Car Insurance Type

Car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind for drivers. With a myriad of insurance options available, it's crucial to understand the different types of coverage to make informed decisions. This comprehensive guide will delve into the world of car insurance, exploring the various types, their benefits, and how they can protect you and your vehicle. From liability coverage to comprehensive plans, we'll cover it all, ensuring you have the knowledge to navigate the complex landscape of car insurance with confidence.

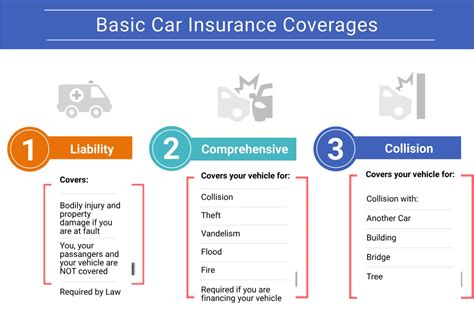

Understanding the Basics: Types of Car Insurance

Car insurance can be categorized into several key types, each serving a specific purpose and offering different levels of protection. Here’s an overview of the primary types of car insurance and their significance:

Liability Insurance

Liability insurance is the cornerstone of car insurance, providing coverage for bodily injury and property damage caused by the policyholder to others in an at-fault accident. This type of insurance is mandatory in most states and is crucial for protecting you from financial liability in the event of an accident. Liability coverage typically consists of two main components:

- Bodily Injury Liability: This covers medical expenses and lost wages for individuals injured in an accident caused by you.

- Property Damage Liability: This pays for the repair or replacement of property damaged in an accident, such as other vehicles, fences, or buildings.

Liability insurance is essential for legal compliance and offers a basic level of protection, ensuring you can meet your financial obligations after an accident.

Collision Insurance

Collision insurance provides coverage for damage to your own vehicle resulting from a collision with another vehicle or object, regardless of fault. This type of insurance is particularly valuable for newer or more expensive vehicles, as it helps cover the costs of repairs or replacement. Collision insurance is often purchased in conjunction with liability insurance to ensure comprehensive protection.

Collision coverage has a deductible, which is the amount you must pay out of pocket before the insurance kicks in. The higher the deductible, the lower the premium, so it’s important to choose a deductible that aligns with your financial situation and risk tolerance.

Comprehensive Insurance

Comprehensive insurance, also known as other than collision coverage, protects against damage to your vehicle caused by events other than collisions. This can include theft, vandalism, natural disasters, falling objects, and animal collisions. Comprehensive insurance is an essential component of a well-rounded insurance policy, as it covers a wide range of unexpected events that could result in costly repairs or replacements.

Similar to collision insurance, comprehensive coverage has a deductible, and the amount you choose will impact your premium. It’s crucial to strike a balance between a deductible you can afford and the level of protection you require.

Personal Injury Protection (PIP)

Personal Injury Protection, or PIP, is a type of insurance coverage that provides benefits to the policyholder and their passengers, regardless of fault in an accident. PIP covers medical expenses, lost wages, and other related costs, ensuring that those injured in an accident receive the necessary care and support. PIP is mandatory in some states and is highly recommended in others, as it offers a safety net for both drivers and passengers.

PIP coverage can vary by state, with some states requiring a minimum level of coverage while others allow policyholders to choose their coverage limits. It’s important to understand the PIP laws in your state and select coverage that aligns with your needs and budget.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist (UM/UIM) coverage protects you in the event of an accident with a driver who has little or no insurance. This type of coverage ensures that you’re not left financially vulnerable if you’re involved in an accident with an uninsured or underinsured driver. UM/UIM coverage typically includes two components:

- Uninsured Motorist Bodily Injury: This covers medical expenses and lost wages for you and your passengers if an uninsured driver causes an accident.

- Underinsured Motorist Bodily Injury: This provides additional coverage if the at-fault driver’s liability limits are insufficient to cover your damages.

UM/UIM coverage is highly recommended, as it provides an added layer of protection against the financial consequences of an accident caused by an uninsured or underinsured driver.

Medical Payments Coverage

Medical Payments Coverage, often referred to as MedPay, is a no-fault insurance option that covers medical expenses for the policyholder and their passengers after an accident, regardless of who is at fault. MedPay is designed to provide quick and easy access to medical care, as it pays for expenses such as hospital stays, doctor visits, and even funeral costs in the event of a fatality. This coverage is particularly beneficial for those who want immediate access to medical treatment without having to wait for liability claims to be resolved.

MedPay coverage has its own limits, typically ranging from 1,000 to 10,000, and the policyholder can choose the amount that best suits their needs and budget. It’s important to note that MedPay coverage is separate from PIP, and policyholders can have both types of coverage for added protection.

Factors Influencing Car Insurance Rates

Car insurance rates can vary significantly based on several factors. Understanding these factors can help you make informed decisions when choosing insurance coverage and potentially save money on your premiums. Here are some key factors that influence car insurance rates:

Driver Profile

Your driving history and personal characteristics play a significant role in determining your insurance rates. Insurers consider factors such as your age, gender, marital status, and driving record. Younger drivers, especially males under the age of 25, are often considered high-risk and may face higher premiums. Similarly, drivers with a history of accidents or traffic violations may be seen as higher risk and pay more for insurance.

Vehicle Type and Usage

The type of vehicle you drive and how you use it can impact your insurance rates. Sports cars and luxury vehicles tend to have higher premiums due to their higher repair costs and increased risk of theft. Additionally, the primary use of your vehicle, whether for commuting, pleasure, or business, can affect your rates. Commercial use, such as using your vehicle for deliveries or ridesharing, may result in higher premiums due to the increased risk of accidents.

Location and Mileage

Where you live and how far you drive can influence your insurance rates. Urban areas often have higher rates due to increased traffic congestion and the risk of accidents. Insurers also consider the annual mileage you drive, as higher mileage is associated with a greater risk of accidents and wear and tear on your vehicle. If you drive fewer miles annually, you may be eligible for a low-mileage discount.

Credit Score

Surprisingly, your credit score can have an impact on your car insurance rates. Many insurers use credit-based insurance scores to assess the risk of insuring a driver. Drivers with higher credit scores are often considered more responsible and are offered lower premiums. If you have a low credit score, it’s worth taking steps to improve it, as this could lead to significant savings on your insurance.

Insurance Company and Coverage Options

Different insurance companies offer a wide range of coverage options and premiums. It’s important to shop around and compare quotes from multiple insurers to find the best deal. Additionally, the coverage options you choose will impact your premium. Higher coverage limits and additional coverage types, such as comprehensive and collision, will typically result in higher premiums.

Choosing the Right Car Insurance Coverage

Selecting the appropriate car insurance coverage involves a careful consideration of your specific needs, budget, and state requirements. Here are some key factors to guide your decision-making process:

Assess Your Risk and Needs

Evaluate your personal circumstances and the potential risks you may face on the road. Consider factors such as your driving record, the value of your vehicle, and the likelihood of accidents or theft in your area. If you have a clean driving record and live in a low-risk area, you may opt for lower coverage limits to save on premiums. However, if you have a history of accidents or live in an area with a high crime rate, higher coverage limits and additional protection may be necessary.

Understand State Requirements

Each state has its own minimum car insurance requirements. These typically include liability coverage for bodily injury and property damage. It’s crucial to understand the specific requirements in your state to ensure you meet the legal obligations. While meeting the minimum requirements is essential, it’s often recommended to go beyond the minimum and opt for additional coverage to protect yourself adequately.

Consider Your Budget

Your financial situation plays a significant role in determining the type and level of car insurance coverage you can afford. While it’s important to have adequate protection, you don’t want to strain your budget with excessive premiums. Assess your financial capabilities and set a realistic budget for your insurance coverage. Look for ways to save, such as bundling your insurance policies or taking advantage of discounts offered by insurers.

Compare Quotes and Coverage Options

Obtain quotes from multiple insurance providers to compare rates and coverage options. This will give you a clearer picture of the market and help you identify the best value for your money. Pay attention to the details of each policy, including the coverage limits, deductibles, and any additional benefits or discounts offered. Don’t be afraid to ask questions and seek clarification to ensure you fully understand the policies being offered.

Tips for Saving on Car Insurance

While car insurance is a necessary expense, there are strategies you can employ to reduce your premiums and save money. Here are some practical tips to help you cut costs without compromising on coverage:

Maintain a Clean Driving Record

A clean driving record is one of the most effective ways to lower your car insurance premiums. Insurers view drivers with a history of accidents or traffic violations as high-risk, resulting in higher premiums. By maintaining a clean record, you demonstrate your responsibility and reliability, which can lead to significant savings on your insurance.

Shop Around and Compare Quotes

Insurance companies offer a wide range of rates and coverage options, so it’s crucial to shop around and compare quotes. Obtain quotes from multiple insurers, both online and through independent agents, to get a comprehensive view of the market. Compare not only the premiums but also the coverage limits, deductibles, and any additional benefits or discounts offered. This will help you find the best value for your money.

Bundle Your Policies

Many insurance companies offer discounts when you bundle multiple policies, such as car insurance, homeowners or renters insurance, and umbrella policies. By combining your insurance needs with a single provider, you can often save money on your premiums. Bundling policies can also streamline your insurance management, making it more convenient and efficient.

Consider Higher Deductibles

Opting for higher deductibles can result in lower premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By increasing your deductible, you take on more financial responsibility in the event of a claim, which can lead to significant savings on your insurance premiums. However, it’s important to choose a deductible amount that you can afford in the event of an accident or other covered loss.

Take Advantage of Discounts

Insurance companies offer a variety of discounts to attract and retain customers. These discounts can vary depending on the insurer and your specific circumstances. Common discounts include safe driver discounts, multi-car discounts, good student discounts, and loyalty discounts for long-term customers. Ask your insurance provider about the discounts they offer and ensure you’re taking advantage of any that apply to your situation.

Improve Your Credit Score

Your credit score can have a significant impact on your car insurance premiums. Many insurers use credit-based insurance scores to assess the risk of insuring a driver. Improving your credit score can lead to lower premiums, as it demonstrates your financial responsibility and reliability. Take steps to improve your credit score, such as paying bills on time, reducing credit card balances, and monitoring your credit report for accuracy.

The Future of Car Insurance: Trends and Innovations

The car insurance industry is constantly evolving, with new trends and innovations shaping the way insurance is provided and consumed. Here’s a glimpse into the future of car insurance and some of the exciting developments on the horizon:

Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and GPS to track driving behavior, is revolutionizing the way insurance is priced. Usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive insurance, allows insurers to offer policies that are tailored to an individual’s driving habits. This means that safe drivers can benefit from lower premiums, while those with riskier driving behaviors may pay higher rates. Telematics technology provides a more accurate assessment of risk, leading to fairer and more personalized insurance pricing.

Connected Car Technology

The rise of connected car technology is transforming the driving experience and offering new opportunities for insurance providers. Connected cars can communicate with other vehicles, infrastructure, and even pedestrians, improving safety and providing real-time data on driving behavior. This data can be used by insurers to offer more accurate and personalized insurance policies. Additionally, connected car technology can facilitate the swift resolution of claims, as insurers can access vehicle data to verify accidents and assess damage.

Autonomous Vehicles and Insurance

The advent of autonomous vehicles is poised to disrupt the car insurance industry. As self-driving cars become more prevalent, the traditional concept of car insurance may need to evolve. With autonomous vehicles, the risk of human error is significantly reduced, potentially leading to a decrease in accidents and claims. This could result in lower insurance premiums for policyholders. However, as autonomous vehicles share the road with traditional cars, insurers will need to adapt their policies to address the unique risks and liabilities associated with this new technology.

Digital Transformation and Customer Experience

The digital transformation of the insurance industry is enhancing the customer experience and streamlining processes. Insurers are investing in digital platforms and mobile apps to make it easier for policyholders to manage their insurance, file claims, and access information. This shift towards a more digital and customer-centric approach is improving efficiency and reducing friction in the insurance process. Policyholders can now expect faster claim settlements, easier policy management, and more personalized interactions with their insurers.

Data Analytics and Risk Assessment

Advancements in data analytics and machine learning are enabling insurers to make more accurate risk assessments and develop innovative pricing models. By analyzing vast amounts of data, insurers can identify patterns and trends that influence risk, such as driving behavior, weather conditions, and road infrastructure. This data-driven approach allows insurers to offer more precise and tailored insurance products, ensuring that policyholders receive the coverage they need at a fair price. Additionally, data analytics can help insurers identify potential fraud and improve overall risk management.

Conclusion

Understanding the different types of car insurance and the factors that influence rates is crucial for making informed decisions about your coverage. By assessing your needs, understanding state requirements, and comparing quotes, you can find the right balance of protection and affordability. Additionally, by adopting strategies to save on insurance, such as maintaining a clean driving record, bundling policies, and taking advantage of discounts, you can further reduce your premiums. As the car insurance industry continues to evolve with new technologies and innovations, staying informed about the latest trends will ensure you stay ahead of the curve and make the most of the opportunities available.

What is the difference between liability and collision insurance?

+Liability insurance covers bodily injury and property damage caused by the policyholder to others in an at-fault accident. Collision insurance, on the other hand, provides coverage for damage to your own vehicle resulting from a collision with another vehicle or object, regardless of fault. Liability insurance is mandatory in most states, while collision insurance is optional but highly recommended for newer or more expensive vehicles.

Do I need comprehensive insurance if I have collision coverage?

+While collision insurance covers damage to your vehicle caused by collisions, comprehensive insurance provides protection against damage caused by events other than collisions, such as theft, vandalism, and natural disasters. Comprehensive insurance is highly recommended for well-rounded protection, especially for newer or more valuable vehicles. It’s important to consider your specific needs and the risks you face when deciding whether to include comprehensive insurance in your policy.

How does my credit score affect my car insurance rates?

+Your credit score can have a significant impact on your car insurance rates. Many insurers use credit-based insurance scores to assess the risk of insuring a driver. Drivers with higher credit scores are often considered more responsible and reliable, which can lead to lower premiums. If you have a low credit score, improving it