Cobra Cost Health Insurance

Welcome to this in-depth exploration of the Cobra Cost Health Insurance, a comprehensive guide designed to provide you with all the essential information you need to make informed decisions about your healthcare coverage. As we delve into the world of health insurance, we will uncover the intricacies of Cobra Cost, its benefits, and how it can impact your financial well-being.

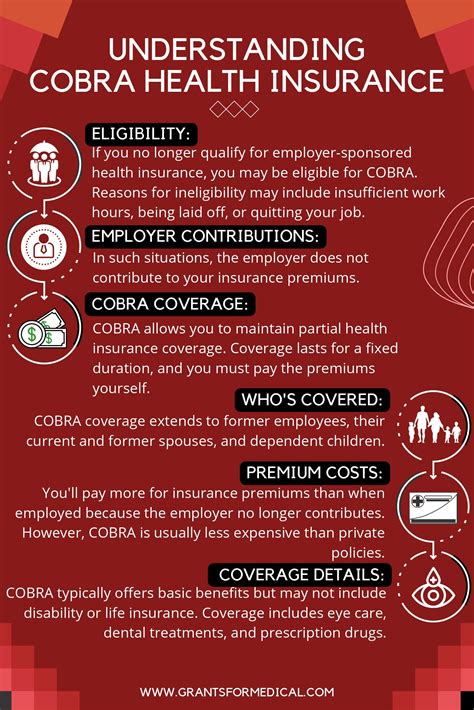

Understanding Cobra Cost Health Insurance

Cobra Cost Health Insurance, often simply referred to as Cobra, is a federal law that allows individuals and their families to continue their group health insurance coverage after specific life events. It offers a safety net for those facing job loss, divorce, or other circumstances that might otherwise leave them without health insurance. Understanding Cobra and its implications is crucial for anyone seeking to navigate the complexities of healthcare coverage.

The Origins and Purpose of Cobra

Cobra, short for the Consolidated Omnibus Budget Reconciliation Act of 1985, was enacted to address the gap in health insurance coverage that often arises when an individual experiences a qualifying event, such as losing their job or going through a divorce. The law ensures that eligible individuals can maintain their health insurance coverage for a temporary period, providing stability and access to healthcare during challenging times.

Cobra is particularly beneficial for those who may have pre-existing medical conditions or are in the process of transitioning to new jobs, as it guarantees continuity of care and prevents gaps in medical treatment. By understanding the intricacies of Cobra, individuals can make strategic decisions about their healthcare coverage, ensuring they have the support they need when they need it most.

Eligibility and Qualifying Events

Not everyone is eligible for Cobra, and it’s important to understand the qualifying events that trigger this coverage. Typically, Cobra applies when an individual experiences a job-related qualifying event, such as involuntary termination, reduction in work hours, or even a strike or lockout situation. Additionally, Cobra can be triggered by non-job-related events, including divorce or legal separation, death of the insured, or a dependent child aging out of coverage.

| Qualifying Event | Description |

|---|---|

| Job Loss | Involuntary termination or reduction in work hours. |

| Divorce/Separation | Legal separation or divorce from the insured. |

| Death | Death of the insured or a covered dependent. |

| Aging Out | Dependent child reaches the age limit for coverage. |

It's crucial to note that while Cobra provides a valuable safety net, it is not without its limitations. The coverage is often more expensive than traditional group health insurance, as individuals are typically responsible for the full premium cost, including the employer's portion. Additionally, Cobra coverage is time-limited, usually lasting up to 18 months, though certain qualifying events may extend this period.

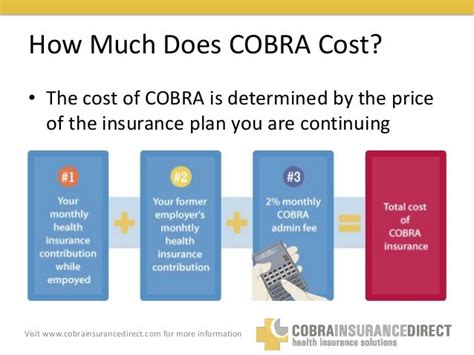

The Cost Dynamics of Cobra

One of the key considerations when exploring Cobra is the financial aspect. Understanding the cost dynamics of Cobra is crucial for individuals to make informed decisions about their healthcare coverage.

Premium Costs and Payment Options

Cobra coverage comes at a cost, and individuals are responsible for paying the full premium, which typically includes both the employee and employer portions. This can result in premiums that are significantly higher than what an individual would pay for traditional group health insurance. The exact premium amount can vary based on several factors, including the individual’s age, location, and the specific health plan they choose.

Payment options for Cobra premiums are generally flexible, allowing individuals to choose from monthly, quarterly, or annual payment plans. Some insurance providers may also offer discounts for paying the entire premium upfront. It's important for individuals to carefully consider their financial situation and choose a payment plan that aligns with their budget and cash flow.

Financial Considerations and Budgeting

The financial implications of Cobra can be significant, especially for those who are already facing financial challenges. Individuals should carefully assess their financial situation and budget to ensure they can afford the premium costs associated with Cobra coverage. It’s essential to consider not only the monthly or annual premium but also any potential out-of-pocket expenses, such as deductibles, copays, and coinsurance.

Creating a detailed budget that accounts for all healthcare-related expenses can help individuals make informed decisions about their Cobra coverage. This may involve comparing the cost of Cobra to other healthcare options, such as individual health insurance plans or short-term health insurance. It's crucial to weigh the financial benefits of maintaining continuous coverage against the potential costs of going without insurance.

Subsidies and Tax Implications

In certain situations, individuals may be eligible for subsidies or tax benefits associated with Cobra coverage. For example, those who qualify for a second chance at health insurance under the Affordable Care Act (ACA) may receive financial assistance to help offset the cost of Cobra premiums. It’s important to explore these potential subsidies and understand the tax implications of Cobra coverage, as they can significantly impact an individual’s financial situation.

Consulting with a tax professional or financial advisor can provide valuable insights into the tax implications of Cobra and help individuals optimize their financial strategies. Understanding the tax benefits and potential deductions associated with healthcare coverage can be a crucial aspect of managing the financial aspects of Cobra.

The Impact of Cobra on Healthcare Coverage

Cobra not only affects an individual’s financial situation but also has a significant impact on their healthcare coverage and access to medical services.

Coverage Benefits and Limitations

Cobra coverage typically mirrors the benefits and limitations of the original group health insurance plan. This means that individuals who opt for Cobra will generally have access to the same network of healthcare providers, prescription drug coverage, and other benefits as they had under their previous employer-sponsored plan. However, it’s important to note that certain benefits, such as dental or vision coverage, may not be included in Cobra and would require separate arrangements.

While Cobra provides continuity of coverage, it is not without its limitations. The coverage period is time-limited, and individuals must be aware of the expiration date of their Cobra coverage. Additionally, certain services or treatments may not be covered under Cobra, and individuals should carefully review their policy to understand the scope of their coverage.

Network of Providers and Access to Care

One of the key advantages of Cobra is the continuity of access to healthcare providers. Individuals who opt for Cobra can typically continue seeing their existing doctors and specialists, ensuring a level of consistency in their medical care. This is particularly beneficial for those with ongoing medical conditions or who are in the midst of treatment plans.

However, it's important to note that while Cobra maintains access to the original network of providers, it does not guarantee that all providers will continue to accept Cobra insurance. Some healthcare providers may choose to opt out of accepting certain insurance plans, including Cobra. In such cases, individuals may need to find alternative providers within their network or explore other coverage options.

Pre-Existing Conditions and Medical Treatment

Cobra is especially valuable for individuals with pre-existing medical conditions. Unlike some individual health insurance plans, Cobra does not allow insurance companies to deny coverage or charge higher premiums based on pre-existing conditions. This means that individuals who have ongoing medical treatments or conditions can maintain their coverage and access to necessary healthcare services without fear of discrimination or financial penalties.

However, it's important to understand that while Cobra provides coverage for pre-existing conditions, it does not necessarily cover all treatments or procedures related to these conditions. Individuals should carefully review their policy and consult with their healthcare providers to ensure that their specific medical needs are covered under their Cobra plan. Being proactive in understanding the scope of coverage can help individuals make informed decisions about their healthcare and avoid unexpected costs.

Strategic Considerations for Cobra Coverage

When navigating the world of Cobra coverage, there are several strategic considerations that can help individuals optimize their healthcare and financial decisions.

Comparing Cobra to Alternative Options

Before committing to Cobra coverage, it’s essential to explore alternative options and compare the benefits, costs, and limitations of each. Depending on an individual’s circumstances, there may be more cost-effective or comprehensive healthcare coverage options available.

For example, those who are eligible for the second chance at health insurance under the ACA may find that individual health insurance plans offer more affordable premiums and a wider range of coverage options. Short-term health insurance plans may also be an option for those seeking temporary coverage while they transition to new jobs or explore other long-term healthcare solutions.

Comparing the features and costs of different healthcare coverage options can help individuals make informed decisions about their healthcare and financial well-being. It's important to consider not only the initial cost of premiums but also the potential out-of-pocket expenses and the long-term financial implications of each coverage option.

Transitioning to Long-Term Coverage

Cobra coverage is designed to provide temporary relief during transitional periods, but it’s crucial for individuals to plan for long-term healthcare coverage. As the Cobra coverage period expires, individuals should be proactive in exploring alternative options to ensure continuous coverage.

For those who have experienced job loss, finding new employment that offers group health insurance benefits can be a top priority. Exploring job opportunities that provide comprehensive healthcare coverage can help individuals maintain stability and access to medical services. Additionally, understanding the healthcare benefits landscape and staying informed about potential changes in insurance regulations can empower individuals to make strategic decisions about their long-term coverage.

Seeking Professional Guidance

Navigating the complexities of healthcare coverage, especially during transitional periods, can be challenging. Seeking professional guidance from healthcare advisors, financial planners, or insurance brokers can provide valuable insights and support.

Healthcare advisors can help individuals understand their specific healthcare needs and explore coverage options that align with those needs. Financial planners can offer guidance on managing the financial aspects of healthcare coverage, including budgeting for premiums and out-of-pocket expenses. Insurance brokers can provide a comprehensive overview of available coverage options and assist in comparing the benefits and costs of different plans.

By seeking professional guidance, individuals can make informed decisions about their healthcare coverage, ensuring they have the support and resources they need to navigate the complexities of Cobra and beyond.

Conclusion: Making Informed Decisions with Cobra

Cobra Cost Health Insurance is a critical tool for individuals facing transitional periods, offering a safety net of continuous healthcare coverage. Understanding the eligibility criteria, cost dynamics, and impact on healthcare access is essential for making informed decisions about Cobra coverage.

By carefully considering the financial implications, comparing alternative coverage options, and planning for long-term healthcare, individuals can optimize their healthcare and financial well-being. Seeking professional guidance can provide valuable support and insights, empowering individuals to navigate the complexities of Cobra and make strategic decisions about their healthcare coverage.

As you explore the world of healthcare coverage, remember that Cobra is just one piece of the puzzle. Stay informed, seek expert advice, and make choices that align with your unique needs and circumstances. With the right knowledge and support, you can navigate the complexities of healthcare coverage and find the solutions that best fit your life.

Can I use Cobra coverage if I already have another health insurance plan?

+Yes, you can use Cobra coverage even if you already have another health insurance plan. Cobra provides a valuable safety net during transitional periods, allowing you to maintain continuity of coverage. However, it’s important to carefully consider the financial implications and ensure that you understand the limitations of your existing coverage before making a decision.

How long does Cobra coverage typically last?

+Cobra coverage typically lasts for a period of 18 months, although certain qualifying events, such as a second chance at health insurance under the ACA, may extend this coverage period. It’s important to understand the specific time limits associated with your Cobra coverage to ensure you have adequate coverage during transitional periods.

Are there any tax implications associated with Cobra coverage?

+Yes, there may be tax implications associated with Cobra coverage. It’s important to consult with a tax professional or financial advisor to understand the specific tax benefits and potential deductions related to healthcare coverage. By carefully navigating the tax landscape, you can optimize your financial strategies and make informed decisions about your healthcare coverage.