New Home Insurance

Acquiring a new home is an exciting milestone, but it also comes with a set of important responsibilities. One crucial aspect of homeownership is ensuring adequate protection through home insurance. This comprehensive guide aims to delve into the world of new home insurance, offering expert insights and practical advice to help you navigate the process seamlessly.

Understanding New Home Insurance: A Comprehensive Overview

When you embark on the journey of purchasing a new home, you open a chapter filled with excitement and anticipation. However, amidst the joy, it’s essential to recognize the significance of safeguarding your investment. This is where new home insurance steps in, providing a safety net to protect your dream home and its contents.

New home insurance is a specialized form of coverage designed to address the unique needs of recent homeowners. It offers financial protection against a wide range of potential risks, ensuring that you can recover from unexpected losses and continue to enjoy your new abode.

The Scope of Coverage: What Does New Home Insurance Entail?

At its core, new home insurance provides coverage for the structure of your home, including the walls, roof, and foundation. This protection extends to the various systems within your home, such as plumbing, electrical wiring, and HVAC. Additionally, the policy covers personal belongings, from furniture and appliances to clothing and electronics.

Furthermore, new home insurance policies often include liability coverage, which safeguards you against legal claims and medical expenses if someone is injured on your property. This comprehensive approach ensures that you're protected from a multitude of angles, providing peace of mind as you settle into your new home.

Key Factors to Consider When Choosing New Home Insurance

As you explore the world of new home insurance, it’s crucial to keep certain factors in mind to make an informed decision. Here are some key considerations to guide your choice:

- Policy Limits and Deductibles: Evaluate the policy limits to ensure they align with the value of your home and belongings. Additionally, consider the deductibles and their impact on your overall premium.

- Coverage Options: Different policies offer varying coverage options. Assess whether the policy covers specific risks relevant to your region, such as natural disasters or theft.

- Additional Coverages: Explore the availability of optional coverages, such as flood insurance or coverage for high-value items. These add-ons can provide enhanced protection tailored to your needs.

- Insurance Provider Reputation: Research the reputation and financial stability of the insurance company. Opt for a provider with a solid track record of claims handling and customer satisfaction.

Navigating the Process: Steps to Obtain New Home Insurance

Obtaining new home insurance involves a systematic approach. Here’s a step-by-step guide to help you through the process:

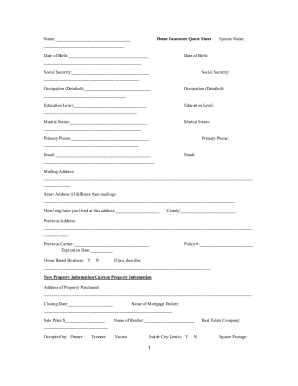

- Research Insurance Providers: Start by researching reputable insurance companies that offer home insurance policies. Look for providers with a strong presence in your area and positive customer reviews.

- Understand Your Needs: Assess your specific insurance needs based on the value of your home, the items you wish to insure, and any potential risks in your region. This step will help you tailor your policy accordingly.

- Request Quotes: Contact the shortlisted insurance providers and request quotes. Provide accurate information about your home, its location, and any additional coverages you require. Compare the quotes to find the best fit for your needs and budget.

- Review Policy Details: Carefully examine the policy documents to understand the coverage, exclusions, and any additional provisions. Ensure that the policy aligns with your expectations and provides adequate protection.

- Purchase the Policy: Once you've found the right policy, proceed with the purchase. Provide the necessary information and documentation to finalize the transaction. Keep a copy of the policy for your records.

Real-Life Case Study: A Successful New Home Insurance Experience

Let’s delve into a real-life scenario to illustrate the benefits of new home insurance. Meet Sarah, a recent homeowner who purchased a charming bungalow in a suburban neighborhood. Shortly after moving in, a severe storm struck her area, causing extensive damage to her roof and some interior walls.

Thanks to her new home insurance policy, Sarah was able to file a claim and receive prompt assistance. The insurance provider covered the costs of repairing the roof and walls, ensuring that her home was restored to its pre-storm condition. Additionally, the policy included coverage for temporary accommodation, allowing Sarah and her family to stay in a nearby hotel while the repairs were underway.

Sarah's experience highlights the crucial role of new home insurance in providing financial protection and peace of mind during unexpected events. It allowed her to focus on the recovery process without the added stress of covering costly repairs out of pocket.

Tips and Strategies for Maximizing Your New Home Insurance

To make the most of your new home insurance policy, consider the following tips and strategies:

- Regularly Review Your Policy: Stay updated on any changes to your home's value or contents. Inform your insurance provider of any significant upgrades or additions to ensure your policy remains adequate.

- Maintain a Home Inventory: Create a comprehensive inventory of your belongings, including photos and receipts. This documentation will be invaluable in the event of a claim, providing evidence of your possessions.

- Understand Exclusions: Familiarize yourself with the exclusions in your policy. Identify any gaps in coverage and consider purchasing additional policies or endorsements to address specific risks.

- Explore Discounts: Insurance providers often offer discounts for bundling policies (e.g., home and auto insurance) or for taking preventive measures like installing security systems.

The Future of New Home Insurance: Trends and Innovations

As the insurance industry evolves, new trends and innovations are shaping the landscape of new home insurance. Here’s a glimpse into the future:

Digital Transformation

Insurance providers are increasingly embracing digital technologies to enhance the customer experience. From online policy management to digital claim submissions, the insurance process is becoming more streamlined and efficient. This shift towards digital solutions offers convenience and accessibility to homeowners.

Personalized Coverages

The rise of data analytics and artificial intelligence is enabling insurance companies to offer more personalized coverage options. By analyzing individual risk profiles, providers can tailor policies to specific needs, ensuring homeowners receive the coverage they truly require.

Enhanced Claims Handling

Insurance companies are investing in advanced technologies to improve claims handling processes. This includes the use of drones for assessing damage, virtual reality for remote inspections, and automated systems for faster claim settlements. These innovations aim to provide quicker and more efficient support to policyholders.

Sustainability and Green Initiatives

With growing environmental awareness, insurance providers are exploring ways to support sustainable practices. Some companies are offering discounts for eco-friendly homes or providing coverage for renewable energy systems. This trend reflects a commitment to both customer needs and environmental responsibility.

Conclusion: Securing Your Dream Home with Confidence

In the world of homeownership, new home insurance serves as a vital tool to protect your investment and provide peace of mind. By understanding the scope of coverage, considering key factors, and following a systematic approach, you can navigate the insurance landscape with confidence.

Remember, your home is more than just a structure; it's a sanctuary filled with memories and aspirations. With the right new home insurance policy, you can rest assured knowing that your dream home is safeguarded, allowing you to focus on creating cherished moments within its walls.

| Key Takeaways | Details |

|---|---|

| Coverage Scope | Protects your home's structure, systems, and belongings, with optional add-ons for specific risks. |

| Considerations | Policy limits, deductibles, coverage options, additional coverages, and insurance provider reputation. |

| Obtaining Insurance | Research providers, understand needs, request quotes, review policy details, and finalize the purchase. |

| Maximizing Benefits | Regular policy review, home inventory maintenance, understanding exclusions, and exploring discounts. |

What is the average cost of new home insurance?

+The average cost of new home insurance can vary based on factors such as location, home value, and coverage options. As a general guideline, homeowners can expect to pay an annual premium ranging from 500 to 2,000. However, it’s essential to obtain quotes tailored to your specific circumstances to get an accurate estimate.

How long does it take to obtain new home insurance?

+The timeline for obtaining new home insurance can vary depending on several factors. Typically, the process can take anywhere from a few days to a couple of weeks. Factors influencing the timeline include the availability of necessary documents, the complexity of your insurance needs, and the efficiency of the insurance provider’s processing systems.

Can I bundle my new home insurance with other policies for discounts?

+Yes, bundling your new home insurance with other policies, such as auto insurance or life insurance, is a common strategy to save money. Many insurance providers offer multi-policy discounts, which can significantly reduce your overall insurance costs. Bundling also simplifies your insurance management, as you’ll have a single provider and potentially a single renewal date for all your policies.