Health Insurance For Retirees

As the topic of retirement looms large for many, ensuring access to quality healthcare is a paramount concern. For those who have dedicated their lives to building a future, the prospect of retirement should be met with the assurance of comprehensive health coverage. In this comprehensive article, we delve into the world of health insurance for retirees, exploring the options, challenges, and strategies to navigate this critical aspect of life post-retirement.

Understanding the Landscape of Health Insurance for Retirees

The path to retirement is unique for every individual, and so is the journey toward securing adequate health insurance coverage. Retirees often face a myriad of questions and considerations when it comes to health insurance. From understanding the different types of plans to navigating the enrollment process and managing costs, the journey can be daunting. However, with the right information and strategic planning, retirees can secure the coverage they need to maintain their health and well-being during their golden years.

In the United States, the healthcare system is complex, and the options for retirees can vary based on several factors, including age, employment history, and pre-existing medical conditions. Understanding the landscape of health insurance is crucial to making informed decisions and ensuring a smooth transition into retirement.

Medicare: The Cornerstone of Health Insurance for Retirees

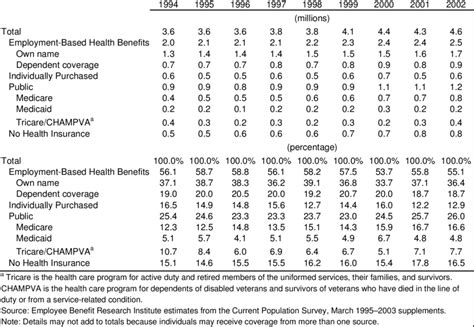

Medicare is a federal health insurance program primarily designed for individuals aged 65 and older, as well as certain younger people with disabilities or specific medical conditions. It serves as a vital safety net for retirees, providing access to essential healthcare services. Medicare is divided into different parts, each covering specific aspects of medical care.

- Medicare Part A: This covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home healthcare services. Part A is premium-free for most retirees who have worked and paid Medicare taxes for at least 10 years.

- Medicare Part B: Part B covers outpatient medical services, including doctor visits, lab tests, and durable medical equipment. Retirees typically pay a monthly premium for Part B coverage.

- Medicare Part C (Medicare Advantage): Part C plans are offered by private insurance companies and provide an alternative to Original Medicare (Parts A and B). These plans often include additional benefits, such as prescription drug coverage and vision or dental care. However, enrollment in Part C plans may require out-of-pocket expenses.

- Medicare Part D: Part D plans cover prescription drugs and are available through private insurance companies. Retirees can choose a stand-alone Part D plan or opt for a Medicare Advantage plan that includes prescription drug coverage.

Understanding the differences between these Medicare parts is crucial for retirees to make informed choices about their health insurance coverage. It's important to note that while Medicare provides a solid foundation, it may not cover all healthcare needs, and retirees may need to explore additional options to fill in the gaps.

Supplemental Insurance: Bridging the Gaps in Medicare Coverage

While Medicare offers comprehensive coverage, it may not cover all medical expenses, and retirees often face significant out-of-pocket costs. This is where supplemental insurance comes into play. Supplemental insurance plans, also known as Medigap plans, are designed to fill the gaps in Medicare coverage, providing additional financial protection.

Medigap plans are offered by private insurance companies and are standardized by the Centers for Medicare & Medicaid Services (CMS). There are ten standardized Medigap plans (Plans A through N), each offering different levels of coverage. Retirees can choose the plan that best suits their needs and budget. These plans can cover expenses such as copayments, coinsurance, and deductibles that are not covered by Medicare.

| Medigap Plan | Coverage Highlights |

|---|---|

| Plan A | Basic coverage for deductibles, coinsurance, and copayments |

| Plan F | Comprehensive coverage, including Part B deductible and excess charges |

| Plan G | Similar to Plan F but with the Part B deductible as an out-of-pocket expense |

| Plan N | Offers reduced coverage but may have lower premiums |

It's important for retirees to carefully evaluate their medical needs and financial situation when choosing a Medigap plan. Some plans may offer more extensive coverage but come with higher premiums, while others may provide cost savings but with limited benefits. Working with a knowledgeable insurance agent or a Medicare expert can help retirees make informed decisions.

Navigating the Enrollment Process and Managing Costs

Enrolling in Medicare and managing the associated costs can be a complex process. Retirees need to be aware of the enrollment periods and deadlines to ensure they don’t miss out on crucial coverage. The Initial Enrollment Period (IEP) is a critical window for individuals turning 65 to enroll in Medicare without facing late enrollment penalties.

Initial Enrollment Period and Late Enrollment Penalties

The Initial Enrollment Period for Medicare begins three months before an individual’s 65th birthday and extends for seven months after their birthday month. During this period, individuals can enroll in Part A and Part B without incurring any late enrollment penalties. However, missing this window can result in permanent monthly premium surcharges for Part B and Part D coverage.

It's crucial for retirees to understand their eligibility for premium-free Part A coverage. Generally, individuals who have worked and paid Medicare taxes for at least 40 quarters (10 years) are eligible for premium-free Part A. Those who don't meet this requirement may need to pay a monthly premium for Part A coverage.

Special Enrollment Periods and Qualifying Life Events

In certain circumstances, retirees may be eligible for Special Enrollment Periods (SEPs) outside of the Initial Enrollment Period. SEPs allow individuals to enroll in Medicare or change their coverage without facing late enrollment penalties. Common qualifying life events that trigger SEPs include:

- Losing employer-sponsored health coverage

- Moving to a new state

- Losing Medicaid coverage

- Gaining or losing eligibility for Extra Help with Medicare prescription drug costs

- Marital status changes

Retirees should be aware of these qualifying life events and understand how they can impact their Medicare enrollment and coverage options.

Cost-Saving Strategies for Retirees

Managing healthcare costs is a significant concern for retirees, especially with the rising expenses associated with medical care. Here are some strategies to help retirees save on health insurance premiums and out-of-pocket expenses:

- Evaluate Medicare Advantage Plans: Medicare Advantage plans often provide more comprehensive coverage than Original Medicare and may include additional benefits such as vision, dental, and fitness programs. Retirees should compare plans and consider the trade-off between premiums and out-of-pocket costs.

- Consider Medigap Plans: Medigap plans can provide valuable coverage for expenses not covered by Medicare. However, it's essential to choose a plan that aligns with individual needs and budget constraints. Retirees should shop around and compare premiums and benefits to find the most cost-effective option.

- Explore Prescription Drug Discount Programs: Many pharmaceutical companies offer discount programs for retirees, providing significant savings on prescription medications. These programs may require enrollment and eligibility criteria, but they can help reduce the financial burden of medication costs.

- Utilize Preventive Services: Medicare covers a range of preventive services, including annual wellness visits, cancer screenings, and immunizations. Taking advantage of these services can help retirees maintain their health and potentially avoid more costly medical interventions in the future.

- Practice Wise Health Spending: Retirees should be mindful of their healthcare spending and explore cost-saving options. This may include shopping around for prescription medications, comparing prices for medical procedures, and considering generic drug alternatives when available.

Conclusion: Securing a Healthy Future in Retirement

Health insurance is a critical component of a secure and fulfilling retirement. By understanding the landscape of health insurance options, navigating the enrollment process, and employing cost-saving strategies, retirees can take control of their healthcare and financial well-being. It’s important to remember that retirement is a journey, and being proactive about health insurance ensures a smoother path toward a healthy and enjoyable retirement.

Frequently Asked Questions

When should I enroll in Medicare if I’m turning 65 soon?

+

It’s important to enroll in Medicare during your Initial Enrollment Period (IEP), which begins three months before your 65th birthday and extends for seven months after your birthday month. Enrolling during this period ensures you avoid late enrollment penalties.

What happens if I miss the Initial Enrollment Period for Medicare?

+

If you miss the Initial Enrollment Period, you may face late enrollment penalties for Part B and Part D coverage. These penalties can result in permanent monthly premium surcharges. However, you may still be able to enroll in Medicare during a Special Enrollment Period if you experience a qualifying life event.

Can I keep my employer-sponsored health insurance when I retire?

+

You may have the option to continue your employer-sponsored health insurance under COBRA (Consolidated Omnibus Budget Reconciliation Act) after retirement. However, COBRA coverage can be expensive, and the coverage period is typically limited to 18 months. It’s important to explore all your Medicare options to find the most cost-effective coverage.

How do I choose the right Medigap plan for my needs and budget?

+

Choosing the right Medigap plan involves careful consideration of your medical needs and financial situation. Evaluate the coverage provided by each plan, compare premiums, and assess your out-of-pocket expenses. Working with an insurance agent or Medicare expert can help you make an informed decision.

Are there any resources to help me understand and navigate Medicare coverage?

+

Yes, there are numerous resources available to help retirees understand and navigate Medicare coverage. The official Medicare website (www.medicare.gov) provides comprehensive information and tools to assist with enrollment and plan selection. Additionally, you can contact your local State Health Insurance Assistance Program (SHIP) for personalized assistance and guidance.