Business Automobile Insurance Quote

Obtaining an accurate and comprehensive automobile insurance quote for your business vehicles is crucial to ensure adequate coverage and financial protection. In the world of commercial transportation, where vehicles are not just a means of mobility but also a significant investment, understanding the intricacies of business auto insurance is essential. This comprehensive guide will delve into the key factors that influence business automobile insurance quotes, provide real-world examples, and offer expert insights to help you make informed decisions.

Understanding Business Automobile Insurance

Business automobile insurance, often referred to as commercial auto insurance, is a specialized form of coverage designed to protect businesses that operate vehicles. This includes a wide range of enterprises, from small delivery services with a single van to large transportation companies with fleets of trucks. The primary goal of this insurance is to safeguard the business, its assets, and its employees in the event of an accident or other vehicular incidents.

The complexity of business auto insurance lies in the diverse nature of commercial vehicles and the varied risks they face. From daily commutes to long-haul deliveries, each type of business use presents unique challenges and potential liabilities. For instance, a delivery driver making frequent stops in urban areas faces different risks compared to a truck driver transporting goods across states.

Key Components of Business Auto Insurance

To fully grasp the quote process, it’s essential to understand the fundamental components of business automobile insurance. These typically include:

- Liability Coverage: This protects the business against claims resulting from accidents caused by its vehicles, covering medical expenses, property damage, and legal fees.

- Physical Damage Coverage: Provides compensation for damages to the insured vehicles, whether due to accidents, theft, or natural disasters.

- Medical Payments Coverage: Covers medical expenses for the driver and passengers of the insured vehicle, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: Offers protection if the at-fault driver in an accident lacks sufficient insurance coverage.

- Additional Coverages: Depending on the nature of the business, additional coverages like rental car reimbursement, towing and labor, or glass repair may be included.

Factors Influencing Business Auto Insurance Quotes

The quote for business automobile insurance is determined by a myriad of factors, each playing a significant role in assessing the potential risks and costs associated with insuring a business’s vehicles. Here’s an in-depth look at these factors, accompanied by real-world examples and expert insights.

Type of Business and Vehicle Usage

The nature of your business and how you use your vehicles are primary factors in determining insurance quotes. For instance, a business that operates heavy-duty trucks for long-haul transportation faces different risks and liabilities compared to a local courier service using compact vans.

Consider the example of Breeze Delivery, a same-day delivery service in a major metropolitan area. Their fleet consists of a dozen compact vans, and drivers often navigate through congested city streets and make multiple stops per day. In this case, the insurance provider would consider factors like the frequency of stops, the potential for accidents in urban environments, and the likelihood of minor collisions or fender benders. On the other hand, TransPacific Logistics, a company specializing in long-haul freight transportation, would have a different risk profile due to the fewer number of stops, but the potential for more severe accidents on highways.

| Business Type | Vehicle Usage |

|---|---|

| Breeze Delivery | Frequent urban stops, potential for minor accidents |

| TransPacific Logistics | Long-haul transportation, fewer stops, potential for severe accidents |

Driver Profile and History

The driving records and experience of your employees play a crucial role in insurance quotes. A clean driving record with no recent accidents or violations typically results in lower premiums. Conversely, a history of accidents or traffic violations can lead to higher insurance costs.

Take the example of Evergreen Hauling, a landscaping company with a fleet of trucks and trailers. Their drivers, mostly seasoned professionals, have excellent driving records with no major incidents in the past five years. This positive driver history contributes to more competitive insurance quotes. However, a small start-up, Go-Getter Movers, with a younger workforce and a few instances of minor accidents in their first year of operation, may face higher insurance costs until they establish a longer track record of safe driving.

Vehicle Details and Maintenance

The type, age, and condition of your vehicles are important considerations. Newer vehicles with advanced safety features often result in lower insurance costs due to their enhanced safety and lower likelihood of accidents. Additionally, proper vehicle maintenance and regular service records can demonstrate a commitment to safety, potentially lowering insurance premiums.

Imagine a large fleet management company, FleetPro Solutions, which prides itself on its well-maintained fleet of trucks and cars. They ensure regular servicing, maintain detailed maintenance records, and invest in the latest safety technologies. This commitment to vehicle upkeep often translates to lower insurance costs. In contrast, a small business owner who neglects regular vehicle maintenance and has older, less safe vehicles may face higher insurance premiums due to the increased risk of breakdowns and accidents.

Insurance Provider and Policy Coverage

The choice of insurance provider and the specific policy coverage you select can significantly impact your insurance quote. Different providers offer varying levels of coverage and benefits, and it’s important to compare options to find the best fit for your business needs.

For instance, AllState Insurance may offer comprehensive coverage with a wide range of additional benefits, but at a higher premium. On the other hand, BasicCover might provide more basic coverage at a lower cost. It's essential to assess your business's specific needs and risks to determine the right level of coverage.

Location and Operating Environment

The geographical location where your vehicles operate can influence insurance quotes. Areas with a higher incidence of accidents, theft, or natural disasters often carry a higher insurance risk. Similarly, the type of environment your vehicles operate in, such as urban vs. rural areas, can impact insurance costs.

Consider a logistics company, LogiXpress, that operates primarily in metropolitan areas with high traffic volumes and a history of accidents. They may face higher insurance premiums due to the increased risk of accidents and theft. In contrast, a rural delivery service, Country Courier, might benefit from lower insurance costs due to the generally safer driving conditions and lower crime rates in rural areas.

Tips for Obtaining Competitive Business Auto Insurance Quotes

Navigating the process of obtaining competitive business auto insurance quotes requires a strategic approach. Here are some expert tips to guide you through this process:

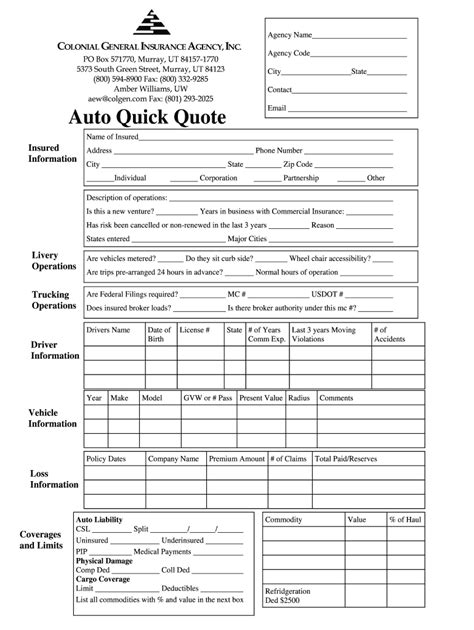

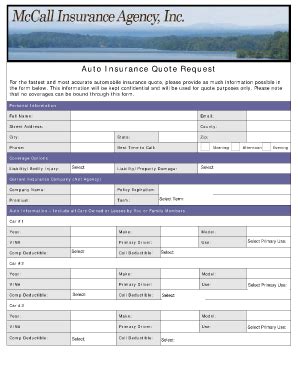

- Gather Comprehensive Information: Provide detailed information about your business, vehicle usage, and driver profiles to ensure accurate quotes. Don't hesitate to highlight your safety measures and any risk-mitigating strategies you employ.

- Compare Multiple Providers: Shop around and compare quotes from different insurance providers. Each provider has its own risk assessment criteria, and you may find significant variations in quotes.

- Assess Your Coverage Needs: Determine the level of coverage your business requires. While comprehensive coverage provides more protection, it may not be cost-effective for all businesses. Tailor your coverage to your specific needs and risks.

- Consider Risk Mitigation Strategies: Implement measures to reduce the risk of accidents and claims. This can include driver training programs, vehicle maintenance schedules, and the use of safety technologies. Such strategies not only enhance safety but can also lead to lower insurance premiums.

- Review and Update Regularly: Insurance needs can change over time as your business grows and evolves. Regularly review your insurance policy and update it as necessary to ensure it continues to meet your needs and provide adequate coverage.

The Future of Business Automobile Insurance

The landscape of business automobile insurance is evolving rapidly, driven by advancements in technology and changing industry dynamics. Here’s a glimpse into the future and how it may impact insurance quotes and coverage:

Technological Advancements

The integration of advanced technologies, such as telematics and artificial intelligence, is transforming the insurance industry. Telematics devices, for instance, can provide real-time data on vehicle usage and driver behavior, allowing insurance providers to offer more accurate and personalized quotes. AI-powered systems can analyze vast amounts of data to identify trends and risks, leading to more efficient risk assessment and potentially lower insurance costs for businesses that adopt these technologies.

Sustainable and Green Practices

As environmental concerns gain prominence, the adoption of sustainable and green practices is becoming a key factor in business operations. Insurance providers are increasingly recognizing the benefits of these practices and offering incentives for businesses that embrace them. For instance, businesses that utilize electric or hybrid vehicles, implement fuel-efficient practices, or adopt eco-friendly waste management systems may be eligible for lower insurance premiums or additional benefits.

Data-Driven Risk Assessment

The insurance industry is moving towards a more data-driven approach to risk assessment. This shift is driven by the increasing availability of data and the use of advanced analytics tools. By leveraging data from various sources, including vehicle sensors, GPS systems, and even social media, insurance providers can gain a more comprehensive understanding of risk factors. This enables them to offer more precise quotes and coverage options tailored to the unique needs and risks of each business.

Changing Regulatory Environment

The regulatory landscape for commercial auto insurance is subject to change, and businesses need to stay informed about these developments. For instance, changes in liability laws or insurance regulations can impact the cost and availability of coverage. It’s essential for businesses to stay updated on these changes and work closely with their insurance providers to ensure compliance and maintain adequate coverage.

Conclusion

Obtaining an accurate and competitive business automobile insurance quote requires a comprehensive understanding of the factors that influence risk and premiums. By providing detailed information about your business, vehicles, and drivers, and by staying abreast of industry trends and technological advancements, you can navigate the insurance market with confidence. Remember, the right insurance coverage is not just a financial investment but a strategic tool to protect your business and its assets.

How often should I review and update my business auto insurance policy?

+It is recommended to review your policy annually or whenever significant changes occur in your business operations, such as adding new vehicles, changing drivers, or expanding your operating area. Regular reviews ensure that your coverage remains adequate and aligned with your business needs.

What are some common discounts available for business auto insurance?

+Discounts may vary depending on the insurance provider, but common discounts include safe driver incentives, fleet discounts for multiple vehicles, accident-free records, and even discounts for implementing certain safety technologies or training programs.

How does the age of my vehicles impact insurance quotes?

+Older vehicles generally carry higher insurance costs due to increased maintenance needs and the potential for higher repair costs. However, some insurance providers offer discounts for vehicles with advanced safety features or for well-maintained older vehicles.