Car Insurance State Farm Quote

Finding the right car insurance coverage at an affordable rate is a priority for many drivers. State Farm is one of the leading providers in the United States, offering a range of insurance products tailored to individual needs. In this article, we delve into the world of State Farm car insurance quotes, exploring the factors that influence rates, the coverage options available, and the steps to secure the best quote for your vehicle. By understanding the intricacies of State Farm's quoting process, you can make informed decisions to protect your vehicle and yourself on the road.

Understanding State Farm Car Insurance Quotes

State Farm’s quoting process is designed to assess your unique circumstances and provide a personalized insurance quote. The quote reflects the coverage and premiums tailored to your specific needs, taking into account various factors such as your driving history, the type of vehicle you own, and the coverage limits you select. Here’s a closer look at how State Farm determines your car insurance quote.

Factors Influencing Your Quote

State Farm considers a multitude of factors when calculating your car insurance quote. These factors can significantly impact the cost of your coverage and include:

- Driving Record: Your driving history plays a pivotal role in determining your insurance rates. A clean driving record with no accidents or traffic violations can lead to lower premiums. Conversely, multiple violations or accidents on your record may result in higher rates.

- Vehicle Type: The make, model, and year of your vehicle are crucial in assessing the risk associated with insuring it. Some vehicles are more expensive to repair or more prone to theft, which can impact your insurance rates.

- Coverage Selection: The level of coverage you choose directly affects your premium. Comprehensive and collision coverage, for instance, provide more extensive protection but come at a higher cost. On the other hand, liability-only coverage is more affordable but offers limited protection.

- Location: Your geographic location is a significant factor in determining your insurance rates. Areas with a higher incidence of accidents, thefts, or natural disasters may have higher insurance costs.

- Age and Gender: While insurance providers cannot discriminate based on gender, age is a factor in determining rates. Younger drivers, particularly those under 25, often face higher premiums due to their relative inexperience on the road.

- Credit History: In many states, insurance providers can consider your credit score when calculating your insurance rates. A good credit history may result in lower premiums, while a poor credit score could lead to higher costs.

It's essential to understand that these factors are not set in stone, and State Farm may weigh them differently based on your unique circumstances and the state you reside in. By being aware of these influences, you can better navigate the quoting process and potentially identify areas where you can negotiate better rates.

Securing the Best State Farm Quote

Obtaining the most advantageous State Farm car insurance quote requires a strategic approach. Here are some steps to help you secure the best deal:

- Shop Around: Compare quotes from multiple insurance providers, including State Farm. Shopping around allows you to gain a better understanding of the market rates and identify the best value for your money.

- Understand Your Coverage Needs: Assess your specific insurance needs. Consider factors like the value of your vehicle, your driving habits, and any additional coverage options you may require. This awareness will help you select the right coverage levels.

- Bundle Policies: If you have multiple insurance needs, such as home or life insurance, bundling these policies with your car insurance can often lead to significant savings. State Farm offers discounts for customers who bundle their policies.

- Explore Discounts: State Farm provides a range of discounts to eligible policyholders. These may include discounts for good driving records, safe vehicle equipment, multiple vehicles insured, and more. Discuss these options with your State Farm agent to determine which discounts you qualify for.

- Review Your Quote: Carefully review your State Farm quote to ensure it aligns with your coverage needs and budget. Verify that all the information provided is accurate, as errors in your quote can lead to unexpected costs down the line.

- Negotiate: Don’t be afraid to negotiate with your State Farm agent. Discuss your circumstances and any unique situations that may impact your insurance needs. Often, agents can work with you to find a quote that better suits your requirements.

By following these steps and staying informed about your insurance options, you can navigate the State Farm quoting process with confidence and secure a quote that provides the coverage you need at a price you can afford.

State Farm Car Insurance Coverage Options

State Farm offers a comprehensive range of car insurance coverage options to meet the diverse needs of its customers. Understanding these coverage types is essential when obtaining a quote, as it allows you to tailor your policy to your specific circumstances. Here’s an overview of the key coverage options provided by State Farm:

Liability Coverage

Liability coverage is a fundamental component of any car insurance policy. It protects you financially if you’re found at fault in an accident that causes injury or property damage to others. State Farm offers both bodily injury liability and property damage liability coverage. Bodily injury liability covers medical expenses and lost wages for injured parties, while property damage liability covers repairs or replacement of damaged property, such as another vehicle or a fence.

Collision and Comprehensive Coverage

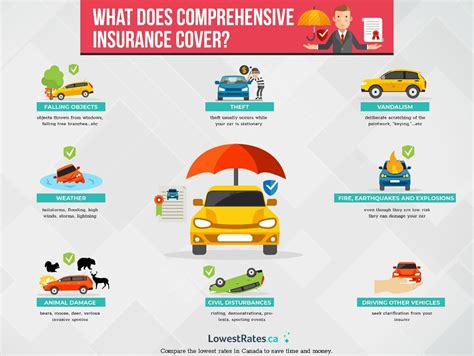

Collision and comprehensive coverage are optional but highly recommended. Collision coverage pays for repairs to your vehicle if you’re involved in an accident, regardless of who is at fault. It covers damage resulting from collisions with other vehicles, objects, or animals. Comprehensive coverage, on the other hand, provides protection for non-collision-related incidents, such as theft, vandalism, natural disasters, or damage caused by falling objects. Both collision and comprehensive coverage typically come with a deductible, which is the amount you pay out of pocket before your insurance coverage kicks in.

Medical Payments Coverage

Medical payments coverage, often referred to as MedPay, is an optional add-on to your car insurance policy. It provides coverage for medical expenses resulting from an accident, regardless of who is at fault. MedPay can cover a wide range of medical costs, including hospital stays, doctor visits, ambulance fees, and even funeral expenses. This coverage is particularly beneficial for those who want to ensure they have adequate medical coverage in the event of an accident.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you in the event of an accident with a driver who either doesn’t have insurance or doesn’t have enough insurance to cover the damages. This coverage can pay for medical expenses, lost wages, and other related costs. It’s an essential coverage to have, as it ensures you’re protected even when the other driver is at fault but lacks sufficient insurance.

Additional Coverage Options

State Farm offers a variety of additional coverage options to further customize your policy. These may include:

- Rental Car Coverage: Provides reimbursement for rental car expenses when your vehicle is being repaired after an insured loss.

- Roadside Assistance: Offers emergency services such as towing, flat tire changes, and fuel delivery.

- Gap Coverage: Helps cover the difference between what your insurance pays and the amount still owed on your car loan or lease if your vehicle is totaled.

- Custom Parts and Equipment Coverage: Protects the cost of custom modifications and upgrades made to your vehicle.

- Accident Forgiveness: Allows you to maintain your good driver discount, even after your first at-fault accident.

It's important to note that the availability and cost of these additional coverage options may vary depending on your state and specific circumstances. Discussing these options with your State Farm agent can help you determine which coverages are most beneficial for your situation.

Performance Analysis and Future Implications

State Farm’s car insurance offerings have consistently performed well in the market, earning recognition for their comprehensive coverage and competitive pricing. The company’s focus on customer service and its extensive network of agents have contributed to its success and popularity among drivers. Additionally, State Farm’s commitment to innovation, as seen through its digital platforms and mobile apps, has enhanced the customer experience, making it easier for policyholders to manage their insurance needs.

Looking ahead, State Farm is well-positioned to adapt to the evolving insurance landscape. With a strong financial foundation and a commitment to technological advancements, the company is poised to meet the changing demands of its customers. As autonomous vehicles and other emerging technologies reshape the industry, State Farm is likely to continue its leadership role, offering innovative solutions and tailored coverage options to stay ahead of the curve.

Furthermore, State Farm's commitment to social responsibility and community involvement has fostered a positive brand image. The company's involvement in various initiatives, from supporting local communities to promoting road safety, has not only strengthened its reputation but also contributed to a more resilient and responsible insurance sector. As State Farm continues to navigate the complexities of the insurance market, its focus on customer satisfaction, technological innovation, and social responsibility is likely to drive its continued success and growth.

Frequently Asked Questions

What is the average State Farm car insurance quote?

+The average State Farm car insurance quote can vary widely depending on factors such as your location, driving record, and the coverage options you select. On average, State Farm customers pay around $1,200 annually for car insurance, but this figure can be higher or lower based on individual circumstances.

How can I lower my State Farm car insurance quote?

+There are several strategies to lower your State Farm car insurance quote. These include maintaining a clean driving record, shopping around for the best rates, exploring discounts (such as good student or safe driver discounts), and bundling your policies with State Farm. Additionally, consider adjusting your coverage levels to find the right balance between cost and protection.

Does State Farm offer discounts on car insurance quotes?

+Yes, State Farm offers a variety of discounts to eligible policyholders. These may include discounts for good driving records, safe vehicle equipment, multiple vehicles insured, and more. Discuss these options with your State Farm agent to determine which discounts you qualify for.

What factors influence State Farm’s car insurance quotes the most?

+The primary factors that influence State Farm’s car insurance quotes include your driving record, the type of vehicle you own, your location, and the coverage limits you select. Other factors, such as your age, gender, and credit history, may also play a role in determining your insurance rates.

How can I get a State Farm car insurance quote?

+You can obtain a State Farm car insurance quote by visiting their official website, where you can use their online quote tool. Alternatively, you can contact a local State Farm agent, who can guide you through the quoting process and help you select the best coverage options for your needs.