How Does An Insurance Deductible Work

Understanding how insurance deductibles work is crucial for policyholders, as it directly impacts their financial responsibilities and coverage claims. Insurance deductibles are a common feature of many insurance policies, and they play a significant role in the insurance landscape. In this comprehensive guide, we will delve into the world of insurance deductibles, exploring their mechanics, implications, and real-world applications.

The Fundamentals of Insurance Deductibles

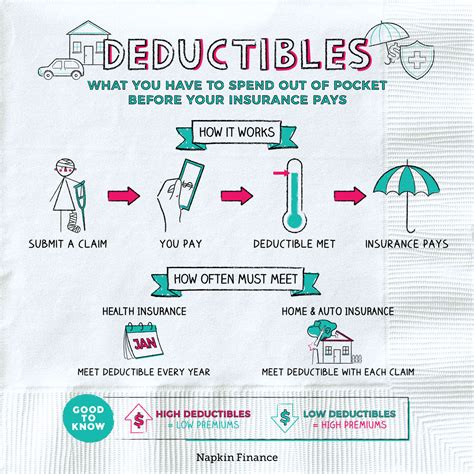

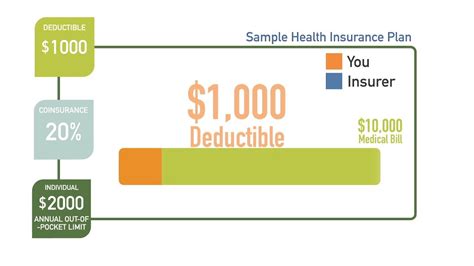

An insurance deductible is a predetermined amount that a policyholder agrees to pay out of pocket before their insurance coverage kicks in. It serves as a cost-sharing mechanism between the insured and the insurance company. Deductibles are designed to discourage small, frequent claims and promote responsible risk management.

Here's a simple breakdown of how deductibles work:

- When an insured event occurs, such as a car accident or a home repair, the policyholder is responsible for paying the agreed-upon deductible amount.

- The insurance company then steps in to cover the remaining costs of the claim, up to the policy's coverage limits.

- For example, if you have a car insurance policy with a $500 deductible and you're involved in an accident that causes $3,000 worth of damage, you'll pay the first $500, and the insurance company will cover the remaining $2,500.

Types of Insurance Deductibles

Insurance deductibles can vary depending on the type of insurance and the specific policy. Here are some common types of deductibles:

Fixed Deductibles

Fixed deductibles are the most straightforward and common type. They are a set amount specified in the policy. Regardless of the claim size, the policyholder pays the same deductible for each covered event.

Percentage Deductibles

Percentage deductibles are based on a percentage of the total claim amount. These deductibles are often used in property and casualty insurance policies. For instance, if you have a 2% deductible on your home insurance policy and your claim is valued at 10,000, you would pay 200 as the deductible.

Composite Deductibles

Composite deductibles combine elements of both fixed and percentage deductibles. They are used in policies where multiple types of coverage are involved. A composite deductible might have a fixed amount for certain coverages and a percentage-based amount for others.

Waivable Deductibles

Some insurance policies offer the option of waiving the deductible under specific circumstances. For example, if you have a no-claims bonus or meet certain safety criteria, your insurance provider might waive the deductible for certain incidents.

The Impact of Deductibles on Policyholders

Insurance deductibles have several implications for policyholders, including:

- Financial Responsibility: Deductibles encourage policyholders to be financially prepared for unexpected events. They act as a safety net, ensuring that individuals have some skin in the game when it comes to insurance claims.

- Claim Frequency: Higher deductibles can reduce the number of small, frequent claims. This is beneficial for both policyholders and insurance companies, as it helps keep premiums affordable and prevents overuse of insurance coverage.

- Coverage Choices: When selecting an insurance policy, policyholders must consider the deductible amount. A higher deductible often results in lower premiums, making it a cost-effective option for those who are comfortable assuming more financial risk.

- Claim Settlement: Understanding the deductible amount is crucial when making a claim. Policyholders must be aware of their financial obligations to ensure a smooth claim settlement process.

Real-World Examples of Deductibles

Let’s explore some real-world scenarios to better understand how insurance deductibles work in practice:

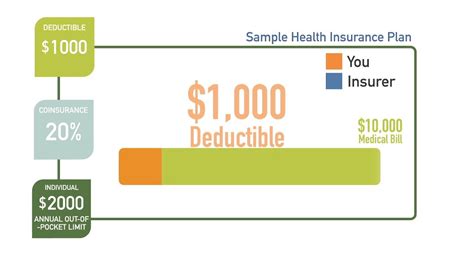

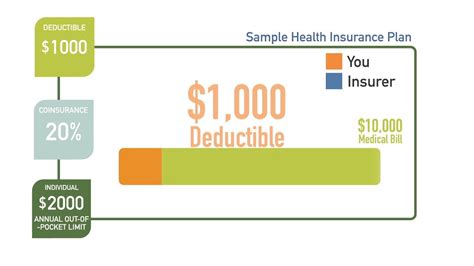

Health Insurance Deductibles

In health insurance, deductibles can vary based on the plan type. For instance, a high-deductible health plan (HDHP) typically has a higher deductible, which means policyholders pay for a significant portion of their healthcare expenses before insurance coverage takes effect. HDHPs are often paired with health savings accounts (HSAs) to help individuals save for future medical needs.

| Plan Type | Deductible Amount |

|---|---|

| HDHP | $1,500 - $5,000 |

| PPO | $500 - $2,000 |

| HMO | $250 - $1,000 |

Auto Insurance Deductibles

Auto insurance deductibles are commonly used to manage the cost of claims. Policyholders can choose between different deductible amounts, which directly impact their premiums. For example, a driver might opt for a higher deductible to reduce their monthly premiums, but they must be prepared to pay a larger amount if an accident occurs.

| Deductible Amount | Premium Savings |

|---|---|

| $250 | Minimal Savings |

| $500 | Moderate Savings |

| $1,000 | Significant Savings |

Homeowners Insurance Deductibles

Homeowners insurance policies often have deductibles that are triggered by specific events, such as hurricanes or earthquakes. These deductibles can be either fixed amounts or a percentage of the home’s value. Policyholders should carefully review their policy to understand the deductible structure for different types of claims.

Tips for Navigating Insurance Deductibles

Here are some expert tips to help you navigate insurance deductibles effectively:

- Review Your Policy: Familiarize yourself with the deductible terms and conditions in your insurance policy. Understand when and how deductibles apply to different types of claims.

- Compare Deductibles: When shopping for insurance, compare policies based on deductibles and premiums. Consider your financial situation and risk tolerance to choose the right deductible level.

- Emergency Fund: Build an emergency fund to cover potential deductibles. This ensures you're prepared for unexpected expenses and can avoid financial strain when making a claim.

- Ask for Clarification: If you have questions or concerns about deductibles, don't hesitate to reach out to your insurance provider. They can provide guidance and help you make informed decisions.

FAQ

Can I Negotiate My Insurance Deductible?

+Insurance deductibles are typically set by the insurance company based on industry standards and risk assessment. While you may have some flexibility in choosing between different deductible options, negotiating a specific deductible amount is generally not possible. However, you can explore different policies and compare deductibles to find the best fit for your needs.

What Happens if I Cannot Afford the Deductible?

+If you find yourself unable to afford the deductible, it’s essential to communicate with your insurance provider. They may offer payment plans or suggest alternative options to help you manage the financial burden. Additionally, building an emergency fund can help you prepare for such situations.

Do Deductibles Apply to All Types of Insurance Claims?

+The application of deductibles can vary depending on the type of insurance and the specific policy. Some policies have deductibles for certain types of claims, while others may not. It’s crucial to review your policy’s terms and conditions to understand when and how deductibles apply.