Insurance Id Number

Insurance ID numbers, often referred to as policy numbers, are unique identifiers assigned to insurance policies. These numbers play a crucial role in the insurance industry, serving as a means to track and manage policies, ensuring efficient and accurate administration. In this comprehensive guide, we will delve into the world of insurance ID numbers, exploring their structure, significance, and the various aspects that make them an essential component of the insurance landscape.

The Structure and Composition of Insurance ID Numbers

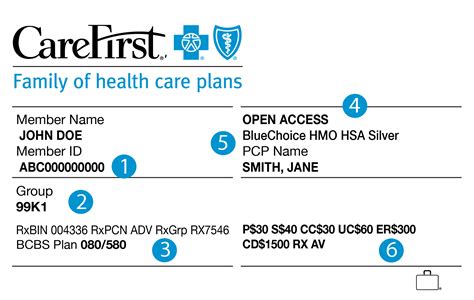

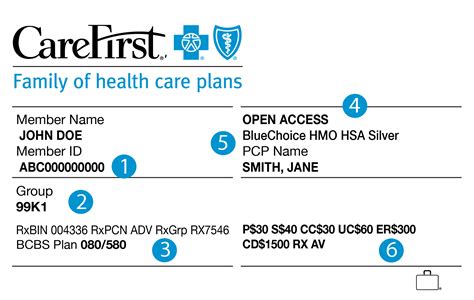

Insurance ID numbers are typically alphanumeric, combining letters and digits to create a unique sequence. The specific structure can vary between insurance companies and types of policies, but they generally follow a consistent format. For instance, a common format could be a string of 8 to 12 characters, with the first few digits representing the insurance company’s code, followed by a unique identifier for the policyholder and the policy itself.

Here's a hypothetical example of an insurance ID number structure:

| Segment | Description |

|---|---|

| ABC123-4567890 |

|

In this example, "ABC123" represents the insurance company, while "4567890" serves as a unique identifier for both the policy and the individual or entity it covers.

Significance and Use of Insurance ID Numbers

Insurance ID numbers hold immense significance in the insurance industry, serving multiple critical purposes:

- Policy Identification: Insurance ID numbers provide a unique reference for each policy, allowing insurance companies to efficiently track and manage numerous policies across different lines of business, such as auto, health, or life insurance.

- Data Management: These numbers facilitate the organization and retrieval of policy-related data. They are essential for maintaining accurate records, ensuring that policy details, claim histories, and other pertinent information are easily accessible when needed.

- Customer Service: Insurance ID numbers are invaluable for customer service representatives and agents. By quickly locating a policy using its ID, they can efficiently address inquiries, process claims, and provide accurate information to policyholders.

- Regulatory Compliance: In many jurisdictions, insurance companies are required to maintain detailed records of policies and their associated data. Insurance ID numbers simplify this process, aiding in regulatory compliance and audits.

- Data Analytics: Insurance companies utilize ID numbers for data analytics and risk assessment. By analyzing trends and patterns in policy data, insurers can make informed decisions, refine their underwriting practices, and offer more competitive products.

The Process of Assigning Insurance ID Numbers

The assignment of insurance ID numbers is a critical step in the policy issuance process. Insurance companies employ various methods to ensure the uniqueness and accuracy of these numbers:

- Sequential Generation: Some insurers use a sequential numbering system, where each new policy is assigned a number in a continuous sequence. This method is straightforward but may not be suitable for companies with a high volume of policies.

- Random Generation: More commonly, insurance ID numbers are generated randomly, using algorithms that produce unique combinations of letters and digits. This approach minimizes the risk of duplication and ensures a high level of uniqueness.

- Incorporating Company Codes: As seen in the example above, insurance companies often incorporate a company-specific code into the ID number. This practice aids in quick identification of the insurer, simplifying record-keeping and data management.

- Policy Type Indicators: In some cases, the ID number might also include indicators for the type of policy, such as auto, home, or health insurance. This additional information can streamline administrative processes.

The Role of Technology in ID Number Management

The efficient management of insurance ID numbers relies heavily on technology. Advanced software systems and databases are employed to generate, store, and retrieve ID numbers, ensuring that they are unique and easily accessible. These systems also facilitate the integration of ID numbers with other policy-related data, enabling comprehensive policy management.

Challenges and Best Practices in ID Number Management

While insurance ID numbers are essential, their management can present challenges. Insurers must ensure that ID numbers are unique, easily traceable, and secure from unauthorized access. Here are some key considerations:

- Data Security: With the increasing sophistication of cyber threats, protecting policy data, including ID numbers, is crucial. Insurers must employ robust security measures, such as encryption and access controls, to safeguard sensitive information.

- Data Integrity: Ensuring the accuracy and integrity of ID numbers is vital. Insurers should implement strict data validation processes to prevent errors and inconsistencies in ID number assignment and management.

- Regulatory Compliance: Insurance companies must adhere to various regulatory requirements related to data privacy and security. Regular audits and compliance checks are essential to ensure that ID number management practices meet these standards.

- Data Backup and Disaster Recovery: Insurers should maintain robust backup systems and disaster recovery plans to protect ID number data in the event of system failures or natural disasters.

The Future of Insurance ID Numbers

As the insurance industry continues to evolve, so too will the role and management of insurance ID numbers. The increasing adoption of digital technologies, such as blockchain and artificial intelligence, will likely transform ID number management. Blockchain, for instance, can provide an immutable, secure ledger for policy data, including ID numbers, enhancing transparency and security.

Additionally, the integration of ID numbers with emerging technologies like biometric authentication and digital signatures will further streamline policy administration and customer experiences. Insurers will need to stay abreast of these advancements to remain competitive and offer efficient, secure services to their policyholders.

How can I locate my insurance ID number if I have lost it or forgotten it?

+If you’ve misplaced your insurance ID number or need to retrieve it, there are several steps you can take. First, check any correspondence or documents you have from your insurance company, as policy ID numbers are often printed on these materials. If you cannot locate it there, contact your insurance agent or the company’s customer service department. They will typically be able to provide your ID number upon verification of your identity.

Can insurance ID numbers be changed, and if so, why would they need to be changed?

+In general, insurance ID numbers are unique and permanent for each policy. However, there are rare instances where an ID number might need to be changed. This could occur if there is a system error or data inconsistency, and the number needs to be updated to ensure accuracy. Additionally, if a policy is transferred between insurance companies, a new ID number might be assigned to reflect the change in insurer.

What happens if two policies are accidentally assigned the same insurance ID number?

+Assigning the same ID number to two policies is highly unlikely due to the random generation and strict management practices employed by insurance companies. However, if such an error occurs, it would be quickly identified through data validation processes. The insurance company would then take immediate steps to rectify the situation, likely by assigning a new, unique ID number to one of the policies.