Private Health Insurer

In today's rapidly evolving healthcare landscape, the role of private health insurers has become increasingly significant. As medical costs rise and access to quality healthcare becomes a growing concern, private health insurance has emerged as a crucial component of many individuals' and families' healthcare plans. This article delves into the intricate world of private health insurance, exploring its key features, benefits, and the impact it has on individuals and the broader healthcare system.

Understanding Private Health Insurance

Private health insurance, often referred to as private medical insurance or PMI, is a form of insurance coverage that provides financial protection for individuals and families in the event of illness or injury. It offers an alternative to public healthcare systems by providing access to private medical facilities and treatments, often with faster access to specialized care and reduced waiting times.

The concept of private health insurance is not new, but its relevance and importance have grown significantly in recent years. With advancements in medical technology and an aging global population, the demand for efficient and personalized healthcare services has increased. Private health insurers have stepped up to meet these demands, offering a range of comprehensive plans tailored to individual needs.

Key Features of Private Health Insurance Plans

Private health insurance plans offer a multitude of features designed to provide comprehensive coverage and peace of mind. Here are some of the key aspects that make these plans attractive to consumers:

- Hospitalization Coverage: The primary purpose of private health insurance is to cover the costs associated with hospitalization. This includes expenses related to surgery, intensive care, and specialized treatments.

- Outpatient Benefits: Many plans also offer coverage for outpatient services, such as consultations with specialists, diagnostic tests, and therapies.

- Dental and Optical Care: Some insurers include dental and optical coverage in their plans, providing additional benefits for maintaining oral and visual health.

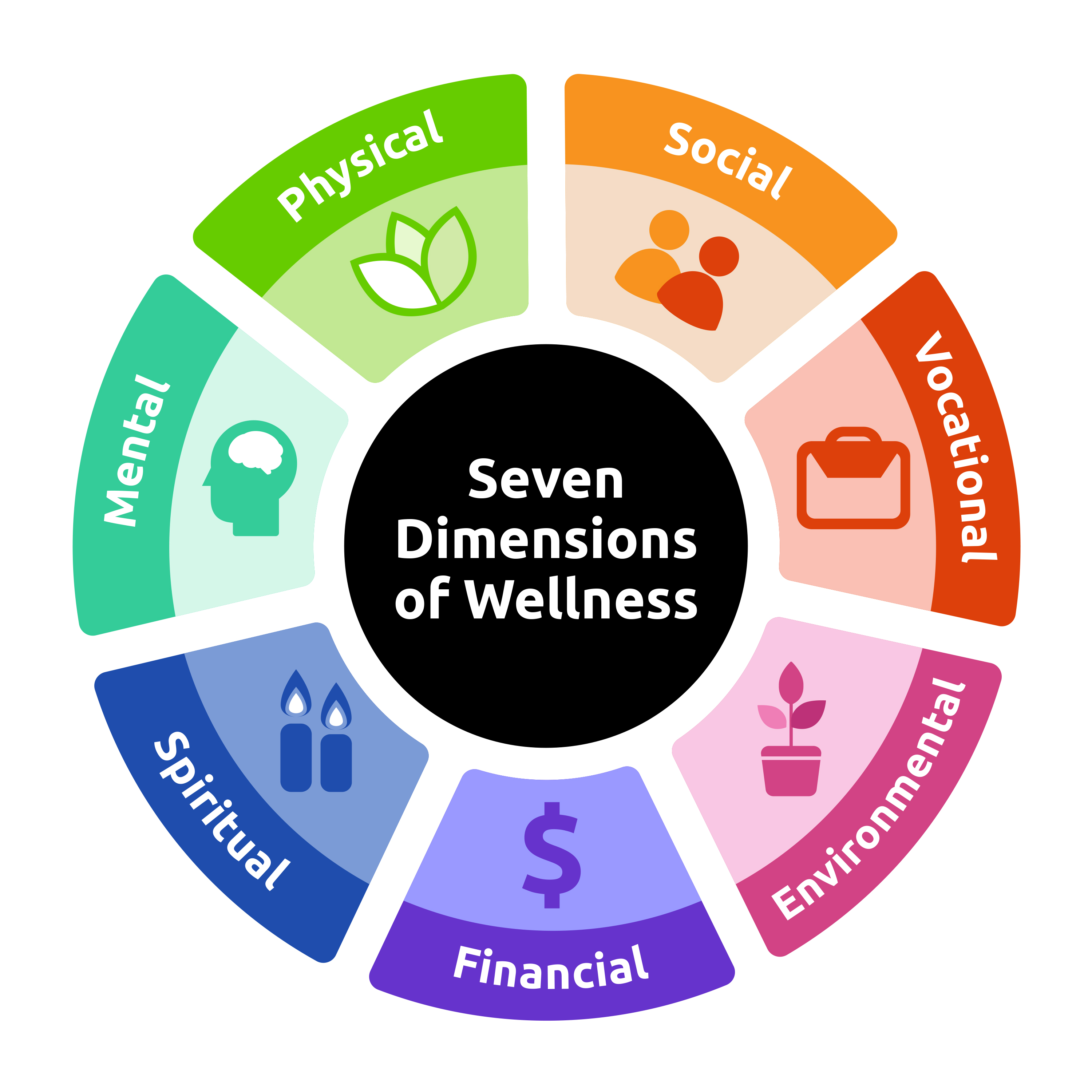

- Mental Health Support: With mental health awareness on the rise, several private health insurers now offer dedicated coverage for mental health conditions, ensuring access to therapy and counseling services.

- Travel Insurance: Certain plans provide international travel insurance, covering medical emergencies that may arise while traveling abroad.

- Alternative Therapies: A unique feature of some private health insurance plans is the inclusion of alternative medicine therapies like acupuncture or chiropractic care.

- Cashless Treatment: Many insurers have partnerships with a network of hospitals and clinics, allowing policyholders to receive treatment without having to pay upfront and then claim reimbursement.

The Benefits of Private Health Insurance

Private health insurance offers a range of advantages that make it an appealing choice for individuals and families:

- Faster Access to Treatment: One of the most significant benefits is the reduced waiting times for medical procedures and consultations. Private patients often receive priority treatment, which can be crucial in emergency situations.

- Choice of Healthcare Providers: Policyholders have the freedom to choose their preferred healthcare professionals and facilities, ensuring they receive care from trusted sources.

- Comprehensive Coverage: Private health insurance plans are highly customizable, allowing individuals to select the level of coverage that suits their specific needs and budget.

- Enhanced Privacy and Comfort: Private healthcare facilities often offer more privacy and comfort compared to public hospitals, ensuring a more personalized and dignified experience during treatment.

- Cover for Pre-existing Conditions: Unlike some public healthcare systems, private health insurance can cover pre-existing conditions, ensuring continuity of care for individuals with chronic illnesses.

- Additional Perks: Many insurers offer additional benefits, such as access to health and wellness programs, discounted gym memberships, and health assessments.

Impact on Individuals and the Healthcare System

The presence of private health insurers has a significant impact on both individuals and the broader healthcare system. Here’s a deeper look at these implications:

Individual Benefits

For individuals, private health insurance provides a safety net against the financial burden of unexpected medical expenses. It offers peace of mind, knowing that they have access to quality healthcare without facing significant financial strain. Additionally, the flexibility and choice provided by private health insurance plans allow individuals to take a more proactive approach to their health and well-being.

Private health insurance is particularly beneficial for individuals with specific healthcare needs, such as those requiring ongoing treatment for chronic conditions or those seeking access to cutting-edge medical technologies. It ensures that they can receive the specialized care they require without having to wait for public healthcare services.

Healthcare System Dynamics

The introduction of private health insurers into the healthcare system has led to a more competitive environment, driving innovation and efficiency in healthcare delivery. Private healthcare providers often invest in advanced medical technologies and specialized facilities, which can benefit the entire healthcare system by setting higher standards for care.

Furthermore, private health insurance can help reduce the strain on public healthcare systems by providing an alternative for those who can afford it. This, in turn, allows public healthcare resources to be allocated more effectively, focusing on those who cannot access private healthcare.

However, it's important to note that the presence of private health insurers also raises concerns about equity and accessibility. Ensuring that private healthcare remains accessible to a diverse range of individuals, regardless of their socioeconomic status, is a critical challenge that policymakers and insurers must address.

Future Outlook

The future of private health insurance looks promising, with a growing demand for personalized and efficient healthcare services. As medical technology continues to advance, private insurers are likely to play an even more significant role in providing access to innovative treatments and specialized care.

Furthermore, with the increasing focus on preventative care and wellness, private health insurers are expected to expand their offerings to include more holistic health management programs. This shift towards preventative healthcare is not only beneficial for individuals but also has the potential to reduce overall healthcare costs in the long run.

However, ensuring that private health insurance remains affordable and accessible to a wide range of individuals will be a key challenge. Insurers and policymakers will need to work together to strike a balance between providing comprehensive coverage and keeping premiums within reach for the average consumer.

Conclusion

Private health insurance is an essential component of the modern healthcare landscape, offering individuals and families access to quality healthcare services with reduced waiting times and increased flexibility. While it presents numerous benefits, it also raises important considerations regarding equity and accessibility.

As we move forward, it is crucial to strike a balance between the advantages of private health insurance and the need to ensure that quality healthcare remains accessible to all. With continued innovation and collaboration between private insurers, healthcare providers, and policymakers, we can work towards a healthcare system that provides efficient, effective, and equitable care for all.

How does private health insurance differ from public healthcare systems?

+Private health insurance offers faster access to specialized treatments and allows individuals to choose their healthcare providers. It provides comprehensive coverage for various medical needs and often includes additional benefits like dental and optical care. In contrast, public healthcare systems typically have longer waiting times and may have limited access to certain specialized treatments.

What factors should I consider when choosing a private health insurance plan?

+When selecting a private health insurance plan, consider your specific healthcare needs, the level of coverage required, and your budget. It’s essential to review the policy’s terms, including exclusions and waiting periods. Additionally, check the insurer’s reputation and financial stability to ensure they can provide long-term coverage.

Can private health insurance cover pre-existing conditions?

+Yes, many private health insurance plans offer coverage for pre-existing conditions. However, it’s crucial to review the policy’s terms and conditions carefully, as some plans may have waiting periods or specific exclusions for certain pre-existing conditions. Consulting with an insurance advisor can help you understand the coverage options available.

Are there any tax benefits associated with private health insurance?

+Tax benefits for private health insurance vary depending on the jurisdiction. In some countries, premiums paid for private health insurance may be tax-deductible, providing an additional incentive for individuals to purchase coverage. It’s advisable to consult with a tax professional or financial advisor to understand the specific tax implications in your region.

How can I compare different private health insurance plans to find the best fit for me?

+Comparing private health insurance plans can be done through online comparison tools or by consulting with an insurance broker. These resources allow you to evaluate plans based on coverage, premiums, and additional benefits. It’s essential to assess your specific healthcare needs and budget to make an informed decision.