Health Insurance Subsidy Chart

The cost of health insurance is a significant concern for many individuals and families, especially those with limited financial resources. In an effort to make healthcare more accessible and affordable, governments and organizations often provide subsidies or tax credits to assist with insurance premiums. Understanding these subsidies is crucial for individuals to make informed decisions about their healthcare coverage and to maximize the benefits available to them.

This comprehensive guide aims to delve into the world of health insurance subsidies, exploring the various programs, their eligibility criteria, and the potential impact they can have on individuals' financial well-being. By examining real-world examples and analyzing the data, we aim to provide an in-depth understanding of this essential aspect of healthcare coverage.

The Role of Health Insurance Subsidies

Health insurance subsidies, also known as premium tax credits, are financial assistance programs designed to reduce the cost of health insurance premiums for eligible individuals and families. These subsidies are typically provided through government-sponsored programs, such as the Affordable Care Act (ACA) in the United States, or through employer-sponsored plans with certain eligibility requirements.

The primary goal of health insurance subsidies is to ensure that individuals have access to affordable healthcare coverage, regardless of their income level. By providing financial support, these programs aim to bridge the gap between the cost of insurance and what individuals can reasonably afford. This is particularly important for those with low to moderate incomes, who may struggle to afford the full cost of insurance premiums.

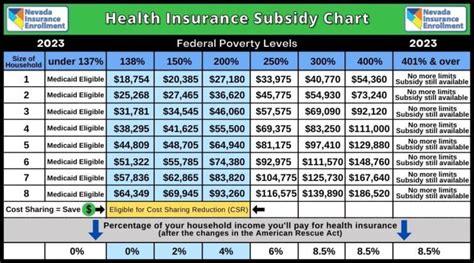

Subsidies are calculated based on a variety of factors, including household income, family size, and the cost of insurance plans in the individual's area. The amount of subsidy an individual receives can significantly impact their out-of-pocket expenses, making healthcare more attainable and reducing the financial burden associated with medical care.

Exploring the Health Insurance Subsidy Chart

To better understand the landscape of health insurance subsidies, let’s delve into a detailed analysis of the subsidy chart, which outlines the various programs, their eligibility criteria, and the potential financial benefits.

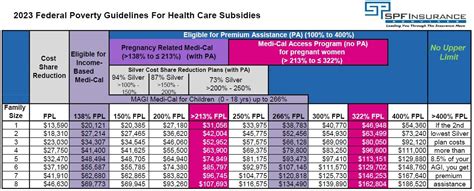

Affordable Care Act (ACA) Subsidies

The Affordable Care Act, a landmark healthcare legislation in the United States, introduced a range of reforms aimed at improving access to healthcare and reducing costs. One of the key components of the ACA is the provision of premium tax credits, which are designed to assist individuals and families in purchasing health insurance through the Health Insurance Marketplace.

ACA subsidies are available to individuals and families with household incomes between 100% and 400% of the Federal Poverty Level (FPL). The exact amount of subsidy an individual receives is determined by their income, with those closer to the FPL receiving a higher percentage of their premium covered.

| Income Percentage of FPL | Premium Subsidy |

|---|---|

| 100% - 133% | 94% of premium covered |

| 133% - 150% | 87% of premium covered |

| 150% - 200% | 73% of premium covered |

| 200% - 250% | 59% of premium covered |

| 250% - 300% | 44% of premium covered |

| 300% - 400% | 2% of premium covered |

For example, an individual with an income of 200% of the FPL would be eligible for a subsidy that covers 59% of their insurance premium. This means that they would only be responsible for paying a reduced premium amount, making healthcare coverage more affordable.

Employer-Sponsored Subsidies

Many employers offer health insurance plans to their employees as a benefit. While these plans are typically not subsidized by the government, some employers choose to provide additional financial assistance to their employees to make insurance more affordable.

Employer-sponsored subsidies can take various forms, such as reduced premiums, contributions towards the cost of insurance, or even fully subsidized plans. The eligibility criteria and the amount of subsidy provided can vary greatly depending on the employer and the specific plan.

For instance, a large corporation may offer a subsidy that covers a significant portion of the insurance premium for employees with certain eligibility criteria, such as a minimum tenure or specific job roles. This can greatly reduce the financial burden on employees and encourage higher participation in the company's healthcare plan.

State-Specific Subsidies

In addition to federal programs like the ACA, some states have implemented their own health insurance subsidy programs to further assist residents in obtaining affordable healthcare coverage. These state-specific programs often have unique eligibility criteria and subsidy amounts, tailored to the specific needs of the state’s population.

For example, California's Covered California program offers premium assistance to individuals and families who purchase insurance through the state's marketplace. The subsidy amounts vary based on income and family size, providing a sliding scale of financial support to ensure accessibility.

| Income Percentage of FPL | Premium Subsidy |

|---|---|

| 100% - 138% | 96% of premium covered |

| 138% - 200% | 84% of premium covered |

| 200% - 250% | 70% of premium covered |

| 250% - 300% | 57% of premium covered |

| 300% - 400% | 26% of premium covered |

Medicaid and CHIP Subsidies

Medicaid and the Children’s Health Insurance Program (CHIP) are government-sponsored programs that provide healthcare coverage to low-income individuals and families. While these programs are not considered traditional insurance subsidies, they offer comprehensive healthcare benefits to eligible individuals, often at no cost or with a very low premium.

Medicaid eligibility is primarily based on income, with each state setting its own income limits. CHIP, on the other hand, is designed for children in families with incomes too high to qualify for Medicaid but still facing financial challenges. CHIP provides affordable healthcare coverage to children up to a certain age, ensuring their access to essential medical services.

Impact and Benefits of Health Insurance Subsidies

The implementation of health insurance subsidies has had a significant impact on individuals’ financial well-being and their ability to access healthcare. By reducing the cost of insurance premiums, these programs have enabled millions of people to obtain coverage that was previously out of reach.

One of the key benefits of health insurance subsidies is the increased accessibility of healthcare services. With reduced premiums, individuals are more likely to enroll in insurance plans, leading to improved overall health outcomes. This is particularly beneficial for individuals with chronic conditions or those who require regular medical care, as they can access the necessary treatments and medications without facing financial hardship.

Additionally, health insurance subsidies have played a crucial role in reducing the number of uninsured individuals. By making insurance more affordable, these programs have encouraged enrollment, leading to a more comprehensive and equitable healthcare system. This has not only improved the overall health of the population but has also reduced the strain on emergency rooms and other safety-net providers.

Real-World Examples

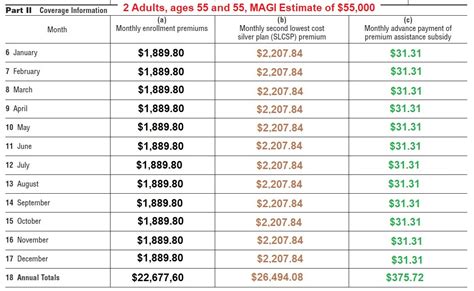

To illustrate the impact of health insurance subsidies, let’s consider a few real-world scenarios:

Scenario 1: Single Individual

John, a 30-year-old single individual, earns an annual income of $30,000, which is 200% of the Federal Poverty Level. Without subsidies, John's insurance premium would cost him $400 per month. However, with the ACA subsidy, he is eligible for a subsidy that covers 59% of his premium, reducing his monthly cost to $164.

Scenario 2: Family of Four

Sarah, a mother of two, earns an annual income of $60,000, which is 250% of the Federal Poverty Level. Her family's insurance premium would typically cost $1,200 per month. With the ACA subsidy, they are eligible for a subsidy that covers 70% of their premium, reducing their monthly cost to $360. This significant reduction in premium cost allows Sarah's family to afford essential healthcare coverage.

Future Implications and Challenges

While health insurance subsidies have made significant strides in improving access to healthcare, there are still challenges and areas for improvement. One of the key challenges is ensuring the sustainability and adequacy of these programs, especially in the face of changing economic landscapes and political environments.

As healthcare costs continue to rise, it is crucial to assess and adjust subsidy programs to ensure they remain effective in assisting individuals and families. This may involve periodic reviews of income thresholds, subsidy amounts, and the overall structure of the programs to maintain their relevance and impact.

Furthermore, ongoing efforts are needed to raise awareness about health insurance subsidies and their eligibility criteria. Many individuals who are eligible for these programs may not be aware of their options, leading to missed opportunities for financial assistance. Educational campaigns and simplified application processes can help bridge this awareness gap and ensure that those in need can access the support they deserve.

Additionally, exploring innovative approaches to healthcare financing, such as expanding employer-sponsored subsidies or implementing new state-specific programs, can further enhance the accessibility and affordability of healthcare coverage.

How do I know if I am eligible for health insurance subsidies?

+

Eligibility for health insurance subsidies typically depends on your household income and family size. In the case of the Affordable Care Act (ACA) subsidies, you are eligible if your income is between 100% and 400% of the Federal Poverty Level (FPL). State-specific programs may have different eligibility criteria, so it’s important to check the specific requirements for your state.

Can I receive both employer-sponsored and ACA subsidies?

+

No, you cannot receive both employer-sponsored and ACA subsidies for the same insurance plan. If you are eligible for both, you must choose one. However, you may be able to combine other types of subsidies or assistance programs to maximize your financial benefits.

Are health insurance subsidies available for everyone?

+

Health insurance subsidies are targeted towards individuals and families with low to moderate incomes. While the specific eligibility criteria may vary depending on the program, generally, those with higher incomes are not eligible for subsidies. However, there are other healthcare programs, such as Medicaid and CHIP, that provide coverage for low-income individuals and families.

How do I apply for health insurance subsidies?

+

The application process for health insurance subsidies varies depending on the program. For ACA subsidies, you can apply through the Health Insurance Marketplace during the open enrollment period or during a special enrollment period if you qualify. State-specific programs may have their own application processes, so it’s important to check the requirements for your state. In many cases, you can apply online or through a designated agency.

Can I lose my health insurance subsidies if my income changes?

+

Yes, changes in your income can impact your eligibility for health insurance subsidies. If your income increases, you may no longer qualify for the same level of subsidy or may not be eligible at all. Conversely, if your income decreases, you may become eligible for a higher subsidy amount. It’s important to report any income changes to the appropriate agency to ensure your subsidy remains accurate.