Kaiser Health Insurance Cost

Kaiser Permanente is a renowned integrated healthcare organization in the United States, known for its comprehensive health plans and integrated care model. As one of the leading healthcare providers, Kaiser Permanente offers a range of health insurance options to cater to various needs and budgets. Understanding the costs associated with Kaiser health insurance plans is essential for individuals and families seeking affordable and quality healthcare coverage.

Understanding Kaiser Health Insurance Costs

Kaiser Permanente’s health insurance costs can vary depending on several factors, including the type of plan, location, age, and the level of coverage desired. The organization offers a variety of plan options, including individual, family, and employer-sponsored plans, each with its own set of benefits and premiums.

One of the unique aspects of Kaiser Permanente's health insurance is its integrated care delivery system. Unlike traditional insurance plans, Kaiser operates its own hospitals and medical facilities, allowing for a more coordinated and efficient healthcare experience. This integrated approach often results in lower administrative costs and can lead to more affordable insurance premiums.

The cost of Kaiser health insurance is primarily determined by the following key factors:

- Plan Type: Kaiser offers a range of plan types, such as HMO (Health Maintenance Organization) and PPO (Preferred Provider Organization). HMO plans generally have lower premiums but may have more restrictions on provider choices, while PPO plans offer more flexibility but typically come with higher costs.

- Coverage Level: The level of coverage desired, including deductibles, copayments, and out-of-pocket maximums, significantly impacts the cost of insurance. Higher coverage levels with lower out-of-pocket expenses usually result in higher premiums.

- Location: The cost of living and healthcare expenses vary across different regions in the United States. Consequently, the cost of Kaiser health insurance can differ based on the state and even the specific area within a state.

- Age and Gender: Like many health insurance providers, Kaiser considers age and gender when determining premiums. Generally, younger individuals pay lower premiums, while older individuals may pay more.

- Tobacco Use: Similar to other insurers, Kaiser may charge higher premiums for individuals who use tobacco products.

Analyzing Kaiser Health Insurance Plans and Costs

To illustrate the cost variations within Kaiser’s health insurance plans, let’s examine some specific examples. Please note that these costs are indicative and may vary based on the factors mentioned earlier.

Individual Plans

For individuals seeking coverage, Kaiser offers a range of plan options. A basic HMO plan with a low monthly premium might have a higher deductible, while a more comprehensive PPO plan could offer lower out-of-pocket expenses but at a higher monthly cost.

| Plan Type | Monthly Premium | Deductible | Out-of-Pocket Max |

|---|---|---|---|

| HMO Basic | $350 | $3,000 | $6,000 |

| PPO Standard | $420 | $2,000 | $4,500 |

In this example, the HMO Basic plan has a lower monthly premium but requires individuals to pay more out-of-pocket expenses before the insurance coverage kicks in. On the other hand, the PPO Standard plan has a higher monthly cost but offers lower deductibles and out-of-pocket maximums, making it a more comprehensive option.

Family Plans

Kaiser Permanente also offers a range of family health insurance plans, designed to provide coverage for multiple family members. These plans often have different pricing structures and benefits compared to individual plans.

| Plan Type | Monthly Premium (Family of 4) | Family Deductible | Individual Out-of-Pocket Max |

|---|---|---|---|

| HMO Family Value | $1,200 | $6,000 | $3,500 |

| PPO Family Select | $1,450 | $4,000 | $2,800 |

In this example, the HMO Family Value plan has a lower monthly premium for a family of four, but it comes with a higher family deductible and individual out-of-pocket maximums. The PPO Family Select plan, on the other hand, offers lower deductibles and out-of-pocket expenses but at a higher monthly cost.

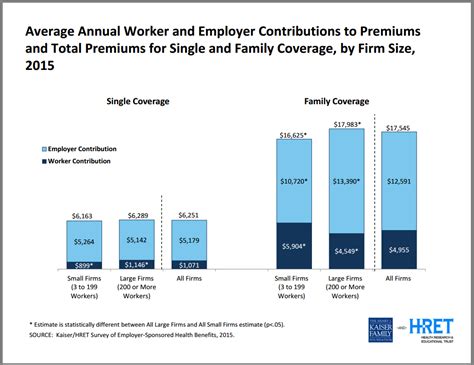

Employer-Sponsored Plans

Many employers offer Kaiser health insurance plans as part of their employee benefits packages. The cost of these plans is typically shared between the employer and the employee, with the employer often contributing a significant portion of the premium.

The specific costs and benefits of employer-sponsored plans can vary greatly depending on the employer's contributions and the plan's design. Employees may have a choice between different plan types, such as HMO or PPO, and may also have the option to enroll in additional coverage, like dental or vision insurance.

Cost-Saving Strategies for Kaiser Health Insurance

To make Kaiser health insurance more affordable, there are several strategies individuals and families can consider:

- Compare Plans: Research and compare the different plan options offered by Kaiser. Understanding the coverage and cost differences between HMO and PPO plans can help you choose the most suitable and cost-effective option for your needs.

- Evaluate Coverage Levels: Assess your healthcare needs and financial situation to determine the appropriate level of coverage. While higher coverage plans offer more financial protection, they may not be necessary if you have few healthcare expenses. Consider a lower coverage plan if it aligns with your needs and budget.

- Utilize Preventive Care: Kaiser Permanente emphasizes preventive care as a key component of its healthcare model. Taking advantage of preventive services, such as annual check-ups, screenings, and immunizations, can help identify and address health issues early on, potentially reducing future healthcare costs.

- Enroll in Wellness Programs: Kaiser offers various wellness programs and incentives to encourage healthy behaviors. Participating in these programs can lead to reduced insurance costs and improved overall health.

- Explore Subsidies and Assistance: If you meet certain income requirements, you may be eligible for subsidies or financial assistance through programs like Medicaid or the Affordable Care Act. These programs can significantly reduce the cost of Kaiser health insurance, making it more accessible.

Future Implications and Conclusion

As the healthcare landscape continues to evolve, Kaiser Permanente remains committed to providing accessible and quality healthcare. The organization’s integrated care model and focus on preventive care position it well to adapt to changing healthcare needs and technologies.

Looking ahead, Kaiser's emphasis on value-based care and its ongoing investments in digital health technologies are expected to further enhance the patient experience and potentially reduce overall healthcare costs. The organization's commitment to innovation and its large network of healthcare professionals and facilities ensure that it remains a leading healthcare provider in the United States.

In conclusion, understanding the costs associated with Kaiser health insurance plans is crucial for making informed decisions about your healthcare coverage. By considering the various plan options, evaluating your healthcare needs, and exploring cost-saving strategies, you can find a Kaiser health insurance plan that provides the right balance of coverage and affordability.

How do I choose the right Kaiser health insurance plan for my needs?

+Choosing the right plan involves assessing your healthcare needs, budget, and preferences. Consider factors like your typical healthcare expenses, the number of family members needing coverage, and whether you prefer more flexibility or lower premiums. Compare the benefits and costs of different plan types, such as HMO and PPO, to find the best fit.

Are there any discounts or special rates available for Kaiser health insurance plans?

+Kaiser offers various discounts and special rates depending on your eligibility. These may include discounts for early enrollment, group plans through employers, or special rates for certain demographics or health conditions. It’s worth checking with Kaiser or your employer to explore these options.

What is the process for enrolling in a Kaiser health insurance plan?

+The enrollment process varies depending on the plan type and your eligibility. For individual plans, you can typically enroll during the annual Open Enrollment period or if you experience a qualifying life event. Employer-sponsored plans often have designated enrollment periods, and you can enroll through your employer’s benefits department. It’s essential to understand the specific enrollment process for your desired plan.