Quotes Renters Insurance

Renters insurance is an essential protection for individuals living in rental properties, safeguarding their belongings and providing liability coverage. In today's world, where unexpected events can occur, having comprehensive insurance is crucial. This article will delve into the world of renters insurance, exploring its benefits, coverage options, and how to find the best quotes to ensure you're adequately protected.

Understanding Renters Insurance: Your Peace of Mind

Renters insurance is a specialized type of insurance designed specifically for tenants and individuals living in rental accommodations. It offers a safety net, ensuring that you are not financially burdened in the event of unforeseen circumstances such as theft, fire, or accidents. While your landlord’s insurance typically covers the building itself, renters insurance protects your personal belongings and provides additional liability coverage.

Here are some key aspects of renters insurance that highlight its importance:

- Property Coverage: Renters insurance covers your personal property, including furniture, electronics, clothing, and other valuables. In the event of a covered loss, you'll be reimbursed for the replacement or repair of these items.

- Liability Protection: It provides liability coverage, which is crucial if someone is injured in your rental unit or if you accidentally cause damage to others' property. This coverage protects you from potential lawsuits and legal fees.

- Additional Living Expenses: In the unfortunate event of a disaster that renders your rental unit uninhabitable, renters insurance can cover the cost of temporary housing and additional living expenses until you can return home.

- Personal Injury Protection: This coverage extends beyond your rental unit, offering protection if you or a family member suffer an injury due to another person's negligence.

With renters insurance, you gain peace of mind, knowing that your belongings and well-being are protected. It's an affordable way to ensure that you're not left financially devastated in the face of unexpected events.

The Benefits of Renters Insurance: Going Beyond Protection

Renters insurance offers a multitude of benefits that go beyond the basic coverage of your personal property. Here’s a deeper look at some of the advantages it provides:

Comprehensive Coverage Options

Renters insurance policies can be tailored to your specific needs. You can choose coverage limits that align with the value of your belongings, ensuring you’re not underinsured. Additionally, you can opt for different types of coverage, such as actual cash value or replacement cost coverage, depending on your preferences.

Valuable Personal Property Protection

Your personal belongings are precious, and renters insurance ensures they’re protected. Whether it’s your cherished family heirlooms, expensive electronics, or valuable jewelry, renters insurance provides coverage for a wide range of items. You can even add special endorsements to cover high-value items that may exceed standard policy limits.

Personal Liability Protection

Liability coverage is a critical aspect of renters insurance. It protects you in the event that someone is injured on your rental property or if you cause damage to others’ property. This coverage provides financial protection against potential lawsuits and legal fees, giving you the assurance that you’re covered in such situations.

Additional Living Expenses Coverage

In the event of a covered loss that makes your rental unit uninhabitable, renters insurance steps in to cover your additional living expenses. This includes the cost of temporary housing, meals, and other necessary expenses until you can return to your home. This coverage ensures that you’re not left without a place to stay during a challenging time.

Personal Injury Protection

Renters insurance also extends beyond your rental unit to cover personal injuries. If you or a family member suffer an injury due to another person’s negligence, this coverage can provide financial assistance to cover medical expenses and other related costs. It’s an added layer of protection that ensures you’re not burdened with unexpected medical bills.

Finding the Best Renters Insurance Quotes: A Comprehensive Guide

Now that we’ve explored the benefits of renters insurance, let’s delve into the process of finding the best quotes to ensure you’re getting the coverage you need at a competitive price.

Compare Multiple Quotes

One of the most effective ways to find the best renters insurance quote is to compare multiple policies from different providers. Online insurance marketplaces can be a great starting point, allowing you to easily request quotes from various insurers. By comparing coverage options, limits, and prices, you can make an informed decision and choose the policy that best suits your needs.

Consider Your Specific Needs

When comparing quotes, it’s essential to consider your unique circumstances and the specific coverage you require. Evaluate your personal property and determine the replacement cost. Assess your liability risks and decide on the level of coverage you need. By tailoring your policy to your needs, you can ensure that you’re not overpaying for coverage you don’t require.

Bundle Policies for Discounts

Many insurance providers offer discounts when you bundle multiple policies together. Consider combining your renters insurance with other types of coverage, such as auto insurance or homeowners insurance, if you own a home. Bundling policies can result in significant savings and streamline your insurance management process.

Review Deductibles and Coverage Limits

When comparing quotes, pay close attention to the deductibles and coverage limits. A higher deductible can result in lower premiums, but it means you’ll have to pay more out of pocket in the event of a claim. Similarly, ensure that the coverage limits are adequate for your needs. Reviewing these details will help you strike the right balance between cost and protection.

Explore Discounts and Special Offers

Insurance providers often offer discounts and special promotions to attract new customers. Keep an eye out for these opportunities and inquire about any available discounts. You may be eligible for discounts based on your profession, membership in certain organizations, or even your age. Taking advantage of these discounts can further reduce your insurance costs.

Read Policy Details Carefully

While comparing quotes, it’s crucial to thoroughly read the policy details. Understand the coverage exclusions, limitations, and any specific conditions that may apply. This ensures that you’re fully aware of what is and isn’t covered by the policy. Being informed about the fine print will help you make an educated decision.

Utilize Online Tools and Resources

In today’s digital age, there are numerous online tools and resources available to assist you in finding the best renters insurance quotes. Insurance comparison websites, mobile apps, and online calculators can provide valuable insights and help you make informed choices. Take advantage of these tools to streamline your quote comparison process.

The Future of Renters Insurance: Trends and Innovations

The world of renters insurance is constantly evolving, and several trends and innovations are shaping the industry. Here’s a glimpse into the future of renters insurance:

Digital Transformation

The insurance industry is embracing digital transformation, and renters insurance is no exception. Online platforms and mobile apps are making it easier for renters to obtain quotes, manage their policies, and file claims. This shift towards digital insurance provides convenience, efficiency, and a seamless customer experience.

Data-Driven Personalization

With advancements in data analytics and artificial intelligence, renters insurance providers are now able to offer more personalized policies. By analyzing customer data and behavior, insurers can tailor coverage options and pricing to individual needs. This data-driven approach ensures that renters receive the right coverage at a competitive price.

Enhanced Coverage Options

Renters insurance providers are expanding their coverage options to meet the evolving needs of tenants. From coverage for high-value items like musical instruments or sports equipment to additional liability protection for shared spaces, insurers are adapting to provide comprehensive coverage for a wide range of scenarios.

Smart Home Integration

The integration of smart home technology is transforming the insurance industry. Renters with smart home devices can benefit from discounts and incentives. Insurers are recognizing the role of smart home technology in preventing losses and are offering incentives to encourage its adoption. This trend is expected to continue, with renters insurance becoming even more aligned with the smart home ecosystem.

Focus on Sustainability

With a growing emphasis on sustainability and environmental responsibility, renters insurance providers are also embracing eco-friendly practices. Insurers are now offering incentives for renters who adopt sustainable habits, such as using energy-efficient appliances or implementing green home improvements. This trend aligns with the broader movement towards a more sustainable future.

FAQs

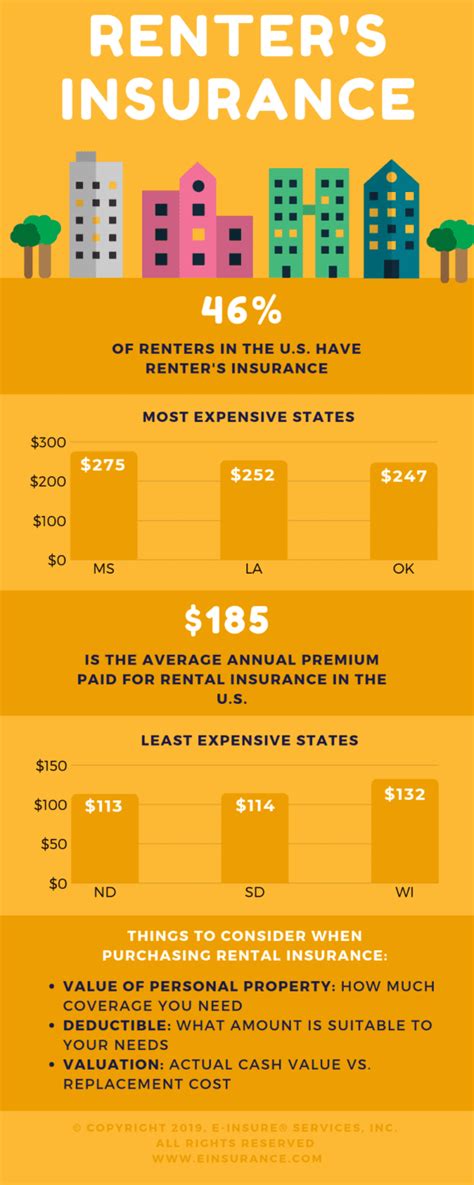

How much does renters insurance typically cost?

+The cost of renters insurance can vary based on several factors, including the location, coverage limits, and any additional endorsements. On average, renters insurance policies range from 15 to 30 per month. However, it’s essential to obtain quotes tailored to your specific needs to get an accurate estimate.

Does renters insurance cover natural disasters like floods or earthquakes?

+Renters insurance typically does not cover damage caused by natural disasters such as floods or earthquakes. These events often require separate coverage known as flood insurance or earthquake insurance. It’s important to review your policy and consider additional coverage options to ensure you’re protected against such risks.

Can I get renters insurance even if I rent a room in a shared house or apartment?

+Yes, renters insurance is available for individuals renting rooms in shared houses or apartments. The coverage applies to your personal belongings and liability protection, regardless of the type of rental arrangement. It’s crucial to ensure that you have adequate coverage to protect your possessions and personal liability.

How often should I review and update my renters insurance policy?

+It’s recommended to review your renters insurance policy annually or whenever there are significant changes in your life or belongings. This ensures that your coverage remains up-to-date and aligns with your current needs. Regular reviews help you stay informed about any changes in coverage, deductibles, or premiums.

Can I add additional coverage for high-value items like jewelry or art collections?

+Yes, renters insurance policies often allow you to add additional coverage for high-value items that may exceed the standard policy limits. This is typically done through special endorsements or riders. By adding these endorsements, you can ensure that your valuable possessions are adequately protected.

Renters insurance is an invaluable tool for protecting your belongings and providing liability coverage. By understanding the benefits, comparing quotes, and staying informed about industry trends, you can ensure that you’re adequately insured. Remember, finding the right renters insurance quote is an essential step towards safeguarding your peace of mind and financial well-being.