Hmo Insurance Meaning

HMO, an acronym for Health Maintenance Organization, is a type of healthcare plan that has been in existence for decades. It offers a unique approach to medical care, emphasizing preventive measures and coordinated care. This insurance model is known for its cost-effectiveness and comprehensive coverage, making it a popular choice for many individuals and families. Let's delve deeper into the world of HMO insurance and explore its meaning, workings, and benefits.

Understanding HMO Insurance

HMO insurance plans are designed to provide a network of healthcare services to members, including primary care physicians, specialists, hospitals, and other medical providers. The core principle of an HMO is to ensure that members receive coordinated and cost-effective healthcare by utilizing a specific network of providers. This network is carefully curated to ensure high-quality care at reasonable costs.

When enrolled in an HMO plan, members are typically required to select a primary care physician (PCP) who acts as the gatekeeper to the rest of the healthcare system. The PCP is responsible for coordinating all the member's healthcare needs, from routine check-ups to specialized treatments. This centralized approach ensures that the member's healthcare is managed efficiently and that all necessary services are received in a timely manner.

Key Characteristics of HMO Insurance:

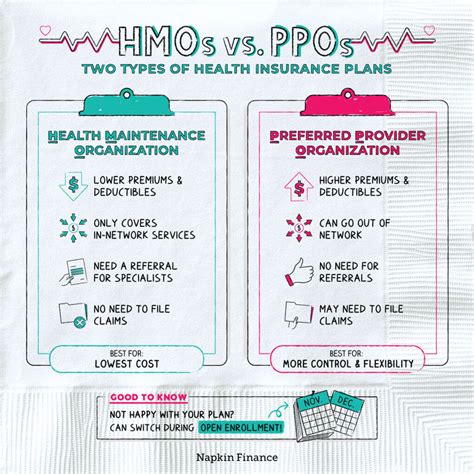

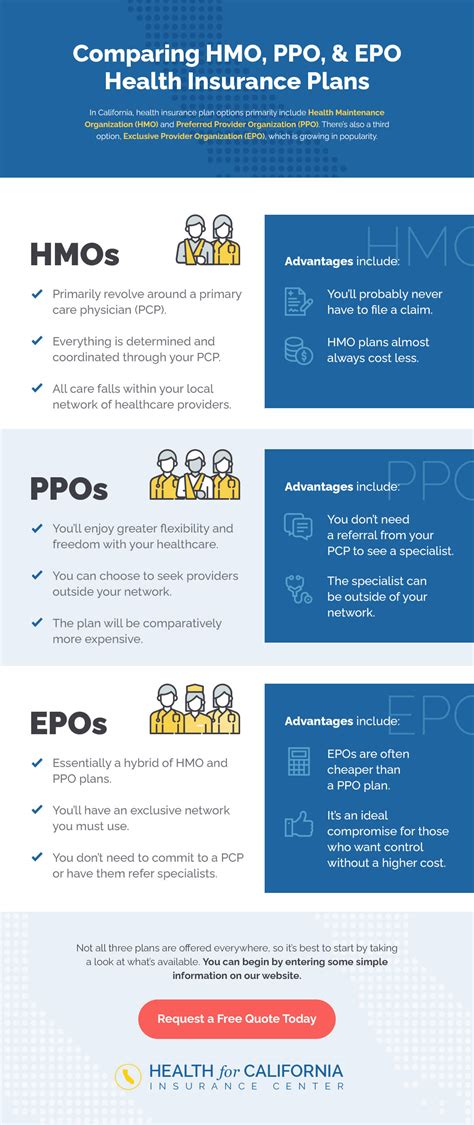

- Provider Network: HMO plans have a closed network of providers, meaning members must receive their care from within this network to ensure coverage. Out-of-network care is usually not covered or comes at a higher cost.

- Primary Care Physician (PCP): As mentioned, a PCP is a vital component of HMO plans. They act as the first point of contact for members and coordinate all their healthcare needs.

- Preventive Care Emphasis: HMO plans place a strong focus on preventive care, such as regular check-ups, immunizations, and screenings. This proactive approach aims to identify and address health issues before they become more serious and costly.

- Co-Payments and Deductibles: HMO plans often require members to pay a co-payment (a fixed amount) for certain services, such as doctor visits or prescription medications. Additionally, there may be an annual deductible, which is the amount members pay out-of-pocket before the insurance coverage kicks in.

- Coverage for Pre-existing Conditions: HMO plans are required by law to cover pre-existing conditions, ensuring that members can access the care they need regardless of their health history.

Benefits of HMO Insurance

HMO insurance plans offer a range of advantages to members, making them a preferred choice for many healthcare consumers.

Cost-Effectiveness:

One of the most significant benefits of HMO plans is their cost-effectiveness. By utilizing a closed network of providers, HMO plans can negotiate lower rates for services, which translates to lower costs for members. Additionally, the emphasis on preventive care can help reduce the need for costly treatments down the line.

Comprehensive Coverage:

HMO plans typically offer a wide range of covered services, including hospital stays, physician visits, laboratory tests, and prescription medications. Some plans may also include vision and dental care, further expanding the scope of coverage.

Coordinated Care:

The role of the PCP in coordinating care ensures that members receive a seamless healthcare experience. This coordination can be especially beneficial for individuals with complex medical needs or multiple health conditions.

Emphasis on Wellness:

The focus on preventive care in HMO plans encourages members to take a proactive approach to their health. Regular check-ups and screenings can help identify potential health issues early on, allowing for timely intervention and better health outcomes.

Choosing the Right HMO Plan

When considering an HMO plan, it’s essential to evaluate your specific healthcare needs and preferences. Here are some factors to consider:

- Provider Network: Ensure that your preferred healthcare providers are included in the plan's network. This is especially important if you have established relationships with certain specialists or hospitals.

- PCP Selection: Choose a PCP who aligns with your healthcare philosophy and preferences. Consider factors such as their location, availability, and specialty.

- Covered Services: Review the plan's benefits summary to understand what services are covered and any limitations or exclusions. Ensure that the plan meets your anticipated healthcare needs.

- Cost: Compare the premiums, co-payments, and deductibles of different HMO plans to find the most cost-effective option for your budget.

- Additional Benefits: Some HMO plans offer extra benefits, such as wellness programs, disease management support, or access to health and wellness apps. Consider these add-ons when making your decision.

HMO Insurance: A Comprehensive Solution

HMO insurance plans provide a comprehensive and coordinated approach to healthcare, offering cost-effective coverage and a focus on preventive care. With a strong network of providers and the coordination of a PCP, HMO plans ensure that members receive the care they need when they need it. By understanding the key features and benefits of HMO insurance, individuals can make informed decisions about their healthcare coverage, ensuring they have the support they need to maintain their health and well-being.

Can I choose my own doctors with an HMO plan?

+Yes, but only from within the plan’s network of providers. HMO plans have a closed network, so you must choose doctors and specialists from this network to ensure coverage.

Are there any age restrictions for HMO plans?

+No, HMO plans are available to individuals of all ages, including children, adults, and seniors. They offer comprehensive coverage for various age groups.

What happens if I need to see a specialist with an HMO plan?

+You will need a referral from your PCP to see a specialist. Your PCP will assess your condition and determine if a specialist is necessary. They will then provide you with a referral to an in-network specialist.