Insurance Telephone Number

The insurance industry, a cornerstone of financial security for countless individuals and businesses, operates on a foundation of trust and reliability. One of the key touchpoints between insurance providers and their policyholders is the telephone, offering a direct and personal means of communication. The insurance telephone number serves as a vital link, providing assistance, guidance, and support during times of need. In this comprehensive exploration, we delve into the significance of insurance telephone numbers, their role in customer service, and the evolving landscape of communication within the insurance sector.

The Role of Insurance Telephone Numbers in Customer Engagement

Insurance telephone numbers are more than just a means to contact a company; they are a crucial component of the customer engagement strategy. In an industry where trust and personalized service are paramount, the telephone line offers an immediate and intimate connection between the insurer and the insured. It allows for a two-way dialogue, enabling policyholders to ask questions, seek clarification, and receive expert advice tailored to their unique circumstances.

The insurance industry has long recognized the value of a dedicated telephone support system. It serves as a primary channel for customer inquiries, claims processing, and policy-related discussions. Insurance companies invest significant resources in training their telephone representatives to handle a diverse range of inquiries, from simple policy updates to complex claims scenarios. This human-centric approach fosters a sense of reassurance and confidence among policyholders, knowing they can reach out and receive prompt, knowledgeable assistance.

Benefits of a Dedicated Insurance Telephone Line

A dedicated insurance telephone line offers several advantages that contribute to a positive customer experience:

- Accessibility: Policyholders can reach out whenever they have a concern or query, ensuring easy access to support.

- Personalized Service: Trained representatives provide tailored advice, catering to individual needs.

- Real-time Support: Immediate assistance is available, addressing urgent matters promptly.

- Emotional Support: In times of stress, such as during a claim, a friendly voice can offer comfort and guidance.

- Trust and Confidence: Regular interaction builds trust, reinforcing the insurer-insured relationship.

Evolving Communication Channels: Beyond Traditional Calls

While the telephone remains a cornerstone of insurance customer service, the industry is embracing a broader spectrum of communication channels to meet the diverse needs and preferences of its customers. The digital transformation has brought about a range of innovative tools that enhance the customer experience and streamline operations.

One notable development is the integration of live chat features on insurance company websites. This real-time text-based communication allows customers to seek assistance without the need for a phone call. Live chat offers a convenient and discrete option, particularly for those who prefer typing over speaking. Insurance providers have invested in training their live chat representatives to handle a wide array of inquiries, ensuring a seamless and efficient experience.

Additionally, social media platforms have emerged as valuable communication channels. Insurance companies now utilize platforms like Twitter and Facebook to engage with customers, answer queries, and provide updates. This shift towards social media not only expands the reach of customer service but also aligns with the digital habits of a younger, tech-savvy demographic.

The rise of mobile apps has also revolutionized insurance communication. Many insurers now offer dedicated apps that enable policyholders to manage their policies, submit claims, and access support resources. These apps often include features like claim status tracking, digital ID cards, and even AI-powered assistants, providing a comprehensive and user-friendly experience.

| Communication Channel | Description |

|---|---|

| Telephone | Traditional voice-based support, offering personalized assistance. |

| Live Chat | Real-time text-based communication, providing an alternative to phone calls. |

| Social Media | Engaging customers through platforms like Twitter and Facebook for inquiries and updates. |

| Mobile Apps | Dedicated apps for policy management, claim submission, and AI-powered assistance. |

The Future of Insurance Communication: Omnichannel Approach

As the insurance industry continues to evolve, a clear trend emerges towards an omnichannel approach to customer communication. This strategy involves seamlessly integrating multiple channels, ensuring a consistent and personalized experience across all touchpoints. By combining traditional telephone support with digital channels like live chat, social media, and mobile apps, insurers can offer a flexible and convenient service that caters to the diverse needs of their customer base.

The omnichannel approach not only enhances customer satisfaction but also presents operational benefits. It allows insurers to collect valuable data and insights from various channels, enabling them to refine their strategies, improve processes, and deliver more targeted services. Additionally, the integration of advanced technologies like AI and machine learning can further optimize communication, providing efficient and accurate responses to customer inquiries.

Conclusion: The Impact of Insurance Telephone Numbers

The insurance telephone number stands as a symbol of reliability and support in an industry built on trust. While the landscape of communication evolves with digital advancements, the fundamental role of the telephone remains pivotal. It serves as a critical link between insurers and policyholders, offering personalized assistance, reassurance, and guidance. As the insurance industry embraces an omnichannel approach, the telephone number continues to be a cornerstone, anchoring a network of communication channels that empower and engage customers.

Frequently Asked Questions

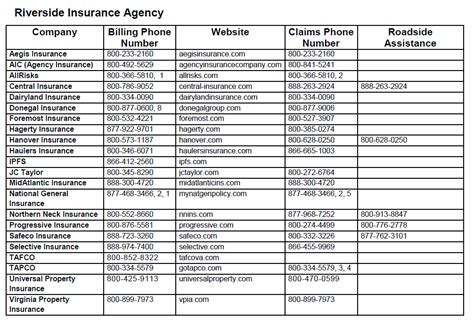

How do I find the insurance telephone number for my policy?

+Locating your insurance company’s telephone number is straightforward. Typically, it can be found on your insurance policy document, either on the first page or in the contact information section. Additionally, most insurance providers list their telephone numbers on their official websites. If you are unable to locate it, you can often find customer support contact details in the ‘Contact Us’ section of their website.

Are there specific hours when I can call the insurance company?

+Insurance companies generally operate within standard business hours, which often vary depending on the location and type of insurance. Some providers offer extended hours or even 24⁄7 support for emergency situations. It’s recommended to check the company’s website or contact details for specific operating hours to ensure you reach a representative when needed.

Can I use the insurance telephone number for urgent matters outside regular business hours?

+Absolutely! Most insurance companies understand the urgency of certain situations and provide dedicated emergency lines or after-hours support. These lines are typically intended for reporting accidents, thefts, or other urgent matters that require immediate attention. However, it’s advisable to check the specific details provided by your insurance company to ensure you reach the appropriate support during off-hours.