How Much Is Car Insurance A Month

Car insurance costs can vary significantly depending on numerous factors, including the type of vehicle, driving history, location, coverage options, and more. Understanding the average monthly premiums and the factors that influence them is crucial for drivers seeking affordable and comprehensive insurance coverage. In this comprehensive guide, we will delve into the world of car insurance costs, providing an in-depth analysis of the average monthly rates and the key factors that impact them. By the end of this article, you'll have a clearer understanding of the financial commitment involved in insuring your vehicle and the steps you can take to secure the best coverage at a reasonable price.

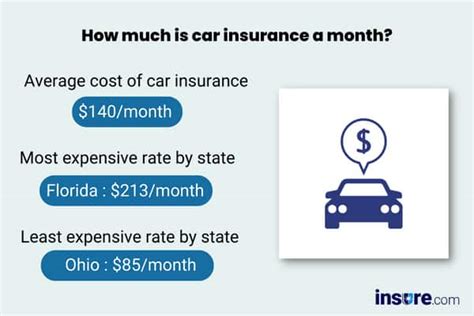

The Average Cost of Car Insurance per Month

The average monthly cost of car insurance in the United States is approximately 150</strong>, which equates to around <strong>1,800 per year. However, it’s essential to note that this average is merely a rough estimate and can vary significantly based on individual circumstances and the factors we will explore in the following sections.

Factors Influencing Car Insurance Costs

The cost of car insurance is determined by a complex interplay of various factors. Understanding these factors can help drivers make informed decisions when selecting insurance coverage and potentially reduce their monthly premiums. Here are some of the key influences on car insurance costs:

Vehicle Type and Value

The type and value of your vehicle play a significant role in determining insurance costs. Generally, more expensive vehicles, luxury cars, and sports cars tend to have higher insurance premiums. This is because these vehicles often come with higher repair costs and are more susceptible to theft or damage.

Additionally, the safety features and accident history of a vehicle can also impact insurance rates. Vehicles with advanced safety technologies may qualify for discounts, while those with a history of accidents or claims may result in higher premiums.

Driving History and Record

Your driving history is a crucial factor in determining insurance rates. Insurance companies carefully examine your driving record to assess your risk level. Drivers with a clean record, free of accidents, violations, or claims, are typically offered lower premiums. Conversely, those with a history of accidents, traffic violations, or multiple claims may face higher insurance costs.

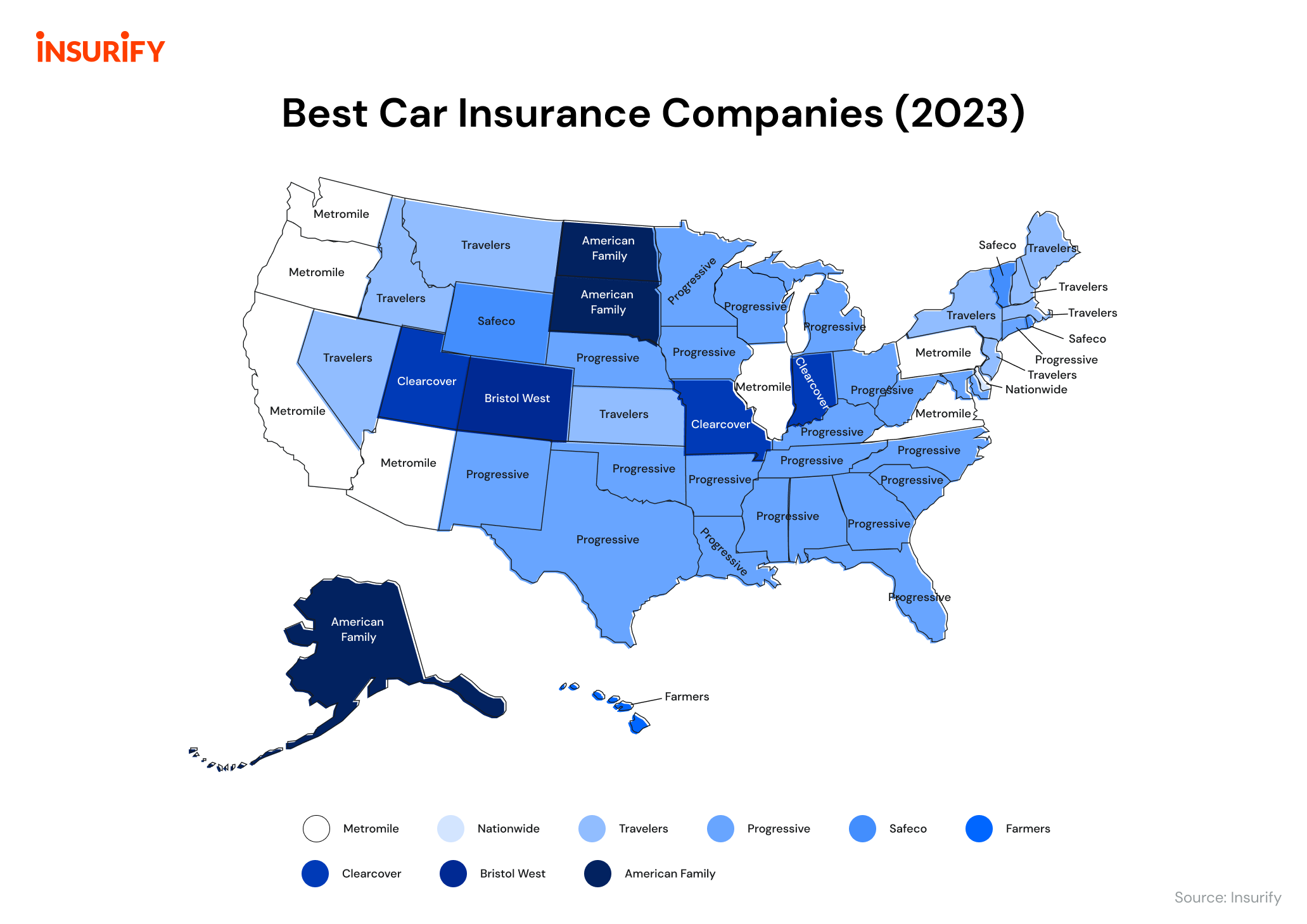

Location and Geographical Factors

Where you live and drive can significantly impact your insurance costs. Insurance rates vary by state and even by specific regions within a state. Factors such as traffic density, crime rates, and the frequency of natural disasters in your area can all influence insurance premiums.

Additionally, the cost of living and the average income in your region can also impact insurance rates. In areas with a higher cost of living, insurance companies may charge more to account for potentially higher repair and replacement costs.

Coverage Options and Limits

The type and extent of coverage you choose directly impact your insurance costs. Car insurance policies typically include various coverage options, such as liability, collision, comprehensive, personal injury protection (PIP), and uninsured/underinsured motorist coverage.

The limits you select for each coverage type also play a role. Higher coverage limits generally result in higher premiums, as they provide more financial protection in the event of an accident or claim. It’s essential to find the right balance between coverage and cost to ensure you have adequate protection without paying excessively.

Age and Gender

Age and gender are factors that insurance companies consider when assessing risk and determining premiums. Young drivers, particularly those under the age of 25, are often charged higher premiums due to their lack of driving experience and higher accident rates. As drivers gain experience and reach their mid-20s, insurance rates typically start to decrease.

Similarly, gender can also influence insurance costs, although this practice is becoming less common. Some insurance companies may charge slightly different rates for male and female drivers based on historical data and accident statistics.

Marital Status and Education

Your marital status and level of education can surprisingly impact your insurance rates. Statistically, married individuals and those with higher levels of education tend to have lower accident rates and are considered lower-risk drivers. As a result, insurance companies may offer discounts or reduced premiums to married individuals and those with advanced degrees.

Credit Score and Payment History

Your credit score and payment history can also play a role in determining insurance rates. Insurance companies often use credit-based insurance scores to assess the risk associated with insuring a driver. Drivers with good credit scores and a positive payment history may be offered lower premiums, as they are considered more responsible and less likely to file claims.

Tips to Reduce Monthly Car Insurance Costs

While the cost of car insurance is influenced by various factors, there are strategies you can employ to potentially reduce your monthly premiums. Here are some tips to help you save on car insurance:

Shop Around and Compare Quotes

Insurance rates can vary significantly between different providers. It’s essential to shop around and compare quotes from multiple insurance companies. Online comparison tools and insurance brokers can be valuable resources to help you find the best rates for your specific circumstances.

Bundling Policies

If you have multiple insurance needs, such as car insurance, homeowners or renters insurance, and life insurance, consider bundling your policies with the same provider. Many insurance companies offer multi-policy discounts, which can result in significant savings on your monthly premiums.

Increase Your Deductible

Increasing your deductible, which is the amount you pay out of pocket before your insurance coverage kicks in, can lead to lower monthly premiums. However, it’s important to choose a deductible that you can comfortably afford in the event of an accident or claim.

Explore Discounts

Insurance companies offer a variety of discounts to encourage safe driving and reduce their risk exposure. Some common discounts include safe driver discounts, good student discounts, loyalty discounts, and discounts for completing defensive driving courses. Be sure to inquire about available discounts when obtaining quotes.

Maintain a Clean Driving Record

A clean driving record is one of the most effective ways to keep your insurance costs low. Avoid accidents, violations, and claims as much as possible. Even a single speeding ticket or at-fault accident can significantly increase your insurance premiums.

Choose a Safer Vehicle

When purchasing a new vehicle, consider its safety features and theft rates. Vehicles with advanced safety technologies and a low risk of theft may qualify for insurance discounts. Researching the insurance costs associated with different vehicles before making a purchase can help you make an informed decision.

Future Implications and Emerging Trends

The car insurance industry is constantly evolving, and several emerging trends are shaping the future of insurance coverage and costs. Here are some key trends to watch:

Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and GPS to track driving behavior, is gaining traction in the insurance industry. Usage-based insurance policies, also known as pay-as-you-drive or pay-how-you-drive, use telematics data to assess a driver’s risk and offer personalized insurance rates. This technology encourages safer driving habits and can result in lower premiums for responsible drivers.

Connected Car Technology

The rise of connected car technology, which integrates vehicles with the internet and various smart devices, is expected to have a significant impact on insurance costs. Connected cars can provide real-time data on driving behavior, vehicle performance, and even predict potential mechanical issues. This data can be used by insurance companies to offer more accurate and personalized insurance rates.

Autonomous Vehicles and Safety Advances

The advent of autonomous vehicles and advanced driver-assistance systems (ADAS) is expected to revolutionize the car insurance industry. As these technologies become more prevalent, accident rates are likely to decrease, leading to lower insurance costs. Additionally, autonomous vehicles may introduce new liability considerations and insurance coverage needs.

Blockchain and Digital Insurance

Blockchain technology has the potential to transform the insurance industry by enhancing transparency, security, and efficiency. Digital insurance platforms powered by blockchain can streamline the claims process, reduce fraud, and provide more accurate risk assessments. As blockchain adoption grows, it may lead to more competitive insurance rates and improved customer experiences.

InsureTech Innovations

The insurance technology (InsureTech) sector is rapidly innovating, introducing new products and services that challenge traditional insurance models. InsureTech startups are developing innovative solutions, such as on-demand insurance, peer-to-peer insurance, and parametric insurance, which offer more flexibility and personalized coverage options. These innovations have the potential to disrupt the car insurance market and drive down costs for consumers.

Conclusion

Understanding the average monthly cost of car insurance and the factors that influence it is essential for drivers seeking affordable and comprehensive coverage. By exploring the various factors and employing strategies to reduce insurance costs, drivers can make informed decisions and secure the best value for their insurance needs.

As the car insurance industry continues to evolve with emerging technologies and trends, staying informed about these developments can help drivers stay ahead of the curve and potentially benefit from more competitive rates and innovative coverage options. With the right knowledge and strategies, you can navigate the world of car insurance with confidence and peace of mind.

How much does car insurance typically cost per month in the United States?

+The average monthly cost of car insurance in the United States is approximately 150, which equates to around 1,800 per year. However, it’s important to note that this average can vary significantly based on individual circumstances and factors such as vehicle type, driving history, location, and coverage options.

What are the main factors that influence car insurance costs?

+Several factors influence car insurance costs, including vehicle type and value, driving history and record, location and geographical factors, coverage options and limits, age and gender, marital status and education, and credit score and payment history.

How can I reduce my monthly car insurance costs?

+To reduce your monthly car insurance costs, you can shop around and compare quotes from multiple providers, bundle your insurance policies, increase your deductible, explore available discounts, maintain a clean driving record, choose a safer vehicle, and stay informed about emerging trends in the insurance industry.

What are some emerging trends in the car insurance industry?

+Emerging trends in the car insurance industry include telematics and usage-based insurance, connected car technology, autonomous vehicles and safety advances, blockchain and digital insurance, and InsureTech innovations. These trends have the potential to disrupt the industry and offer more competitive rates and personalized coverage options.