Do I Have Flood Insurance

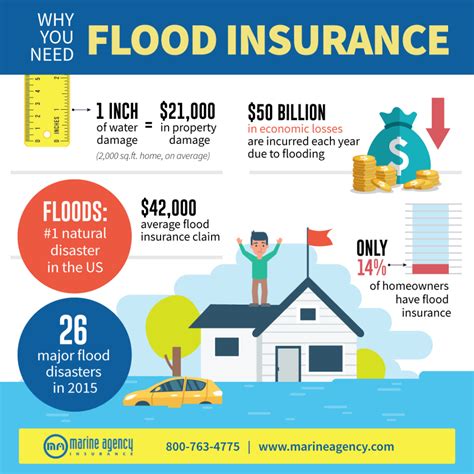

As a homeowner or renter, it's essential to understand your insurance coverage, especially when it comes to natural disasters like floods. Flooding can cause significant damage to properties, and being prepared with the right insurance can provide much-needed financial protection. This article aims to guide you through the process of determining whether you have flood insurance, understanding its importance, and making informed decisions to safeguard your assets.

Understanding Flood Insurance

Flood insurance is a specialized type of coverage that provides financial assistance to policyholders in the event of flooding. Unlike standard homeowner’s or renter’s insurance policies, which typically exclude flood damage, flood insurance is designed to cover losses specifically caused by flooding.

Flooding can occur due to various reasons, including heavy rainfall, storm surges, river overflow, or even inadequate drainage systems. It can result in extensive damage to buildings, personal belongings, and even structural integrity. Without proper flood insurance, the costs of repairs and replacements can be overwhelming, often exceeding the financial capabilities of individuals.

Who Needs Flood Insurance?

The need for flood insurance is not limited to specific geographic areas. While it is true that certain regions are more prone to flooding due to their proximity to bodies of water or history of flooding events, any property can be at risk. Floods can happen anywhere, and the potential for damage is real.

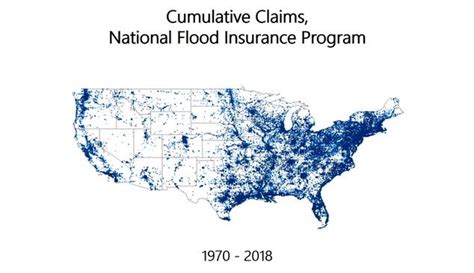

The Federal Emergency Management Agency (FEMA) categorizes flood risk zones based on historical data and scientific analysis. Properties located in high-risk flood zones, known as Special Flood Hazard Areas (SFHAs), are considered to have a 1% annual chance of flooding. These areas are mandatory for purchasing flood insurance, as outlined by the National Flood Insurance Program (NFIP).

However, it's crucial to note that even properties outside of high-risk zones can be susceptible to flooding. Moderate- to low-risk areas, while having a lower statistical likelihood of flooding, are not immune. Flooding can occur due to heavy rainfall, flash floods, or other unforeseen events. It's essential to assess your individual risk and take appropriate measures to protect your property.

| Flood Risk Zone | Description |

|---|---|

| High-Risk (SFHA) | Properties in these zones have a 1% annual chance of flooding and are mandatory for flood insurance. |

| Moderate- to Low-Risk | While less likely to flood, these areas are still susceptible and should be considered for insurance coverage. |

Checking Your Insurance Policy

Determining whether you have flood insurance involves a careful review of your existing insurance policies. Here are some steps to help you navigate this process:

1. Review Your Homeowner’s or Renter’s Insurance Policy

Start by examining your primary homeowner’s or renter’s insurance policy. These policies typically cover a range of perils, including fire, theft, and certain weather-related damages. However, standard policies often exclude flood damage. Look for a section dedicated to covered perils or exclusions to confirm whether flooding is included.

If your policy explicitly excludes flood damage, it's a strong indicator that you may not have flood insurance. In such cases, you will need to explore other options to obtain the necessary coverage.

2. Contact Your Insurance Provider

Reach out to your insurance provider or agent to discuss your coverage options. They can provide valuable insights into your current policy and guide you in understanding whether flood insurance is included. Insurance providers often have dedicated customer service representatives who can clarify any doubts and explain the specific terms of your policy.

During your conversation, ask about the extent of your coverage and any additional endorsements or riders that may be applicable. Some insurance providers offer optional flood insurance coverage as an add-on to standard policies, so it's essential to inquire about these possibilities.

3. Assess Your Flood Risk

Even if your current insurance policy does not include flood coverage, it’s crucial to assess your individual flood risk. Consider the following factors:

- Location: Evaluate the flood risk associated with your property's location. Research historical flood data, local floodplain maps, and community flood plans to gain an understanding of the potential hazards.

- Property Characteristics: Assess the elevation and proximity to water bodies, drainage systems, or flood-prone areas. Properties located in low-lying areas or near rivers are at higher risk.

- Community Resources: Check if your community has flood management plans, early warning systems, or other measures in place to mitigate flood risks. These factors can impact your overall flood risk assessment.

Obtaining Flood Insurance

If you determine that your current insurance policy does not provide adequate flood coverage, it’s essential to take steps to obtain the necessary protection. Here’s what you need to know:

1. Understand Your Options

There are two primary sources of flood insurance:

- National Flood Insurance Program (NFIP): The NFIP, administered by FEMA, provides flood insurance to homeowners, renters, and business owners. It offers standardized coverage and is widely available across the United States. NFIP policies can be purchased through participating private insurance companies or directly through FEMA.

- Private Insurance Companies: Some private insurance providers offer their own flood insurance policies. These policies may provide additional coverage options or customization to meet specific needs. It's important to compare the terms, limits, and costs of private flood insurance policies with those offered by the NFIP.

2. Shop Around and Compare

Research and compare different flood insurance options to find the best coverage and pricing that suits your needs. Consider factors such as coverage limits, deductibles, and any additional benefits or exclusions. Reach out to multiple insurance providers or brokers to obtain quotes and assess their reputation and customer service.

When comparing policies, pay attention to the coverage limits and deductibles. Ensure that the limits are sufficient to cover the potential damage to your property and belongings. Deductibles can vary, so choose a deductible that aligns with your financial capabilities and risk tolerance.

3. Apply for Flood Insurance

Once you have identified the appropriate flood insurance provider, proceed with the application process. This typically involves filling out an application form, providing details about your property, and paying the required premium. The application process may vary depending on the insurance provider and the type of policy you choose.

Keep in mind that flood insurance policies often have waiting periods before they become effective. It's essential to plan ahead and apply for coverage well in advance of the flood season or any anticipated flooding events.

Understanding Flood Insurance Coverage

Flood insurance coverage can vary depending on the type of policy and the provider. It’s crucial to understand the specific terms and conditions of your policy to ensure you have the protection you need.

Coverage for Structures

Flood insurance typically covers the physical structure of your property, including the foundation, walls, ceilings, and floors. It may also cover certain permanent fixtures, such as built-in cabinets, plumbing, and electrical systems. However, it’s important to note that coverage for structures may have limitations, especially for older homes or properties with certain construction features.

Coverage for Contents

Flood insurance policies often provide coverage for personal belongings and contents within your home. This can include furniture, clothing, electronics, appliances, and other valuables. However, coverage limits and specific exclusions may apply. It’s essential to review your policy carefully to understand what is covered and the maximum limits for your personal belongings.

Additional Living Expenses

In the event that your home becomes uninhabitable due to flood damage, flood insurance policies may provide coverage for additional living expenses. This coverage helps reimburse you for temporary housing, meals, and other necessary expenses incurred while you cannot reside in your home. The coverage limits and duration for additional living expenses can vary, so review your policy to understand the specific terms.

Preparing for a Flood

Having flood insurance is an essential step in protecting your property, but it’s equally important to take proactive measures to prepare for potential flooding. Here are some key steps to consider:

1. Develop a Flood Preparedness Plan

Create a comprehensive flood preparedness plan that outlines the steps you and your family will take in the event of a flood. This plan should include evacuation routes, emergency contacts, and a list of important documents and valuables to prioritize. Share the plan with your household members and regularly review and update it to ensure everyone is aware of the necessary actions.

2. Elevate and Protect Valuables

Consider elevating important documents, electronics, and other valuable items to higher levels in your home. This can help minimize potential damage in the event of flooding. Additionally, invest in waterproof containers or bags to protect these items further. By taking these precautions, you can reduce the impact of flood damage on your belongings.

3. Maintain and Inspect Your Property

Regularly inspect and maintain your property to identify and address any potential flood-related issues. Check for proper drainage, clear any debris from gutters and downspouts, and ensure that your sump pump is in good working condition. Addressing these maintenance tasks can help prevent water accumulation and reduce the risk of flood damage.

Conclusion

Flood insurance is a vital component of protecting your home and belongings from the devastating effects of flooding. By understanding your insurance coverage, assessing your flood risk, and taking proactive measures, you can ensure that you have the necessary protection in place. Remember, flooding can happen anywhere, so it’s crucial to be prepared and have a comprehensive insurance plan.

Stay informed about your insurance options, regularly review your policies, and don't hesitate to reach out to insurance professionals for guidance. By taking these steps, you can have peace of mind knowing that you are covered in the event of a flood.

What is the average cost of flood insurance?

+The cost of flood insurance can vary depending on several factors, including the location of your property, the level of flood risk, and the coverage limits you choose. On average, flood insurance policies through the National Flood Insurance Program (NFIP) can range from a few hundred to a few thousand dollars per year. However, it’s important to note that the cost can be higher or lower based on your specific circumstances.

Can I get flood insurance if I live in a high-risk flood zone?

+Absolutely! In fact, if your property is located in a high-risk flood zone (SFHA), flood insurance is mandatory. The National Flood Insurance Program (NFIP) provides coverage for properties in these zones. It’s crucial to ensure that you have the necessary coverage to protect your investment.

Are there any alternatives to NFIP flood insurance?

+Yes, some private insurance companies offer flood insurance policies as an alternative to NFIP coverage. These policies may provide additional coverage options or customization. However, it’s important to carefully compare the terms, limits, and costs to ensure you get the best coverage for your needs.