Insurance And Annuities

The world of financial planning and investment is vast and often complex, with various tools and strategies available to secure one's future. Among these, insurance and annuities play a pivotal role in safeguarding individuals and their assets. This comprehensive guide aims to delve into the intricacies of insurance and annuities, shedding light on their functions, benefits, and the critical role they play in long-term financial planning.

Understanding the Basics: Insurance and Annuities

Insurance and annuities are financial instruments designed to protect individuals and their assets from unforeseen events and to provide a steady income stream during retirement. While they share some similarities, they serve distinct purposes and cater to different financial needs.

Insurance: A Safety Net for Uncertain Times

Insurance, in its essence, is a form of risk management primarily used to hedge against the financial repercussions of potential future events. It is a contract between an individual (the policyholder) and an insurance company, where the policyholder pays a premium in exchange for financial protection against specific losses, damages, or risks.

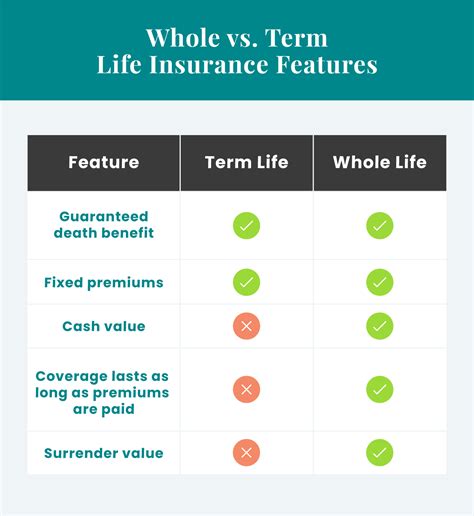

The scope of insurance is vast, covering a multitude of areas such as health, life, property, liability, and more. Each type of insurance serves a unique purpose, offering tailored protection against specific risks. For instance, health insurance provides coverage for medical expenses, life insurance offers financial security to dependents in the event of the policyholder's demise, and property insurance safeguards against losses resulting from damage to one's home or assets.

One of the key advantages of insurance is its ability to provide peace of mind and financial security. By paying regular premiums, individuals can ensure they are prepared for unexpected events, reducing the financial burden that may arise from accidents, illnesses, or other unforeseen circumstances.

Additionally, insurance fosters a community-based risk-sharing model. Through premiums, policyholders contribute to a pool of funds that can be utilized to compensate those who suffer losses. This collaborative approach ensures that the financial burden of an event is shared by the entire community, making it more manageable for individuals.

| Insurance Type | Coverage |

|---|---|

| Health Insurance | Medical expenses, hospitalization, prescription drugs |

| Life Insurance | Financial protection for dependents in case of policyholder's death |

| Property Insurance | Protection against damage or loss of property, including homes and assets |

Annuities: Securing Your Retirement Income

Annuities, on the other hand, are financial products primarily designed to provide a steady stream of income during retirement. They are often purchased with a lump sum or through regular premium payments, and in return, the insurance company guarantees a regular income for a specified period or for the policyholder’s lifetime.

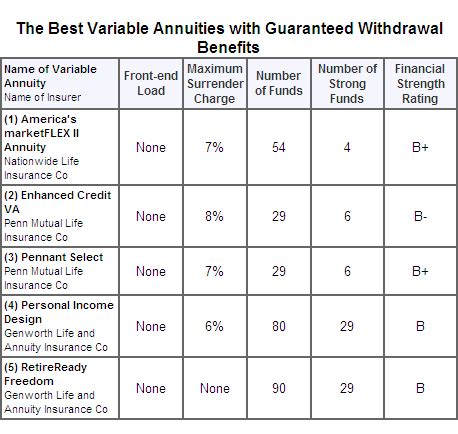

There are several types of annuities, each with its own unique features and benefits. Fixed annuities offer a guaranteed income stream with a predetermined interest rate, providing stability and predictability. Variable annuities, on the other hand, allow policyholders to invest in a range of underlying funds, offering potential for higher returns but with more market risk. Indexed annuities provide a balance, linking returns to a market index while offering some protection against market downturns.

One of the key advantages of annuities is their ability to guarantee a lifetime income. This is particularly beneficial for retirees who are concerned about outliving their savings or who want a steady income stream regardless of market conditions. Annuities can also offer tax-deferred growth on earnings, providing an opportunity for funds to grow faster.

However, it's important to note that annuities may have surrender charges if the policy is terminated early, and they may not be suitable for all investors. Understanding the terms and conditions of an annuity contract is crucial before making a decision.

| Annuity Type | Key Features |

|---|---|

| Fixed Annuities | Guaranteed income stream with a predetermined interest rate |

| Variable Annuities | Investment in underlying funds, potential for higher returns but with market risk |

| Indexed Annuities | Linked to a market index, offering a balance between growth and protection |

The Role of Insurance and Annuities in Financial Planning

Insurance and annuities are integral components of a well-rounded financial plan, offering protection and income security at different stages of life.

Insurance: Protecting Your Assets and Loved Ones

Insurance plays a critical role in safeguarding individuals and their assets. It provides a financial safety net, ensuring that individuals and their families are protected from the financial repercussions of unforeseen events. For instance, health insurance can cover expensive medical treatments, while life insurance can provide financial security to dependents in the event of a policyholder’s untimely death.

Furthermore, insurance can also protect businesses and their assets. Commercial insurance policies can cover a range of risks, from property damage to liability claims, ensuring that businesses can continue to operate smoothly despite unexpected events.

In essence, insurance is a risk management tool that allows individuals and businesses to transfer potential financial risks to an insurance company. This transfer of risk provides peace of mind, financial security, and stability, knowing that they are prepared for a wide range of potential events.

Annuities: Planning for a Secure Retirement

Annuities are a critical tool for retirement planning, offering a guaranteed income stream that can supplement other retirement savings. They provide a predictable source of income, ensuring that retirees have the financial means to maintain their desired lifestyle even if their other investments perform poorly or if they live longer than expected.

Annuities can also offer tax advantages. Depending on the type of annuity and the specific tax laws in a jurisdiction, earnings within an annuity may grow tax-deferred, potentially allowing for faster accumulation of funds. Additionally, withdrawals from annuities may be taxed at a lower rate than other types of income, providing further tax benefits.

However, it's important to note that annuities are not without their drawbacks. They may have high fees, and the guaranteed income may be lower than what could be achieved through other investment strategies. Therefore, it's crucial to carefully consider the terms and conditions of an annuity contract and consult with a financial advisor to determine if it aligns with one's overall financial goals and risk tolerance.

Key Considerations and Future Implications

As with any financial instrument, insurance and annuities come with a set of considerations and potential future implications that individuals should be aware of when making decisions.

Considerations When Choosing Insurance and Annuities

When selecting insurance policies or annuities, individuals should carefully consider their specific needs and circumstances. Factors such as age, health, financial goals, and risk tolerance should all be taken into account.

For insurance, it's important to assess the risks one is exposed to and choose policies that provide adequate coverage. This may involve comparing different providers, understanding the fine print of the policy, and ensuring that the coverage aligns with one's needs. For annuities, individuals should consider their retirement income goals, their tolerance for market risk, and the potential impact of fees and surrender charges.

It's also crucial to regularly review and update insurance policies and annuities to ensure they remain aligned with one's changing needs and circumstances. Life events such as marriage, the birth of a child, or a career change can significantly impact one's insurance and retirement planning needs.

Future Implications and Industry Trends

The insurance and annuity industry is continually evolving, with new products and trends emerging to meet the changing needs of individuals and businesses. One notable trend is the increasing focus on personalized insurance and annuity solutions. With the advancement of technology and data analytics, insurance companies are now able to offer more tailored products that meet the unique needs of individual policyholders.

Additionally, the rise of digital platforms and insurtech is transforming the way insurance and annuities are sold and managed. These platforms offer increased convenience, allowing individuals to easily compare policies, obtain quotes, and manage their insurance needs online. They also provide opportunities for more efficient claims processing and better customer service.

Looking ahead, the insurance and annuity industry is likely to continue adapting to meet the evolving needs of individuals and businesses. This may include further personalization of products, increased focus on digital transformation, and the development of innovative solutions to address emerging risks and changing market dynamics.

Conclusion

Insurance and annuities are essential tools in any comprehensive financial plan. They provide a safety net against unforeseen events and offer a reliable income stream during retirement. By understanding the unique features and benefits of insurance and annuities, individuals can make informed decisions to protect their assets, secure their future, and achieve their financial goals.

As the financial landscape continues to evolve, staying informed and proactive in managing one's insurance and annuity portfolios is crucial. This comprehensive guide has aimed to provide a detailed overview of these financial instruments, offering valuable insights to help individuals navigate the complex world of insurance and annuities.

What is the difference between insurance and annuities?

+

Insurance and annuities serve distinct purposes. Insurance is primarily used to protect against financial losses due to unforeseen events, while annuities are financial products designed to provide a steady income stream during retirement. Insurance provides coverage for specific risks, such as health, life, or property, while annuities offer a guaranteed income for a specified period or lifetime.

How do I choose the right insurance coverage for my needs?

+

Choosing the right insurance coverage involves assessing your unique needs and circumstances. Consider factors such as your age, health, financial goals, and risk tolerance. Compare different insurance providers and policies, understand the fine print, and ensure the coverage aligns with your specific requirements. Regularly review and update your insurance policies to stay aligned with your changing needs.

What are the advantages of annuities for retirement planning?

+

Annuities offer several advantages for retirement planning. They provide a guaranteed income stream, ensuring a steady source of income during retirement. Annuities can also offer tax-deferred growth on earnings, allowing funds to grow faster. Additionally, they can provide a lifetime income, which is particularly beneficial for retirees concerned about outliving their savings.

What are some emerging trends in the insurance and annuity industry?

+

The insurance and annuity industry is experiencing several emerging trends. One notable trend is the focus on personalized insurance and annuity solutions, leveraging technology and data analytics to offer more tailored products. Additionally, the rise of digital platforms and insurtech is transforming the way insurance and annuities are sold and managed, providing increased convenience and efficiency.