Business Insurer

In the world of commerce, the importance of safeguarding one's business ventures cannot be overstated. The role of a Business Insurer is pivotal in this regard, providing the necessary coverage to mitigate risks and ensure the longevity and resilience of enterprises. This comprehensive guide delves into the intricacies of business insurance, offering an in-depth analysis of its significance, types, and the benefits it brings to the corporate landscape.

The Vital Role of Business Insurers

A Business Insurer serves as a guardian of sorts, offering protection against a myriad of potential threats that could cripple a company. From natural disasters to legal liabilities, the scope of coverage is broad and tailored to the unique needs of each business. The primary goal is to provide peace of mind, allowing entrepreneurs to focus on growth and innovation without the constant worry of unforeseen events.

Understanding the Risks

The first step in effective business insurance is recognizing the risks. Every enterprise, regardless of size or industry, faces its own set of challenges. These could include property damage, theft, liability suits, or even data breaches. A Business Insurer works closely with clients to identify these risks and tailor insurance policies accordingly.

| Risk Type | Coverage |

|---|---|

| Property Damage | Covers repairs or replacements due to natural disasters, fires, or vandalism. |

| Theft | Provides compensation for stolen assets, including inventory and equipment. |

| Liability | Protects against lawsuits arising from accidents or injuries on company premises. |

| Data Breaches | Offers support for costs related to cyber attacks and data loss. |

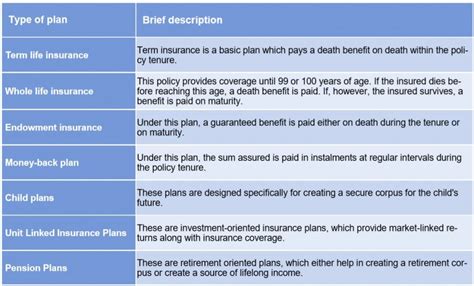

Types of Business Insurance

The insurance landscape is diverse, offering a range of policies to address different business needs. Here’s an overview of some common types:

- General Liability Insurance: Provides coverage for third-party claims related to bodily injury, property damage, or personal and advertising injury.

- Product Liability Insurance: Protects businesses that manufacture or sell products against claims of injury or property damage caused by their products.

- Professional Liability Insurance: Also known as Errors and Omissions (E&O) insurance, it safeguards professionals against negligence claims made by clients.

- Workers' Compensation Insurance: Covers medical expenses and lost wages for employees injured on the job.

- Business Owner's Policy (BOP): A bundle of policies tailored to small businesses, often including property, liability, and business interruption insurance.

The Benefits of Comprehensive Coverage

Having robust business insurance brings a multitude of advantages, many of which extend beyond the obvious financial protections.

Financial Stability

In the event of a covered loss, business insurance provides the necessary funds to cover repairs, replacements, or legal fees. This ensures that the business can continue operating without facing significant financial strain.

Legal Protection

Liability insurance is a critical component, especially for businesses that interact closely with the public. It offers a safety net against potential lawsuits, providing legal defense and covering settlement costs.

Employee Morale and Retention

Workers’ compensation insurance not only ensures that injured employees receive proper care but also helps maintain a positive work environment and employee loyalty. It demonstrates a commitment to employee well-being, which can boost morale and reduce turnover.

Peace of Mind

Perhaps the most significant benefit of business insurance is the peace of mind it affords. Entrepreneurs can rest assured knowing that their ventures are protected, allowing them to focus on strategic growth and long-term success.

Real-World Examples of Business Insurance in Action

To illustrate the impact of business insurance, consider these scenarios:

A Retail Store’s Theft Coverage

Imagine a retail store that falls victim to a theft. Without insurance, the financial loss could be devastating. However, with comprehensive coverage, the store owner can file a claim and receive compensation to replace stolen merchandise and repair any damage, ensuring the business can quickly return to normal operations.

Protecting a Tech Startup’s Data

In today’s digital age, data breaches are a significant concern. A tech startup that experiences such an incident could face substantial costs for data recovery and legal fees. With the right insurance, the startup can access the necessary resources to mitigate the damage and continue its operations.

Future Trends and Innovations in Business Insurance

The insurance industry is evolving, adapting to the changing needs of businesses. Here are some trends to watch out for:

Emphasis on Cyber Security

With the rise of remote work and digital transactions, cyber security is becoming a top priority. Business insurers are increasingly offering comprehensive cyber insurance policies to protect against the growing threat of cyber attacks.

Data-Driven Risk Assessment

Advanced analytics and data modeling are being used to more accurately assess risks. This allows insurers to offer more precise and tailored coverage, ensuring businesses are protected without paying for unnecessary premiums.

Insurtech Innovations

The integration of technology into the insurance industry, known as Insurtech, is revolutionizing the way policies are managed. From digital claims processing to AI-powered risk assessment, these innovations are streamlining the insurance process and enhancing customer experience.

Conclusion

Business insurance is a cornerstone of modern commerce, providing the necessary security and peace of mind for entrepreneurs. By understanding the risks and leveraging the right insurance policies, businesses can thrive and focus on their core competencies. As the industry continues to innovate, the future of business insurance looks bright, offering even more effective and tailored solutions.

How do I choose the right Business Insurer for my company?

+Choosing a Business Insurer involves careful consideration of your specific business needs. Assess the risks your company faces and look for insurers who offer tailored policies. It’s also beneficial to read reviews and seek recommendations from industry peers. Remember, the right insurer should provide comprehensive coverage at a competitive price while offering excellent customer service.

What happens if I don’t have enough insurance coverage for a major loss?

+In the event of a major loss that exceeds your insurance coverage, you may be responsible for covering the remaining costs out of pocket. This could have significant financial implications for your business. It’s crucial to regularly review your insurance policies and ensure you have adequate coverage to protect your assets and operations.

Can Business Insurance policies be customized to fit unique business needs?

+Absolutely! Business Insurers understand that every business is unique. They work with clients to create customized policies that address specific risks and concerns. This tailored approach ensures that businesses receive the precise coverage they require, without paying for unnecessary protections.