strategic partnerships with other industry leaders, further enhancing its capabilities and reach. These partnerships allow the company to leverage cutting-edge technologies, access new markets, and offer enhanced services to its customers. By collaborating with industry peers, American National continues to stay at the forefront of the insurance landscape, delivering innovative solutions that meet the evolving needs of its clientele.

Performance Analysis: American National Insurance’s Financial Strength and Stability

American National Insurance’s financial strength is a cornerstone of its reputation and a key factor in its success. The company has consistently demonstrated robust financial performance, characterized by strong reserves, prudent investment strategies, and a commitment to maintaining high levels of solvency.

American National's financial stability is reflected in its rating by independent rating agencies. These agencies, such as A.M. Best and Standard & Poor's, consistently assign high ratings to American National, signifying its strong financial position and ability to meet its obligations to policyholders. This financial strength provides assurance to customers, reinforcing the reliability and security of American National's insurance offerings.

Investment Strategies and Diversification

A significant contributor to American National’s financial success is its prudent investment strategies. The company’s investment portfolio is carefully curated to balance risk and return, ensuring the stability of its reserves while also generating competitive returns. This approach allows American National to maintain its financial strength over the long term, providing a solid foundation for its insurance operations.

Additionally, American National's investment strategy is characterized by diversification. The company invests across a range of asset classes, including stocks, bonds, and real estate, among others. This diversification reduces exposure to specific market risks and helps to stabilize the company's financial performance, even during periods of economic volatility.

The Future of American National Insurance: Innovations and Technological Advancements

American National Insurance is committed to staying at the forefront of the insurance industry through continuous innovation and technological advancements. The company recognizes the importance of leveraging technology to enhance the customer experience, streamline operations, and offer more efficient and accessible insurance solutions.

Digital Transformation

American National has embraced digital transformation, investing in technologies that enhance its online presence and customer engagement. The company’s website and mobile applications offer a seamless digital experience, allowing customers to access their policies, make payments, and file claims from the convenience of their homes or on the go. This digital approach not only improves customer satisfaction but also streamlines the insurance process, making it more efficient and accessible.

Data Analytics and Personalized Insurance

American National utilizes advanced data analytics to gain insights into customer needs and behaviors. By analyzing large datasets, the company can identify trends and patterns, allowing it to develop more personalized insurance products and services. This approach ensures that American National’s offerings are tailored to the unique needs of its customers, enhancing the value and relevance of its insurance solutions.

Furthermore, data analytics enable American National to improve its risk assessment and underwriting processes. By leveraging advanced analytics techniques, the company can make more accurate predictions about potential risks, leading to more efficient and effective insurance coverage. This data-driven approach enhances the company's overall performance and competitiveness in the insurance market.

Collaborative Partnerships and Industry Innovation

American National recognizes the value of collaborative partnerships in driving industry innovation. The company actively engages with startups and established technology firms to explore new ideas and develop cutting-edge insurance solutions. These partnerships allow American National to stay at the forefront of technological advancements, ensuring that its products and services remain relevant and competitive in the rapidly evolving insurance landscape.

Conclusion: American National Insurance’s Enduring Legacy

American National Insurance’s journey from its humble beginnings in Galveston, Texas, to its current status as a leading insurance provider is a testament to its commitment to financial security and customer satisfaction. The company’s comprehensive suite of insurance products, financial strength, and dedication to innovation have positioned it as a trusted name in the insurance industry.

As American National continues to evolve, it remains focused on its core values of integrity, reliability, and customer-centricity. With its eyes firmly set on the future, the company is poised to continue delivering innovative insurance solutions that meet the diverse needs of individuals and businesses. American National Insurance's enduring legacy is a testament to its ability to adapt, innovate, and provide financial security to its valued customers.

What are the key benefits of American National Insurance’s life insurance policies?

+American National’s life insurance policies offer a range of benefits, including customizable coverage, flexible premium payment options, and the ability to add riders for additional benefits like accidental death or critical illness coverage. These policies provide financial protection and security to policyholders and their families, ensuring a stable financial future.

How does American National’s health insurance compare to other providers in terms of coverage and affordability?

+American National’s health insurance plans offer comprehensive coverage at competitive rates. The company provides a range of options, including individual and family plans, as well as group health insurance for businesses. Their plans cover a wide range of medical expenses, including hospitalization, preventative care, and specialty treatments, making healthcare more accessible and affordable for their customers.

What sets American National’s property and casualty insurance apart from competitors?

+American National’s property and casualty insurance offerings stand out for their comprehensive coverage and tailored approach. The company provides robust protection for a wide range of assets and liabilities, including homeowners’ insurance, renters’ insurance, auto insurance, and business insurance. Their policies are designed to address the unique needs and exposures of individuals and businesses, offering peace of mind and financial security.