How Much Life Insurance Should I Have

Determining the right amount of life insurance coverage is a crucial financial decision that requires careful consideration. Life insurance serves as a safety net, providing financial protection and peace of mind for your loved ones in the event of your untimely demise. However, with various types of life insurance policies and differing coverage amounts, it can be challenging to determine the ideal amount that suits your unique circumstances.

In this comprehensive guide, we will delve into the factors that influence the amount of life insurance you should have. By understanding these considerations and implementing strategic planning, you can ensure that your life insurance policy aligns perfectly with your financial goals and provides the necessary support for your family's future.

Understanding Life Insurance Coverage

Life insurance is a financial tool designed to provide a monetary benefit to your beneficiaries upon your death. It acts as a safety net, ensuring that your loved ones are financially secure and can maintain their standard of living even in the absence of your income. The coverage amount you choose directly impacts the level of financial protection your beneficiaries will receive.

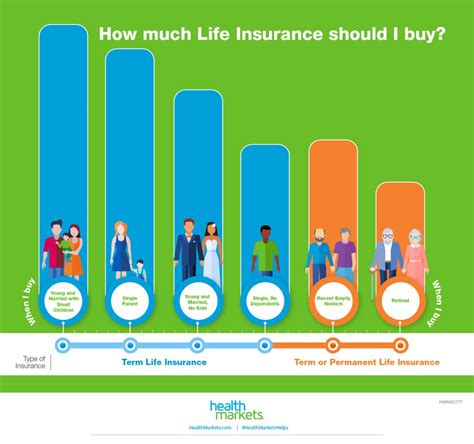

There are primarily two types of life insurance: term life insurance and permanent life insurance. Term life insurance offers coverage for a specified period, typically ranging from 10 to 30 years. It is often more affordable and suitable for individuals with temporary financial needs, such as covering mortgage payments or supporting young children until they become financially independent. On the other hand, permanent life insurance, including whole life and universal life policies, provides lifelong coverage and accumulates cash value over time, making it a more comprehensive and long-term solution.

Assessing Your Financial Needs

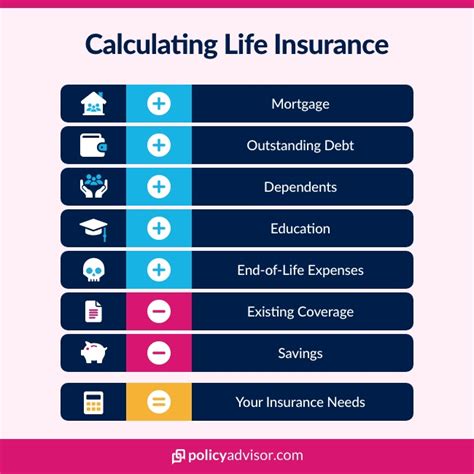

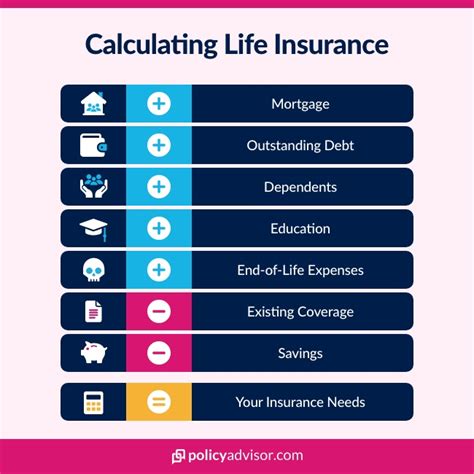

To determine the appropriate amount of life insurance coverage, you must first assess your unique financial needs. This involves evaluating various factors that contribute to your overall financial picture. Here are some key considerations:

Income Replacement

One of the primary purposes of life insurance is to replace your income and ensure your family’s financial stability. Calculate the amount of income your family would need annually to maintain their current lifestyle and cover essential expenses such as housing, groceries, education, and healthcare. Consider factors like your current income, the number of dependents, and any future income expectations. Aim to provide a coverage amount that can replace your income for an extended period, ideally until your children become financially independent or your spouse can comfortably retire.

| Factor | Amount |

|---|---|

| Current Income | $[Current Income] |

| Number of Dependents | [Number of Dependents] |

| Future Income Expectations | $[Future Income] |

| Total Coverage Needed | $[Total Coverage] |

Debt Obligations

Evaluate your outstanding debts, including mortgages, car loans, credit card balances, and any other liabilities. Ensure that your life insurance coverage can pay off these debts, providing your family with financial freedom and eliminating the burden of monthly payments. Consider the outstanding balance and the interest rates associated with each debt to determine the necessary coverage amount.

Funeral and Estate Expenses

Funeral and estate expenses can be a significant financial burden for your loved ones. Life insurance coverage should include an amount sufficient to cover these costs, ensuring that your family doesn’t have to compromise on your final arrangements or face financial strain during an already challenging time.

Educational Goals

If you have children or plan to have them, consider their future educational expenses. Calculate the estimated cost of their education, including tuition fees, accommodation, and other related expenses. Ensure that your life insurance coverage includes an amount dedicated to funding their education, providing them with opportunities for a brighter future.

Specific Financial Goals

Identify any specific financial goals or milestones that you wish to achieve or provide for your family. This could include purchasing a new home, starting a business, or saving for retirement. Life insurance coverage should accommodate these goals, ensuring that your loved ones can continue pursuing their dreams even in your absence.

Factors Influencing Coverage Amount

Apart from assessing your financial needs, several other factors influence the amount of life insurance coverage you should have. Understanding these factors will help you make an informed decision.

Age and Health

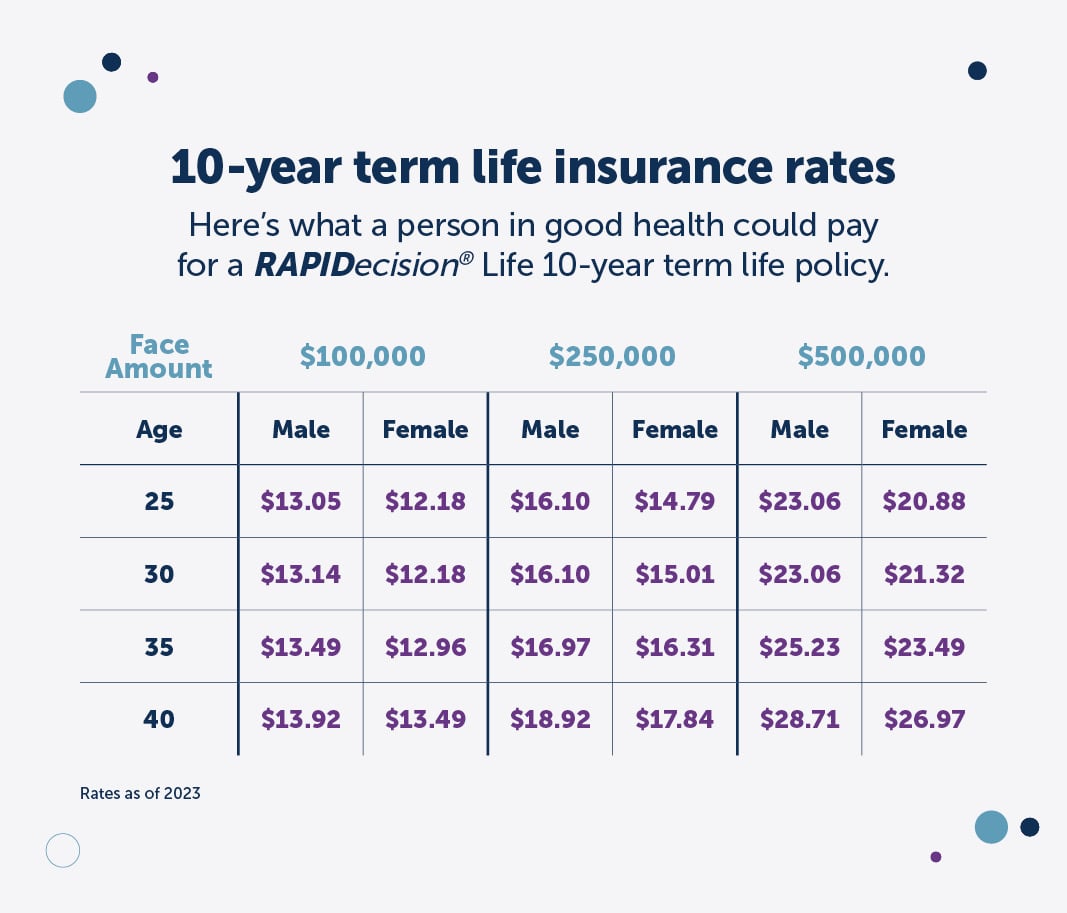

Your age and health play a significant role in determining life insurance coverage. Generally, younger individuals with good health can obtain more extensive coverage at lower premiums. As you age or if you have certain health conditions, the cost of coverage may increase, and you may need to consider alternative policy options.

Inflation and Future Needs

Inflation is a crucial consideration when determining life insurance coverage. The purchasing power of money decreases over time due to inflation, so it’s essential to account for this factor. Ensure that your coverage amount is adjusted for inflation to maintain its real value and meet your future financial needs. Consider the historical inflation rate and project future costs to determine an adequate coverage amount.

Lifestyle and Risk Factors

Your lifestyle and risk factors can impact the cost and availability of life insurance coverage. Engaging in high-risk activities, such as extreme sports or dangerous occupations, may result in higher premiums or limited coverage options. Be transparent about your lifestyle choices when applying for life insurance to ensure you receive accurate coverage and premium estimates.

Beneficiaries and Their Needs

Consider the specific needs and financial responsibilities of your beneficiaries. If you have a spouse who relies on your income, ensure that the coverage amount is sufficient to support their lifestyle and cover their expenses. Additionally, consider any special needs or financial obligations your beneficiaries may have, such as medical expenses or long-term care requirements.

Strategies for Optimizing Coverage

Once you have assessed your financial needs and considered the influencing factors, it’s time to explore strategies to optimize your life insurance coverage. Here are some approaches to consider:

Term Life Insurance

Term life insurance is often an excellent choice for individuals with specific financial needs that are temporary in nature. If you have young children or a mortgage that will be paid off within a certain timeframe, term life insurance can provide adequate coverage during those critical years. Choose a term length that aligns with your financial goals and ensure the coverage amount is sufficient to meet those needs.

Permanent Life Insurance

Permanent life insurance, such as whole life or universal life policies, offers lifelong coverage and builds cash value over time. This type of insurance is ideal for individuals seeking long-term financial protection and the opportunity to accumulate wealth. The cash value component can be used for various purposes, such as funding retirement, paying off debts, or providing a financial cushion for your family.

Combining Policies

In some cases, combining term and permanent life insurance policies can be a strategic approach. You can purchase a term life insurance policy to cover your immediate financial needs, such as mortgage payments or child-rearing expenses, while simultaneously investing in a permanent life insurance policy that builds cash value over time. This combination ensures short-term financial protection and long-term financial security.

Regularly Review and Adjust Coverage

Life insurance coverage should be regularly reviewed and adjusted to accommodate changing circumstances. As your financial needs evolve, whether due to increased income, new dependents, or different financial goals, ensure that your coverage amount remains adequate. Regularly assess your coverage and make necessary adjustments to ensure it continues to meet your family’s needs.

Conclusion

Determining the right amount of life insurance coverage is a critical financial decision that requires a thorough understanding of your financial needs and the influencing factors. By assessing your income replacement needs, debt obligations, educational goals, and specific financial aspirations, you can make an informed choice about the coverage amount that best suits your situation. Remember to consider factors such as age, health, inflation, and lifestyle when making this decision.

With the right life insurance coverage in place, you can provide your loved ones with the financial security and peace of mind they deserve. It's an investment in their future and a way to ensure they can continue living their lives comfortably and pursuing their dreams, even in your absence. Take the time to carefully evaluate your needs, seek professional guidance, and choose a life insurance policy that aligns perfectly with your financial goals.

Frequently Asked Questions

How much life insurance do I need if I’m single with no dependents?

+If you’re single with no dependents, your life insurance needs may be primarily focused on covering funeral and estate expenses. A coverage amount of around 10,000 to 25,000 should be sufficient to cover these costs. However, it’s important to consider any outstanding debts or specific financial goals you may have, such as paying off student loans or funding a business venture. Consult with a financial advisor to determine the appropriate coverage amount for your unique circumstances.

What if I have a high-risk occupation or engage in extreme sports? Will I be able to get life insurance coverage?

+Having a high-risk occupation or engaging in extreme sports can impact your life insurance coverage and premiums. Insurance companies consider these factors when assessing your risk profile. While it may be more challenging to obtain coverage, there are still options available. You may need to disclose your activities and potentially undergo additional medical examinations or provide detailed information about your participation in high-risk activities. Consulting with a specialized insurance broker who works with high-risk individuals can help you find suitable coverage options.

Can I increase my life insurance coverage in the future if my financial needs change?

+Yes, you can increase your life insurance coverage in the future if your financial needs change. Most life insurance policies allow you to make adjustments to your coverage amount. However, it’s important to review your policy’s terms and conditions, as some policies may have limitations or require additional medical examinations when increasing coverage. Regularly reassessing your financial needs and consulting with your insurance provider can help you make informed decisions about adjusting your coverage.

Are there any tax benefits associated with life insurance coverage?

+Yes, life insurance coverage can offer certain tax benefits. The death benefit proceeds from a life insurance policy are generally income tax-free to the beneficiaries. Additionally, the cash value component of permanent life insurance policies may have tax advantages, as it grows tax-deferred. However, it’s important to consult with a tax professional to understand the specific tax implications and benefits associated with your life insurance policy.