Lincoln National Insurance

Lincoln National Insurance, a prominent player in the insurance industry, has established itself as a trusted name in the field of financial protection. With a rich history spanning over a century, this company has consistently adapted to the evolving needs of its clients, offering a diverse range of insurance solutions. In this article, we delve into the world of Lincoln National Insurance, exploring its offerings, impact, and the reasons behind its enduring success.

A Legacy of Financial Security

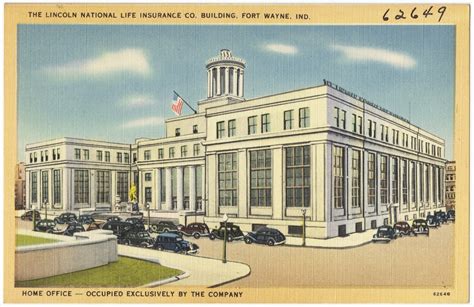

Lincoln National Insurance Corporation, commonly known as Lincoln Financial Group, was founded in 1905 in Fort Wayne, Indiana. Over the past 118 years, the company has grown from its humble beginnings to become a leading provider of life insurance, annuities, retirement plans, and other financial services. The organization’s journey is a testament to its resilience and commitment to meeting the evolving financial needs of individuals and businesses.

Key Milestones and Innovations

Early Beginnings: Lincoln National Insurance started its operations with a focus on life insurance, offering policies that provided financial security to families during challenging times.

Expansion and Diversification: Throughout the 20th century, the company expanded its reach, acquiring various insurance and financial businesses. This strategic move allowed Lincoln to diversify its product portfolio, catering to a broader range of customers.

Retirement Solutions: In the 1970s, Lincoln National Insurance recognized the growing importance of retirement planning. The company introduced innovative retirement products, including annuities and pension plans, helping individuals secure their financial futures.

Digital Transformation: Staying ahead of the curve, Lincoln embraced digital technologies in the 21st century. The company developed online platforms and mobile applications, enabling customers to manage their policies and access financial services conveniently.

Product Offerings and Impact

Lincoln National Insurance offers a comprehensive suite of products designed to address various financial needs:

Life Insurance

Term Life Insurance: Providing coverage for a specified period, this policy offers affordable protection for individuals and families, ensuring financial stability in the event of unforeseen circumstances.

Whole Life Insurance: A permanent life insurance option, offering lifetime coverage and building cash value over time, making it a versatile financial tool.

Annuities

Fixed Annuities: These contracts offer a guaranteed stream of income during retirement, providing peace of mind and predictable cash flows.

Variable Annuities: With investment options, variable annuities allow individuals to customize their retirement savings and potentially grow their wealth.

Retirement Plans

401(k) and 403(b) Plans: Lincoln partners with employers to offer retirement savings plans, empowering employees to plan for their financial futures.

Individual Retirement Accounts (IRAs): Lincoln’s IRAs provide tax-advantaged savings options for individuals, helping them achieve their retirement goals.

Other Financial Services

Long-Term Care Insurance: Protecting individuals from the financial burden of extended care needs, this insurance covers a range of services, including home healthcare and nursing home stays.

Disability Insurance: Providing income protection in the event of a disability, Lincoln’s policies ensure financial stability during challenging times.

Industry Recognition and Achievements

Lincoln National Insurance’s commitment to excellence has been recognized by various industry bodies and rating agencies:

A.M. Best: The company consistently maintains a strong financial strength rating, reflecting its stability and ability to meet its obligations.

Fortune 500: Lincoln has been featured on the prestigious Fortune 500 list, highlighting its significant presence and impact in the business world.

Industry Awards: Lincoln has received numerous awards for its innovative products, exceptional customer service, and contributions to the financial services industry.

Customer Experience and Service

Lincoln National Insurance prioritizes delivering an exceptional customer experience:

Personalized Approach: The company understands that financial needs vary, and thus, it offers tailored solutions to meet individual goals and circumstances.

Educational Resources: Lincoln provides extensive educational materials, helping customers make informed decisions about their financial futures.

24⁄7 Support: With round-the-clock customer service, Lincoln ensures that its clients have access to assistance whenever they need it.

Future Outlook and Innovations

As the financial landscape continues to evolve, Lincoln National Insurance remains committed to staying at the forefront:

Digital Innovation: The company is investing in cutting-edge technologies to enhance its digital offerings, providing customers with efficient and secure online experiences.

Sustainable Investing: Lincoln is exploring environmentally and socially responsible investment options, aligning with the growing demand for sustainable financial practices.

Data Analytics: Leveraging advanced data analytics, Lincoln aims to offer more personalized and targeted financial solutions, meeting the unique needs of each customer.

Table: Product Comparison

| Product Category | Description | Key Benefits |

|---|---|---|

| Life Insurance | Offers financial protection to beneficiaries upon the insured’s death | Provides peace of mind and financial stability |

| Annuities | Contracts providing guaranteed income during retirement | Ensures predictable cash flow and long-term financial security |

| Retirement Plans | Savings plans for retirement, including employer-sponsored and individual options | Helps individuals build wealth and achieve retirement goals |

| Long-Term Care Insurance | Covers the costs of extended care needs, including home healthcare and nursing home stays | Protects individuals from the financial burden of long-term care |

| Disability Insurance | Provides income protection in case of disability | Ensures financial stability and peace of mind during challenging times |

Expert Insights

“Lincoln National Insurance has consistently demonstrated its ability to adapt to changing market dynamics. Their comprehensive product portfolio, combined with a customer-centric approach, positions them as a trusted partner for individuals and businesses seeking financial security and peace of mind.” – Financial Industry Analyst

FAQ

What is Lincoln National Insurance's financial strength rating?

+Lincoln National Insurance maintains a strong financial strength rating from A.M. Best, reflecting its ability to meet its financial obligations.

How can I access my Lincoln policy information online?

+You can access your policy information through Lincoln's online platform or mobile app. Simply log in using your credentials to manage your policies and view account details.

What are the key factors to consider when choosing a life insurance policy with Lincoln National Insurance?

+When selecting a life insurance policy, consider your financial goals, the level of coverage you require, and the term length that aligns with your needs. Lincoln offers a range of options to cater to different circumstances.

Lincoln National Insurance stands as a beacon of financial security, offering a wide array of insurance solutions to individuals and businesses. With a rich history, a commitment to innovation, and a customer-centric approach, the company continues to shape the financial landscape, ensuring that its clients can navigate their financial journeys with confidence and peace of mind.