Rates Insurance

Insurance rates, a vital aspect of the financial landscape, play a crucial role in safeguarding individuals, businesses, and assets from unforeseen risks and losses. The complexity of these rates often goes beyond simple numerical values, encompassing a wide array of factors that influence their determination. This article aims to delve into the intricacies of insurance rates, exploring the various elements that contribute to their calculation and the strategies employed to secure the most favorable coverage at competitive prices.

Understanding Insurance Rates: A Comprehensive Overview

Insurance rates, also known as premiums, represent the financial obligation that policyholders undertake in exchange for the protection and security provided by insurance companies. These rates are meticulously calculated based on a multitude of variables, each contributing uniquely to the overall risk assessment and subsequent pricing.

Key Factors Influencing Insurance Rates

The determination of insurance rates is a meticulous process that takes into account a diverse range of factors. These include:

- Risk Assessment: A comprehensive evaluation of potential risks is conducted, considering factors such as the nature of the insured asset, its location, and historical data related to similar risks.

- Policy Coverage: The extent of coverage chosen by the policyholder significantly influences the rate. Higher coverage levels typically result in higher premiums.

- Demographic Factors: Personal information like age, gender, and occupation can impact rates, as certain demographics may be associated with higher risk profiles.

- Historical Claims: Insurance companies analyze an individual’s or business’s claim history to assess their risk propensity. Frequent claims may lead to higher premiums.

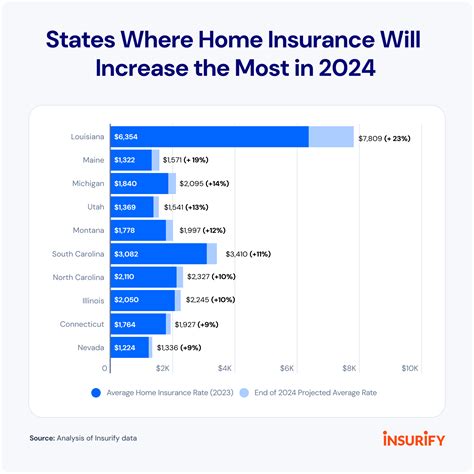

- Location: Geographical factors, including the incidence of natural disasters or crime rates, can substantially affect insurance rates.

- Type of Insurance: Different types of insurance, such as auto, health, or property insurance, carry varying levels of risk and hence, different premium structures.

- Competitive Market: The insurance market is highly competitive, and companies often adjust their rates to remain competitive while maintaining profitability.

The Impact of Personal and Business Factors

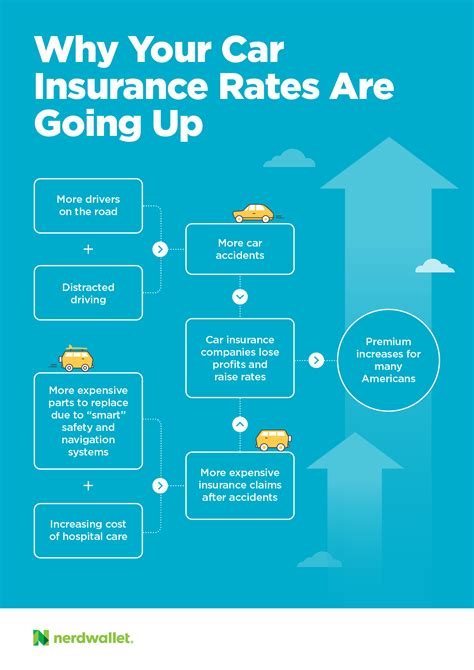

For individuals, insurance rates can be influenced by personal choices and lifestyle factors. For instance, a person’s driving record and the safety features of their vehicle can impact auto insurance rates. Similarly, health insurance premiums may be affected by an individual’s medical history and lifestyle habits.

Businesses, on the other hand, face a unique set of challenges. Insurance rates for commercial entities can be influenced by factors such as the industry they operate in, the size of their operations, and their safety records. For example, a manufacturing company with a history of workplace accidents may face higher insurance rates compared to a similar company with a strong safety record.

| Factor | Impact on Rates |

|---|---|

| Risk Assessment | Crucial in determining the base rate and can significantly affect the overall premium. |

| Policy Coverage | Higher coverage often leads to higher premiums, providing a broader safety net. |

| Demographic Factors | Can influence rates, especially for age-related risks like life or health insurance. |

| Historical Claims | Frequent or costly claims can lead to increased premiums to offset the risk. |

| Location | Geographical risks, such as natural disasters or crime, can substantially affect rates. |

| Type of Insurance | Different types of insurance carry varying levels of risk, impacting the premium structure. |

| Competitive Market | Companies may adjust rates to remain competitive, offering attractive premiums. |

Strategies for Securing Competitive Insurance Rates

Navigating the complexities of insurance rates can be challenging, but several strategies can help individuals and businesses secure competitive premiums. Here’s a comprehensive guide to optimizing your insurance coverage and costs.

1. Understand Your Risk Profile

The first step towards securing favorable insurance rates is understanding your unique risk profile. This involves a thorough assessment of your personal or business circumstances, including any factors that might increase your risk level. By identifying these risks, you can take proactive measures to mitigate them, which can lead to reduced insurance premiums.

2. Shop Around and Compare Quotes

The insurance market is highly competitive, and rates can vary significantly between providers. Shopping around and comparing quotes from multiple insurers is a powerful strategy to ensure you’re getting the best value for your money. Online comparison tools can be particularly useful for quickly and efficiently assessing a range of options.

3. Bundle Your Insurance Policies

Many insurance companies offer discounts when you bundle multiple policies with them. For instance, you might consider combining your auto and home insurance, or your life and health insurance. This not only simplifies your insurance management but can also lead to substantial savings.

4. Increase Your Deductible

Opting for a higher deductible can significantly reduce your insurance premiums. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you’re essentially taking on more financial responsibility, which can result in lower rates.

5. Maintain a Good Credit Score

In many cases, your credit score can impact your insurance rates. Insurance companies often use credit-based insurance scores to assess your risk level. A higher credit score can indicate a lower risk profile, which may result in more favorable insurance rates. So, maintaining a good credit score can be a strategic move when it comes to insurance.

6. Utilize Loyalty and Other Discounts

Insurance companies often offer loyalty discounts to reward long-term customers. Additionally, you might be eligible for other types of discounts, such as those for safe driving, home security systems, or certain professional affiliations. Be sure to inquire about all the potential discounts you might qualify for.

7. Review and Adjust Your Coverage Regularly

Your insurance needs can change over time, whether due to life changes, business growth, or other factors. Regularly reviewing your insurance coverage and making necessary adjustments can help ensure you’re adequately protected without overpaying. This might involve increasing or decreasing your coverage limits or making other adjustments to your policy.

8. Explore Alternative Insurance Options

Traditional insurance isn’t the only option. Alternative insurance models, such as peer-to-peer insurance or parametric insurance, are gaining traction and can offer unique benefits and cost savings. While these options might not be suitable for everyone, they’re worth exploring as they could provide a more tailored and cost-effective solution.

9. Seek Professional Advice

Navigating the complex world of insurance can be challenging. Consider seeking advice from a qualified insurance broker or financial advisor who can provide expert guidance tailored to your specific needs and circumstances. They can help you understand your options, make informed decisions, and potentially negotiate better rates on your behalf.

The Future of Insurance Rates: Emerging Trends and Technologies

The insurance industry is undergoing significant transformation, driven by technological advancements and changing consumer expectations. These shifts are poised to shape the future of insurance rates and how they’re determined.

Technological Disruption in the Insurance Sector

The integration of technology, particularly artificial intelligence (AI) and data analytics, is revolutionizing the insurance landscape. AI-powered algorithms can now analyze vast amounts of data to assess risks more accurately and efficiently. This enhanced risk assessment capability enables insurance companies to offer more precise and competitive rates, tailored to individual needs.

The Rise of Telematics and Usage-Based Insurance

Telematics, the technology used to track and monitor vehicle usage, is gaining prominence in the insurance industry. Usage-based insurance (UBI) models leverage telematics data to offer rates that are directly linked to an individual’s driving behavior. This innovative approach provides drivers with greater control over their insurance costs, as safer driving habits can lead to significant savings.

Blockchain and Smart Contracts in Insurance

Blockchain technology is poised to disrupt the insurance industry by enhancing transparency, security, and efficiency. Smart contracts, self-executing contracts with the terms of the agreement directly written into code, can automate various insurance processes, including claims handling. This technology has the potential to reduce administrative costs and streamline insurance operations, ultimately impacting insurance rates.

The Role of Insurtech Startups

Insurtech startups are driving innovation in the insurance sector, leveraging technology to offer more efficient and customer-centric solutions. These startups are challenging traditional insurance models by offering innovative products, streamlined processes, and competitive rates. Their disruptive presence is forcing established insurers to adapt and innovate, ultimately benefiting consumers through improved services and more competitive pricing.

Conclusion: Navigating the Complex World of Insurance Rates

Insurance rates are a critical aspect of financial planning, impacting individuals and businesses alike. By understanding the factors that influence these rates and implementing strategic approaches to secure competitive premiums, you can ensure you’re adequately protected without compromising your financial well-being.

As the insurance industry continues to evolve, driven by technological advancements and changing market dynamics, staying informed and adaptable is key. Whether it's leveraging new technologies, exploring alternative insurance models, or seeking expert advice, there are numerous avenues to optimize your insurance coverage and costs.

How do insurance companies determine rates for different types of insurance?

+Insurance companies use a combination of factors to determine rates for different types of insurance. These factors include risk assessment, policy coverage, demographic information, historical claims data, location, and the competitive market. Each type of insurance (e.g., auto, health, property) carries unique risks and therefore requires a tailored approach to rate determination.

What are some strategies to lower insurance rates for individuals?

+For individuals, strategies to lower insurance rates include understanding your risk profile, shopping around for the best quotes, bundling policies with the same insurer, increasing your deductible, maintaining a good credit score, utilizing available discounts, and regularly reviewing and adjusting your coverage.

How are businesses impacted by insurance rates, and what strategies can they employ to manage costs?

+Businesses are significantly impacted by insurance rates, as these costs can directly affect their profitability. To manage insurance costs, businesses can implement strategies such as conducting a comprehensive risk assessment, negotiating rates with insurers, leveraging technology for risk mitigation, exploring alternative insurance models, and regularly reviewing and adjusting their coverage to align with their changing business needs.

What role does technology play in shaping the future of insurance rates?

+Technology is playing an increasingly significant role in shaping the future of insurance rates. Innovations like AI, data analytics, telematics, blockchain, and smart contracts are transforming the industry, enabling more accurate risk assessment, efficient claims handling, and personalized insurance products. These advancements have the potential to lower administrative costs and provide consumers with more competitive insurance rates.