Comprehensive Coverage Insurance

Comprehensive Coverage Insurance: Navigating the Essentials

Comprehensive coverage insurance is a vital component of financial protection and risk management for individuals and businesses alike. In an unpredictable world, this type of insurance provides a safety net against a wide range of unforeseen events, offering peace of mind and a pathway to recovery. This article aims to delve into the intricacies of comprehensive coverage, exploring its benefits, key features, and how it can be tailored to meet specific needs.

Understanding Comprehensive Coverage

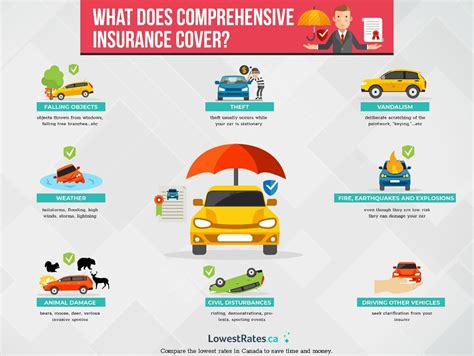

At its core, comprehensive coverage insurance is designed to safeguard against losses and damages that are not typically covered by standard insurance policies. It serves as an all-encompassing protection net, extending beyond the boundaries of traditional policies. While the specific scope of coverage may vary depending on the provider and the type of insurance, comprehensive coverage often includes:

- Protection against natural disasters such as hurricanes, earthquakes, and floods.

- Coverage for damages caused by vandalism, riots, or civil unrest.

- Compensation for theft or attempted theft of insured items.

- Assistance in the event of a collision with an uninsured or unidentified driver.

- Reimbursement for damages resulting from falling objects, fires, explosions, or collisions with animals.

The beauty of comprehensive coverage lies in its ability to provide a customized solution. Policyholders can often choose specific add-ons or endorsements to tailor their coverage to their unique circumstances and risks. This level of personalization ensures that individuals and businesses can address their specific concerns, whether it's protecting valuable assets, mitigating regional risks, or covering unique vulnerabilities.

Key Benefits of Comprehensive Coverage

Comprehensive coverage insurance offers a multitude of advantages that make it an essential consideration for anyone seeking robust financial protection.

Financial Security

In the face of unexpected events, comprehensive coverage steps in to provide financial stability. Whether it’s a natural disaster, an act of vandalism, or a collision with an uninsured driver, this type of insurance ensures that policyholders are not left with the full financial burden. By covering a wide range of potential losses, comprehensive coverage helps individuals and businesses maintain their financial health and stability.

Peace of Mind

Living with uncertainty can be stressful. Comprehensive coverage alleviates this stress by offering a sense of security. Policyholders can rest assured knowing that they are protected against a variety of unforeseen circumstances. This peace of mind allows individuals and businesses to focus on their day-to-day operations and personal lives without the constant worry of potential financial ruin.

Tailored Protection

One of the standout features of comprehensive coverage is its flexibility. Policyholders can often customize their coverage to fit their specific needs and circumstances. This level of personalization ensures that the insurance policy is not just a generic solution but a tailored plan that addresses the unique risks and concerns of the individual or business. From adding coverage for specific assets to including protection against regional hazards, comprehensive coverage can be adapted to provide the right level of protection.

Rapid Response and Recovery

In the event of a covered loss, comprehensive coverage insurance providers typically offer swift response times. This rapid response ensures that policyholders can quickly address the situation and begin the recovery process. Whether it’s coordinating repairs, providing temporary accommodations, or replacing stolen items, the insurance company works to minimize the disruption caused by the loss. This timely response is crucial in helping individuals and businesses get back on their feet as soon as possible.

Real-World Applications and Examples

To illustrate the practical benefits of comprehensive coverage insurance, let’s explore a few real-world scenarios where this type of insurance has made a significant impact.

Natural Disaster Recovery

Imagine a small business located in a region prone to hurricanes. Despite taking precautions, the business is severely damaged during a storm. With comprehensive coverage insurance, the business owner can receive financial support to cover the costs of repairs, temporary relocation, and even lost revenue during the recovery period. This support ensures the business can bounce back and continue serving its community.

Vandalism and Theft Protection

A family living in an urban area faces the unfortunate reality of vandalism and theft. Their home is targeted, resulting in significant property damage and the loss of valuable possessions. With comprehensive home insurance, the family can receive compensation for the repairs and replacements needed, helping them restore their home and providing financial relief during a difficult time.

Uninsured Motorist Collision

While driving through a rural area, an individual is involved in a collision with an uninsured motorist. The accident causes significant damage to their vehicle and results in medical expenses. With comprehensive auto insurance, the individual can receive coverage for the vehicle repairs and medical bills, ensuring they are not left financially burdened by the accident.

| Scenario | Comprehensive Coverage Benefit |

|---|---|

| Natural Disaster | Financial support for repairs, temporary relocation, and lost revenue. |

| Vandalism and Theft | Compensation for property damage and replacement of stolen items. |

| Uninsured Motorist | Coverage for vehicle repairs and medical expenses. |

Customizing Your Comprehensive Coverage

One of the most powerful aspects of comprehensive coverage insurance is its ability to be tailored to individual needs. Policyholders have the opportunity to work with insurance providers to design a plan that addresses their specific concerns and circumstances.

Adding Endorsements

Endorsements, also known as policy riders, are additions to a standard insurance policy that provide extra coverage for specific situations or assets. These endorsements can be crucial in addressing unique risks. For example, if you live in an area prone to wildfires, you might consider adding a wildfire endorsement to your home insurance policy. Similarly, if you have a classic car that is more than just a means of transportation, you might opt for an endorsement that provides specialized coverage for its unique value.

Increasing Coverage Limits

In some cases, the standard coverage limits provided by an insurance policy may not be sufficient to cover the full extent of potential losses. Fortunately, policyholders have the option to increase these limits to better align with their needs. For instance, if you have high-value jewelry or artwork, you might want to increase the coverage limits for personal property to ensure these items are fully protected.

Bundling Policies

Bundling multiple insurance policies can often result in cost savings and enhanced coverage. By combining auto, home, and liability insurance, for example, you can not only simplify your insurance portfolio but also potentially unlock discounts and additional benefits. This approach ensures that your comprehensive coverage extends across all aspects of your life, providing a seamless and comprehensive protection plan.

The Process of Claiming Comprehensive Coverage

When an insured event occurs, understanding the claims process is crucial. Here’s a simplified breakdown of what you can expect:

- Report the Incident: As soon as possible, report the event to your insurance provider. Provide detailed information about the loss or damage, including any relevant documentation or photographs.

- Assessment and Investigation: The insurance company will assess the claim and investigate the circumstances. This process helps to verify the validity of the claim and determine the extent of the coverage.

- Approval and Settlement: Once the claim is approved, the insurance provider will settle the claim, either through direct payment or by arranging for repairs or replacements. The specific process may vary depending on the type of insurance and the nature of the loss.

It's important to note that the claims process can vary depending on the insurance provider and the type of insurance. Always review your policy documents and reach out to your insurance agent or provider for specific guidance and instructions.

Future Trends and Innovations in Comprehensive Coverage

The insurance industry is constantly evolving, and comprehensive coverage is no exception. Here are some trends and innovations that are shaping the future of this type of insurance:

Digital Transformation

The rise of digital technologies is revolutionizing the insurance industry. Comprehensive coverage providers are leveraging digital tools and platforms to enhance the customer experience. From online policy management and claims submission to real-time risk assessment and personalized coverage recommendations, digital transformation is making insurance more accessible, efficient, and tailored to individual needs.

Data-Driven Insights

With the vast amount of data available, insurance companies are harnessing the power of analytics to gain deeper insights into risks and customer needs. By analyzing data patterns, insurers can develop more accurate risk models and offer customized coverage options. This data-driven approach allows for more precise pricing and coverage, ensuring that policyholders receive the right level of protection at a fair cost.

Sustainability and Resilience

As environmental concerns continue to grow, the insurance industry is playing a role in promoting sustainability and resilience. Comprehensive coverage providers are increasingly incorporating sustainability considerations into their policies. This may include offering incentives for eco-friendly practices, providing coverage for green technologies, or supporting initiatives that mitigate the impacts of climate change. By aligning with sustainability goals, insurance companies are not only contributing to a greener future but also helping policyholders mitigate risks associated with environmental challenges.

Artificial Intelligence and Automation

Artificial intelligence (AI) and automation are transforming various industries, and insurance is no exception. These technologies are being utilized to streamline processes, enhance risk assessment, and improve customer service. From AI-powered chatbots that provide instant support to automated claim processing systems, these innovations are making insurance more efficient and responsive. By leveraging AI and automation, comprehensive coverage providers can offer faster response times, more accurate coverage, and a seamless customer experience.

Frequently Asked Questions

What is the difference between comprehensive coverage and collision coverage in auto insurance?

+Comprehensive coverage and collision coverage are both essential components of auto insurance, but they protect against different types of losses. Comprehensive coverage protects against damages caused by events other than collisions, such as natural disasters, theft, or vandalism. Collision coverage, on the other hand, specifically covers damages resulting from collisions with other vehicles, objects, or rollovers.

How does comprehensive coverage for home insurance work?

+Comprehensive home insurance coverage typically protects against a wide range of risks, including natural disasters, vandalism, theft, and damage from falling objects. It provides financial protection for the structure of your home and often includes coverage for personal belongings. It’s important to review your policy to understand the specific coverage limits and any exclusions.

Are there any limitations or exclusions to comprehensive coverage insurance?

+Yes, comprehensive coverage insurance, like any other insurance policy, may have limitations and exclusions. These can vary depending on the provider and the type of insurance. It’s crucial to carefully review your policy documents to understand what is and isn’t covered. Common exclusions may include intentional damage, wear and tear, and certain types of high-risk activities.

How can I determine the right amount of comprehensive coverage for my needs?

+Determining the right amount of comprehensive coverage depends on your specific circumstances and the value of the assets you want to protect. It’s recommended to work with an insurance agent or advisor who can help assess your risks and recommend appropriate coverage limits. They can guide you in selecting the right endorsements and ensuring your policy aligns with your needs.

Can comprehensive coverage be customized for unique circumstances or high-value items?

+Absolutely! One of the strengths of comprehensive coverage is its flexibility. Policyholders can often customize their coverage by adding endorsements or riders to address specific risks or protect high-value items. For example, you can add coverage for jewelry, fine art, or collectibles to ensure they are adequately protected.