Cheap Car Insurance Mi

Finding cheap car insurance in Michigan can be a daunting task, as the state is known for its high insurance rates. However, with the right knowledge and strategies, it is possible to secure affordable coverage. This comprehensive guide will delve into the factors influencing car insurance costs in Michigan, explore the various options available to residents, and provide expert tips to help you navigate the process and find the best deals.

Understanding the Michigan Car Insurance Landscape

Michigan’s unique no-fault insurance system plays a significant role in shaping the insurance landscape. Understanding this system is crucial to making informed decisions. Michigan requires all drivers to carry Personal Injury Protection (PIP) coverage, which can lead to higher insurance premiums compared to other states. Additionally, the state’s competitive market offers numerous insurance providers, each with its own set of rates and coverage options.

Key Factors Affecting Insurance Rates

Several factors contribute to the cost of car insurance in Michigan. These include:

- Vehicle Type and Usage: The make, model, and age of your vehicle, as well as how often you drive, can impact your insurance rates.

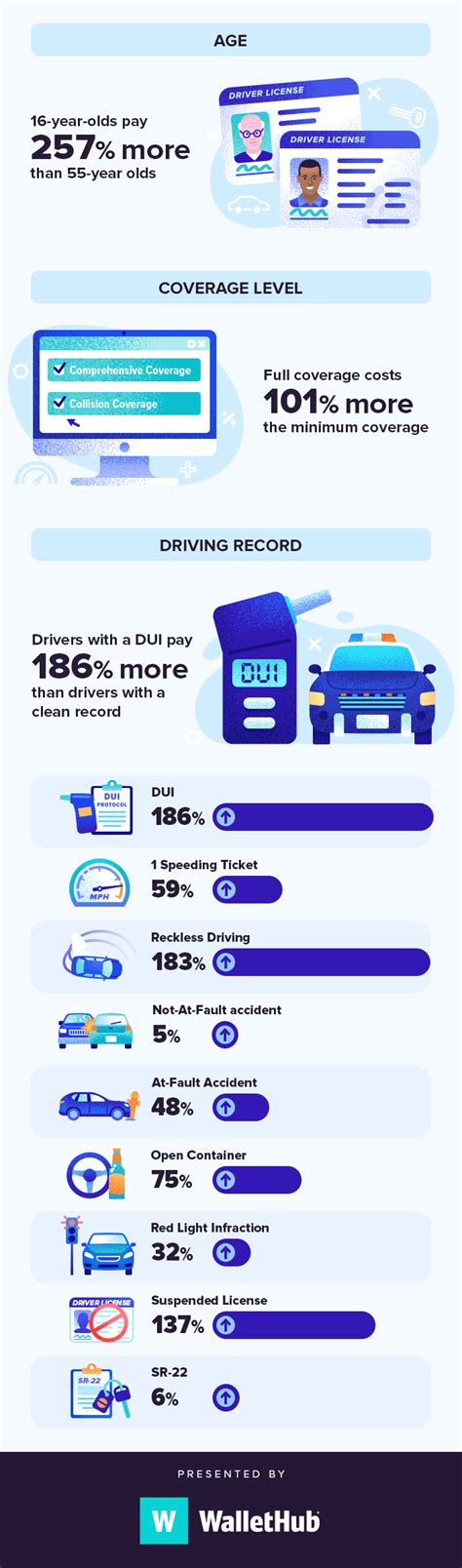

- Driving History: Your record, including accidents, tickets, and claims, is a significant factor in determining insurance costs.

- Location: The area where you live and drive can affect your rates due to varying levels of traffic congestion, crime, and accident rates.

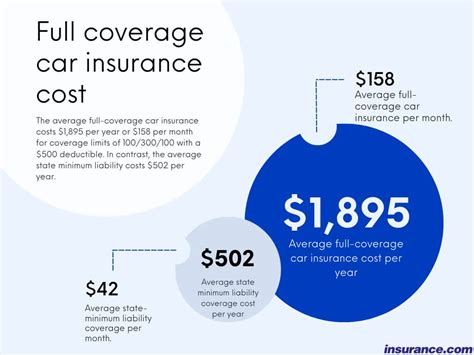

- Coverage and Deductibles: The level of coverage you choose and your deductible amount can greatly influence your insurance premiums.

- Personal Factors: Age, gender, marital status, and credit score are also considered when calculating insurance rates.

| Factor | Impact on Rates |

|---|---|

| Vehicle Type | Sports cars and luxury vehicles often have higher premiums. |

| Driving History | Clean records result in lower rates, while accidents and violations increase costs. |

| Location | Urban areas with higher traffic and crime rates may have elevated insurance costs. |

| Coverage Level | Higher coverage limits and lower deductibles lead to increased premiums. |

| Personal Factors | Younger drivers and those with poor credit may face higher insurance rates. |

Strategies for Finding Cheap Car Insurance in Michigan

Securing affordable car insurance in Michigan requires a strategic approach. Here are some expert tips to help you find the best deals:

Compare Multiple Quotes

Obtain quotes from various insurance providers to compare rates and coverage options. Online comparison tools can be especially useful for this purpose. By comparing quotes, you can identify the most competitive rates for your specific needs.

Review Coverage Options

Examine the different coverage types and levels offered by insurance providers. Understand the minimum requirements in Michigan, but also consider additional coverage options that might be beneficial for your situation. For example, consider adding rental car coverage or gap insurance if you have a lease or loan on your vehicle.

Bundle Policies

If you have multiple insurance needs, such as home and auto, consider bundling your policies with the same provider. Many insurance companies offer discounts when you combine multiple policies, potentially saving you a significant amount on your car insurance.

Maintain a Clean Driving Record

A clean driving record is crucial for keeping insurance costs down. Avoid accidents, reduce speeding tickets, and practice safe driving habits. Over time, a clean record can lead to substantial savings on your insurance premiums.

Consider Higher Deductibles

Opting for a higher deductible can lower your insurance premiums. However, it’s important to choose a deductible amount that you can comfortably afford in the event of a claim. Be cautious, as a higher deductible means you’ll have to pay more out of pocket before your insurance kicks in.

Explore Discounts

Insurance providers offer a variety of discounts that can significantly reduce your premiums. Common discounts include good student discounts for young drivers with good grades, loyalty discounts for long-term customers, and safe driver discounts for those with clean records. Ask your insurance agent about the discounts available and how you can qualify for them.

Shop Around Regularly

Insurance rates can change over time, and new providers may offer better deals. It’s a good practice to shop around for car insurance quotes at least once a year. This ensures you’re always getting the best value for your money and allows you to take advantage of any new discounts or promotions.

The Role of Credit Score in Michigan Car Insurance

In Michigan, insurance providers are allowed to use credit-based insurance scoring to determine insurance rates. This means that your credit score can impact the cost of your car insurance. While a good credit score can lead to lower premiums, a poor credit score may result in higher costs.

If you're concerned about your credit score affecting your insurance rates, consider taking steps to improve your credit. This could involve paying off debts, reducing credit card balances, and consistently making on-time payments. Over time, these efforts can positively impact your credit score and potentially lower your insurance premiums.

Conclusion: Navigating the Michigan Insurance Landscape

Finding cheap car insurance in Michigan requires a comprehensive understanding of the state’s unique insurance system and a strategic approach to shopping for coverage. By comparing quotes, reviewing coverage options, and exploring discounts, you can secure affordable insurance that meets your needs. Remember to maintain a clean driving record and regularly shop around to ensure you’re getting the best deals available.

Can I find cheap car insurance with a poor driving record in Michigan?

+While a poor driving record can make it more challenging to find affordable car insurance, it is not impossible. Some insurance providers specialize in high-risk drivers and offer competitive rates. It’s important to shop around and compare quotes to find the best deal. Additionally, consider improving your driving record over time to potentially lower your insurance premiums.

Are there any specific insurance providers known for offering cheap car insurance in Michigan?

+The car insurance market in Michigan is highly competitive, and rates can vary significantly between providers. It’s recommended to obtain quotes from multiple companies to find the most affordable option for your specific needs. Online comparison tools can be especially useful for this purpose.

How can I save money on car insurance if I have a teen driver in my household?

+Insuring teen drivers can significantly increase car insurance premiums. However, there are strategies to mitigate these costs. Consider adding your teen driver to your existing policy to take advantage of potential discounts for multiple drivers. Encourage your teen to maintain a clean driving record and good grades, as many insurance providers offer discounts for young drivers with these achievements. Additionally, explore options for higher deductibles and consider bundling policies to potentially save on overall insurance costs.

What is the average cost of car insurance in Michigan, and how does it compare to other states?

+The average cost of car insurance in Michigan is relatively high compared to other states due to its unique no-fault insurance system. According to recent data, the average annual premium in Michigan is around $2,500, which is significantly higher than the national average. However, it’s important to note that insurance rates can vary widely based on individual factors such as driving record, vehicle type, and location.