Vehicle Insurance Uber

The ride-sharing giant, Uber, has revolutionized the way people commute and travel, offering a convenient and affordable alternative to traditional taxis. With its rapid growth and global presence, Uber has also sparked discussions and debates surrounding various aspects of its operations, including insurance coverage for its drivers and passengers. In this comprehensive article, we delve into the world of Uber vehicle insurance, exploring the policies, protections, and potential pitfalls associated with this evolving industry.

Understanding Uber’s Insurance Ecosystem

The insurance landscape for Uber drivers is a complex and dynamic one, shaped by the unique nature of ride-sharing services. Unlike traditional employment, Uber drivers are considered independent contractors, which has significant implications for insurance coverage.

The Uber Insurance Model

Uber, in partnership with leading insurance providers, has developed a multi-tiered insurance model that aims to protect drivers, passengers, and third parties involved in Uber-related incidents. This model consists of several coverage tiers, each applicable to different stages of an Uber trip.

| Coverage Tier | Description | Coverage Amount |

|---|---|---|

| Period 0: Offline | When the Uber app is off and the driver is not providing services. | $0 |

| Period 1: Waiting | When the driver has the app on and is waiting for a ride request. | $50,000 per person / $100,000 per accident (liability) |

| Period 2: En Route | While the driver is en route to pick up a passenger. | $50,000 per person / $100,000 per accident (liability) |

| Period 3: Active | During an active trip with a passenger in the vehicle. | $1,000,000 (comprehensive) |

It's important to note that while Uber provides these insurance coverages, drivers are still responsible for maintaining their own personal auto insurance policies. This dual-insurance system aims to address the gaps in traditional insurance coverage that may arise due to the nature of ride-sharing services.

Key Considerations for Drivers

Understanding the insurance coverage provided by Uber is crucial for drivers, as it directly impacts their financial and legal responsibilities. Here are some key considerations for Uber drivers regarding insurance:

Personal Auto Insurance Requirements

Uber requires its drivers to maintain personal auto insurance that meets the minimum coverage requirements of their state or region. This insurance typically covers the driver and their vehicle when they are not logged into the Uber app. However, during an active trip, Uber’s insurance policy takes precedence, providing comprehensive coverage.

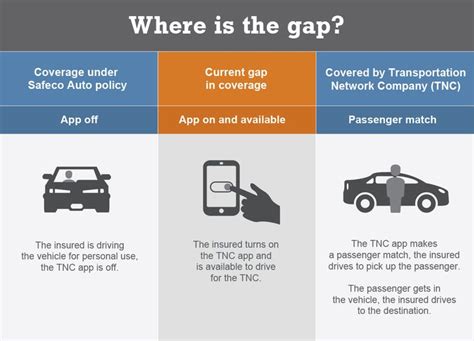

Understanding Coverage Gaps

While Uber’s insurance model aims to be comprehensive, there are still potential coverage gaps that drivers should be aware of. For instance, during Period 1 and Period 2 (when the driver is waiting or en route to a passenger), the liability coverage provided by Uber is relatively low compared to the comprehensive coverage during an active trip. Drivers should consider this when assessing their personal insurance needs.

Accident and Claims Process

In the event of an accident or incident, Uber provides a dedicated support team to assist drivers and passengers with the claims process. This process typically involves filing a report with Uber, contacting the insurance provider, and providing all necessary documentation to support the claim. It’s essential for drivers to understand their rights and responsibilities during this process to ensure a smooth and fair resolution.

Protecting Personal Assets

Given the nature of ride-sharing, Uber drivers may face unique risks that could impact their personal assets. It’s crucial for drivers to carefully review their personal insurance policies and consider additional coverage options to protect against potential liabilities. This may include exploring commercial auto insurance policies or adding riders to their existing policies to cover ride-sharing activities.

Passenger Protection and Coverage

Passenger safety and protection are paramount for Uber, and the company’s insurance policies are designed to provide comprehensive coverage for passengers during their trips.

Passenger Injury and Liability

During an active Uber trip, passengers are covered by Uber’s $1,000,000 liability insurance policy. This policy provides protection in the event of an accident, covering medical expenses, property damage, and other related costs. Uber’s insurance extends to passengers regardless of whether the accident was caused by the driver, another party, or even an act of nature.

Property Damage and Lost Items

In addition to personal injury coverage, Uber’s insurance policy also covers property damage that may occur during a trip. This includes damage to a passenger’s belongings or the Uber vehicle itself. Uber has implemented a lost and found system to assist passengers in recovering their lost items, and in cases where items are not recovered, Uber’s insurance may provide coverage for the replacement value of the lost items.

Safety and Emergency Protocols

Uber has established comprehensive safety protocols and emergency response systems to ensure the well-being of its passengers. In the event of an emergency, passengers can access in-app features to quickly connect with emergency services or Uber’s dedicated support team. These protocols, combined with the comprehensive insurance coverage, aim to provide passengers with a secure and reliable ride-sharing experience.

The Future of Uber Insurance

As the ride-sharing industry continues to evolve and expand, the insurance landscape for Uber and its drivers is likely to undergo further transformations. Here are some potential future developments and implications:

Expanded Coverage and Benefits

With growing competition and changing consumer expectations, Uber may explore ways to enhance its insurance offerings. This could include increased coverage limits, expanded benefits for drivers and passengers, and potentially new insurance products tailored to the unique needs of ride-sharing services.

Regulatory Changes and Industry Standards

The insurance requirements and regulations surrounding ride-sharing services are subject to change as governments and industry bodies continue to evaluate and shape this emerging sector. Uber and its insurance partners will need to adapt to any new regulations or standards to ensure compliance and continued protection for all parties involved.

Technological Innovations and Safety Measures

Advancements in technology, such as autonomous vehicles and advanced safety features, could significantly impact the insurance landscape for Uber. As these technologies become more prevalent, insurance policies may need to adapt to address new risks and potential liabilities associated with driverless or semi-autonomous ride-sharing services.

Driver and Passenger Education

Ensuring that drivers and passengers are well-informed about insurance coverage and their rights is crucial for the long-term success of Uber’s insurance model. Uber may invest more resources into educational initiatives, providing clear and accessible information about insurance policies, claim processes, and safety protocols to enhance the overall user experience.

Conclusion

Uber’s vehicle insurance model is a complex yet necessary component of its ride-sharing operations. By understanding the various coverage tiers, drivers and passengers can make informed decisions and ensure their safety and financial well-being. As the industry continues to evolve, Uber’s insurance policies will play a pivotal role in shaping the future of ride-sharing, providing peace of mind to millions of users worldwide.

What happens if I get into an accident while driving for Uber?

+If you are involved in an accident while driving for Uber, it’s important to first ensure the safety of all passengers and yourself. Contact emergency services if necessary. Then, notify Uber through the app and provide all relevant details. Uber’s insurance policy will provide coverage based on the stage of your trip (Period 0, 1, 2, or 3), and you should also contact your personal auto insurance provider to understand your coverage in relation to the accident.

Are there any limitations or exclusions in Uber’s insurance policy?

+Yes, like any insurance policy, Uber’s coverage has certain limitations and exclusions. For instance, coverage may be limited or excluded for intentional acts, criminal activities, or damage caused by certain perils like floods or earthquakes. It’s important to carefully review Uber’s insurance policy and your personal insurance policy to understand any potential limitations or exclusions that may apply.

How can I ensure I have sufficient insurance coverage as an Uber driver?

+To ensure you have sufficient insurance coverage, you should first review your state’s minimum insurance requirements and ensure your personal auto insurance policy meets those standards. Additionally, consider adding riders or purchasing commercial auto insurance to cover your ride-sharing activities. Consult with an insurance professional to understand your options and ensure you have adequate coverage for your needs.