California Department Of Insurance Phone Number

The California Department of Insurance (CDI) is a vital state agency responsible for regulating the insurance industry and protecting the rights and interests of consumers in California. With a comprehensive range of responsibilities, from licensing insurance companies and agents to investigating consumer complaints and ensuring compliance with insurance laws, the CDI plays a crucial role in maintaining a fair and transparent insurance market. This article aims to provide an in-depth exploration of the CDI, its functions, and its significance to California residents, with a particular focus on its phone number and other essential contact details.

Understanding the Role of the California Department of Insurance

The California Department of Insurance was established to oversee and regulate the insurance industry within the state. It acts as a watchdog, ensuring that insurance companies and professionals operate ethically and in the best interests of policyholders. The CDI’s jurisdiction extends to all forms of insurance, including auto, health, life, property, and business insurance, making it a comprehensive regulatory body.

One of the key functions of the CDI is consumer protection. It receives and investigates complaints from policyholders, ensuring that insurance companies uphold their commitments and treat consumers fairly. Additionally, the department is responsible for licensing and regulating insurance professionals, including agents, brokers, and adjusters, to maintain high standards of professionalism and integrity within the industry.

The CDI also plays a crucial role in educating the public about insurance. It provides resources and guidance to help consumers make informed decisions when purchasing insurance policies. Furthermore, the department advocates for policyholders' rights, working to ensure that insurance laws are fair and consumer-friendly.

California Department of Insurance Contact Information

When it comes to contacting the California Department of Insurance, there are several methods available to reach out and seek assistance. The primary mode of communication is through their official phone number, which is a toll-free number accessible to all residents of California. Additionally, the CDI offers various other contact options to ensure accessibility and convenience for different types of inquiries and needs.

Here's a detailed breakdown of the California Department of Insurance contact information:

Phone Number

The primary phone number for the California Department of Insurance is (800) 927-HELP (4357). This toll-free number is available for all general inquiries, consumer complaints, and requests for information. The customer service representatives at this number are well-equipped to provide guidance and assistance on a wide range of insurance-related matters.

Office Addresses

The CDI maintains multiple offices across the state to serve California’s diverse population. Here are the addresses of the main offices:

| Office | Address |

|---|---|

| San Francisco | 300 South Spring Street, 14th Floor, Los Angeles, CA 90013 |

| Los Angeles | P.O. Box 944700, Sacramento, CA 94244-7000 |

| Sacramento | 1515 S Street, Sacramento, CA 95811 |

| Fresno | 2344 Mariposa Mall, Room 3513, Fresno, CA 93721 |

| Oakland | 1515 Clay Street, Suite 1700, Oakland, CA 94612 |

These offices provide in-person assistance and can be visited during regular business hours. Appointments are recommended for specific inquiries or to ensure prompt attention.

Online Resources and Contact Forms

The CDI has a comprehensive website that serves as a valuable resource for consumers. The website provides detailed information on various insurance topics, consumer rights, and regulatory updates. Additionally, it offers online contact forms for specific inquiries and complaints. These forms allow consumers to submit detailed information and receive personalized responses from CDI staff.

Email and Fax

For those who prefer electronic communication, the California Department of Insurance provides official email addresses and fax numbers for specific departments and inquiries. These contact details are typically listed on the CDI website and can be used for more formal or sensitive communications.

Social Media and Online Presence

The CDI maintains an active online presence through social media platforms such as Twitter, Facebook, and Instagram. These channels are used to share important updates, consumer alerts, and educational resources. While social media is primarily used for disseminating information, it can also be a channel for consumers to reach out and ask general questions.

How to Reach the Right Department at CDI

The California Department of Insurance is a large organization with various departments and divisions, each specializing in specific areas of insurance regulation and consumer protection. To ensure that your inquiry reaches the right department, it’s important to understand the different divisions and their functions.

Here's a brief overview of some key departments within the CDI and their roles:

Consumer Services

The Consumer Services division is the primary point of contact for consumers. This department handles inquiries, complaints, and requests for information. If you have a general question or need assistance with a consumer issue, this is the department to reach out to.

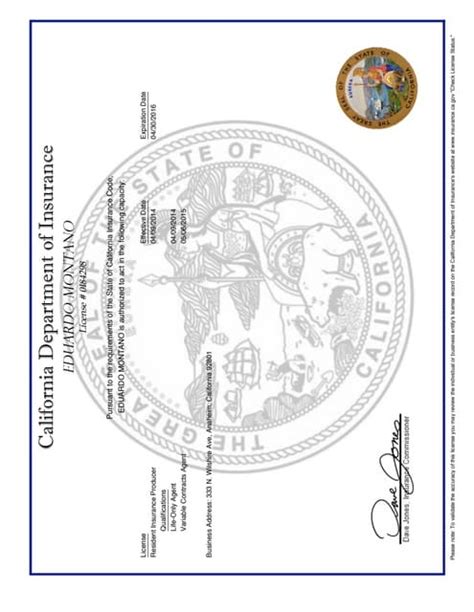

Agent and Broker Services

This division is responsible for licensing and regulating insurance agents and brokers. If you have questions about becoming an insurance professional or need to report unethical behavior by an agent or broker, this department can provide guidance and assistance.

Legal Division

The Legal Division handles legal matters related to insurance, including enforcement actions, investigations, and litigation. If you have a legal inquiry or need to report a potential violation of insurance laws, this department is the appropriate point of contact.

Fraud Division

The Fraud Division investigates and prosecutes insurance fraud. If you have information about suspected insurance fraud, this department plays a crucial role in maintaining the integrity of the insurance system.

Health Care Services

The Health Care Services division oversees health insurance plans, including individual and group policies. If you have questions or concerns about your health insurance coverage, this department can provide assistance and guidance.

Workers’ Compensation Insurance

This division is dedicated to regulating and overseeing workers’ compensation insurance. If you have inquiries or need to report an issue related to workers’ compensation, this department handles such matters.

Tips for Effective Communication with the CDI

When reaching out to the California Department of Insurance, it’s essential to provide clear and detailed information to ensure a prompt and accurate response. Here are some tips to facilitate effective communication with the CDI:

- Be Prepared: Before contacting the CDI, gather all relevant documents and information related to your inquiry or complaint. This includes policy numbers, names of insurance companies or professionals involved, dates of events, and any supporting evidence.

- Choose the Right Channel: Different inquiries may require different contact methods. For general questions, the toll-free phone number is a convenient option. For more detailed or sensitive matters, consider using the online contact form or sending an email to the appropriate department.

- Provide Specific Details: When contacting the CDI, be as specific as possible about your issue. Clearly describe the problem, including any relevant dates, locations, and individuals involved. This helps the CDI staff understand your situation and provide the most accurate guidance.

- Follow Up: If you haven't received a response within a reasonable timeframe, it's appropriate to follow up on your inquiry. You can do this by calling the CDI's general phone number or sending a follow-up email to the specific department you contacted.

- Stay Informed: The CDI's website is a valuable resource for consumers. Regularly check the website for updates, news, and important announcements. This will help you stay informed about any changes in insurance regulations or consumer protections.

Conclusion: The Importance of the California Department of Insurance

The California Department of Insurance is a critical institution that plays a pivotal role in safeguarding the interests of California residents in the insurance market. With its comprehensive regulatory framework and consumer-centric approach, the CDI ensures that insurance companies operate ethically and transparently. By providing accessible contact information and resources, the CDI empowers consumers to make informed decisions and seek assistance when needed.

Whether you're a policyholder with a complaint, an insurance professional seeking guidance, or a consumer with general inquiries, the CDI is dedicated to serving the needs of all Californians. By understanding the department's various departments and their functions, you can effectively navigate the insurance landscape and protect your rights as a consumer.

Remember, insurance is a complex field, and having a regulatory body like the CDI is essential for maintaining fairness and integrity. So, the next time you have an insurance-related question or concern, don't hesitate to reach out to the California Department of Insurance. They are here to help and ensure that your insurance experience is as smooth and beneficial as possible.

How can I file a complaint with the CDI?

+To file a complaint with the California Department of Insurance, you can use their online complaint form available on their website. Alternatively, you can call their toll-free number (800) 927-HELP (4357) and speak to a consumer services representative who can guide you through the complaint process.

What types of insurance inquiries does the CDI handle?

+The CDI handles a wide range of insurance inquiries, including questions about coverage, policy changes, claim processes, and consumer rights. They also provide guidance on choosing the right insurance policy and assist with licensing and regulatory matters for insurance professionals.

How long does it typically take for the CDI to respond to inquiries or complaints?

+The response time can vary depending on the nature and complexity of the inquiry or complaint. Generally, the CDI aims to provide initial responses within 30 days. However, more complex cases may require additional time for thorough investigation and resolution.

Can I schedule an appointment with the CDI for in-person assistance?

+Yes, you can schedule an appointment with the CDI by contacting their Consumer Services division. They offer in-person appointments at their main offices in San Francisco, Los Angeles, Sacramento, Fresno, and Oakland. Appointments are recommended for specific inquiries or complex matters that require detailed discussion.

What should I do if I suspect insurance fraud?

+If you suspect insurance fraud, it’s important to report it to the CDI’s Fraud Division. You can do this by calling their toll-free number (800) 927-HELP (4357) and speaking to a fraud investigator or by submitting a detailed report through their online fraud reporting form.