Find Health Insurance

Navigating the Complex World of Health Insurance: A Comprehensive Guide

Health insurance is a vital aspect of our lives, providing financial protection and access to essential healthcare services. With the ever-evolving healthcare landscape, finding the right health insurance coverage can be a daunting task. This comprehensive guide aims to demystify the process, offering you a detailed roadmap to navigate the complex world of health insurance and make informed decisions.

Understanding Your Health Insurance Needs

Before diving into the vast array of health insurance options, it's crucial to understand your unique healthcare needs. Consider the following factors to tailor your search effectively:

Assessing Your Health Status

Your current health status plays a significant role in determining the type of coverage you require. If you have pre-existing medical conditions or chronic illnesses, you'll want to prioritize plans that offer comprehensive coverage for these specific needs. For instance, individuals with diabetes may benefit from plans that cover insulin, regular check-ups, and specialized care.

Considering Your Prescription Needs

Prescription medications can be a significant expense, so it's essential to choose a plan that provides adequate prescription drug coverage. Some plans offer lower co-pays or even free generic medications, which can greatly reduce your out-of-pocket costs. Make a list of the medications you regularly take and research plans that include them in their formularies.

| Prescription Type | Potential Coverage Options |

|---|---|

| Brand-Name Medications | Plans with flexible prescription benefits, allowing for coverage of specific brands. |

| Generic Medications | Health insurance plans that prioritize cost-saving measures, often covering generics at lower costs. |

| Specialty Drugs | Plans with dedicated specialty drug coverage, ensuring access to expensive, often life-saving medications. |

Family Planning and Maternity Coverage

If you're planning to start or expand your family, it's crucial to select a plan that offers comprehensive maternity and family planning benefits. These benefits can include prenatal care, delivery expenses, and postnatal care for both mother and child. Some plans may also cover infertility treatments, so be sure to explore these options if relevant.

Exploring Health Insurance Options

Now that you have a clearer understanding of your healthcare needs, it's time to explore the various health insurance options available. The market offers a wide range of plans, each with its own set of advantages and limitations. Here's a breakdown of the most common types of health insurance:

Private Health Insurance Plans

Private health insurance is typically purchased directly from insurance companies or through a broker. These plans offer a wide range of coverage options, allowing you to choose the level of coverage that suits your needs. Private plans often provide more flexibility in terms of provider choice and may offer additional benefits such as vision or dental care.

Employer-Provided Health Insurance

Many employers offer health insurance benefits as part of their employee compensation packages. These plans are often more cost-effective as the employer contributes to the premium. Employer-provided plans usually come with a limited number of options, so it's important to carefully review the coverage and benefits offered to ensure they align with your needs.

Government-Sponsored Health Insurance Programs

Government-sponsored health insurance programs are designed to provide coverage for specific populations, such as low-income individuals, the elderly, or those with disabilities. In the United States, programs like Medicare, Medicaid, and the Children's Health Insurance Program (CHIP) offer comprehensive coverage at little to no cost. Understanding your eligibility for these programs can be a significant step towards securing necessary healthcare.

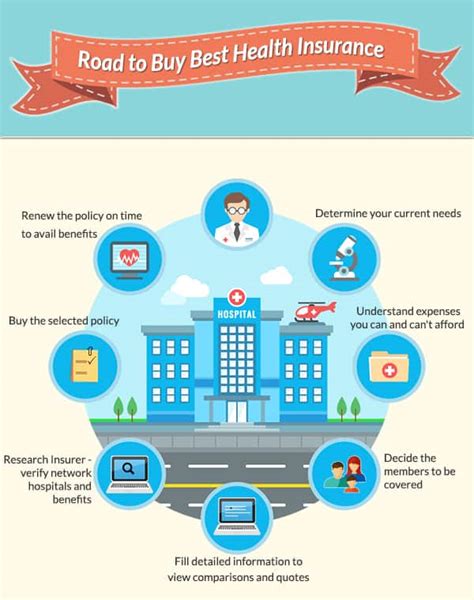

Comparing Health Insurance Plans

Once you've identified the types of health insurance plans that interest you, it's time to delve deeper and compare the specific details. Here are some key factors to consider when comparing plans:

Premium Costs

The premium is the amount you pay monthly to maintain your health insurance coverage. While it's tempting to choose the plan with the lowest premium, it's important to consider other factors as well. Some plans with higher premiums may offer more comprehensive coverage or have lower out-of-pocket costs, making them a better long-term investment.

Deductibles and Out-of-Pocket Costs

Deductibles are the amount you must pay out of pocket before your insurance coverage kicks in. Plans with higher deductibles often have lower premiums, while plans with lower deductibles may have higher premiums. It's crucial to strike a balance between these two factors based on your expected healthcare needs.

Network of Providers

Health insurance plans typically have a network of healthcare providers with whom they have negotiated discounted rates. It's essential to review the plan's provider network to ensure that your preferred doctors, hospitals, and specialists are included. If you have a specific healthcare provider you prefer, confirm their participation in the plan's network.

Covered Services and Benefits

Review the plan's summary of benefits and coverage to understand what services and treatments are covered. Look for plans that align with your specific healthcare needs, whether it's mental health services, prescription drug coverage, or specialized treatments. Ensure that the plan covers preventive care, as these services can help catch potential health issues early on.

Enrolling in Health Insurance

Once you've thoroughly researched and compared your options, it's time to enroll in a health insurance plan. The enrollment process may vary depending on the type of plan you choose. Here's a general overview of the enrollment process for different types of health insurance:

Private Health Insurance Enrollment

Private health insurance plans often have open enrollment periods, during which anyone can apply for coverage. If you miss the open enrollment period, you may still be able to enroll if you've experienced a qualifying life event, such as marriage, divorce, birth, or job loss. When enrolling, you'll typically need to provide personal information, such as your name, date of birth, and social security number.

Employer-Provided Health Insurance Enrollment

Enrollment in employer-provided health insurance plans usually occurs during an annual open enrollment period. During this time, you'll have the opportunity to review and select the plan that best suits your needs. Some employers may also offer enrollment opportunities outside of the open enrollment period if you experience a qualifying life event.

Government-Sponsored Health Insurance Enrollment

Enrollment in government-sponsored health insurance programs, such as Medicare or Medicaid, is based on eligibility criteria. For Medicare, enrollment typically occurs during the Initial Enrollment Period, which is a seven-month window around your 65th birthday. For Medicaid, eligibility is determined by your income and other factors, and enrollment can occur year-round if you meet the criteria.

Maximizing Your Health Insurance Benefits

Once you've enrolled in a health insurance plan, it's essential to understand how to maximize the benefits it offers. Here are some tips to help you get the most out of your coverage:

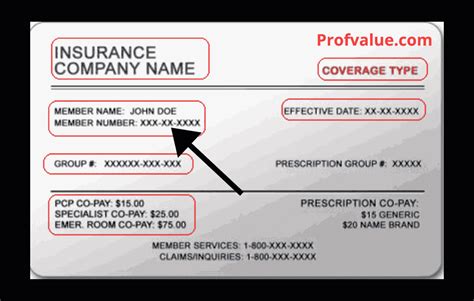

Stay Informed About Your Plan's Coverage

Familiarize yourself with the details of your health insurance plan, including covered services, provider networks, and out-of-pocket costs. Regularly review your plan's summary of benefits and coverage to stay updated on any changes or additions.

Choose In-Network Providers

Whenever possible, choose healthcare providers that are part of your insurance plan's network. Out-of-network providers may result in higher costs or reduced coverage. If you need to see a specialist, check with your primary care physician or insurance company to ensure they are in-network.

Understand Your Out-of-Pocket Costs

Be aware of your deductible, co-pays, and co-insurance amounts. Knowing these costs can help you budget for healthcare expenses and avoid unexpected financial burdens. Some plans offer tools or apps to help you estimate these costs before receiving treatment.

Utilize Preventive Care Services

Many health insurance plans cover preventive care services, such as annual physicals, immunizations, and screenings, at no additional cost. Taking advantage of these services can help detect potential health issues early on, leading to better overall health and potentially lower healthcare costs in the long run.

FAQ: Health Insurance Questions Answered

How do I know if I'm eligible for government-sponsored health insurance programs like Medicaid or Medicare?

+Eligibility for government-sponsored health insurance programs is typically based on income, age, or specific health conditions. For Medicaid, eligibility is determined by your income level and family size. For Medicare, you become eligible when you turn 65 or if you have certain disabilities. It's recommended to visit the official government websites or contact your local health department for detailed information on eligibility criteria.

Can I switch health insurance plans if I'm not satisfied with my current coverage?

+Yes, you can switch health insurance plans during open enrollment periods or if you experience a qualifying life event. Open enrollment periods typically occur once a year, allowing you to review and change your coverage. Qualifying life events, such as marriage, divorce, or job loss, may also trigger a special enrollment period, giving you the opportunity to make changes outside of the regular open enrollment period.

What happens if I can't afford the health insurance premium?

+If you're struggling to afford health insurance, there are options available to help make coverage more affordable. Government-sponsored programs like Medicaid or the Children's Health Insurance Program (CHIP) offer coverage at little to no cost for eligible individuals. Additionally, the Affordable Care Act (ACA) provides financial assistance in the form of premium tax credits for those who qualify based on their income.

How can I ensure I'm choosing the right health insurance plan for my needs?

+Choosing the right health insurance plan involves careful consideration of your unique healthcare needs. Assess your current health status, prescription needs, and any family planning goals. Review the plan's summary of benefits and coverage, paying attention to deductibles, out-of-pocket costs, and provider networks. Seek advice from healthcare professionals or insurance brokers who can guide you through the process.

Finding the right health insurance coverage is a critical step towards ensuring your financial and physical well-being. By understanding your healthcare needs, exploring your options, and comparing plans thoroughly, you can make an informed decision that provides the coverage and benefits you require. Remember, health insurance is a long-term investment, so take the time to research and choose a plan that aligns with your lifestyle and health goals.