Online Business Insurance Quote

In today's digital age, an increasing number of businesses are venturing into the online realm, establishing a strong presence and reaching a global audience. This shift towards e-commerce and online services has revolutionized the way businesses operate, but it also introduces a unique set of risks and challenges. One of the most critical aspects of running an online business is ensuring it is adequately protected with the right insurance coverage. Obtaining an online business insurance quote is an essential step in this process, offering a comprehensive overview of the insurance options available and the associated costs.

Understanding the Importance of Online Business Insurance

Online businesses, regardless of their size or nature, face a variety of potential risks that can have severe financial and operational consequences. From data breaches and cyberattacks to product liability claims and employee injuries, the range of potential hazards is vast and often unpredictable. This is where online business insurance steps in as a crucial safeguard.

Business insurance serves as a financial safety net, providing coverage for a wide range of potential losses and liabilities. It offers protection against financial losses resulting from property damage, lawsuits, employee injuries, and other unforeseen events. For online businesses, this coverage is especially critical due to the unique nature of their operations and the risks associated with the digital realm.

The Benefits of Online Business Insurance Quotes

Seeking an online business insurance quote offers numerous advantages to business owners. Firstly, it provides a clear understanding of the different types of insurance policies available and their associated costs. This transparency allows business owners to make informed decisions about their insurance needs and budget accordingly.

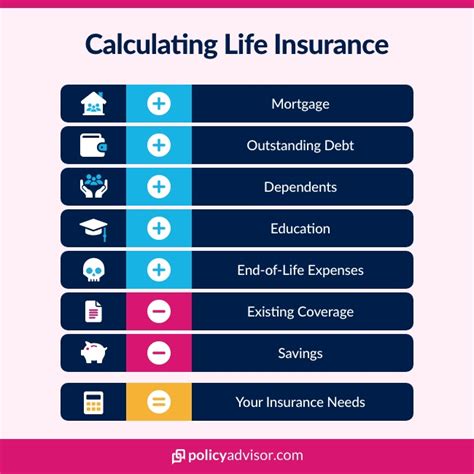

Secondly, an online business insurance quote often includes a detailed breakdown of the coverage provided. This includes the specific risks and liabilities covered by the policy, the policy limits, deductibles, and any exclusions or limitations. Having this information upfront enables business owners to tailor their insurance coverage to their unique needs, ensuring they are not overinsured or underinsured.

Customizable Coverage Options

One of the key advantages of obtaining an online business insurance quote is the ability to customize the coverage to fit the specific needs of the business. Online platforms often provide a range of insurance options, allowing business owners to choose the policies that best suit their operations. This flexibility ensures that businesses can protect themselves against the risks they are most likely to face, while also keeping costs manageable.

| Coverage Type | Description |

|---|---|

| General Liability Insurance | Covers bodily injury, property damage, and personal and advertising injury claims. |

| Professional Liability Insurance | Protects against negligence claims arising from professional services. |

| Cyber Liability Insurance | Provides coverage for data breaches, cyber attacks, and online privacy violations. |

| Product Liability Insurance | Offers protection for businesses that sell products, covering claims of product defects or injuries caused by the product. |

Comparing Multiple Quotes

Another benefit of the online quote process is the ability to compare multiple insurance providers and their offerings. Business owners can easily shop around and evaluate different policies, allowing them to make an informed decision about which insurer and policy best meets their needs. This competitive environment often leads to more competitive pricing and better terms for the business.

The Process of Obtaining an Online Business Insurance Quote

The process of obtaining an online business insurance quote is typically straightforward and user-friendly. Most insurance providers have dedicated websites or online platforms that guide business owners through the quoting process. Here’s a general overview of what you can expect:

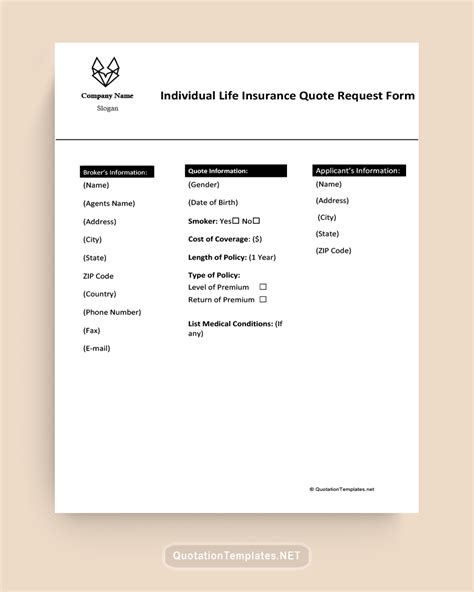

Step 1: Basic Information

The first step typically involves providing basic information about your business, such as the business name, address, and contact details. You may also be asked to provide information about the nature of your business, the products or services you offer, and the number of employees you have.

Step 2: Coverage Requirements

In this step, you’ll be asked to specify the types of insurance coverage you’re interested in. This is where you can customize your quote based on your specific needs. Most platforms will guide you through the different coverage options, providing a clear understanding of what each policy covers.

Step 3: Business Details

To provide an accurate quote, insurance providers often require more detailed information about your business. This may include the annual revenue of your business, the number of years in operation, and any specific risks or challenges your business faces. For online businesses, they may ask about the nature of your online presence, the types of data you handle, and your cybersecurity measures.

Step 4: Review and Submit

Once you’ve provided all the necessary information, you’ll be able to review the quote, including the coverage details and the associated costs. If you’re satisfied with the quote, you can proceed to purchase the insurance policy. In some cases, you may be able to make adjustments to your coverage or shop around for better rates before finalizing your purchase.

Factors Affecting Online Business Insurance Quotes

The cost of online business insurance can vary significantly depending on several factors. Understanding these factors can help business owners make informed decisions and potentially reduce their insurance costs.

Industry and Business Size

The industry your business operates in can have a significant impact on your insurance costs. Certain industries, such as e-commerce, technology, or professional services, may face higher risks and therefore higher insurance premiums. Similarly, the size of your business, measured by factors such as annual revenue or the number of employees, can also affect your insurance costs. Larger businesses often require more extensive coverage and may face higher premiums.

Claims History

Insurance providers consider the claims history of a business when determining insurance rates. Businesses with a history of frequent or large claims may be seen as higher risk and may face higher premiums. Conversely, businesses with a clean claims record may be rewarded with lower insurance costs.

Risk Management Measures

Insurance companies often offer incentives for businesses that take proactive measures to reduce their risks. This can include implementing robust cybersecurity measures, employee training programs, or adopting safety protocols. By demonstrating a commitment to risk management, businesses can potentially lower their insurance costs and improve their overall risk profile.

Choosing the Right Insurance Provider

When it comes to selecting an insurance provider for your online business, it’s important to consider several factors to ensure you’re getting the best coverage and value for your money.

Reputation and Financial Stability

Opting for an insurance provider with a solid reputation and strong financial stability is crucial. This ensures that the provider will be able to meet their obligations and pay out claims when needed. Check for customer reviews and ratings, and consider the provider’s financial strength rating from independent agencies like AM Best or Moody’s.

Coverage Options and Customization

Different insurance providers offer varying coverage options and customization capabilities. Assess your specific business needs and risks, and choose a provider that offers comprehensive coverage tailored to your requirements. Some providers may specialize in certain industries or offer unique coverage options that align with your business activities.

Claims Handling and Customer Service

The claims process and customer service of an insurance provider can significantly impact your experience as a policyholder. Look for providers with a track record of efficient and fair claims handling. Consider factors such as response times, the availability of dedicated customer service representatives, and the overall ease of communication and interaction with the provider.

Pricing and Value

While pricing is an important consideration, it’s essential to balance cost with the value and quality of coverage. Compare quotes from multiple providers to ensure you’re getting competitive rates. However, remember that the cheapest option may not always provide the best coverage or service. Evaluate the coverage limits, deductibles, and exclusions to ensure you’re getting adequate protection for your business.

The Future of Online Business Insurance

The landscape of online business insurance is evolving rapidly, driven by technological advancements and changing business needs. Here’s a glimpse into some of the trends and developments shaping the future of this industry.

Increased Focus on Cyber Risks

As online businesses become more vulnerable to cyber threats, insurance providers are placing a greater emphasis on cyber risk coverage. We can expect to see more comprehensive cyber liability insurance policies, offering protection against a wider range of cyber incidents, including data breaches, ransomware attacks, and social engineering scams. These policies will likely become a standard part of any online business insurance portfolio.

Artificial Intelligence and Data Analytics

Insurance providers are increasingly leveraging artificial intelligence (AI) and data analytics to improve their risk assessment and underwriting processes. By analyzing vast amounts of data, insurers can more accurately identify and assess risks, leading to more tailored and efficient insurance solutions. This technology can also be used to develop predictive models, helping businesses identify potential risks and take proactive measures to mitigate them.

Digital Transformation of Insurance

The insurance industry as a whole is undergoing a digital transformation, with many providers investing in online platforms and digital tools to enhance the customer experience. This includes streamlined online quoting and purchasing processes, digital claims submission and tracking, and the use of mobile apps for policy management. These digital innovations will make it even easier for online businesses to access and manage their insurance coverage.

Collaborative Risk Management

Insurers are recognizing the importance of partnering with businesses to manage risks effectively. This collaborative approach involves providing businesses with resources, tools, and expertise to identify and mitigate risks. Insurance providers may offer risk assessment services, educational resources, or even discounts for businesses that demonstrate a commitment to risk management. This collaborative model benefits both businesses and insurers, leading to more sustainable and resilient operations.

FAQs

How do I know what type of insurance coverage my online business needs?

+

The type of insurance coverage your online business needs depends on several factors, including the nature of your business, the products or services you offer, and the potential risks you face. Common insurance policies for online businesses include general liability, professional liability, cyber liability, and product liability insurance. It’s essential to assess your specific needs and consult with an insurance professional to determine the right coverage for your business.

Can I customize my online business insurance policy to fit my specific needs?

+

Yes, many insurance providers offer customizable insurance policies for online businesses. You can typically choose the coverage types and limits that best fit your business’s unique needs. This customization ensures you’re not paying for coverage you don’t need while still maintaining adequate protection.

Are there any discounts available for online business insurance policies?

+

Yes, insurance providers often offer discounts for online businesses that take proactive measures to manage risks. This can include discounts for implementing robust cybersecurity measures, employee training programs, or adopting safety protocols. Additionally, some providers may offer bundle discounts if you purchase multiple policies from them.

How can I ensure I’m getting the best value for my online business insurance policy?

+

To ensure you’re getting the best value for your online business insurance policy, it’s essential to shop around and compare quotes from multiple providers. Look for providers that offer comprehensive coverage tailored to your specific needs, and consider factors such as reputation, financial stability, claims handling, and customer service. Remember to balance cost with the quality and adequacy of coverage.