Overseas Insurance Travel

Overseas travel insurance is a vital consideration for any international trip, offering travelers peace of mind and financial protection against unexpected events and emergencies. This article delves into the intricacies of overseas travel insurance, exploring its coverage, benefits, and the key factors to consider when choosing the right policy for your journey.

Understanding Overseas Travel Insurance

Overseas travel insurance is a specialized form of insurance designed to safeguard travelers during their international adventures. It provides comprehensive coverage for a range of potential issues that may arise during a trip, from medical emergencies to trip cancellations and lost luggage. This insurance is particularly crucial for travelers venturing to unfamiliar destinations, as it offers financial support and assistance in navigating foreign healthcare systems and other challenges.

The coverage offered by overseas travel insurance policies can vary significantly depending on the provider and the chosen plan. Here's a breakdown of some of the essential components:

Medical and Health Coverage

Medical emergencies can occur unexpectedly, and having adequate coverage is vital when traveling abroad. Overseas travel insurance typically includes provisions for emergency medical treatment, hospital stays, and sometimes even repatriation if necessary. It’s essential to understand the limits and exclusions of this coverage, as some policies may have specific restrictions on pre-existing conditions or adventure activities.

| Coverage Type | Details |

|---|---|

| Emergency Medical Treatment | Covers expenses for immediate medical attention, including doctor visits, tests, and procedures. |

| Hospitalization | Provides coverage for hospital stays, including room and board charges. |

| Repatriation | Assists with the costs of returning the insured to their home country for medical reasons. |

Trip Cancellation and Delay

Trip cancellation and delay coverage is another critical aspect of overseas travel insurance. It provides financial protection in the event that a trip needs to be canceled or significantly altered due to unforeseen circumstances. This coverage can include reasons such as severe weather, natural disasters, or personal emergencies. Trip delay coverage may also compensate for additional expenses incurred due to a delay in travel.

Lost or Delayed Baggage

Losing luggage during travel can be a significant inconvenience. Overseas travel insurance often includes coverage for lost, stolen, or delayed baggage, providing reimbursement for essential items purchased to replace lost belongings. However, it’s important to note that there are usually limits to the amount that can be claimed for each item and for the overall claim.

Personal Liability

Personal liability coverage is a safeguard against legal costs and compensation claims resulting from accidents or injuries caused by the insured during their travels. This coverage can provide financial protection if the traveler is found legally responsible for any damages or injuries sustained by others.

Other Benefits

Overseas travel insurance policies may also offer additional benefits, such as coverage for rental car damage, accidental death and dismemberment, and even emergency evacuation in certain situations. Some policies may also include travel assistance services, providing 24⁄7 support for various travel-related issues.

Choosing the Right Policy

Selecting the appropriate overseas travel insurance policy involves careful consideration of several factors. Here are some key aspects to keep in mind:

- Trip Duration and Destination: Consider the length of your trip and the countries you'll be visiting. Some policies may offer more comprehensive coverage for longer trips or have specific provisions for certain high-risk destinations.

- Pre-existing Medical Conditions: If you have any pre-existing medical conditions, ensure that the policy you choose covers them adequately. Some insurers may require additional information or offer limited coverage for certain conditions.

- Adventure Activities: If your trip involves adventure sports or activities, make sure the policy covers these specifically. Some insurers may offer add-ons or have separate policies for adventure travel.

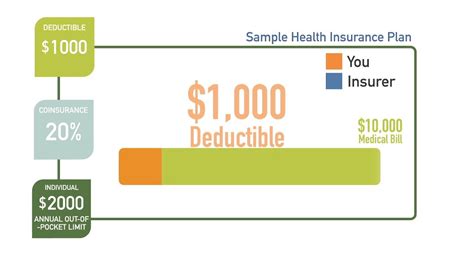

- Deductibles and Limits: Understand the deductibles (the amount you must pay before the insurance kicks in) and the coverage limits for different aspects of the policy. Higher limits may provide more peace of mind, but they often come with a higher premium.

- Exclusions: Carefully review the exclusions listed in the policy. Common exclusions include acts of war, civil unrest, and certain high-risk activities like skydiving.

- Reputation and Financial Stability: Choose an insurer with a good reputation and financial stability to ensure they'll be able to honor their commitments if needed.

- Customer Service and Claims Process: Research the insurer's customer service record and the ease of their claims process. You want to ensure you can easily reach them and that they have a straightforward process for filing and settling claims.

Real-Life Examples and Case Studies

Understanding the impact of overseas travel insurance is best illustrated through real-life examples. Consider the following scenarios:

Medical Emergency Abroad

Imagine a traveler on a European adventure who suffers a severe allergic reaction while hiking in the Swiss Alps. Without travel insurance, they would be responsible for the full cost of emergency treatment, which could easily run into the tens of thousands of dollars. However, with comprehensive travel insurance, the insurer covers the medical expenses, providing critical support in a foreign healthcare system.

Trip Cancellation Due to Natural Disaster

In another instance, a family planning a trip to Hawaii encounters a major volcanic eruption shortly before their departure. With travel insurance that includes trip cancellation coverage, they can receive reimbursement for their non-refundable expenses, including flights and accommodations, saving them from significant financial loss.

Lost Baggage on a Business Trip

A business traveler en route to a conference in Singapore has their luggage lost in transit. With travel insurance, they can file a claim for the cost of replacing essential items like clothing and toiletries, ensuring they can continue their trip without undue financial burden.

Industry Insights and Expert Tips

Industry experts emphasize the importance of thorough research and customization when selecting an overseas travel insurance policy. Here are some additional tips to consider:

It's also recommended to compare multiple policies to find the best fit for your needs. Consider using comparison websites or seeking advice from travel agents or insurance brokers who specialize in travel insurance.

Additionally, for those with complex travel plans or specific requirements, consulting with an insurance professional can provide tailored advice and ensure all potential risks are covered adequately.

Future Trends and Innovations

The travel insurance industry is continually evolving to meet the changing needs of travelers. Here are some emerging trends and innovations to watch for:

- Digital Transformation: The rise of digital technology is making it easier for travelers to access and manage their insurance policies online. Insurers are developing user-friendly platforms and apps, enabling policyholders to file claims, track their status, and receive updates in real-time.

- Personalized Coverage: Insurers are increasingly offering customizable policies, allowing travelers to choose the specific coverages they need based on their unique trip plans and personal circumstances.

- Enhanced Assistance Services: Many insurers are expanding their travel assistance services to include additional support, such as emergency communication and coordination with local authorities, legal assistance, and even translation services.

- Incorporating AI and Machine Learning: Insurers are leveraging AI and machine learning to improve claim processing, risk assessment, and fraud detection, ultimately enhancing the overall efficiency and accuracy of the insurance process.

Conclusion

Overseas travel insurance is an indispensable tool for any international traveler, offering a vital safety net against unforeseen circumstances and emergencies. By understanding the coverage, benefits, and key factors involved in choosing a policy, travelers can make informed decisions to protect themselves and their travel investments. With the right policy, travelers can embark on their journeys with confidence, knowing they have the support and protection they need, wherever their adventures take them.

What should I do if I need to make a claim while traveling overseas?

+If you find yourself in a situation where you need to make a claim while traveling, it’s important to take prompt action. Contact your insurance provider’s emergency assistance number as soon as possible to report the incident and receive guidance on the next steps. Keep all relevant documentation, such as medical reports, receipts, and police reports, if applicable. Remember to follow the specific claim procedures outlined in your policy document to ensure a smooth process.

Are there any common mistakes to avoid when purchasing overseas travel insurance?

+Absolutely! One common mistake is assuming that your existing health insurance or credit card travel benefits will cover you adequately while overseas. Always carefully review the terms and conditions of your travel insurance policy to understand the specific exclusions and limitations. Additionally, avoid the temptation to choose the cheapest policy without considering the coverage and potential risks associated with your trip.

How can I ensure I’m getting the best value for my overseas travel insurance policy?

+To get the best value for your travel insurance policy, it’s crucial to compare multiple policies based on your specific needs and trip details. Consider factors like the level of coverage, deductibles, and any additional benefits that may be valuable to you. Remember that the cheapest policy may not always offer the best value, so strike a balance between cost and comprehensive coverage.