Find Car Insurance Quote

In today's fast-paced world, having a reliable car insurance policy is not just a necessity but a smart financial decision. Whether you're a seasoned driver or a novice behind the wheel, understanding the intricacies of car insurance quotes is essential to making an informed choice that suits your unique needs. This comprehensive guide will delve into the world of car insurance quotes, offering an expert analysis to help you navigate this critical aspect of vehicle ownership.

Understanding Car Insurance Quotes

Car insurance quotes are personalized estimates provided by insurance companies, detailing the cost of coverage for your specific vehicle and driving circumstances. These quotes are influenced by a myriad of factors, each playing a crucial role in determining the overall cost of your insurance policy.

Factors Affecting Car Insurance Quotes

- Vehicle Type and Age: The make, model, and age of your car significantly impact insurance rates. Newer, more expensive vehicles often carry higher premiums due to their higher replacement and repair costs.

- Driver’s Profile: Your age, gender, driving record, and years of driving experience are key considerations. Younger drivers and those with a history of accidents or traffic violations may face higher insurance costs.

- Coverage Level: The level of coverage you choose, including liability, collision, comprehensive, and additional add-ons, will directly affect your insurance quote. More extensive coverage means higher premiums.

- Location and Usage: Where you live and how often you drive can influence your insurance rates. Urban areas with higher traffic volumes and accident rates often result in higher premiums.

- Discounts and Bundles: Many insurance companies offer discounts for various reasons, such as safe driving records, bundling multiple policies, or having certain safety features in your vehicle.

Obtaining a Car Insurance Quote

The process of acquiring a car insurance quote has evolved to become more accessible and convenient. You can now obtain quotes online, over the phone, or by visiting an insurance agent’s office.

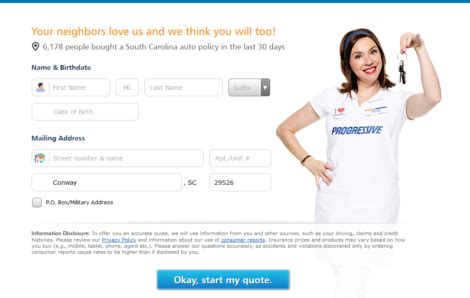

Online Quoting

Online car insurance quoting is a quick and efficient way to compare multiple quotes from different providers. Most insurance companies offer online quote tools on their websites, allowing you to input your details and receive instant estimates.

| Insurance Provider | Average Quote (USD) |

|---|---|

| Provider A | $1,200 |

| Provider B | $1,150 |

| Provider C | $1,350 |

Phone Quoting

If you prefer a more personalized approach, contacting insurance providers over the phone can be an excellent option. This allows you to discuss your specific needs and circumstances with an agent, who can guide you through the quoting process and offer tailored recommendations.

In-Person Quoting

Meeting with a local insurance agent in person provides an opportunity for a detailed discussion about your coverage needs. Agents can offer expert advice, answer questions, and provide a more personalized quote based on your unique situation.

Comparing and Choosing the Right Policy

Once you’ve gathered quotes from multiple providers, the next step is to carefully compare them to choose the policy that best fits your needs and budget.

Key Considerations for Comparison

- Coverage Level: Ensure that the quotes you’re comparing offer the same level of coverage. This includes liability limits, deductibles, and any additional coverages you require.

- Premium Costs: While cost is a significant factor, it’s important not to choose solely based on the lowest premium. Consider the overall value and reputation of the insurance company.

- Company Reputation: Research the track record and customer satisfaction ratings of the insurance providers. A reputable company with a history of prompt claim processing and customer support can be worth a slightly higher premium.

- Discounts and Add-ons: Review the discounts and additional coverages offered by each provider. Some companies may offer unique benefits or specialized coverages that align with your specific needs.

Expert Tips for Lowering Your Car Insurance Quote

While your car insurance quote is largely influenced by factors beyond your control, there are strategies you can employ to potentially lower your insurance costs.

Strategies to Reduce Insurance Costs

- Shop Around: Compare quotes from multiple insurance providers. Competition can drive down costs, and you may find significant differences in premiums between companies.

- Increase Your Deductible: Opting for a higher deductible can lower your insurance premiums. However, ensure that you can afford the higher out-of-pocket expense in the event of a claim.

- Bundle Policies: If you have multiple insurance needs, such as home and auto, consider bundling your policies with one provider. Many companies offer discounts for bundling multiple policies.

- Safe Driving Practices: Maintaining a clean driving record and practicing safe driving habits can lead to lower insurance rates. Avoid traffic violations and accidents to keep your insurance costs down.

The Future of Car Insurance Quotes

The car insurance industry is evolving, and technology is playing an increasingly significant role in how quotes are determined. Telematics and usage-based insurance are emerging trends that could revolutionize how insurance rates are calculated.

Emerging Trends in Car Insurance

- Telematics: Telematics devices installed in vehicles can track driving behavior, such as hard braking, acceleration, and mileage. This data can be used to offer more personalized insurance rates, rewarding safe drivers with lower premiums.

- Usage-Based Insurance (UBI): UBI programs offer insurance rates based on actual vehicle usage. Drivers can opt to install a tracking device or use a smartphone app to monitor their driving habits, with premiums adjusted accordingly.

- Artificial Intelligence: AI is being utilized to streamline the insurance quoting process and improve accuracy. Advanced algorithms can analyze vast amounts of data to provide more precise quotes and identify potential risks.

Conclusion

Finding the right car insurance quote is a critical step in ensuring you have adequate coverage for your vehicle. By understanding the factors that influence quotes and utilizing the strategies outlined above, you can make an informed decision that protects your vehicle and your finances. As the car insurance industry continues to evolve, staying informed about emerging trends and technologies can help you navigate this complex landscape with confidence.

What is the average cost of car insurance in the United States?

+

The average cost of car insurance in the U.S. varies widely based on factors like location, driving history, and vehicle type. As of 2023, the national average for car insurance premiums is around 1,674 annually, or about 140 per month. However, this average can vary significantly from state to state and even within different regions of the same state.

Can I get car insurance if I have a poor driving record or multiple accidents?

+

Yes, you can still obtain car insurance even with a less-than-perfect driving record. However, insurance companies typically charge higher premiums for drivers with accidents or traffic violations on their record. It’s important to shop around and compare quotes from different providers, as rates can vary significantly. Additionally, consider taking steps to improve your driving record, such as completing a defensive driving course, which may help reduce your insurance costs over time.

Are there any ways to save money on car insurance for young drivers?

+

Young drivers often face higher insurance premiums due to their lack of driving experience and the higher risk associated with their age group. However, there are ways to mitigate these costs. One strategy is to maintain a good academic record; some insurance companies offer discounts for students with a certain GPA. Additionally, young drivers can consider taking a defensive driving course, which may help reduce insurance costs. Finally, bundling your auto insurance with other policies, such as home or renters insurance, can sometimes lead to discounts.