Cell Phone Insurance Providers

In today's fast-paced and often hectic world, our cell phones have become indispensable companions. They keep us connected, informed, and entertained, but with this reliance comes a certain vulnerability. The reality is that accidents happen, and our beloved devices can suffer from cracks, water damage, or even complete failure. This is where cell phone insurance steps in as a valuable safeguard, offering peace of mind and financial protection.

Cell phone insurance providers have emerged as a crucial part of the modern mobile ecosystem, providing coverage for a range of potential mishaps. From the accidental drop in the toilet to the unexpected screen shatter, these providers offer a safety net that can save users from hefty repair or replacement costs. In this comprehensive guide, we'll delve into the world of cell phone insurance, exploring the top providers, their coverage options, and the key considerations to help you make an informed decision.

The Landscape of Cell Phone Insurance

The market for cell phone insurance is diverse and competitive, with a range of providers offering various plans and benefits. From specialized insurers to well-known telecom companies, the options can be overwhelming. Understanding the landscape is the first step in choosing the right coverage for your needs.

Specialized Insurers

Specialized cell phone insurance companies have made a name for themselves by focusing solely on providing coverage for mobile devices. These insurers often offer comprehensive plans that cover a wide range of incidents, from accidental damage to theft. They typically provide quick and efficient claim processes, ensuring a seamless experience when you need it most.

One of the key advantages of specialized insurers is their flexibility. They often allow you to customize your plan, offering options to choose the level of coverage and the deductible that suits your budget. Additionally, these companies may provide add-ons, such as coverage for loss or extended warranties, to cater to specific needs.

| Provider | Coverage Highlights |

|---|---|

| Assurant | Comprehensive plans, covering accidental damage, theft, and mechanical failures. Quick claim processing and the option for add-ons like loss coverage. |

| SquareTrade | Known for their extensive coverage, including accidental damage, mechanical breakdowns, and power surge protection. Offers flexible plans and a user-friendly claims process. |

| Warranty Wise | Provides extended warranties and protection plans for a variety of devices, including cell phones. Offers 24/7 support and covers both accidental and mechanical issues. |

Telecom Companies

Major telecom providers often offer their own cell phone insurance plans as an additional service to their customers. These plans can be convenient, as they are often bundled with your existing phone plan, providing a one-stop solution. Telecom insurance plans typically cover accidental damage, and some may even include theft protection.

One advantage of opting for insurance through your telecom provider is the potential for seamless integration. You may find that the claim process is streamlined, and you can manage your insurance alongside your regular phone bill. Additionally, telecom companies often have partnerships with device manufacturers, which can result in exclusive benefits or discounted rates.

| Provider | Coverage Highlights |

|---|---|

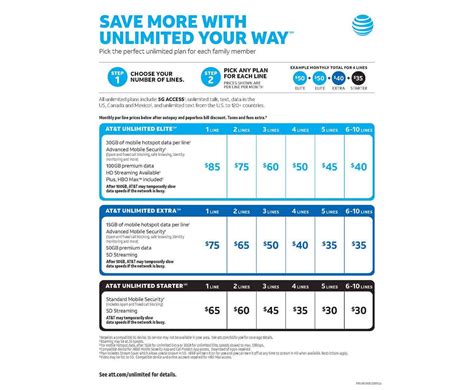

| AT&T | Offers "AT&T Protect Advantage" plans, covering accidental damage, mechanical and electrical failures, and limited loss protection. Provides convenient monthly billing and a simple claim process. |

| Verizon | Provides "Total Mobile Protection" plans, including coverage for accidental damage, mechanical failures, and even limited protection against cracked screens. Offers additional benefits like cloud storage and tech support. |

| T-Mobile | Features "T-Mobile Protection" plans, covering accidental damage, mechanical breakdowns, and theft. Provides options for add-ons like insurance for connected devices. |

Manufacturer-Offered Insurance

Some device manufacturers also offer their own insurance plans, providing coverage specifically tailored to their products. These plans can be an excellent option for those who want coverage that understands the unique needs of their device.

Manufacturer-offered insurance often comes with benefits such as original manufacturer parts for repairs, ensuring the highest quality and compatibility. Additionally, these plans may provide faster turnarounds for repairs or replacements, as they work directly with the manufacturer's network.

| Manufacturer | Coverage Highlights |

|---|---|

| Apple | Offers "AppleCare+" plans, providing coverage for accidental damage and technical support. Includes access to Apple's network of authorized repair centers and the option for extended warranty coverage. |

| Samsung | Provides "Samsung Care+" plans, covering accidental damage, screen repair, and mechanical failures. Offers convenient repair or replacement options and access to Samsung's network of authorized service centers. |

| Features "Google Play Protect" insurance, which covers accidental damage and provides theft protection. Offers easy claim processes and the option for extended coverage. |

Key Considerations for Choosing Cell Phone Insurance

With a vast array of options available, selecting the right cell phone insurance provider can be a daunting task. Here are some key considerations to help guide your decision:

Coverage Options

The scope of coverage is arguably the most crucial factor. Ensure that the plan you choose covers the incidents that are most likely to affect your device. For instance, if you’re prone to dropping your phone, accidental damage coverage is essential. Similarly, if you often travel, theft protection could be a priority.

Deductibles and Premiums

Cell phone insurance plans often come with a deductible, which is the amount you’ll need to pay out of pocket when making a claim. Consider your budget and choose a plan with a deductible that you’re comfortable with. Additionally, evaluate the premium costs, ensuring they align with your financial plan.

Claim Process

Understanding the claim process is vital. Look for providers that offer straightforward and efficient claim procedures. Check if they have a good track record of prompt resolutions and whether they provide multiple options for claim submissions, such as online portals or dedicated apps.

Reputation and Customer Service

Research the reputation of the insurance provider. Check reviews and ratings to ensure they have a good track record of customer satisfaction. Additionally, evaluate their customer service offerings, including response times and the availability of support channels.

Additional Benefits

Some cell phone insurance plans offer extra benefits that can enhance your coverage. These may include things like extended warranties, cloud storage, or even tech support. Consider whether these add-ons are valuable to you and can provide additional peace of mind.

Real-World Scenarios and Case Studies

Understanding the theoretical aspects of cell phone insurance is one thing, but seeing how it plays out in real-life situations can provide invaluable insight. Let’s explore a few case studies to illustrate the impact of having the right cell phone insurance coverage.

Accidental Damage: A Common Occurrence

John, an avid hiker, accidentally dropped his phone into a river while crossing a stream. The device was completely submerged, and despite his best efforts, it was beyond repair. John had purchased cell phone insurance through a specialized insurer, which covered accidental water damage. With a simple claim process, he was able to get a replacement device, ensuring he stayed connected during his outdoor adventures.

Theft Protection: Peace of Mind on the Go

Emily, a frequent traveler, had her phone stolen while exploring a new city. She had opted for a telecom provider’s insurance plan, which included theft protection. With the help of the insurance provider’s support team, Emily was able to quickly report the theft and initiate the claim process. Within a few days, she received a replacement device, allowing her to continue her travels without interruption.

Extended Warranty: Long-Term Peace of Mind

Michael, a tech enthusiast, purchased a high-end smartphone and decided to invest in an extended warranty through the manufacturer. A year later, his device developed a mechanical issue. Thanks to the extended warranty, he was able to get his phone repaired at an authorized service center, saving him from a costly out-of-pocket expense.

The Future of Cell Phone Insurance

As technology advances and our reliance on cell phones grows, the landscape of cell phone insurance is also evolving. Here are some trends and insights to consider for the future:

Emerging Technologies

The integration of emerging technologies, such as AI and blockchain, could revolutionize the cell phone insurance industry. AI-powered claim processing could enhance efficiency, while blockchain technology could provide secure and transparent transaction records, improving trust between insurers and customers.

Personalized Coverage

The future of cell phone insurance may see a shift towards highly personalized plans. With the advancement of data analytics, insurers could offer tailored coverage based on individual usage patterns and device needs, providing a more customized experience.

Extended Partnerships

Collaboration between device manufacturers, telecom providers, and specialized insurers could lead to more comprehensive and integrated insurance offerings. These partnerships could result in exclusive benefits and seamless experiences for customers.

Enhanced Customer Support

The focus on customer experience is likely to remain a priority. Insurance providers may invest in innovative support channels, such as 24⁄7 chatbots or virtual assistants, to provide instant assistance and guidance to policyholders.

FAQ

What is the average cost of cell phone insurance per month?

+The cost of cell phone insurance can vary widely depending on the provider, the level of coverage, and the device being insured. On average, you can expect to pay between 5 and 15 per month for basic coverage, with premiums increasing for more comprehensive plans.

Can I get cell phone insurance if I already have a cracked screen or other pre-existing damage?

+Most cell phone insurance providers will not cover pre-existing damage. It’s essential to carefully review the policy terms and conditions to understand what is and isn’t covered. Some providers may offer options to repair or replace a device with pre-existing damage at an additional cost.

How long does it typically take to process a cell phone insurance claim?

+The time it takes to process a claim can vary depending on the provider and the nature of the claim. Simple claims, such as accidental damage, may be resolved within a few days. More complex claims, like theft or mechanical failures, may take longer, often up to a few weeks, to thoroughly investigate and process.

Are there any alternatives to cell phone insurance?

+Yes, there are alternatives to traditional cell phone insurance. Some device manufacturers offer limited warranties that cover certain issues for a specific period. Additionally, extended warranties or protection plans offered by third-party providers can be an option. It’s essential to carefully review the terms and conditions of these alternatives to ensure they meet your needs.

As we’ve explored, cell phone insurance is a critical aspect of modern mobile device ownership. With the right coverage, you can protect your investment and ensure you’re never left without a vital connection to the world. Whether you opt for a specialized insurer, a telecom provider’s plan, or a manufacturer’s offering, the key is to choose a provider that understands your needs and provides the peace of mind you deserve.