Auto State Insurance

In the ever-evolving world of insurance, it is crucial to explore the unique offerings of various providers to make informed decisions about protecting our assets and securing our financial future. Among the multitude of insurance companies, Auto State Insurance stands out with its specialized services and a focus on the automotive industry. This article aims to delve deep into the world of Auto State Insurance, uncovering its history, services, and the impact it has on its customers and the industry as a whole.

A Legacy of Protection: The History of Auto State Insurance

Auto State Insurance, a name synonymous with automotive protection, has its roots firmly planted in the rich history of the insurance industry. Founded in 1972 by a group of visionary entrepreneurs, the company was born out of a passion for providing comprehensive insurance solutions tailored specifically to the needs of vehicle owners.

The early days of Auto State Insurance were marked by a commitment to innovation and a desire to revolutionize the way insurance was perceived and utilized. The founders, with their extensive experience in the industry, recognized the gap in the market for an insurance provider that specialized in automotive risks and tailored its policies to cater to the unique needs of car owners.

Over the years, Auto State Insurance has grown exponentially, establishing itself as a leading provider of automotive insurance across the nation. With a network of dedicated agents and a customer-centric approach, the company has successfully expanded its reach, offering its specialized services to millions of vehicle owners.

A key milestone in the company's history was its acquisition by a prominent insurance conglomerate in 2005. This strategic move not only provided Auto State Insurance with the resources and support to further enhance its services but also allowed it to leverage the expertise and infrastructure of a larger organization. The result was a more robust and efficient insurance provider, capable of delivering an even higher standard of service to its customers.

Today, Auto State Insurance continues to thrive, driven by its core values of integrity, innovation, and customer satisfaction. With a strong focus on research and development, the company consistently adapts to the changing landscape of the automotive industry, ensuring its policies remain relevant and comprehensive. This dedication to staying ahead of the curve has solidified Auto State Insurance's position as a trusted partner for vehicle owners seeking specialized insurance coverage.

The Breadth of Services: What Does Auto State Insurance Offer?

Auto State Insurance is not just another insurance provider; it is a comprehensive solution for all your automotive insurance needs. The company’s extensive range of services is tailored to provide the utmost protection and peace of mind to its customers.

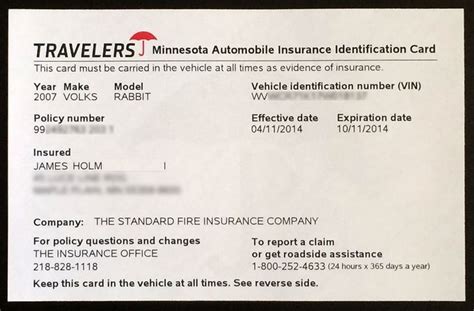

Comprehensive Auto Insurance

At the heart of Auto State Insurance’s offerings is its flagship product - comprehensive auto insurance. This policy provides a robust coverage plan that includes liability, collision, and comprehensive coverage, ensuring that vehicle owners are protected against a wide range of risks, from accidents to natural disasters.

| Coverage Type | Description |

|---|---|

| Liability | Covers bodily injury and property damage claims made against the insured. |

| Collision | Pays for repairs or replacement of the insured vehicle after an accident. |

| Comprehensive | Covers damages caused by non-collision incidents such as theft, vandalism, or natural disasters. |

Specialized Coverages

Beyond the standard auto insurance, Auto State Insurance offers a suite of specialized coverages designed to cater to the unique needs of different vehicle owners. These include:

- Classic Car Insurance: Tailored coverage for classic and vintage vehicles, offering specialized appraisal services and flexible mileage options.

- Motorcycle Insurance: Comprehensive protection for bikers, including coverage for accessories, custom parts, and medical payments.

- RV and Camper Insurance: Customized policies for recreational vehicles, providing coverage for personal belongings, emergency expenses, and liability protection.

- Boat and Watercraft Insurance: Protection for boat owners, covering hull damage, liability, and personal property on board.

Additional Services

Auto State Insurance goes beyond traditional insurance services by offering a range of value-added benefits to its customers. These include:

- Roadside Assistance: 24⁄7 emergency services for flat tires, towing, battery jumps, and more.

- Accident Forgiveness: A unique program that protects long-term customers from rate increases after their first at-fault accident.

- Discounts and Rewards: Auto State Insurance offers various discounts, such as multi-policy, good student, and safe driver discounts, as well as loyalty rewards for long-term customers.

The Impact: How Auto State Insurance Benefits Its Customers and the Industry

Auto State Insurance’s presence in the market has had a profound impact, not only on its customers but also on the insurance industry as a whole. Through its innovative approach and customer-centric services, the company has set new standards and driven positive change.

Enhanced Customer Experience

At the core of Auto State Insurance’s success is its unwavering focus on delivering an exceptional customer experience. The company’s dedicated agents, with their deep understanding of the automotive industry, provide personalized advice and tailored solutions to each customer. This level of service ensures that vehicle owners receive insurance coverage that is not only comprehensive but also aligned with their unique needs and circumstances.

Additionally, Auto State Insurance's online platform and mobile app offer customers convenient access to their policies and a range of self-service options. From policy management to filing claims, the digital tools provided by the company empower customers to take control of their insurance journey, further enhancing their overall experience.

Industry Innovation and Leadership

Auto State Insurance’s commitment to innovation has propelled the company to the forefront of the insurance industry. By continuously investing in research and development, the company stays ahead of the curve, anticipating and addressing emerging risks and trends in the automotive sector. This forward-thinking approach has led to the development of cutting-edge products and services that set new standards for the industry.

One notable example of Auto State Insurance's innovation is its introduction of advanced telematics technology. By leveraging this technology, the company offers usage-based insurance policies that reward safe driving behaviors with personalized rate adjustments. This not only encourages safer driving practices but also provides customers with more control over their insurance costs, fostering a culture of responsible driving.

Positive Social Impact

Beyond its core insurance services, Auto State Insurance is committed to making a positive impact on the communities it serves. The company actively engages in various social responsibility initiatives, supporting causes that promote road safety, environmental sustainability, and community development.

Through its partnerships with local organizations and charities, Auto State Insurance contributes to initiatives such as driver education programs, road safety campaigns, and environmental conservation efforts. These endeavors not only reflect the company's values but also help foster a safer and more sustainable future for all road users.

The Future of Auto State Insurance: Trends and Predictions

As we look to the future, Auto State Insurance is well-positioned to continue its trajectory of success and innovation. With a solid foundation built on customer satisfaction, industry leadership, and social responsibility, the company is poised to adapt and thrive in an ever-changing market.

Expanding Digital Presence

In line with the evolving preferences of its customers, Auto State Insurance is committed to enhancing its digital presence and offerings. The company recognizes the importance of providing a seamless and intuitive online experience, and thus, continues to invest in the development of its digital platforms and mobile applications.

By leveraging advanced technologies and innovative digital solutions, Auto State Insurance aims to make insurance more accessible and convenient for its customers. From simplified online policy management to enhanced claim processing and real-time communication, the company's digital initiatives will further empower customers to take control of their insurance journey.

Focus on Personalized Insurance

As the insurance industry continues to evolve, Auto State Insurance remains dedicated to delivering personalized insurance solutions that cater to the unique needs of each customer. The company understands that every vehicle owner has distinct requirements and circumstances, and thus, strives to offer tailored coverage options that provide the right balance of protection and affordability.

Through its advanced analytics and data-driven approach, Auto State Insurance will continue to refine its underwriting processes, ensuring that policies are accurately priced and tailored to individual risk profiles. This commitment to personalized insurance not only enhances customer satisfaction but also fosters a deeper understanding of customer needs, enabling the company to deliver even more targeted solutions in the future.

Embracing Sustainability and Environmental Initiatives

With growing awareness and concern for environmental sustainability, Auto State Insurance is committed to playing its part in reducing the industry’s environmental impact. The company recognizes the importance of adopting sustainable practices and integrating environmental considerations into its business operations.

From promoting eco-friendly driving behaviors to supporting electric vehicle adoption and sustainable transportation initiatives, Auto State Insurance aims to contribute to a greener and more sustainable future. By incorporating environmental considerations into its product offerings and corporate social responsibility programs, the company demonstrates its commitment to being a responsible corporate citizen and driving positive change in the industry.

What sets Auto State Insurance apart from other insurance providers?

+Auto State Insurance distinguishes itself through its specialized focus on automotive insurance, offering a comprehensive range of policies tailored to the unique needs of vehicle owners. The company’s commitment to innovation, customer satisfaction, and social responsibility sets it apart as a leading provider in the industry.

How does Auto State Insurance ensure competitive pricing for its insurance policies?

+Auto State Insurance employs advanced analytics and data-driven underwriting processes to accurately assess risk and price policies competitively. The company’s focus on personalized insurance ensures that policies are tailored to individual risk profiles, resulting in fair and affordable coverage options.

What additional benefits do Auto State Insurance customers enjoy beyond standard insurance coverage?

+In addition to comprehensive insurance coverage, Auto State Insurance customers benefit from value-added services such as 24⁄7 roadside assistance, accident forgiveness programs, and various discounts and rewards. These additional benefits enhance the overall customer experience and provide added peace of mind.