Dental Health Insurance

Dental health is an essential aspect of overall well-being, often overlooked by many. However, the significance of maintaining optimal oral health cannot be overstated. In today's world, where medical expenses can be daunting, having a solid understanding of dental health insurance becomes crucial. This article aims to delve deep into the world of dental insurance, exploring its intricacies, benefits, and implications for individuals and families.

Understanding Dental Health Insurance

Dental health insurance, often referred to as dental coverage, is a form of insurance policy designed to cover dental care expenses. It offers financial protection against the high costs associated with dental treatments, ranging from routine check-ups and cleanings to more complex procedures like root canals and dental implants.

Unlike traditional health insurance, dental insurance plans often have separate networks of providers, with specific dentists and dental practices included in the coverage. This means that policyholders must choose their dental care providers from within the network to maximize the benefits of their insurance.

The Importance of Dental Coverage

Maintaining good oral health is vital for several reasons. Firstly, dental issues can lead to significant pain and discomfort, affecting an individual’s quality of life. Secondly, untreated dental problems can escalate and lead to more serious health issues, such as infections and even cardiovascular diseases. Lastly, dental treatments can be costly, and without insurance, many individuals may delay or forgo necessary care due to financial constraints.

Dental health insurance provides a safety net, ensuring that individuals can access the dental care they need without worrying about the financial burden. It promotes regular dental check-ups, which are crucial for early detection and prevention of dental diseases.

| Dental Issue | Potential Impact |

|---|---|

| Tooth Decay | Cavities, toothaches, and potential tooth loss |

| Gum Disease | Inflammation, bleeding gums, and potential bone loss |

| Oral Cancer | Serious health risks if not detected early |

Types of Dental Insurance Plans

Dental insurance plans come in various forms, each with its own set of features and coverage options. Understanding the different types can help individuals choose the plan that best suits their needs and budget.

Indemnity Plans

Also known as fee-for-service plans, indemnity plans offer the most flexibility in terms of provider choice. Policyholders can visit any dentist, whether in-network or out-of-network, and the insurance company will reimburse a portion of the costs. However, these plans often come with higher premiums and deductibles.

Preferred Provider Organization (PPO) Plans

PPO plans offer a balance between flexibility and cost. Policyholders can choose from a network of preferred providers, and they typically pay lower out-of-pocket costs when visiting these providers. However, they still have the freedom to visit out-of-network dentists, although at a higher cost.

Dental Health Maintenance Organization (DHMO) Plans

DHMO plans are known for their affordability and structured care. Members must choose a primary dentist from within the network and receive most of their dental care from this provider. DHMO plans often cover a wide range of services, but policyholders may need to change dentists if they move or their primary dentist leaves the network.

Discount Dental Plans

Discount dental plans are not traditional insurance policies but rather membership programs. Members pay an annual fee to access discounted dental services from a network of providers. While these plans offer savings, they typically do not provide comprehensive coverage for more complex procedures.

| Plan Type | Flexibility | Cost |

|---|---|---|

| Indemnity | High | Premium: High, Deductible: High |

| PPO | Moderate | Premium: Moderate, Deductible: Moderate |

| DHMO | Low | Premium: Low, Deductible: Low |

| Discount Plans | Varies | Annual Fee: Low |

Dental Insurance Coverage and Benefits

Dental insurance plans typically cover a range of dental services, with the level of coverage varying depending on the plan and the specific policy. Understanding the coverage and benefits is crucial to ensure you receive the care you need without unexpected costs.

Preventive Care

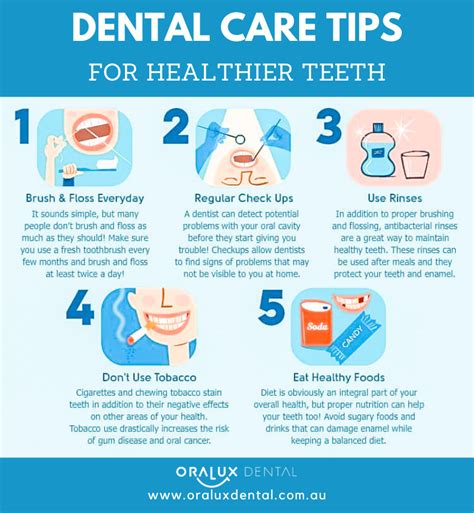

Preventive care is often the cornerstone of dental insurance plans. It includes services like routine dental cleanings, check-ups, X-rays, and fluoride treatments. These services are crucial for maintaining good oral health and catching potential issues early on. Most plans cover these preventive services at 100% or with a minimal copay.

Basic and Major Restorative Procedures

Basic restorative procedures include fillings, root planing, and simple extractions. Major restorative procedures, on the other hand, are more complex and may include crowns, bridges, root canals, and periodontal treatments. The coverage for these procedures varies widely among plans, with some offering partial coverage and others excluding certain procedures altogether.

Orthodontic Treatment

Orthodontic treatment, such as braces and clear aligners, can be a significant investment. Some dental insurance plans offer coverage for orthodontic care, typically with an annual maximum and a longer waiting period. It’s important to check the specific plan’s coverage and any age restrictions, as orthodontic benefits may be limited to children and adolescents.

Cosmetic Dentistry

Cosmetic dentistry procedures, such as teeth whitening, veneers, and contouring, are often not covered by dental insurance plans. These procedures are considered elective and are aimed at enhancing the appearance of the teeth rather than addressing functional issues. However, some plans may offer limited coverage for certain cosmetic procedures if they also serve a restorative purpose.

| Dental Service | Typical Coverage |

|---|---|

| Preventive Care | 100% or Minimal Copay |

| Basic Restorative | Partial Coverage |

| Major Restorative | Varies by Plan |

| Orthodontic Treatment | Limited Coverage with Waiting Period |

| Cosmetic Dentistry | Generally Not Covered |

Choosing the Right Dental Insurance Plan

Selecting the appropriate dental insurance plan can be a daunting task, given the myriad of options available. It’s essential to consider several factors to ensure you choose a plan that aligns with your oral health needs and financial situation.

Assessing Your Dental Health Needs

The first step in choosing a dental insurance plan is to assess your current and potential future dental health needs. Consider your past dental history, any ongoing treatments or conditions, and your general oral health. If you have children, their orthodontic needs should also be taken into account.

Evaluating Plan Features and Costs

Next, evaluate the features and costs of different plans. Consider the premiums, deductibles, and copays associated with each plan. Understand the coverage limits and any exclusions. Compare the networks of providers to ensure that your preferred dentists are included. Also, review the waiting periods for certain procedures, as these can vary significantly between plans.

Understanding Out-of-Pocket Costs

Dental insurance plans typically require policyholders to pay a portion of the costs out of pocket. These out-of-pocket expenses can include deductibles, copays, and coinsurance. Understanding these costs is crucial, as they can add up quickly, especially for complex procedures. Some plans offer options to reduce out-of-pocket costs, such as higher premiums for lower deductibles.

Comparing Provider Networks

The network of providers is a critical aspect of dental insurance plans. Ensure that your preferred dentists and specialists are included in the network to maximize your benefits. Consider the geographic reach of the network, especially if you travel frequently or have plans to relocate. A broader network can provide more flexibility and peace of mind.

Maximizing Your Dental Insurance Benefits

Once you’ve chosen your dental insurance plan, it’s important to make the most of your benefits to ensure you receive the best possible care while minimizing out-of-pocket expenses.

Understanding Your Policy

Take the time to thoroughly understand your dental insurance policy. Review the summary of benefits and coverage details. Familiarize yourself with the network of providers, any limitations or exclusions, and the steps to file a claim. Understanding your policy will help you navigate the insurance process smoothly and avoid potential pitfalls.

Choosing In-Network Providers

Whenever possible, choose dental care providers who are within your insurance network. This ensures that you receive the maximum benefits and minimize out-of-pocket costs. Many insurance companies provide tools and directories to help you find in-network dentists in your area.

Utilizing Preventive Care Benefits

Preventive care is often fully covered or offered at a minimal cost under dental insurance plans. Take advantage of these benefits by scheduling regular dental check-ups and cleanings. These preventive measures can help detect potential issues early on, saving you from more costly and complex treatments down the line.

Understanding Waiting Periods

Dental insurance plans often have waiting periods for certain procedures, especially for major restorative work and orthodontic treatment. Understand the waiting periods associated with your plan and plan your dental care accordingly. If you anticipate needing more complex procedures, consider enrolling in a plan with shorter waiting periods.

Conclusion

Dental health insurance is a crucial component of maintaining optimal oral health and overall well-being. By understanding the different types of plans, their coverage, and how to choose the right plan, individuals can make informed decisions to protect their smiles and their wallets. With a solid understanding of dental insurance, you can navigate the world of dental care with confidence and ensure that your oral health remains a top priority.

How do I choose the right dental insurance plan for my family’s needs?

+

When selecting a dental insurance plan for your family, consider your family’s oral health needs, the flexibility of provider choice, and your budget. Evaluate the coverage, premiums, deductibles, and any exclusions. Ensure that your preferred dentists are in-network, and review the plan’s waiting periods for major procedures. Creating a comprehensive checklist of your family’s specific needs can help you make an informed decision.

Are there any tax benefits associated with dental insurance plans?

+

Yes, dental insurance plans purchased through a workplace often come with tax benefits. These plans are typically offered as part of an employer’s benefits package, and the premiums are usually paid with pre-tax dollars, reducing your taxable income. However, it’s important to consult a tax professional to understand the specific tax implications for your situation.

What happens if I change jobs or move to a different state?

+

If you change jobs or move, your dental insurance coverage may be impacted. When changing jobs, you may have the option to continue your dental insurance coverage through COBRA (Consolidated Omnibus Budget Reconciliation Act) for a limited period. If you move, you’ll need to check if your current plan’s network extends to your new location. If not, you may need to explore new dental insurance options.