Full Coverage Auto Insurance Quotes

Full coverage auto insurance is a comprehensive protection plan for vehicle owners, offering peace of mind and financial security in various scenarios. This type of insurance goes beyond the basic liability coverage, providing additional layers of protection to cover damages to your own vehicle, as well as any potential legal and medical expenses arising from an accident. In this guide, we'll delve into the intricacies of full coverage auto insurance, exploring its benefits, how it works, and most importantly, how to obtain accurate quotes to find the best coverage for your needs.

Understanding Full Coverage Auto Insurance

Full coverage auto insurance is an essential component of responsible vehicle ownership, providing an extensive safety net against a range of potential mishaps on the road. This type of insurance is designed to offer comprehensive protection, covering not only the damage caused by you to other parties (liability coverage), but also the damage sustained by your own vehicle in an accident or due to other covered perils. Additionally, full coverage policies often include protection for instances of theft, vandalism, and natural disasters, ensuring that your vehicle is safeguarded in a variety of unforeseen circumstances.

Here's a breakdown of the key components typically included in a full coverage auto insurance policy:

- Comprehensive Coverage: This protects against damage caused by events other than collisions, such as fire, theft, vandalism, and natural disasters.

- Collision Coverage: It covers the cost of repairing or replacing your vehicle after an accident, regardless of who is at fault.

- Liability Coverage: This is a legal requirement in most states, covering the cost of injuries or damages you cause to others in an accident.

- Uninsured/Underinsured Motorist Coverage: This provides protection if you're involved in an accident with a driver who doesn't have enough insurance to cover the damages.

- Medical Payments Coverage: It covers the medical expenses for you and your passengers after an accident, regardless of fault.

Full coverage auto insurance is a comprehensive solution that provides extensive protection, ensuring that you're not only covered for the damage you cause to others but also for a wide range of incidents that could affect your own vehicle. It's a vital consideration for any vehicle owner, offering the peace of mind that comes with knowing you're protected in a variety of scenarios.

The Benefits of Full Coverage

Opting for full coverage auto insurance offers a multitude of advantages, providing a robust safety net for vehicle owners. Here’s a closer look at some of the key benefits:

Comprehensive Protection

Full coverage policies offer a comprehensive approach to vehicle protection, extending beyond the standard liability coverage. This means that you’re not only covered for damages caused to others, but also for a wide range of incidents that could affect your own vehicle, including collisions, theft, vandalism, and natural disasters. This level of protection provides a significant peace of mind, knowing that your vehicle is safeguarded against a variety of potential risks.

Legal and Financial Security

Full coverage auto insurance provides vital legal and financial security in the event of an accident. With liability coverage included, you’re protected against the cost of injuries or damages you cause to others, ensuring that you’re not left with substantial legal or financial liabilities. This aspect of full coverage is particularly important, as it can help shield you from the potentially devastating financial implications of an accident.

Peace of Mind

Having full coverage auto insurance gives vehicle owners the peace of mind that comes with knowing they’re well-protected. Whether it’s an accident on the road, a theft in a parking lot, or damage from a natural disaster, full coverage policies provide a comprehensive safety net. This sense of security can significantly reduce the stress and worry associated with vehicle ownership, allowing you to enjoy the benefits of driving with confidence.

Customizable Coverage

One of the key advantages of full coverage auto insurance is its flexibility. Policies can be tailored to meet the specific needs and preferences of individual vehicle owners. This means that you can select the levels of coverage that best suit your circumstances, whether you require additional protection for a valuable vehicle or prefer a more basic level of coverage. This customization ensures that you’re not paying for coverage you don’t need, while still maintaining a robust safety net.

How to Get Full Coverage Auto Insurance Quotes

Obtaining full coverage auto insurance quotes is a straightforward process, thanks to the availability of online tools and the expertise of insurance brokers. Here’s a step-by-step guide to help you navigate the process:

Step 1: Understand Your Coverage Needs

Before requesting quotes, it’s essential to have a clear understanding of the coverage you require. Consider factors such as the value of your vehicle, your driving habits, and the level of protection you desire. This initial assessment will help guide your choices and ensure that you’re getting quotes for policies that meet your specific needs.

Step 2: Compare Quotes from Multiple Insurers

One of the keys to finding the best full coverage auto insurance is to compare quotes from a variety of insurers. This allows you to see the range of options available and make informed decisions about coverage and pricing. Online comparison tools can be a valuable resource, providing quick and easy access to quotes from multiple providers. However, it’s important to note that these tools often provide only a basic overview, and you may need to contact insurers directly for more detailed quotes.

Step 3: Work with an Insurance Broker

An insurance broker can be an invaluable resource when seeking full coverage auto insurance quotes. Brokers have extensive knowledge of the insurance market and can provide personalized advice based on your specific needs. They can help you understand the intricacies of different policies, guide you through the quote process, and ensure that you’re getting the best possible coverage at a competitive price. Working with a broker can save you time and effort, and often results in more comprehensive and cost-effective coverage.

Step 4: Review Policy Details and Terms

When you receive quotes, it’s important to thoroughly review the policy details and terms. This includes understanding the coverage limits, deductibles, and any exclusions or limitations. Be sure to compare not only the price but also the quality and extent of the coverage. This step is crucial to ensuring that you’re getting the right level of protection for your needs and that there are no unexpected gaps in coverage.

Factors Affecting Full Coverage Auto Insurance Quotes

Several factors can influence the quotes you receive for full coverage auto insurance. Understanding these factors can help you anticipate potential costs and make informed decisions about your coverage. Here’s an overview of some of the key factors:

Vehicle Type and Value

The type and value of your vehicle play a significant role in determining insurance quotes. Generally, more expensive vehicles will result in higher insurance premiums, as they are more costly to repair or replace. Additionally, certain types of vehicles, such as sports cars or SUVs, may be more prone to accidents or theft, which can also impact insurance costs.

Driver Profile

Your personal driving history and demographics can significantly affect insurance quotes. Factors such as age, gender, driving record, and location can all impact the perceived risk associated with insuring you. Younger drivers, for example, are often considered higher-risk and may face higher premiums. Similarly, drivers with a history of accidents or traffic violations may also see increased insurance costs.

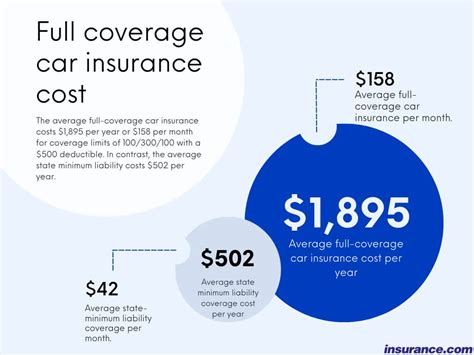

Coverage Levels and Deductibles

The level of coverage you choose and the associated deductibles can have a substantial impact on your insurance quotes. Higher levels of coverage typically result in higher premiums, as they provide a more comprehensive safety net. Conversely, selecting a higher deductible can lower your premiums, as you’re assuming more of the financial responsibility in the event of a claim. It’s important to find the right balance between coverage and cost to ensure you’re adequately protected without paying more than necessary.

Insurance Company and Policy Features

Different insurance companies offer varying levels of coverage and pricing, and the specific features of a policy can also impact quotes. Some insurers may specialize in certain types of vehicles or drivers, offering more competitive rates for those groups. Additionally, the availability of discounts, such as for safe driving or multiple policy bundles, can significantly reduce the cost of insurance. It’s worth exploring the options from multiple insurers to find the best combination of coverage and value.

Obtaining Full Coverage Auto Insurance: A Step-by-Step Guide

Navigating the process of obtaining full coverage auto insurance can be streamlined with a clear, step-by-step approach. Here’s a comprehensive guide to help you through the process:

Step 1: Research and Understand Your Options

Before diving into the quote process, take the time to research and understand the different types of coverage available. Familiarize yourself with the key components of full coverage auto insurance, including comprehensive, collision, liability, and other optional coverages. Understanding these components will help you make informed decisions about the level of protection you require.

Step 2: Gather Necessary Information

To obtain accurate quotes, you’ll need to gather some key information. This includes details about your vehicle (make, model, year, and VIN), your personal information (name, address, date of birth, and driver’s license number), and your driving history (including any accidents or traffic violations). Having this information readily available will streamline the quote process and ensure that you receive accurate quotes.

Step 3: Use Online Comparison Tools

Online comparison tools can be a valuable resource for obtaining multiple quotes quickly and easily. These tools allow you to input your vehicle and personal information, and then provide a list of quotes from various insurers. While these quotes may not be as detailed as those obtained directly from insurers, they can give you a good starting point for understanding the range of prices and coverage options available.

Step 4: Contact Insurers Directly

While online comparison tools can be helpful, it’s important to also contact insurers directly for more detailed and accurate quotes. This allows you to ask specific questions about coverage, clarify any uncertainties, and ensure that you’re getting the best possible deal. Many insurers offer online quote forms or phone-based quote services, making it convenient to obtain quotes and discuss your coverage needs.

Step 5: Review and Compare Quotes

Once you’ve obtained quotes from multiple insurers, take the time to carefully review and compare them. Look beyond just the price and consider the coverage limits, deductibles, and any exclusions or limitations. Ensure that the quotes you’re comparing are for similar levels of coverage, as this will give you a more accurate comparison. This step is crucial to finding the best balance of coverage and cost to meet your needs.

Step 6: Choose the Right Coverage

With a clear understanding of your options and a thorough comparison of quotes, you can now make an informed decision about your full coverage auto insurance. Select a policy that provides the level of protection you require at a price that fits your budget. Remember, while cost is an important factor, it’s not the only consideration. Ensuring that you have the right coverage to protect your vehicle and your financial well-being is paramount.

Step 7: Complete the Application Process

Once you’ve chosen the right coverage, the final step is to complete the application process. This typically involves providing additional information, such as proof of vehicle ownership and payment details. The insurer will then finalize your policy and provide you with the necessary documentation. Be sure to carefully review all the policy details and ask any questions you may have before finalizing your coverage.

Common Misconceptions about Full Coverage Auto Insurance

There are several common misconceptions about full coverage auto insurance that can lead to confusion and misinformed decisions. Here’s a look at some of these misconceptions and the reality behind them:

Misconception: Full Coverage Means No Out-of-Pocket Costs

One common misconception is that full coverage auto insurance means that you won’t have any out-of-pocket expenses in the event of a claim. While full coverage does provide a comprehensive safety net, it typically includes a deductible that you’re responsible for paying. This deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premiums, but it also means you’ll have to pay more out of pocket if you need to make a claim.

Misconception: Full Coverage Includes All Types of Insurance

Another misconception is that full coverage auto insurance includes all types of insurance, such as life insurance or health insurance. In reality, full coverage auto insurance refers specifically to the insurance coverage for your vehicle and the damages it may cause or sustain. It does not include other types of insurance, and you’ll need separate policies for those needs.

Misconception: Full Coverage is Always the Best Option

While full coverage auto insurance provides a high level of protection, it’s not always the best option for everyone. The level of coverage you need depends on various factors, including the value of your vehicle, your driving habits, and your personal financial situation. For some, a basic liability-only policy may be more appropriate and cost-effective. It’s important to carefully assess your needs and choose the level of coverage that best suits your circumstances.

Misconception: Full Coverage is Only for Expensive Vehicles

There’s a common belief that full coverage auto insurance is only necessary for expensive vehicles. While it’s true that the cost of full coverage may be higher for more valuable vehicles, it’s not exclusively for these types of cars. Full coverage can provide valuable protection for vehicles of all values, ensuring that you’re not left with unexpected costs in the event of an accident or other covered incident. It’s a decision that should be based on your specific needs and the level of protection you desire.

Making the Most of Your Full Coverage Auto Insurance

Once you’ve obtained your full coverage auto insurance policy, there are several strategies you can employ to make the most of your coverage and potentially save on premiums. Here are some tips to consider:

Maintain a Safe Driving Record

A clean driving record can significantly impact your insurance premiums. Insurers often offer discounts for safe driving, and a history of accident-free driving can lead to lower rates. Focus on safe driving practices, such as avoiding speeding, maintaining a safe following distance, and obeying traffic laws. By demonstrating responsible driving behavior, you can potentially reduce your insurance costs over time.

Consider Bundling Policies

Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance. By combining your policies with the same insurer, you may be eligible for significant savings. It’s worth exploring the options for bundling to potentially reduce your overall insurance costs.

Take Advantage of Discounts

Insurance companies offer a variety of discounts that can help reduce your premiums. These may include discounts for safe driving, good student status, advanced driver training, or even for belonging to certain professional organizations. Be sure to inquire about available discounts when obtaining quotes and consider how you might qualify for additional savings.

Review Your Policy Regularly

Insurance needs can change over time, and it’s important to periodically review your policy to ensure that it still meets your requirements. As your circumstances change, you may need to adjust your coverage levels or add additional endorsements. Regularly reviewing your policy can help you stay up-to-date with your coverage and ensure that you’re not paying for unnecessary premiums.

Understand Your Deductibles

While selecting a higher deductible can lower your premiums, it’s important to understand the financial implications. If you choose a high deductible and then need to make a claim, you’ll be responsible for paying that amount out of pocket before your insurance coverage takes effect. Ensure that you have the financial means to cover the deductible in the event of a claim, and consider whether a lower deductible may be a more appropriate choice for your circumstances.

Future of Full Coverage Auto Insurance

The landscape of full coverage auto insurance is continually evolving, driven by technological advancements and changing consumer needs. Here’s a glimpse into some of the potential future developments and their implications:

Increased Use of Telematics

Telematics, the technology that tracks driving behavior and vehicle performance, is likely to play a more significant role in full coverage auto insurance. Insurers may increasingly use telematics data to offer usage-based insurance policies, where premiums are determined based on actual driving behavior. This could lead to more personalized and potentially lower premiums for safe drivers.

Advancements in Autonomous Vehicles

The rise of autonomous vehicles is expected to have a significant impact on full coverage auto insurance. As these vehicles become more prevalent, insurers may need to adapt their policies to cover the unique risks and benefits associated with self-driving cars. This could lead to new types of coverage and potentially lower premiums as the risk of human error is reduced.

Integration of AI and Machine Learning

Artificial Intelligence (AI) and Machine Learning are already being used by insurers to improve risk assessment and claim processing. In the future, these technologies are likely to become even more integrated into the insurance process, leading to more accurate and efficient risk assessment and potentially lower premiums. Additionally, AI-powered chatbots and virtual assistants could enhance customer service, providing faster and more personalized support.

Enhanced Focus on Prevention

Insurers are increasingly recognizing the value of preventing accidents and claims rather than simply