House Insurance In California

House insurance, also known as homeowners insurance, is a vital aspect of protecting your most valuable asset. In a state like California, with its diverse climate and natural hazards, understanding the ins and outs of home insurance is crucial. From wildfires to earthquakes, Californians face unique challenges that require tailored insurance coverage. This comprehensive guide will delve into the specifics of house insurance in California, offering insights, real-world examples, and expert advice to ensure you make informed decisions.

Navigating California’s Home Insurance Landscape

California’s diverse geography and climate present a unique set of risks that homeowners must consider when insuring their properties. From the scenic coastal regions to the expansive deserts and the mountainous areas, each region brings its own set of potential hazards. Wildfires, earthquakes, and floods are some of the most common natural disasters that Californians must prepare for.

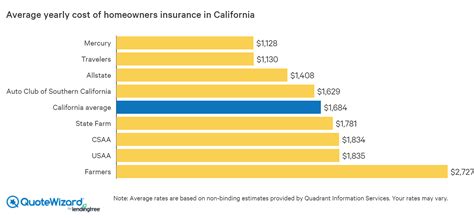

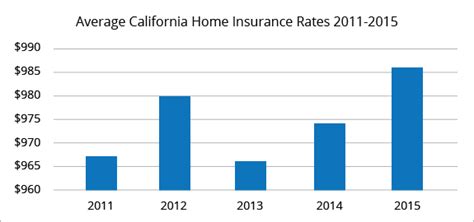

The cost of house insurance in California can vary significantly based on several factors. The location of your home plays a pivotal role; areas with a higher risk of natural disasters or crime will generally have higher insurance premiums. The age, size, and construction materials of your home are also taken into account. Additionally, the coverage limits and deductibles you choose will directly impact the overall cost.

Understanding Coverage Options

House insurance policies in California typically offer a range of coverage options to protect your home and its contents. The standard policy, known as HO-3, provides coverage for your dwelling, personal property, liability, and additional living expenses. However, certain risks, such as earthquakes and floods, are typically excluded and require additional policies.

For instance, earthquake insurance is crucial in California due to the state's seismic activity. This coverage protects your home and belongings from damage caused by earthquakes, a significant risk factor in many parts of the state. Similarly, flood insurance, provided by the National Flood Insurance Program (NFIP), is essential for homes located in flood-prone areas, as standard house insurance policies often do not cover flood damage.

When assessing your coverage needs, it's essential to consider the specific risks your home faces. For example, if your home is in an area prone to wildfires, you'll want to ensure your policy includes coverage for fire damage. Additionally, consider the value of your personal belongings and choose a policy that provides adequate coverage for their replacement.

| Coverage Type | Description |

|---|---|

| Dwelling Coverage | Protects the physical structure of your home. |

| Personal Property Coverage | Covers the cost of replacing your belongings. |

| Liability Coverage | Provides protection if someone is injured on your property. |

| Additional Living Expenses | Covers temporary living expenses if your home becomes uninhabitable. |

Claim Process and Considerations

In the unfortunate event of a claim, understanding the process and your rights as a policyholder is crucial. When a disaster strikes, the last thing you want is uncertainty about your insurance coverage. Here’s a step-by-step guide to help you navigate the claim process effectively.

Reporting a Claim

As soon as you become aware of damage to your home, it’s essential to contact your insurance company to report the claim. Most insurers have a 24⁄7 claims hotline, ensuring you can reach them promptly. During this initial contact, provide as much detail as possible about the incident and any damage sustained. This will help the insurer understand the scope of the claim and assign the appropriate resources.

After reporting the claim, an adjuster will be assigned to your case. This individual will assess the damage and determine the extent of the insurer's liability. It's crucial to cooperate fully with the adjuster and provide any requested documentation or information. This may include photographs, videos, and detailed descriptions of the damage.

Assessment and Settlement

The adjuster will schedule a time to inspect your property, usually within a few days of your initial report. During this inspection, they will thoroughly examine the damage, taking notes, photos, and measurements. It’s beneficial to have a list of any damaged items or areas of concern ready for the adjuster’s visit.

After the inspection, the adjuster will assess the extent of the damage and provide an estimate for repairs. This estimate will form the basis of the insurer's offer for settlement. If you disagree with the adjuster's findings or feel that the offer is insufficient, you have the right to request a re-evaluation or seek an independent assessment. It's crucial to keep detailed records of all communications and documentation related to the claim process.

Real-Life Claim Scenarios

Let’s consider a couple of scenarios to illustrate the claim process in real-world situations. Imagine a California homeowner, Sarah, whose house is damaged in a wildfire. She promptly reports the incident to her insurance company and provides detailed information about the damage. The insurer assigns an adjuster who visits Sarah’s home, assesses the damage, and provides an estimate for repairs.

In another scenario, John, a resident of an earthquake-prone area, experiences significant damage to his home during a seismic event. He contacts his insurer and provides photos and videos of the damage. The insurer's adjuster visits John's home, carefully evaluates the extent of the damage, and offers a settlement based on the policy's terms and conditions.

In both cases, the homeowners play an active role in the claim process, ensuring they receive the coverage they are entitled to under their policies. By being proactive and providing detailed information, they facilitate a smoother and more efficient claims process.

Choosing the Right Insurance Provider

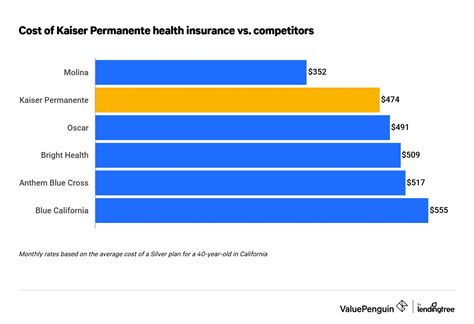

With a vast array of insurance providers operating in California, selecting the right one can be a daunting task. It’s essential to consider several factors to ensure you find an insurer that meets your specific needs and provides the coverage and service you deserve.

Reputation and Financial Stability

Start by researching the insurer’s reputation and financial stability. A well-established company with a strong track record of paying claims and providing excellent customer service is often a safer bet. Check online reviews and ratings, and consider the insurer’s financial strength as rated by independent agencies like AM Best or Moody’s.

Policy Customization and Coverage Options

Every homeowner’s needs are unique, so it’s crucial to choose an insurer that offers customizable policies. Look for providers that allow you to tailor your coverage to match the specific risks and values of your home. This ensures you’re not overpaying for coverage you don’t need or leaving yourself underinsured.

Additionally, consider the range of coverage options available. Some insurers offer specialized policies for high-value homes, while others may have specific endorsements for unique risks like identity theft or cyber threats. Ensure the insurer provides the coverage options you require to protect your home adequately.

Customer Service and Claims Handling

The quality of an insurer’s customer service and claims handling can make a significant difference in your experience. Look for an insurer with a dedicated customer support team that is readily accessible and responsive. Read reviews and testimonials from other policyholders to gauge their satisfaction with the insurer’s service.

Consider how the insurer handles claims. Do they have a streamlined process? Are they known for prompt and fair settlements? These factors can impact your overall satisfaction and the ease of managing a claim should the need arise.

Discounts and Bundling Options

Many insurers offer discounts to policyholders who meet certain criteria. These discounts can include loyalty discounts for long-term customers, safety discounts for homes with enhanced security features, or bundling discounts for those who insure multiple properties or vehicles with the same insurer. Explore these options to potentially reduce your premium.

Future of House Insurance in California

As climate change continues to impact California’s natural landscape, the future of house insurance in the state is likely to evolve significantly. Insurers are already adapting their policies and coverage options to address the increasing frequency and severity of natural disasters. Here’s a glimpse into what the future may hold for house insurance in California.

Climate Change and Risk Assessment

Climate change is expected to bring more frequent and intense natural disasters, such as wildfires and droughts. Insurers will need to refine their risk assessment models to accurately predict and price these risks. This may lead to changes in coverage availability and pricing, particularly in high-risk areas.

Technology and Digital Innovations

The insurance industry is embracing digital transformation, and this trend is likely to accelerate. From online policy management and claims submission to the use of artificial intelligence for risk assessment, technology will play a significant role in the future of house insurance. Policyholders can expect more efficient processes and potentially lower costs as insurers leverage these advancements.

Sustainable and Resilient Housing

As California faces increasing environmental challenges, there is a growing emphasis on sustainable and resilient housing. Insurers may offer incentives or discounts to policyholders who adopt eco-friendly and resilient home designs or incorporate sustainable materials and technologies. This shift could encourage more homeowners to adopt sustainable practices, contributing to a greener and more resilient California.

How often should I review my house insurance policy?

+It's recommended to review your policy annually or whenever there are significant changes to your home or personal circumstances. Regular reviews ensure your coverage remains adequate and up-to-date.

What factors influence the cost of house insurance in California?

+The cost of house insurance is influenced by factors such as location, the age and size of your home, the coverage limits you choose, and the deductible. Additionally, the specific risks your home faces, like wildfires or earthquakes, can impact the premium.

Can I bundle my house insurance with other policies to save money?

+Yes, many insurers offer discounts when you bundle your house insurance with other policies, such as auto or umbrella insurance. Bundling can be a cost-effective way to protect multiple aspects of your life under one provider.

What should I do if I'm not satisfied with my insurance company's claim settlement offer?

+If you feel the settlement offer is inadequate, you can request a re-evaluation or seek an independent assessment. It's essential to provide detailed evidence and documentation to support your claim and negotiate a fair settlement.

How can I reduce my house insurance premiums in California?

+You can potentially lower your premiums by increasing your deductible, maintaining a good claims history, and exploring discounts for safety features or policy bundling. Additionally, regularly reviewing and adjusting your coverage to match your needs can help keep costs down.

House insurance in California is a complex but essential aspect of homeownership. By understanding the coverage options, claim process, and the factors influencing premiums, you can make informed decisions to protect your home and its contents. With the right insurance coverage and a proactive approach, you can navigate the unique challenges of California’s natural hazards with confidence.